Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carol Brady lives at 461 Ocean Blvd, Savannah, GA, 31512. Ms. Brady's social security number is 256-74-8432, and she is 55 years old. Carol

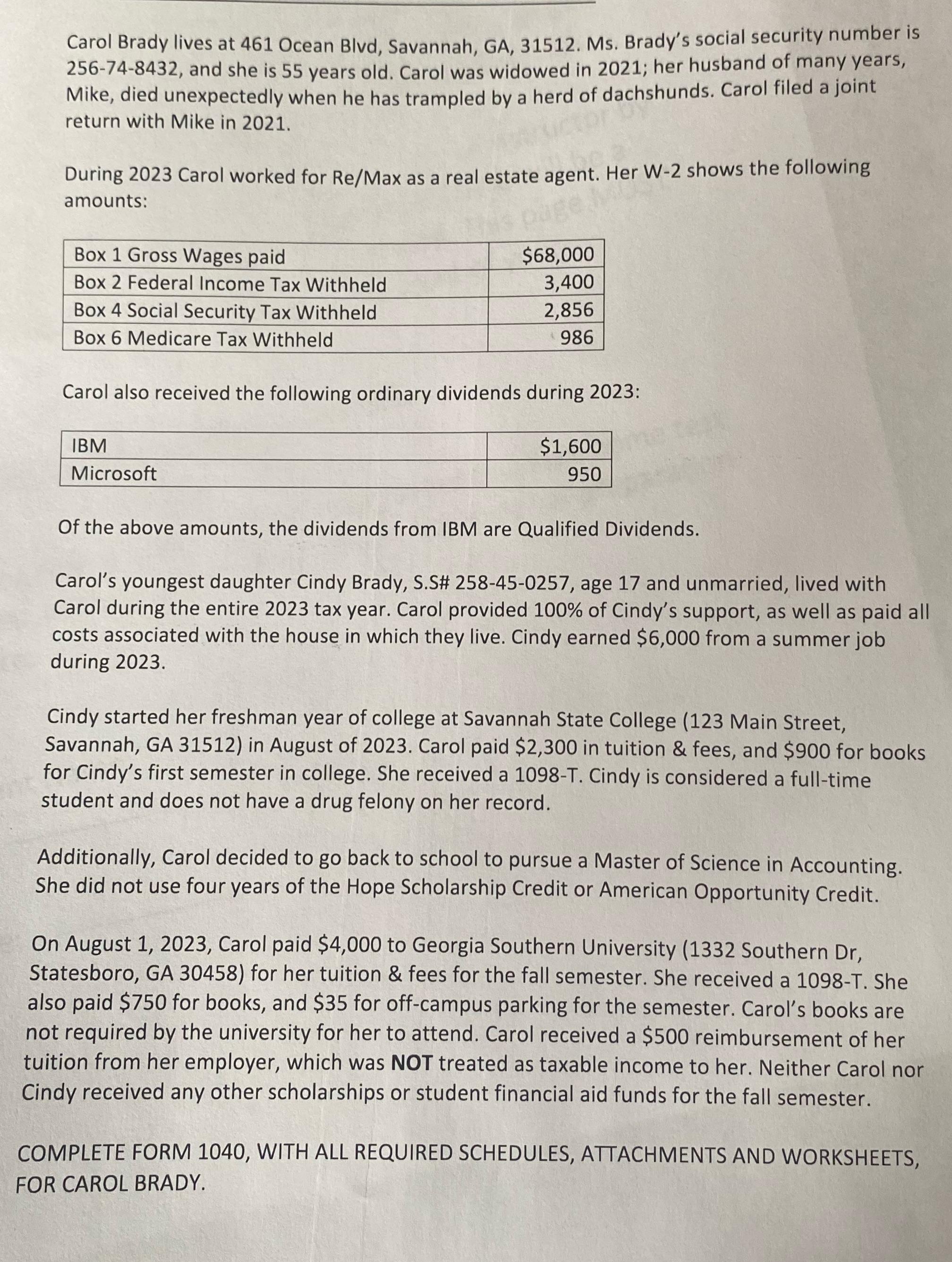

Carol Brady lives at 461 Ocean Blvd, Savannah, GA, 31512. Ms. Brady's social security number is 256-74-8432, and she is 55 years old. Carol was widowed in 2021; her husband of many years, Mike, died unexpectedly when he has trampled by a herd of dachshunds. Carol filed a joint return with Mike in 2021. During 2023 Carol worked for Re/Max as a real estate agent. Her W-2 shows the following amounts: Box 1 Gross Wages paid Box 2 Federal Income Tax Withheld Box 4 Social Security Tax Withheld Box 6 Medicare Tax Withheld $68,000 3,400 2,856 986 Carol also received the following ordinary dividends during 2023: IBM Microsoft $1,600 950 Of the above amounts, the dividends from IBM are Qualified Dividends. Carol's youngest daughter Cindy Brady, S.S# 258-45-0257, age 17 and unmarried, lived with Carol during the entire 2023 tax year. Carol provided 100% of Cindy's support, as well as paid all costs associated with the house in which they live. Cindy earned $6,000 from a summer job during 2023. Cindy started her freshman year of college at Savannah State College (123 Main Street, Savannah, GA 31512) in August of 2023. Carol paid $2,300 in tuition & fees, and $900 for books for Cindy's first semester in college. She received a 1098-T. Cindy is considered a full-time student and does not have a drug felony on her record. Additionally, Carol decided to go back to school to pursue a Master of Science in Accounting. She did not use four years of the Hope Scholarship Credit or American Opportunity Credit. On August 1, 2023, Carol paid $4,000 to Georgia Southern University (1332 Southern Dr, Statesboro, GA 30458) for her tuition & fees for the fall semester. She received a 1098-T. She also paid $750 for books, and $35 for off-campus parking for the semester. Carol's books are not required by the university for her to attend. Carol received a $500 reimbursement of her tuition from her employer, which was NOT treated as taxable income to her. Neither Carol nor Cindy received any other scholarships or student financial aid funds for the fall semester. COMPLETE FORM 1040, WITH ALL REQUIRED SCHEDULES, ATTACHMENTS AND WORKSHEETS, FOR CAROL BRADY.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started