Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CarryALL, Inc., makes and sells small cargo trailers to individuals and small businesses. Since its opening in 1990, it has allocated indirect costs (IDC)

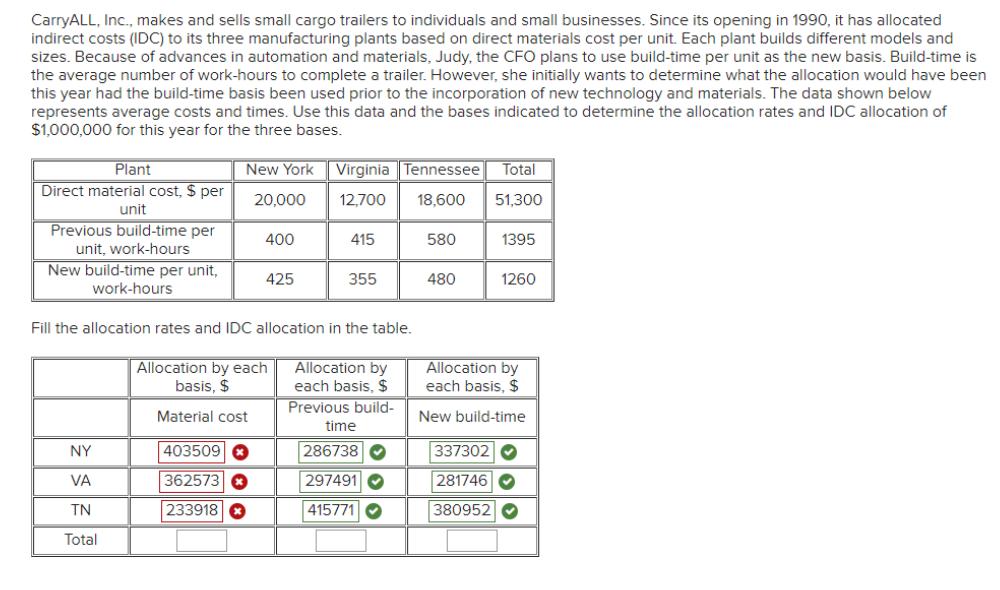

CarryALL, Inc., makes and sells small cargo trailers to individuals and small businesses. Since its opening in 1990, it has allocated indirect costs (IDC) to its three manufacturing plants based on direct materials cost per unit. Each plant builds different models and sizes. Because of advances in automation and materials, Judy, the CFO plans to use build-time per unit as the new basis. Build-time is the average number of work-hours to complete a trailer. However, she initially wants to determine what the allocation would have been this year had the build-time basis been used prior to the incorporation of new technology and materials. The data shown below represents average costs and times. Use this data and the bases indicated to determine the allocation rates and IDC allocation of $1,000,000 for this year for the three bases. Plant Direct material cost, $ per unit New York Virginia Tennessee Total 20,000 12,700 18,600 51,300 Previous build-time per 400 415 580 1395 unit, work-hours New build-time per unit, 425 355 480 1260 work-hours Fill the allocation rates and IDC allocation in the table. Allocation by each Allocation by basis, $ each basis, $ Previous build- Allocation by each basis, $ Material cost New build-time time NY 403509 286738 337302 VA 362573 297491 281746 TN 233918 415771 380952 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started