Carmichael Cleaners needs a new steam finishing machine that costs $100,000. The company is evaluating whether it should lease or purchase the machine. The equipment

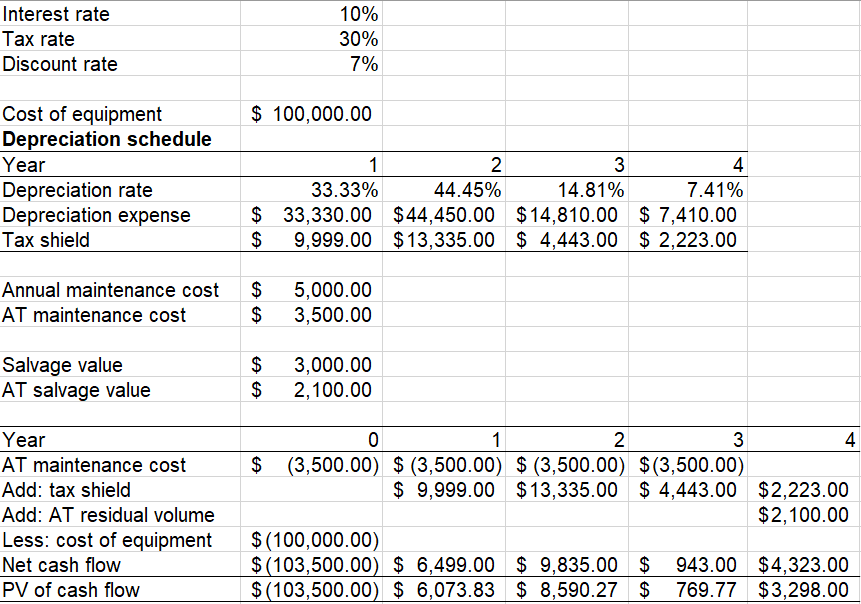

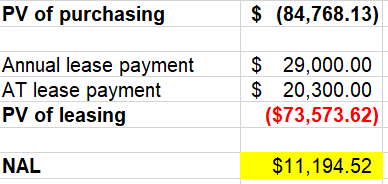

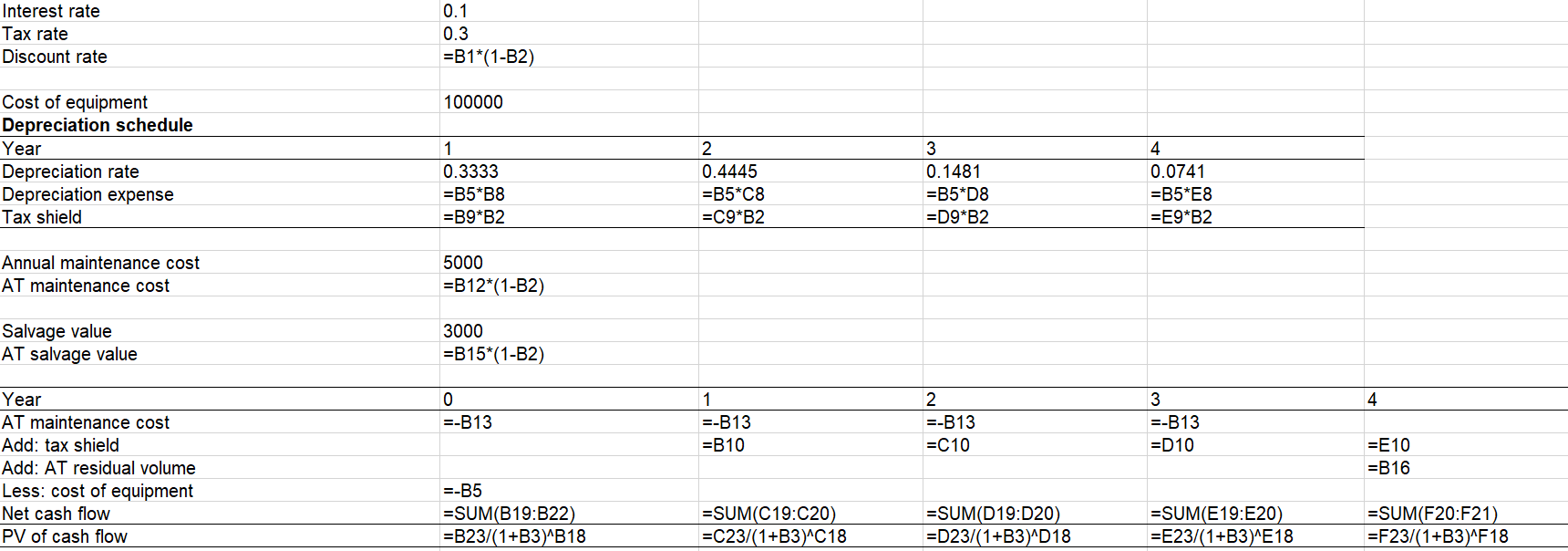

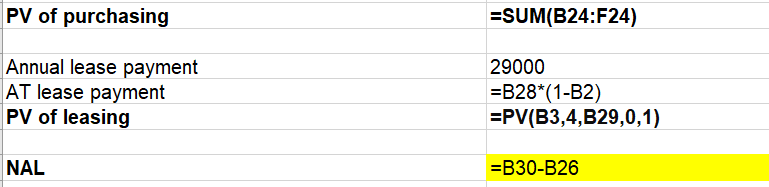

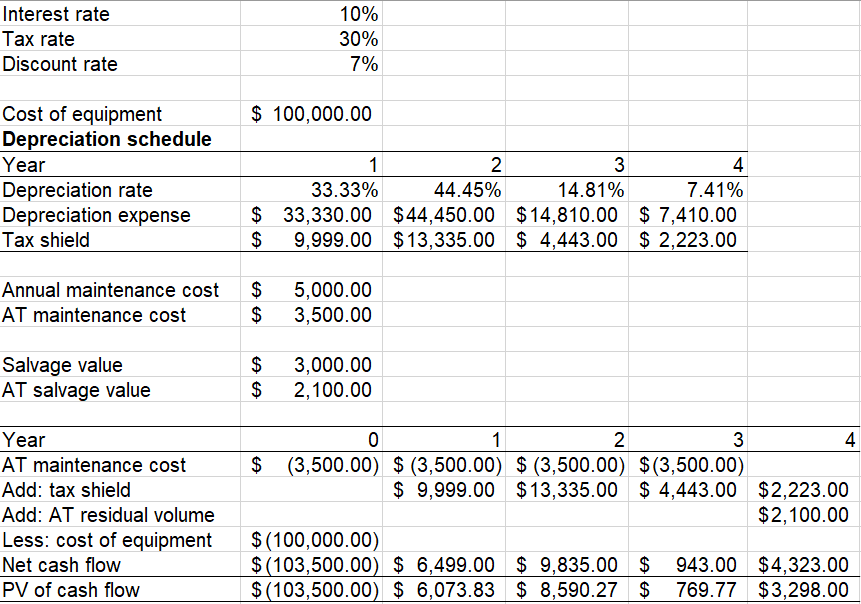

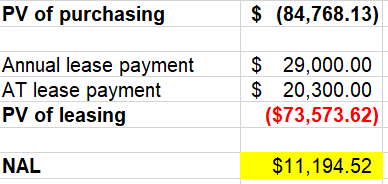

Carmichael Cleaners needs a new steam finishing machine that costs $100,000. The company is evaluating whether it should lease or purchase the machine. The equipment falls into the MACRS 3-year class, and it would be used for 4 years and then sold, because the firm plans to move to a new facility at that time. The estimated value of the equipment after 4 years is $30,000. A maintenance contract on the equipment would cost $5,000 per year, payable at the beginning of each year. Alternatively, the firm could lease the equipment for 4 years for a lease payment of $29,000 per year, payable at the beginning of each year. The lease would include maintenance. The firm could obtain a 4-year simple interest loan, interest payable at the end of the year, to purchase the equipment at a before-tax cost of 10%. The firm is in the 30% tax bracket. If there is a positive Net Advantage to Leasing the firm will lease the equipment. Otherwise, it will buy it. What is the NAL? (Note: Assume MACRS rates for Years 1 to 4 are 0.3333, 0.4445, 0.1481, and 0.0741.)

