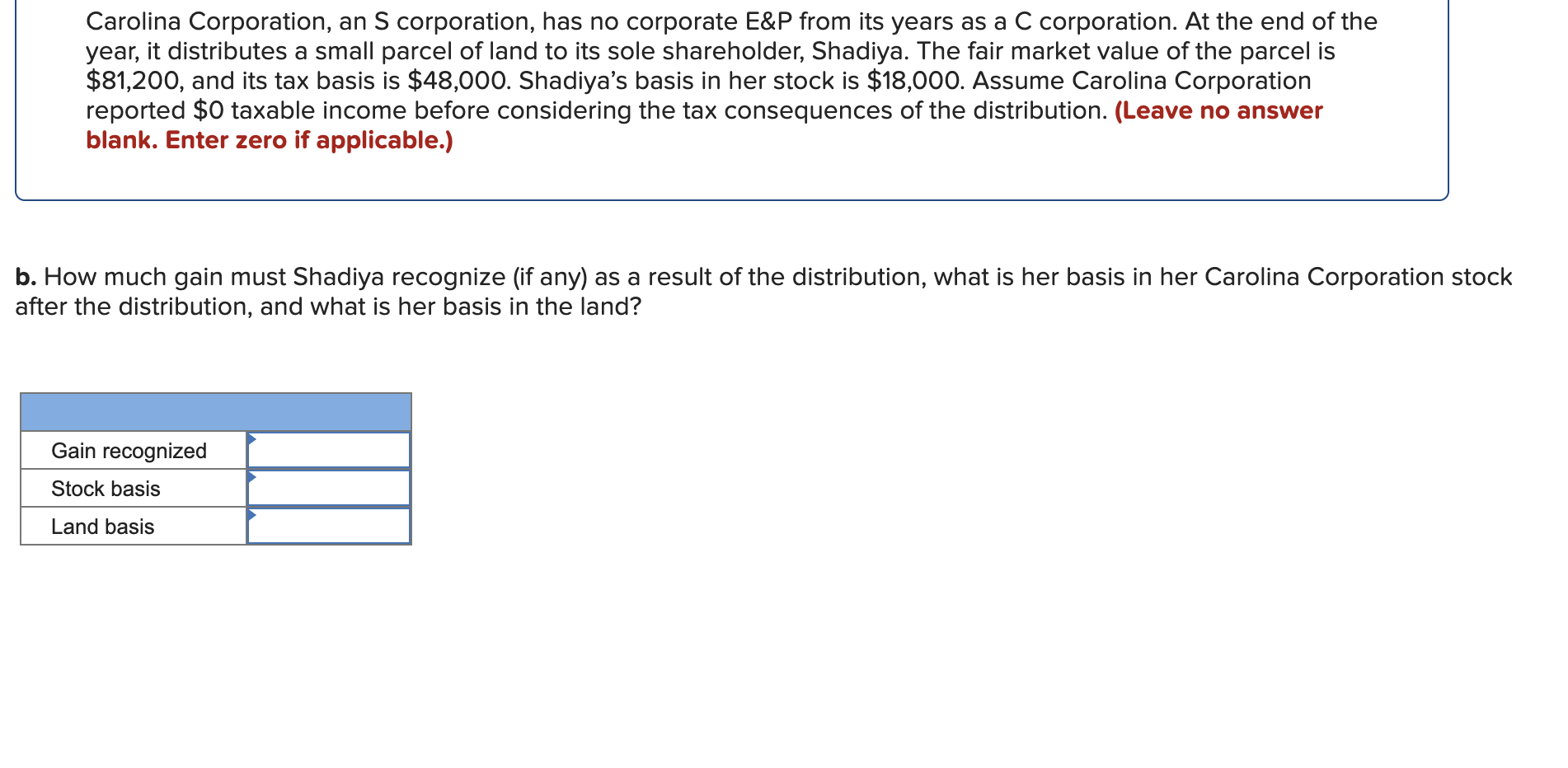

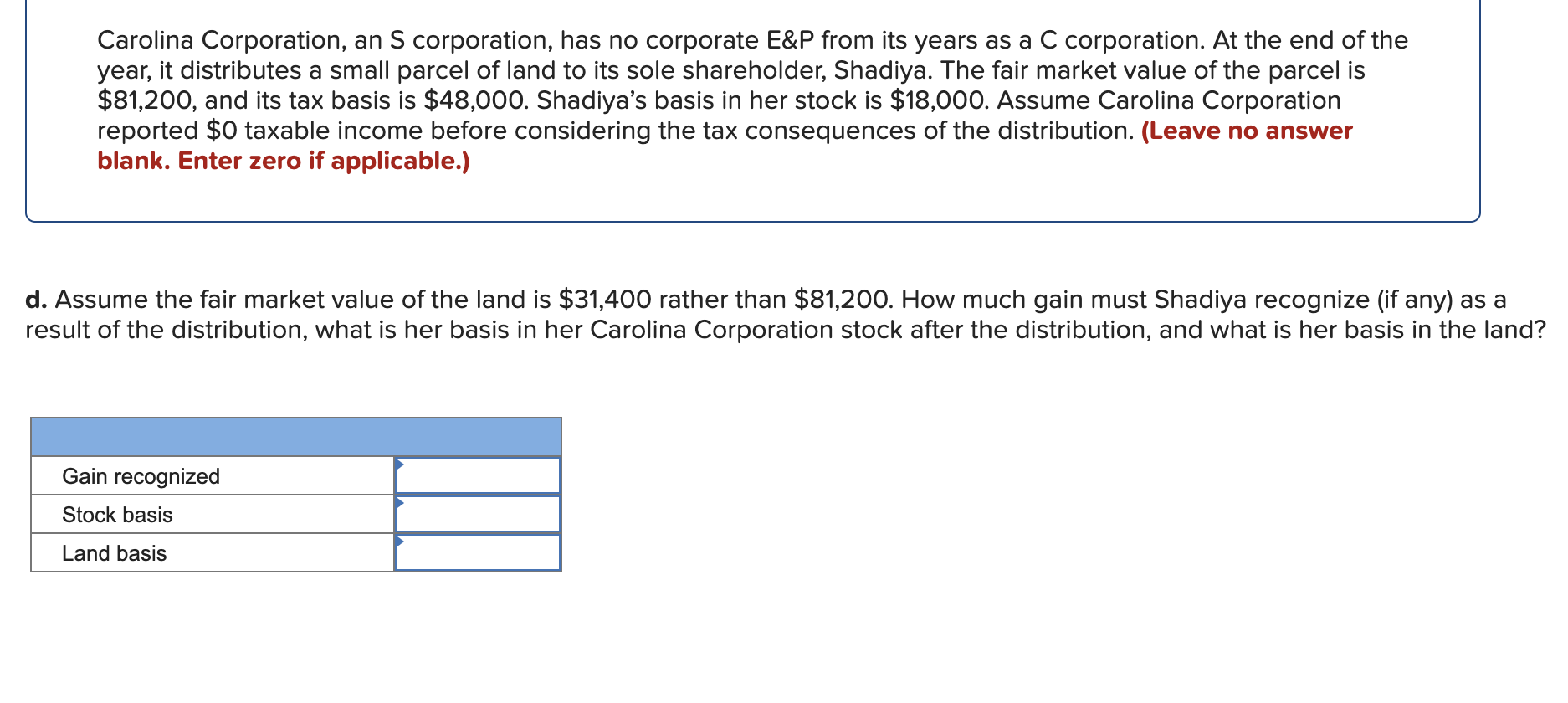

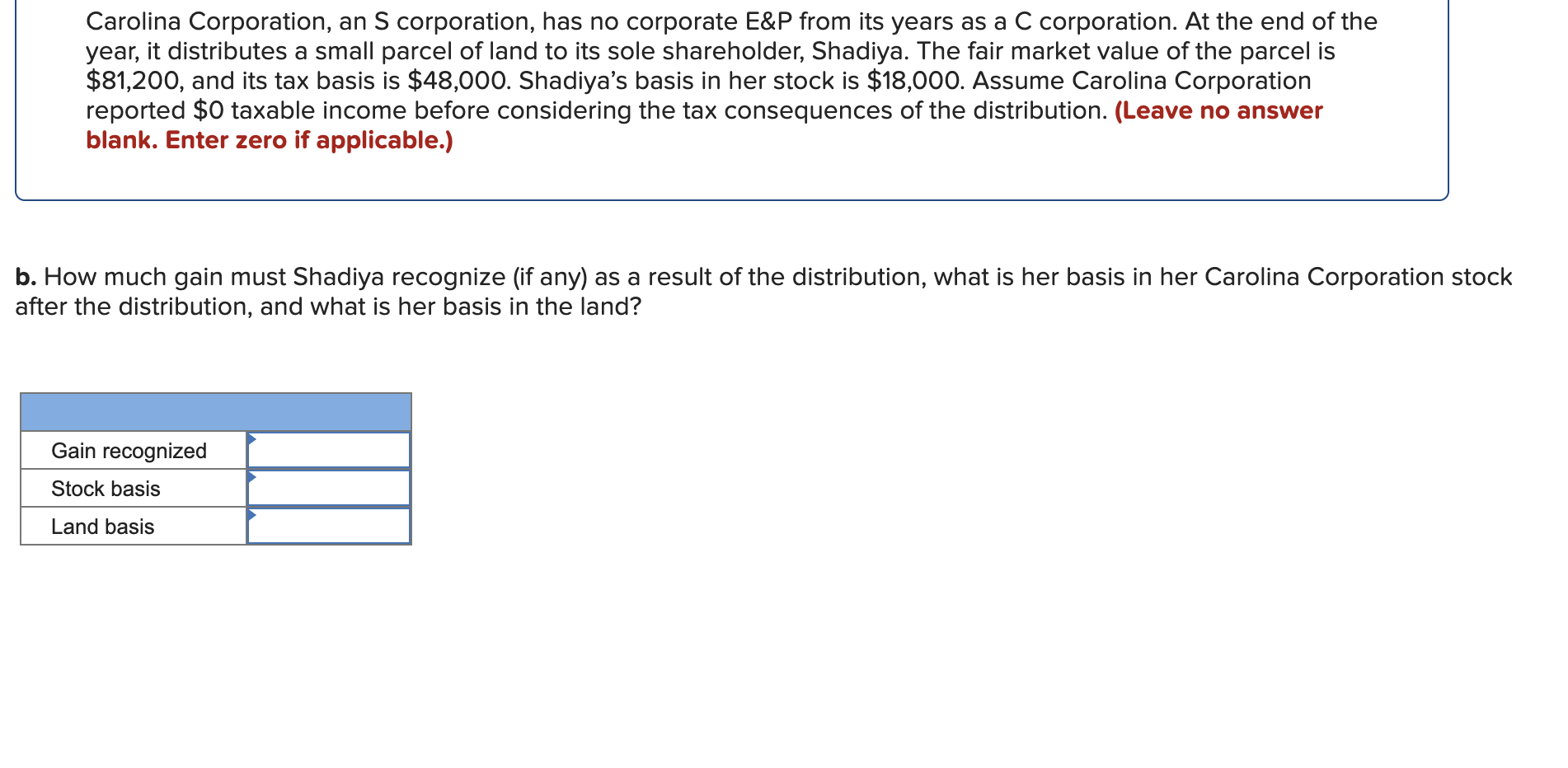

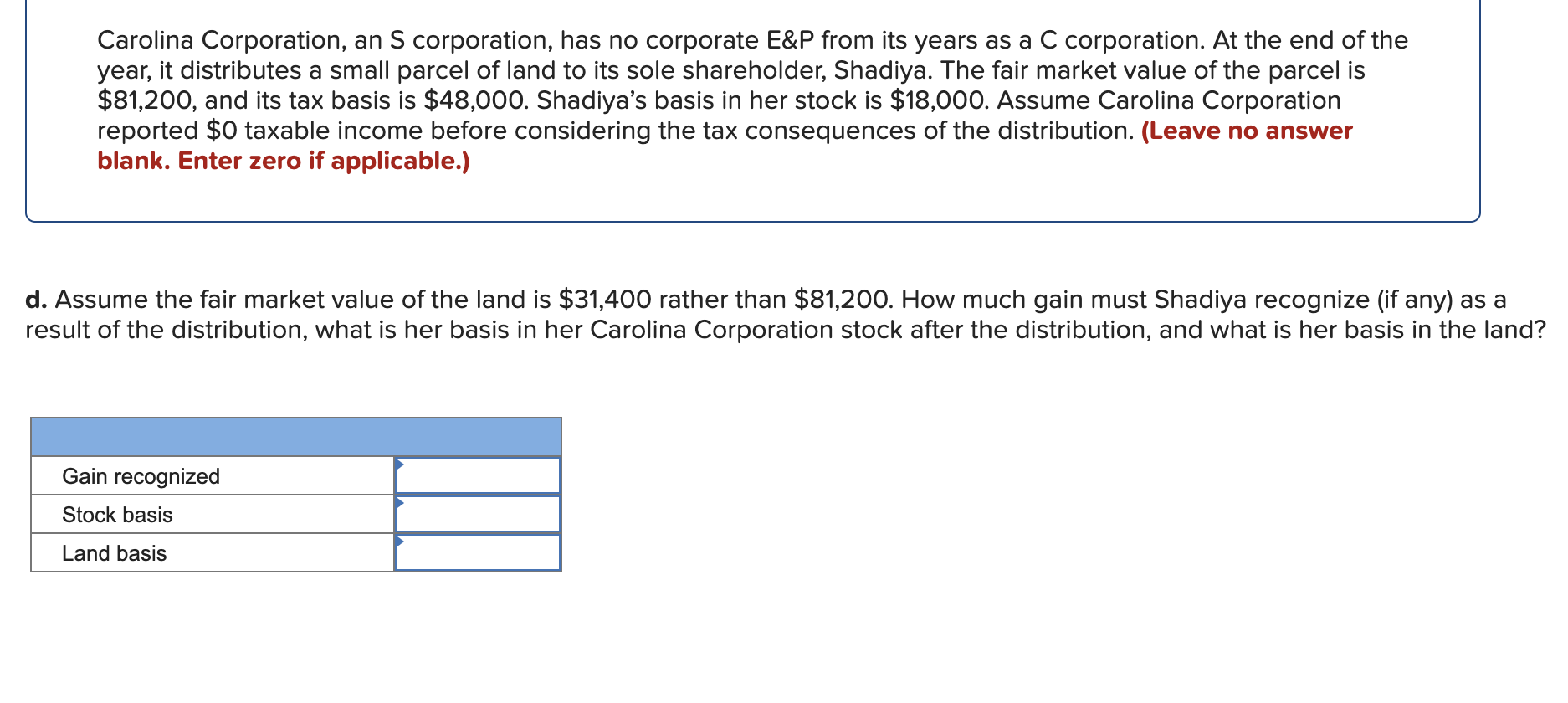

Carolina Corporation, an s corporation, has no corporate E&P from its years as a C corporation. At the end of the year, it distributes a small parcel of land to its sole shareholder, Shadiya. The fair market value of the parcel is $81,200, and its tax basis is $48,000. Shadiya's basis in her stock is $18,000. Assume Carolina Corporation reported $0 taxable income before considering the tax consequences of the distribution. (Leave no answer blank. Enter zero if applicable.) a. What amount of gain or loss, if any, does Carolina Corporation recognize