Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Abu and Ali formed a partnership on January 1, 2021. Abu invests RM25,000 cash, and Ali contributes RM5,000 and equipment having a book value

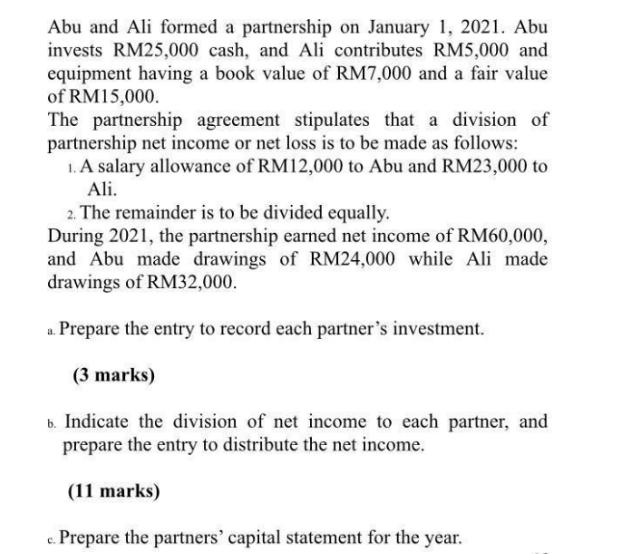

Abu and Ali formed a partnership on January 1, 2021. Abu invests RM25,000 cash, and Ali contributes RM5,000 and equipment having a book value of RM7,000 and a fair value of RM15,000. The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows: 1. A salary allowance of RM12,000 to Abu and RM23,000 to Ali. 2. The remainder is to be divided equally. During 2021, the partnership earned net income of RM60,000, and Abu made drawings of RM24,000 while Ali made drawings of RM32,000. a. Prepare the entry to record each partner's investment. (3 marks) 6. Indicate the division of net income to each partner, and prepare the entry to distribute the net income. (11 marks) c. Prepare the partners' capital statement for the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Journal entry to record partners investment Date Particulars Debit Credit 1121 Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started