Question

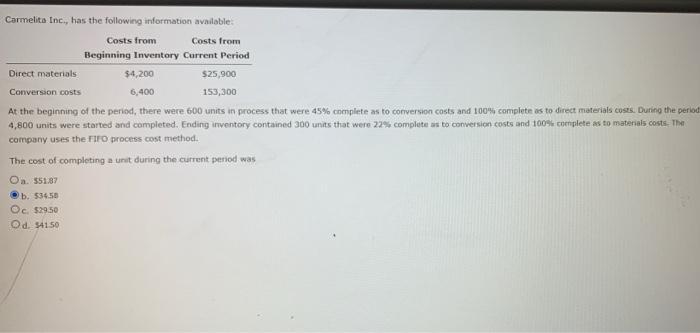

Carmelita Inc., has the following information available: Costs from Costs from Beginning Inventory Current Period Direct materials $4,200 $25,900 Conversion costs 6,400 153,300 At

Carmelita Inc., has the following information available: Costs from Costs from Beginning Inventory Current Period Direct materials $4,200 $25,900 Conversion costs 6,400 153,300 At the beginning of the period, there were 600 units in process that were 45% complete as to conversion costs and 100% complete as to direct materials costs. During the period 4,800 units were started and completed. Ending inventory contained 300 units that were 22% complete as to conversion costs and 100% complete as to materials costs. The company uses the FIFO process cost method. The cost of completing a unit during the current period was Oa. S5187 b. $34.58 Oc. $29.50 Od. S4150

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Solution Option b is correct option ie the 3458 Becaus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting: A Business Process Approach

Authors: Jane L. Reimers

3rd edition

978-013611539, 136115276, 013611539X, 978-0136115274

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App