Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carolina Shoe Company (CSC) was founded fifteen years ago by Robert Young and Peter Sinclair. CSC is a distributor that purchases and sells women's

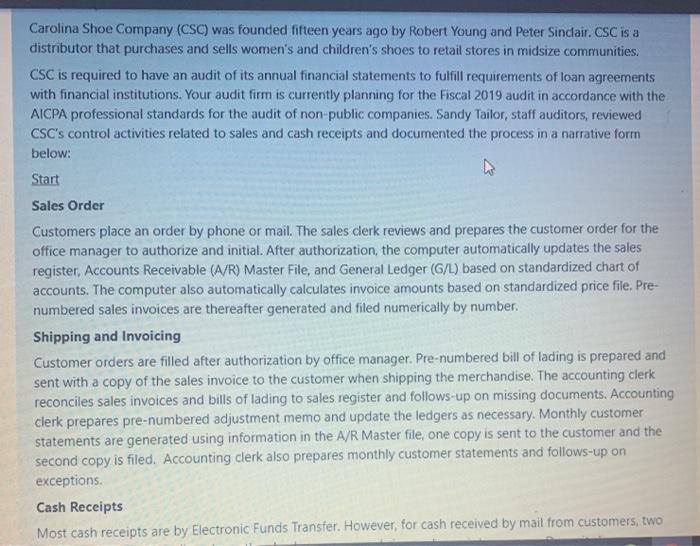

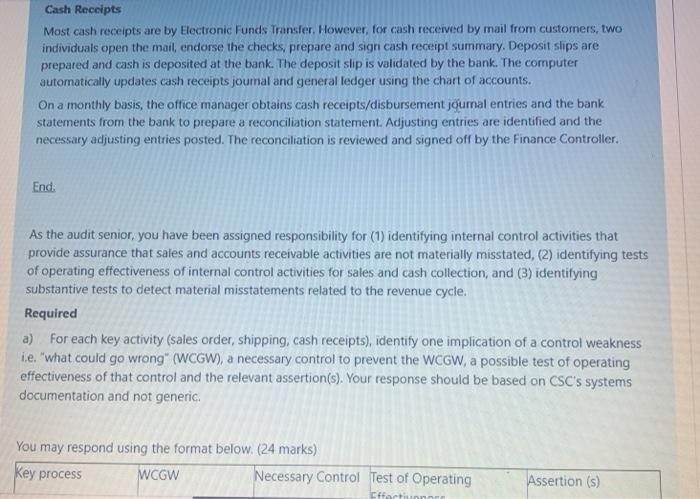

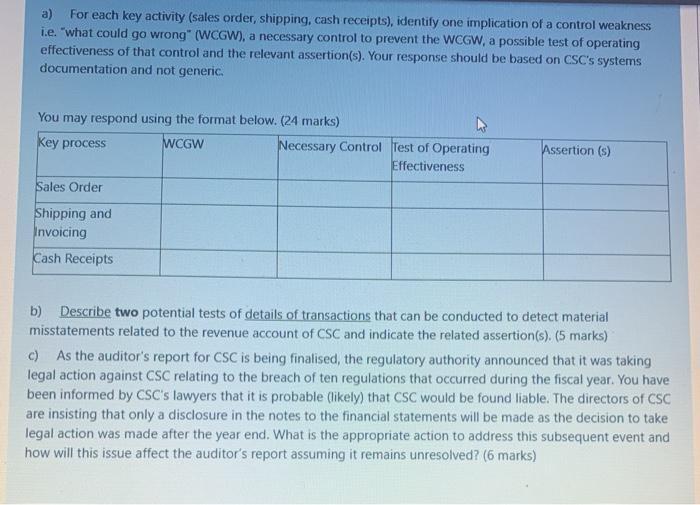

Carolina Shoe Company (CSC) was founded fifteen years ago by Robert Young and Peter Sinclair. CSC is a distributor that purchases and sells women's and children's shoes to retail stores in midsize communities. CSC is required to have an audit of its annual financial statements to fulfill requirements of loan agreements with financial institutions. Your audit firm is currently planning for the Fiscal 2019 audit in accordance with the AICPA professional standards for the audit of non-public companies. Sandy Tailor, staff auditors, reviewed CSC's control activities related to sales and cash receipts and documented the process in a narrative form below: Start Sales Order Customers place an order by phone or mail. The sales clerk reviews and prepares the customer order for the office manager to authorize and initial. After authorization, the computer automatically updates the sales register, Accounts Receivable (A/R) Master File, and General Ledger (G/L) based on standardized chart of accounts. The computer also automatically calculates invoice amounts based on standardized price file. Pre- numbered sales invoices are thereafter generated and filed numerically by number. Shipping and Invoicing Customer orders are filled after authorization by office manager. Pre-numbered bill of lading is prepared and sent with a copy of the sales invoice to the customer when shipping the merchandise. The accounting clerk reconciles sales invoices and bills of lading to sales register and follows-up on missing documents. Accounting clerk prepares pre-numbered adjustment memo and update the ledgers as necessary. Monthly customer statements are generated using information in the A/R Master file, one copy is sent to the customer and the second copy is filed. Accounting clerk also prepares monthly customer statements and follows-up on exceptions. Cash Receipts Most cash receipts are by Electronic Funds Transfer. However, for cash received by mail from customers, two Cash Receipts Most cash receipts are by Electronic Funds Transfer. However, for cash received by mail from customers, two individuals open the mail, endorse the checks, prepare and sign cash receipt summary. Deposit slips are prepared and cash is deposited at the bank. The deposit slip is validated by the bank. The computer automatically updates cash receipts joumal and general ledger using the chart of accounts. On a monthly basis, the office manager obtains cash receipts/disbursement journal