on the distribution? Carolina Corporation, an S corporation, has no corporate E&P from its years as a C corporation. At the end of the year, it distributes a small parcel of land to its sole shareholder, Shadiya. The fair market value of the parcel is $81,200, and its tax basis is $48,000. Shadiya's basis in her stock is $18,000. Assume Carolina Corporation reported $0 taxable income before considering the tax consequences of the distribution. (Leave no answer blank. Enter zero if applicable.) b. How much gain must Shadiya recognize (if any) as a result of the distribution, what is her basis in her Carolina Corporation stock after the distribution, and what is her basis in the land? Gain recognized Stock basis Land basis Carolina Corporation, an s corporation, has no corporate E&P from its years as a C corporation. At the end of the year, it distributes a small parcel of land to its sole shareholder, Shadiya. The fair market value of the parcel is $81,200, and its tax basis is $48,000. Shadiya's basis in her stock is $18,000. Assume Carolina Corporation reported $0 taxable income before considering the tax consequences of the distribution. (Leave no answer blank. Enter zero if applicable.) . Assume the fair market value of the land is $31,400 rather than $81,200. What amount of gain or loss, if any, does Carolina Corporation recognize on the distribution? Carolina Corporation, an S corporation, has no corporate E&P from its years as a C corporation. At the end of the year, it distributes a small parcel of land to its sole shareholder, Shadiya. The fair market value of the parcel is $81,200, and its tax basis is $48,000. Shadiya's basis in her stock is $18,000. Assume Carolina Corporation reported $0 taxable income before considering the tax consequences of the distribution. (Leave no answer blank. Enter zero if applicable.) d. Assume the fair market value of the land is $31,400 rather than $81,200. How much gain must Shadiya recognize (if any) as a result of the distribution, what is her basis in her Carolina Corporation stock after the distribution, and what is her basis in the land? Gain recognized Stock basis Land basis