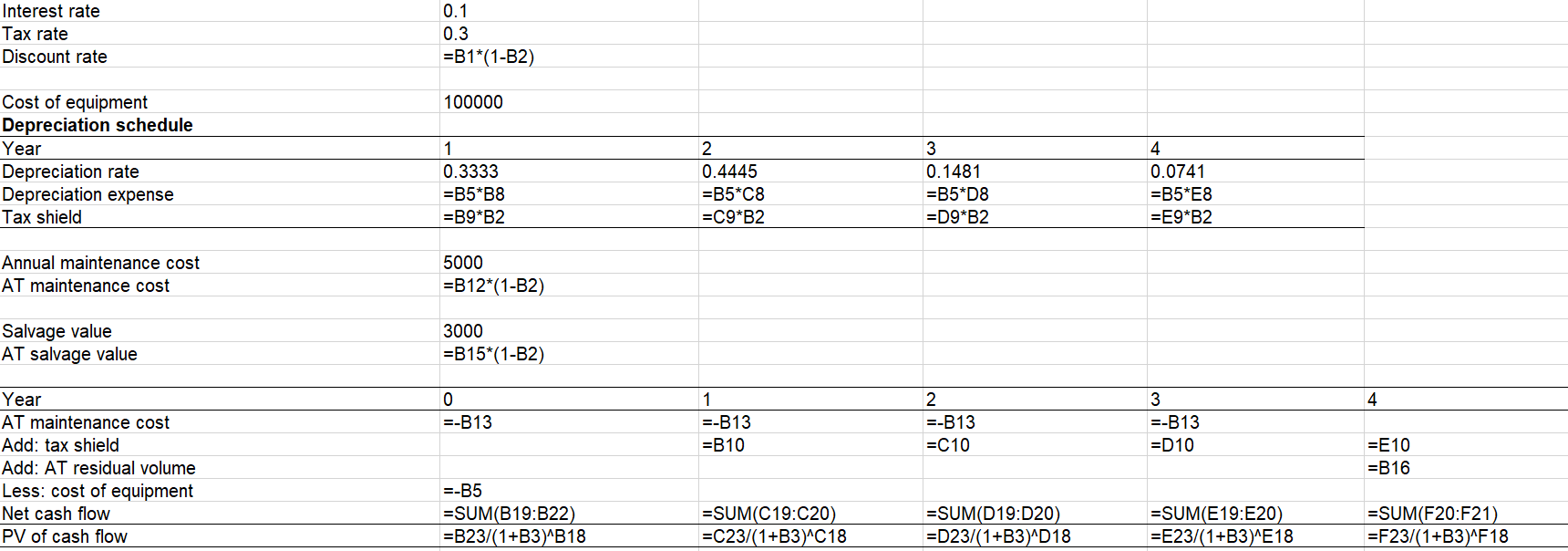

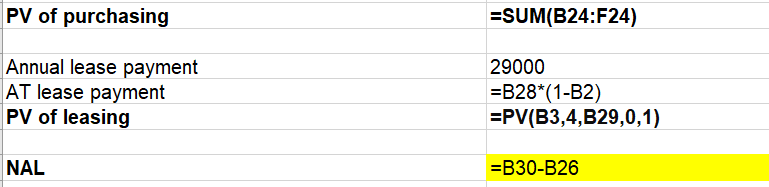

**Before answering the question, please review my excel sheet along with the feedback I have received from the professor.**

The PV cost of leasing is accurate, however, the PV cost of owning is not accurate because of the following reasons:

- after-tax residual value is not $2,100;

- for owning option, we need to assume that the lessee borrow the money then purchase the equipment, so the cash flows need to include the after-tax loan payment.