entries and the bank statements from the bank to prepare a reconciliation statement. Adjusting entries are identified and the necessary adjusting entries posted. The reconciliation is reviewed and signed off by the Finance Controller. End. As the audit senior, you have been assigned responsibility for (1) identifying internal control activities that provide assurance that sales and accounts receivable activities are not materially misstated, (2) identifying tests of operating effectiveness of internal control activities for sales and cash collection, and (3) identifying substantive tests to detect material misstatements related to the revenue cycle. Required a) For each key activity (sales order, shipping, cash receipts), identify one implication of a control weakness i.e. "what could go wrong" (WCGW), a necessary control to prevent the WCGW, a possible test of operating effectiveness of that control and the relevant assertion(s). Your response should be based on CSC's systems documentation and not generic. You may respond using the format below. (24 marks) Key process WCGW Necessary Control Test of Operating Effectivonor Assertion (s) a) For each key activity (sales order, shipping, cash receipts), identify one implication of a control weakness i.e. "what could go wrong" (WCGW), a necessary control to prevent the WCGW, a possible test of operating effectiveness of that control and the relevant assertion(s). Your response should be based on CSC's systems documentation and not generic. You may respond using the format below. (24 marks) Key process WCGW Sales Order Shipping and Invoicing Cash Receipts Necessary Control Test of Operating Effectiveness Assertion (s) b) Describe two potential tests of details of transactions that can be conducted to detect material misstatements related to the revenue account of CSC and indicate the related assertion(s). (5 marks) c) As the auditor's report for CSC is being finalised, the regulatory authority announced that it was taking legal action against CSC relating to the breach of ten regulations that occurred during the fiscal year. You have been informed by CSC's lawyers that it is probable (likely) that CSC would be found liable. The directors of CSC are insisting that only a disclosure in the notes to the financial statements will be made as the decision to take legal action was made after the year end. What is the appropriate action to address this subsequent event and how will this issue affect the auditor's report assuming it remains unresolved? (6 marks)

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Sales Order WCGW Sales orders may not be accurately recorded leading to incorrect inventory tracking and potential loss of sales Necessary Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started