Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carol is a true accountant: she not only likes knowing where every dollar is going, she is obsessed with it. So she is happy

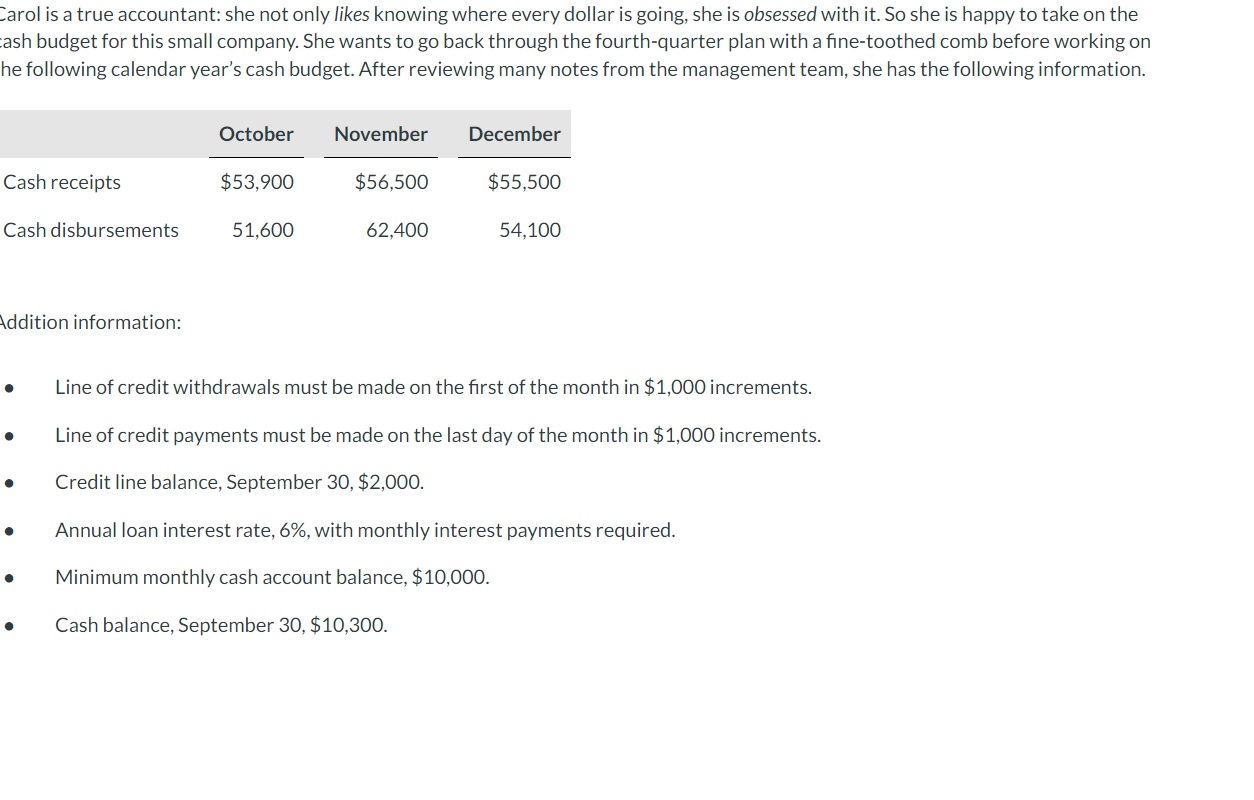

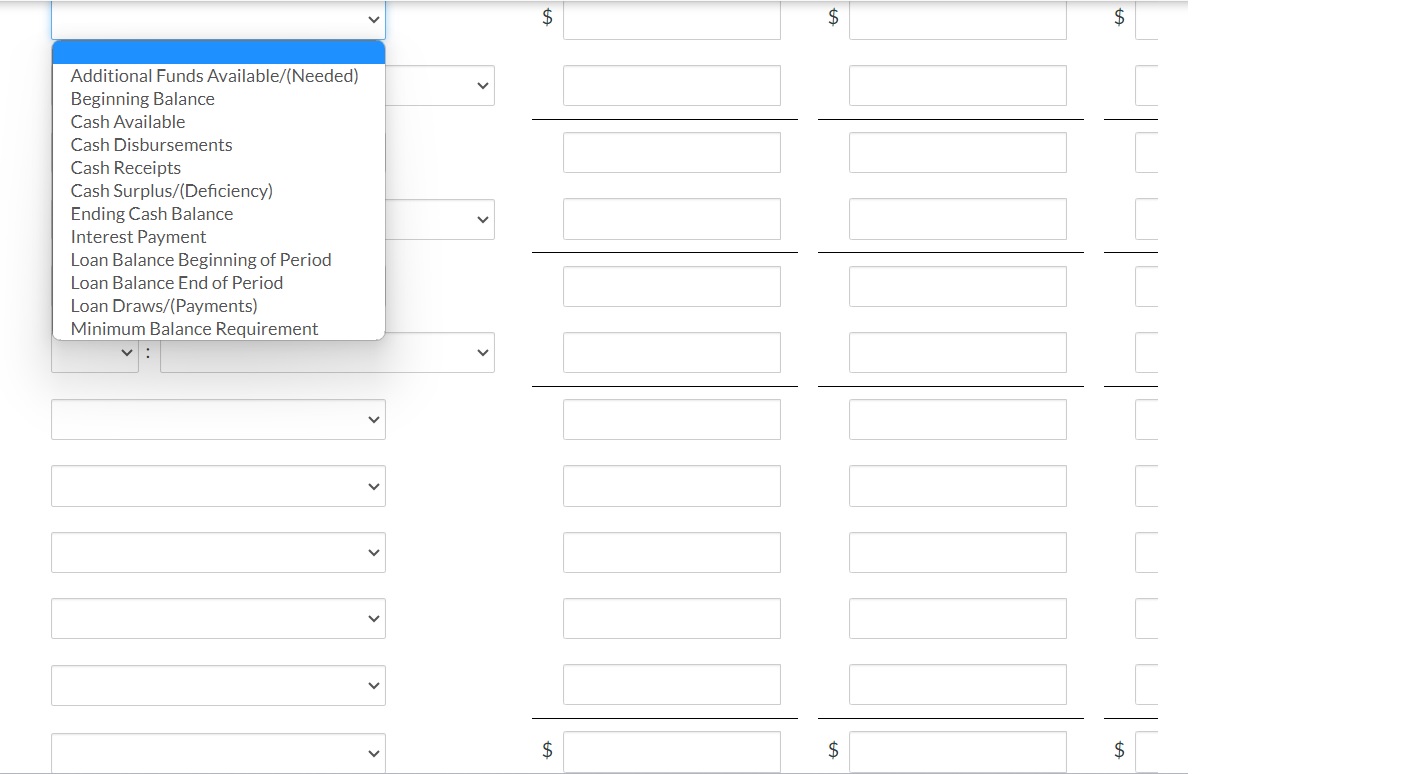

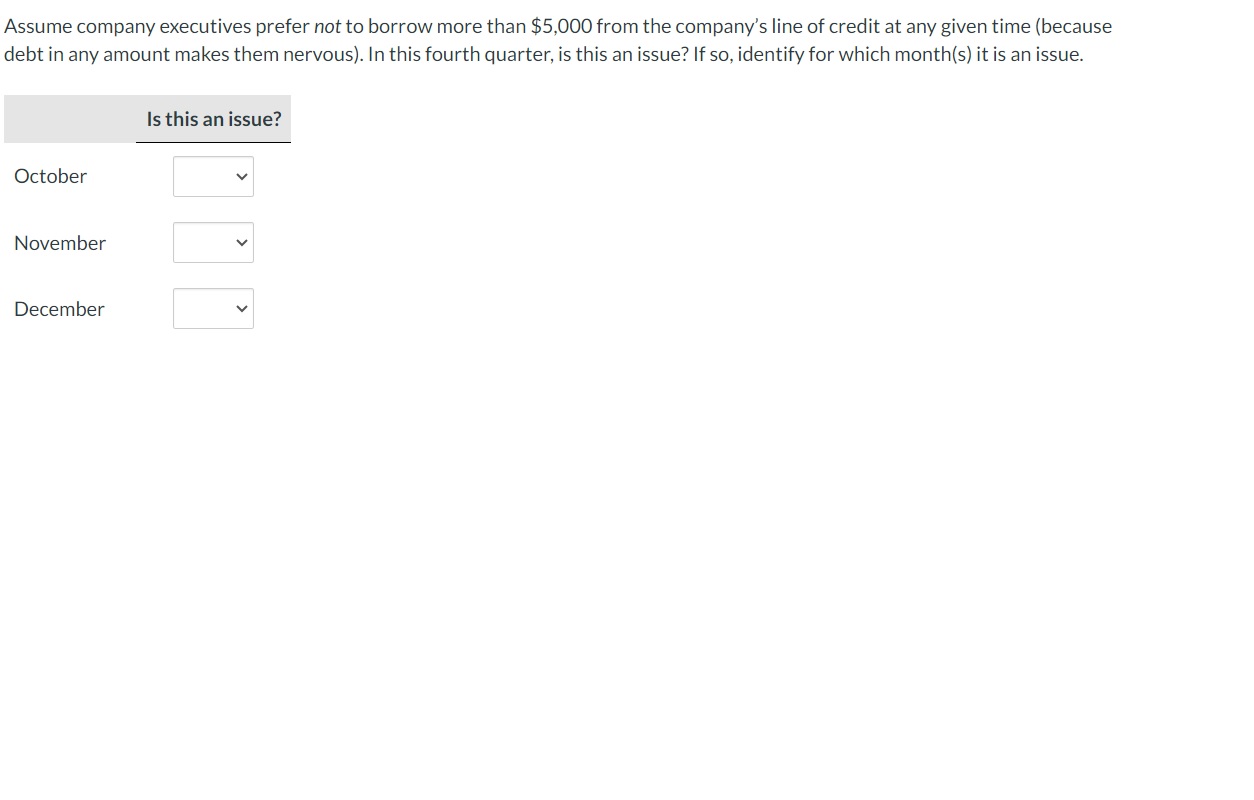

Carol is a true accountant: she not only likes knowing where every dollar is going, she is obsessed with it. So she is happy to take on the cash budget for this small company. She wants to go back through the fourth-quarter plan with a fine-toothed comb before working on he following calendar year's cash budget. After reviewing many notes from the management team, she has the following information. October November December Cash receipts $53,900 $56,500 $55,500 Cash disbursements 51,600 62,400 54,100 Addition information: Line of credit withdrawals must be made on the first of the month in $1,000 increments. Line of credit payments must be made on the last day of the month in $1,000 increments. Credit line balance, September 30, $2,000. Annual loan interest rate, 6%, with monthly interest payments required. Minimum monthly cash account balance, $10,000. Cash balance, September 30, $10,300. Additional Funds Available/(Needed) Beginning Balance Cash Available Cash Disbursements Cash Receipts Cash Surplus/(Deficiency) Ending Cash Balance Interest Payment Loan Balance Beginning of Period Loan Balance End of Period Loan Draws/(Payments) Minimum Balance Requirement $ $ $ > $ $ $ Assume company executives prefer not to borrow more than $5,000 from the company's line of credit at any given time (because debt in any amount makes them nervous). In this fourth quarter, is this an issue? If so, identify for which month(s) it is an issue. October November December Is this an issue?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started