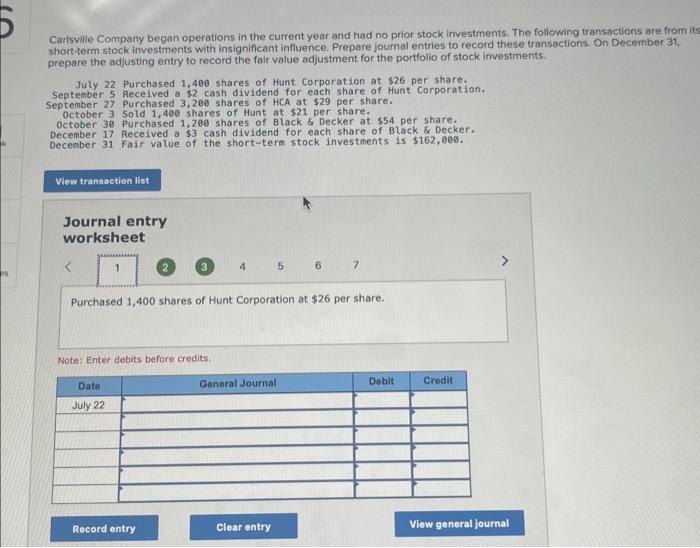

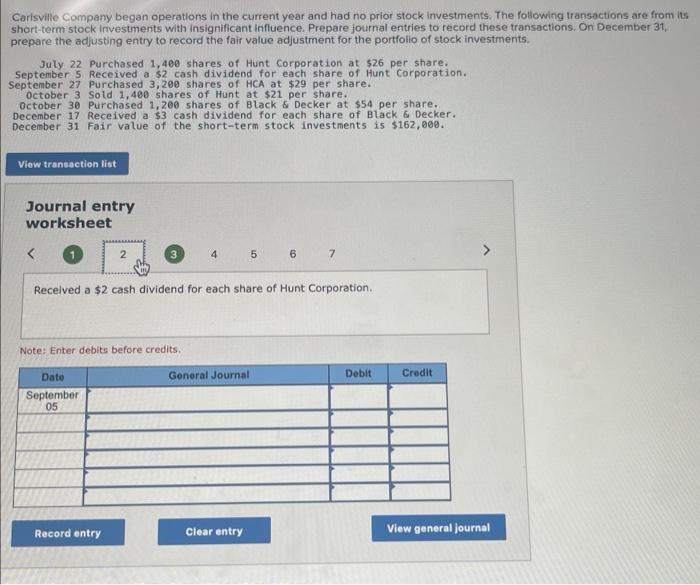

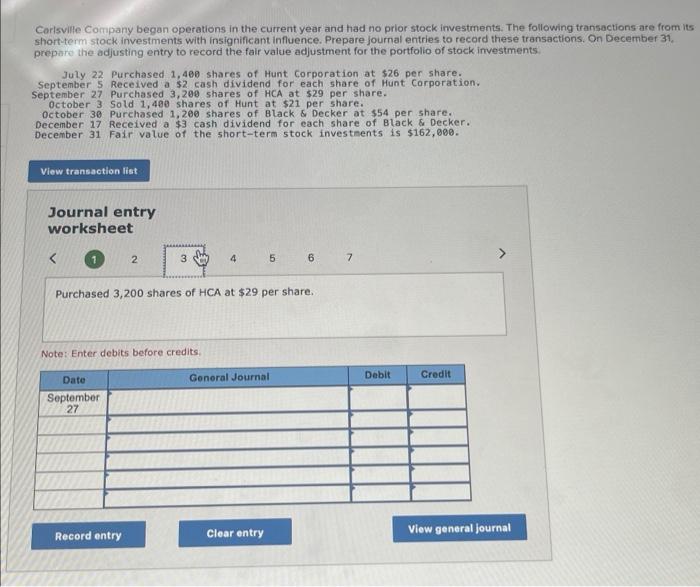

Carlswille Company began operations in the current year and had no prior stock imvestments. The following transactions are from its short-term stock investments with insignificant influence. Prepare journal entries to record these transactions. On December 31 . prepare the adjusting entry to record the fair value adjustment for the portfolio of stock investments. Juty 22 Purchased 1,400 shares of Hunt Corporation at $26 per share. September 5 Received a \$2 cash dividend for each share of Hunt Corporation. September 27 Purchased 3,260 shares of HCA at $29 per share. october 3 Sold 1,400 shares of Hunt at $21 per share. october 30 Purchased 1,200 shares of Black \& Decker at $54 per share. December 17 Received a $3 cash dividend for each share of Black \& Decker. Decenber 31 Fair value of the short-term stock investments is $162,000. Journal entry worksheet 1,400 shares of Hunt Corporation at $26 per share. Purchased 1,400 shares of Hunt Corporation at $26 per share. Note: Enter debits before credits. Carisville Company began operations in the current year and had no prior stock investments. The following transactions are from its short-term stock investments with insignificant influence. Prepare journal entries to record these transactions. On December 31 , prepare the adjusting entry to record the fair value adjustment for the portfolio of stock investments. July 22 Purchased 1,400 shares of Hunt Corporation at $26 per share. September 5 Received a $2 cash dividend for each share of Hunt Corporation. september 27 Purchased 3,200 shares of HCA at $29 per share. october 3 sold 1,400 shares of Hunt at $21 per share. october 30 Purchased 1,200 shares of Black \& Decker at $54 per share. December 17 Received a $3 cash dividend for each share of Black \& Decker. December 31 Fair value of the short-term stock investments is $162,000. Journal entry worksheet \begin{tabular}{l|lllll|} \hline worksheet \\ Recelved a $2 cash dividend for each share of Hunt Corporation. \end{tabular} Note: Enter debits before credits. Corlswille Company began operations in the current year and had no prior stock imvestrnents. The following transactions are from its short-rerm stock investments with insignificant influence. Prepare journal entries to record these transactions. On December 31 , prepare the adjusting entry to record the fair value adjustment for the portfolio of stock investments. July 22 Purchased 1,460 shares of Hunt Corporation at $26 per share. September 5 Received a $2 cash dividend for each share of Hunt Corporation. september 27 Purchased 3,200 shares of HCA at $29 per share. october 3 Sold 1, 480 shares of Hunt at $21 per share. october 30 Purchased 1,20 shares of Black \& Decker at $54 per share. December 17 Received a $3 cash dividend for each share of Black \& Decker. December 31 Fair value of the short-term stock investients is $162,000. Journal entry worksheet 5 6 7 Purchased 3,200 shares of HCA at $29 per share. Note: Enter debits before credits. Carlsville Company began operations in the current year and had no prior stock investments. The following transactions are from its short-term stock investments with insignificant influence. Prepare journal entries to record these transactions. On December 31 . prepare the adjusting entry to record the fair value adjustment for the portfolio of stock investments. Juty 22 Purchased 1,400 shares of