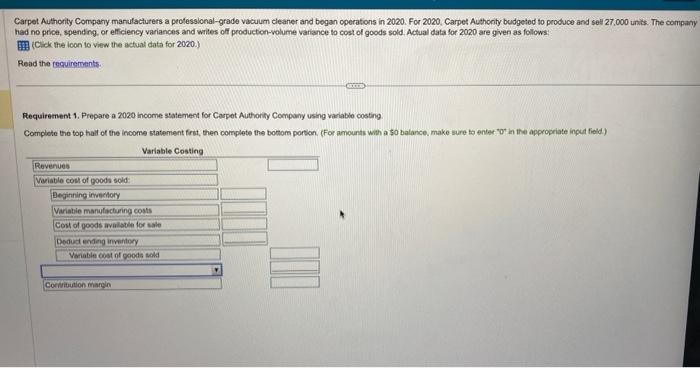

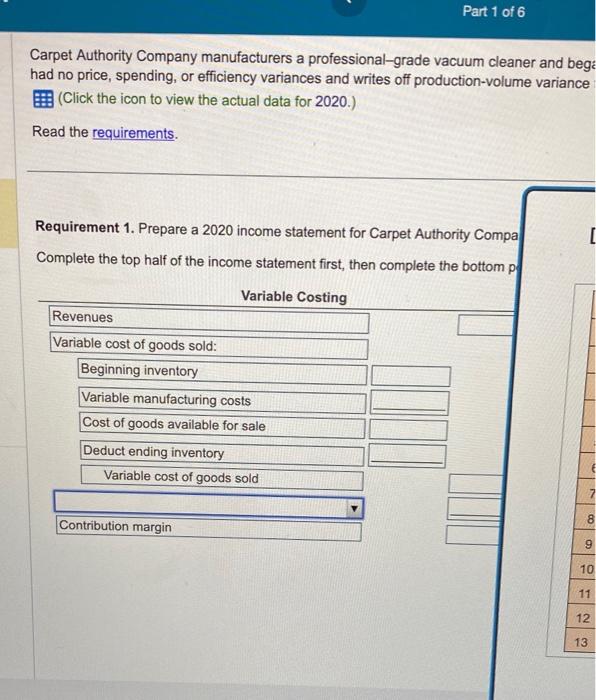

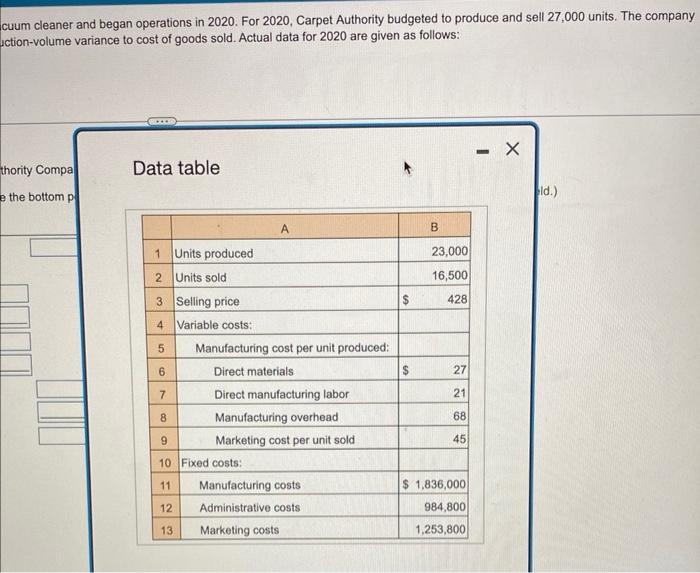

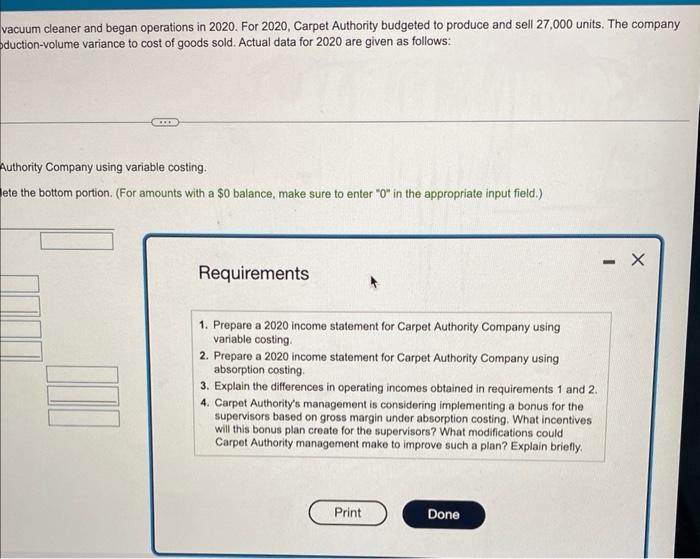

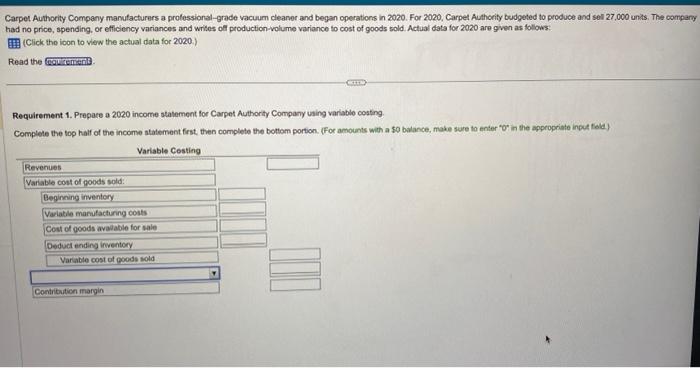

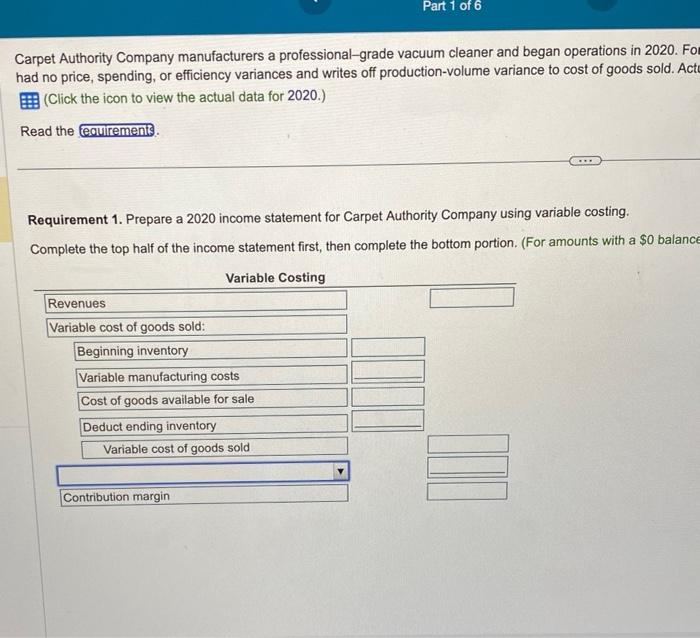

Carpet Authority Company manulacturers a peotessional-grade vacuum cleaner and began operations in 2020 . For 2020 , Carpet Authonty budgetod to produce and sell 27,000 unis. The company had no price, spending. or efficiency variances and wites off producton-volume variance to cost of goods sold. Actual data for 2020 are given as follows: (Cick the icon to view the actual data for 2020.) Read the feguirements. Requirement 1. Prepare a 2020 income statemect for Carpet Authorify Company using variabio costing Complete the top haif of the income statement frest, then corplete the bothom porton. (For amounts with a 50 batance. make sure to enter "ot in the appropriate input field) Carpet Authority Company manufacturers a professional-grade vacuum cleaner and beg had no price, spending, or efficiency variances and writes off production-volume variance (Click the icon to view the actual data for 2020. ) Read the requirements. Requirement 1. Prepare a 2020 income statement for Carpet Authority Compa Complete the top half of the income statement first, then complete the bottom p cuum cleaner and began operations in 2020 . For 2020, Carpet Authority budgeted to produce and sell 27,000 units. The company uction-volume variance to cost of goods sold. Actual data for 2020 are given as follows: Data table id.) vacuum cleaner and began operations in 2020. For 2020, Carpet Authority budgeted to produce and sell 27,000 units. The company duction-volume variance to cost of goods sold. Actual data for 2020 are given as follows: Authority Company using variable costing. ete the bottom portion. (For amounts with a $0 balance, make sure to enter " 0 " in the appropriate input field.) Requirements 1. Prepare a 2020 income statement for Carpet Authority Company using variable costing. 2. Prepare a 2020 income statement for Carpet Authority Company using absorption costing. 3. Explain the differences in operating incomes obtained in requirements 1 and 2. 