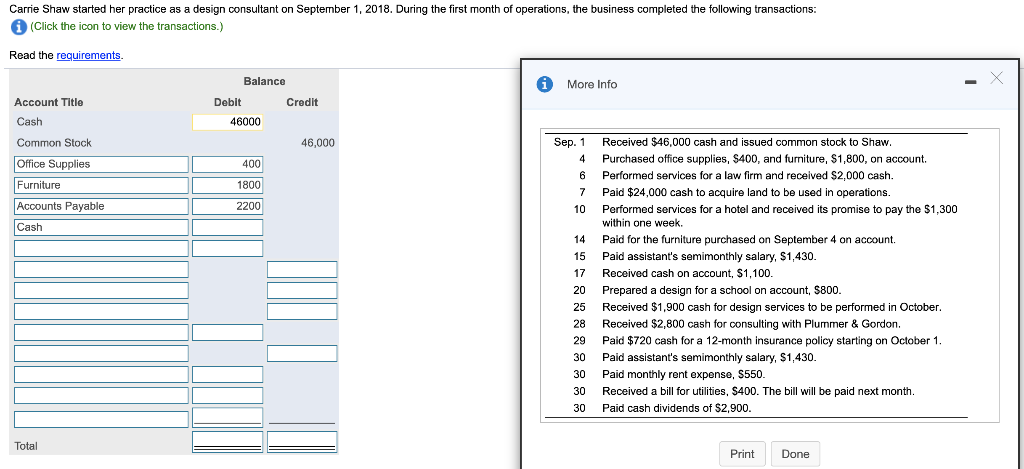

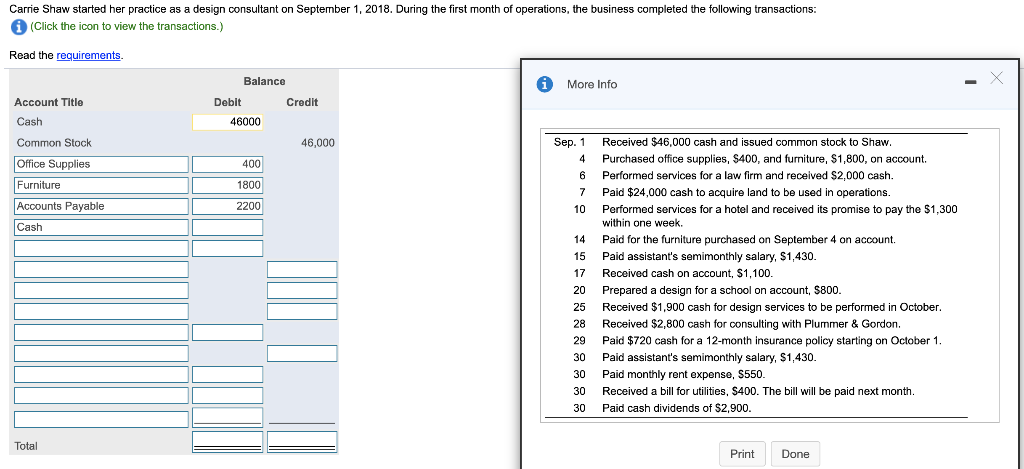

Carrie Shaw started her practice as a design consultant on September 1, 2018. During the first month of operations, the business completed the following transactions: (Click the icon to view the transactions.) Read the requirements. i More Info Account Title Cash Common Stock Balance Debit Credit 46000 46,000 400 Office Supplies Sep. 1 4 6 7 10 Furniture 1800 Accounts Payable 2200 Cast 14 15 17 20 25 28 29 30 30 30 30 Received $46,000 cash and issued common stock to Shaw. Purchased office supplies, $400, and furniture, $1,800, on account. Performed services for a law firm and received $2,000 cash. Paid $24,000 cash to acquire land to be used in operations. Performed services for a hotel and received its promise to pay the $1,300 within one week. Paid for the furniture purchased on September 4 on account. Paid assistant's semimonthly salary, $1,430. Received cash on account, $1,100. Prepared a design for a school on account, $800. Received $1,900 cash for design services to be performed in October. Received $2,800 cash for consulting with Plummer & Gordon Paid $720 cash for a 12-month insurance policy starting on October 1. Paid assistant's semimonthly salary, $1,430. Paid monthly rent expense, $550. Received a bill for utilities, $400. The bill will be paid next month. Paid cash dividends of $2,900. Total Print Done Carrie Shaw started her practice as a design consultant on September 1, 2018. During the first month of operations, the business completed the following transactions: (Click the icon to view the transactions.) Read the requirements. i More Info Account Title Cash Common Stock Balance Debit Credit 46000 46,000 400 Office Supplies Sep. 1 4 6 7 10 Furniture 1800 Accounts Payable 2200 Cast 14 15 17 20 25 28 29 30 30 30 30 Received $46,000 cash and issued common stock to Shaw. Purchased office supplies, $400, and furniture, $1,800, on account. Performed services for a law firm and received $2,000 cash. Paid $24,000 cash to acquire land to be used in operations. Performed services for a hotel and received its promise to pay the $1,300 within one week. Paid for the furniture purchased on September 4 on account. Paid assistant's semimonthly salary, $1,430. Received cash on account, $1,100. Prepared a design for a school on account, $800. Received $1,900 cash for design services to be performed in October. Received $2,800 cash for consulting with Plummer & Gordon Paid $720 cash for a 12-month insurance policy starting on October 1. Paid assistant's semimonthly salary, $1,430. Paid monthly rent expense, $550. Received a bill for utilities, $400. The bill will be paid next month. Paid cash dividends of $2,900. Total Print Done