Interest rate Tax rate Discount rate 10% 30% 7% $ 100,000.00 Cost of equipment Depreciation schedule Year Depreciation rate Depreciation expense Tax shield 1 2 3 4 33.33% 44.45% 14.81% 7.41% $ 33,330.00 $44,450.00 $14,810.00 $ 7,410.00 $ 9,999.00 $13,335.00 $ 4,443.00 $ 2,223.00 A Annual maintenance cost AT maintenance cost $ $ 5,000.00 3,500.00 Salvage value AT salvage value $ $ 3,000.00 2,100.00 Year AT maintenance cost Add: tax shield Add: AT residual volume Less: cost of equipment Net cash flow PV of cash flow 0 1 2 3 4 $ (3,500.00) $ (3,500.00) $ (3,500.00) $(3,500.00) $ 9,999.00 $13,335.00 $ 4,443.00 $2,223.00 $2,100.00 $(100,000.00) $(103,500.00 $ 6,499.00 $ 9,835.00 $ 943.00 $4,323.00 $(103,500.00 $ 6,073.83 $ 8,590.27 $ 769.77 $3,298.00 PV of purchasing $ (84,768.13) Annual lease payment AT lease payment PV of leasing $ 29,000.00 $ 20,300.00 ($73,573.62) NAL $11,194.52 Interest rate Tax rate Discount rate 0.1 0.3 =B1*(1-B2) 100000 Cost of equipment Depreciation schedule Year Depreciation rate Depreciation expense Tax shield 1 0.3333 =B5*B8 =B9*B2 2 0.4445 =B5*C8 =C9*B2 3 0.1481 =B5*D8 =D9*B2 4 0.0741 =B5*E8 =E9*B2 Annual maintenance cost AT maintenance cost 5000 =B12*(1-B2) Salvage value AT salvage value 3000 =B15*(1-B2) 4 0 E-B13 1 =-B13 =B10 2 =-B13 =C10 3 =-B13 =D10 Year AT maintenance cost Add: tax shield Add: AT residual volume Less: cost of equipment Net cash flow PV of cash flow =E10 =B16 =-B5 =SUM(B19:B22) =B23/(1+B3)B18 =SUM(C19:C20) =C23/(1+B3)C18 =SUM(D19:D20) =D23/(1+B3)^D18 =SUM(E19:E20) =E23/(1+B3)^E18 =SUM(F20:F21) =F23/(1+B3)^F18 PV of purchasing =SUM(B24:F24) Annual lease payment AT lease payment PV of leasing 29000 =B28*(1-B2) =PV(B3,4,B29,0,1) NAL =B30-B26 Interest rate Tax rate Discount rate 10% 30% 7% $ 100,000.00 Cost of equipment Depreciation schedule Year Depreciation rate Depreciation expense Tax shield 1 2 3 4 33.33% 44.45% 14.81% 7.41% $ 33,330.00 $44,450.00 $14,810.00 $ 7,410.00 $ 9,999.00 $13,335.00 $ 4,443.00 $ 2,223.00 A Annual maintenance cost AT maintenance cost $ $ 5,000.00 3,500.00 Salvage value AT salvage value $ $ 3,000.00 2,100.00 Year AT maintenance cost Add: tax shield Add: AT residual volume Less: cost of equipment Net cash flow PV of cash flow 0 1 2 3 4 $ (3,500.00) $ (3,500.00) $ (3,500.00) $(3,500.00) $ 9,999.00 $13,335.00 $ 4,443.00 $2,223.00 $2,100.00 $(100,000.00) $(103,500.00 $ 6,499.00 $ 9,835.00 $ 943.00 $4,323.00 $(103,500.00 $ 6,073.83 $ 8,590.27 $ 769.77 $3,298.00 PV of purchasing $ (84,768.13) Annual lease payment AT lease payment PV of leasing $ 29,000.00 $ 20,300.00 ($73,573.62) NAL $11,194.52 Interest rate Tax rate Discount rate 0.1 0.3 =B1*(1-B2) 100000 Cost of equipment Depreciation schedule Year Depreciation rate Depreciation expense Tax shield 1 0.3333 =B5*B8 =B9*B2 2 0.4445 =B5*C8 =C9*B2 3 0.1481 =B5*D8 =D9*B2 4 0.0741 =B5*E8 =E9*B2 Annual maintenance cost AT maintenance cost 5000 =B12*(1-B2) Salvage value AT salvage value 3000 =B15*(1-B2) 4 0 E-B13 1 =-B13 =B10 2 =-B13 =C10 3 =-B13 =D10 Year AT maintenance cost Add: tax shield Add: AT residual volume Less: cost of equipment Net cash flow PV of cash flow =E10 =B16 =-B5 =SUM(B19:B22) =B23/(1+B3)B18 =SUM(C19:C20) =C23/(1+B3)C18 =SUM(D19:D20) =D23/(1+B3)^D18 =SUM(E19:E20) =E23/(1+B3)^E18 =SUM(F20:F21) =F23/(1+B3)^F18 PV of purchasing =SUM(B24:F24) Annual lease payment AT lease payment PV of leasing 29000 =B28*(1-B2) =PV(B3,4,B29,0,1) NAL =B30-B26