4. Carpet Authority's management is considering implementing a bonus for the supervisors based on gross margin under absorption costing. What incentives will this bonus plan create for the supervisors? What modifications could Carpet Authority management make to improve such a plan? Explain briefly. Carpel Authority Company manufacturers a protessional-grade vacuum cleaner and began operations in 2020. For 2020, Carpel Authority budpeted to produce and sel 27,000 units. The company had no price, spending, or efliciency variances and writes ofl production-volume variance to cost of goods sold. Actual data for 2020 are gven as follows: (Click the ioon to view the actual data for 2020.) Read the Requirement 1. Prepare a 2020 income statement for Carpet Authority Company uaing varable costing. Complete the top half of the income statement first then complete the bottom portion. (For amounts with a so bulance, make sure to enter "O" in the appropriate input fald) Carpet Authority Company manufacturers a professional-grade vacuum cleaner and began operations in 2020 . Fo had no price, spending, or efficiency variances and writes off production-volume variance to cost of goods sold. Act (Click the icon to view the actual data for 2020.) Read the Requirement 1. Prepare a 2020 income statement for Carpet Authority Company using variable costing. Complete the top half of the income statement first, then complete the bottom portion. (For amounts with a $0 balanc Carpet Authority Company manulacturers a peotessional-grade vacuum cleaner and began operations in 2020 . For 2020 , Carpet Authonty budgetod to produce and sell 27,000 unis. The company had no price, spending. or efficiency variances and wites off producton-volume variance to cost of goods sold. Actual data for 2020 are given as follows: (Cick the icon to view the actual data for 2020.) Read the feguirements. Requirement 1. Prepare a 2020 income statemect for Carpet Authorify Company using variabio costing Complete the top haif of the income statement frest, then corplete the bothom porton. (For amounts with a 50 batance. make sure to enter "ot in the appropriate input field) Carpet Authority Company manufacturers a professional-grade vacuum cleaner and beg had no price, spending, or efficiency variances and writes off production-volume variance (Click the icon to view the actual data for 2020. ) Read the requirements. Requirement 1. Prepare a 2020 income statement for Carpet Authority Compa Complete the top half of the income statement first, then