Hunt Corporation at $26 per share. September 5 Received a $2 cash dividend for each share of Hunt Corporation. September 27 Purchased 3,200 shares of HCA at $29 per share. October 3 Sold 1,400 shares of Hunt at $21 per share. october 30 Purchased 1,200 shares of Black \& Decker at $54 per share. December 17 Received a $3 cash dividend for each share of Black 5 Decker. December 31 Fair vatue of the short-term stock investments is $162, 868 . Journal entry worksheet 1 2 6 7 > Sold 1,400 shares of Hunt at $21 per share. Note: Enter debits before credits. Carlsvilie Company began operations in the current year and had no prior stock investments. The following transactions are from it: short-term stock investments with insignificant influence. Prepare journal entries to record these transactions. On December 31 . prepare the adjusting entry to record the fair value adjustment for the portfolio of stock investments. July 22 Purchased 1,400 shares of Hunt Corporation at $26 per share. September 5 Received a $2 cash dividend for each share of Hunt Corporation. september 27 Purchased 3,200 shares of HCA at $29 per share. october 3 Sotd 1,400 shares of Hunt at $21 per share. october 30 Purchased 1,200 shares of Black o. Decker at $54 per share. December 17 Received a $3 cash dividend for each share of Black\& Decker. December 31 Fair value of the short-term stock investments is $162,00. Journal entry worksheet (1) 2 7 Purchased 1,200 shares of Black \& Decker at $54 per share. Note: Enter debits before credits. Carlsville Company began operations in the current year and had no prior stock imvestments, The following transactions are from its short-term stockinvestments with insignificant influence. Prepare journal entries to record these transactions. On December 31, prepare the adjusting entry to record the fair value adjustment for the portfolio of stock investments. Juty 22 Purchased 1,400 shares of Hunt Corporation at $26 per share. September 5 Received a $2 cash dividend for each share of Hunt Corporation. September 27 Purchased 3,200 shares of HCA at $29 per share. october 3 Sotd 1,400 shares of Hunt at $21 per share. october 30 Purchased 1,200 shares of 8 lack $ Decker at $54 per share. December 17 Received a $3 cash dividend for each share of Black & Decker. Decenber 31 Fair value of the short-term stock investments is $162,000. Journal entry worksheet (1) 2 3 4 7 > Received a $3 cash dividend for each share of Black \& Decker. Nate: Enter debits before credits. Carlisville Company began operations in the current year and had no prior stock investments. The following tranisactions are from short-term stock investments with insignificant influence. Prepare journal entries to record these transactions. On. December 31 , prepare the adjusting entry to record the fair value adjustment for the portfollo of stock investments. July 22 Purchased 1,400 shares of Hunt Corporation at $26 per share. September 5 Received a $2 cash dividend for each share of Hunt Corporation. September 27 Purchased 3,200 shares of HCA at $29 per share. October 3 Sotd 1,400 shares of Hunt at $21 per share. october 30 Purchased 1,200 shares of Black \& Decker at $54 per 5 hare. Decenber 17 Received a $3 cash dividend for each share of Black \& Decker. December 31 Fair value of the short-term stock investments is $162,000. Journal entry worksheet (1) 2 4 > Fair value of the short-term stock investments is $162,000. Record the yearend adjustment to fair value, if any. Note: Enter debits before credits