complete the bottom p cuum cleaner and began operations in 2020 . For 2020, Carpet Authority budgeted to produce and sell 27,000 units. The company uction-volume variance to cost of goods sold. Actual data for 2020 are given as follows: Data table id.) vacuum cleaner and began operations in 2020. For 2020, Carpet Authority budgeted to produce and sell 27,000 units. The company duction-volume variance to cost of goods sold. Actual data for 2020 are given as follows: Authority Company using variable costing. ete the bottom portion. (For amounts with a $0 balance, make sure to enter " 0 " in the appropriate input field.) Requirements 1. Prepare a 2020 income statement for Carpet Authority Company using variable costing. 2. Prepare a 2020 income statement for Carpet Authority Company using absorption costing. 3. Explain the differences in operating incomes obtained in requirements 1 and 2. 4. Carpet Authority's management is considering implementing a bonus for the supervisors based on gross margin under absorption costing. What incentives will this bonus plan create for the supervisors? What modifications could Carpet Authority management make to improve such a plan? Explain briefly. Carpel Authority Company manufacturers a protessional-grade vacuum cleaner and began operations in 2020. For 2020, Carpel Authority budpeted to produce and sel 27,000 units. The company had no price, spending, or efliciency variances and writes ofl production-volume variance to cost of goods sold. Actual data for 2020 are gven as follows: (Click the ioon to view the actual data for 2020.) Read the Requirement 1. Prepare a 2020 income statement for Carpet Authority Company uaing varable costing. Complete the top half of the income statement first then complete the bottom portion. (For amounts with a so bulance, make sure to enter "O" in the appropriate input fald) Carpet Authority Company manufacturers a professional-grade vacuum cleaner and began operations in 2020 . Fo had no price, spending, or efficiency variances and writes off production-volume variance to cost of goods sold. Act (Click the icon to view the actual data for 2020.) Read the Requirement 1. Prepare a 2020 income statement for Carpet Authority Company using variable costing. Complete the top half of the income statement first, then complete the bottom portion. (For amounts with a $0 balanc