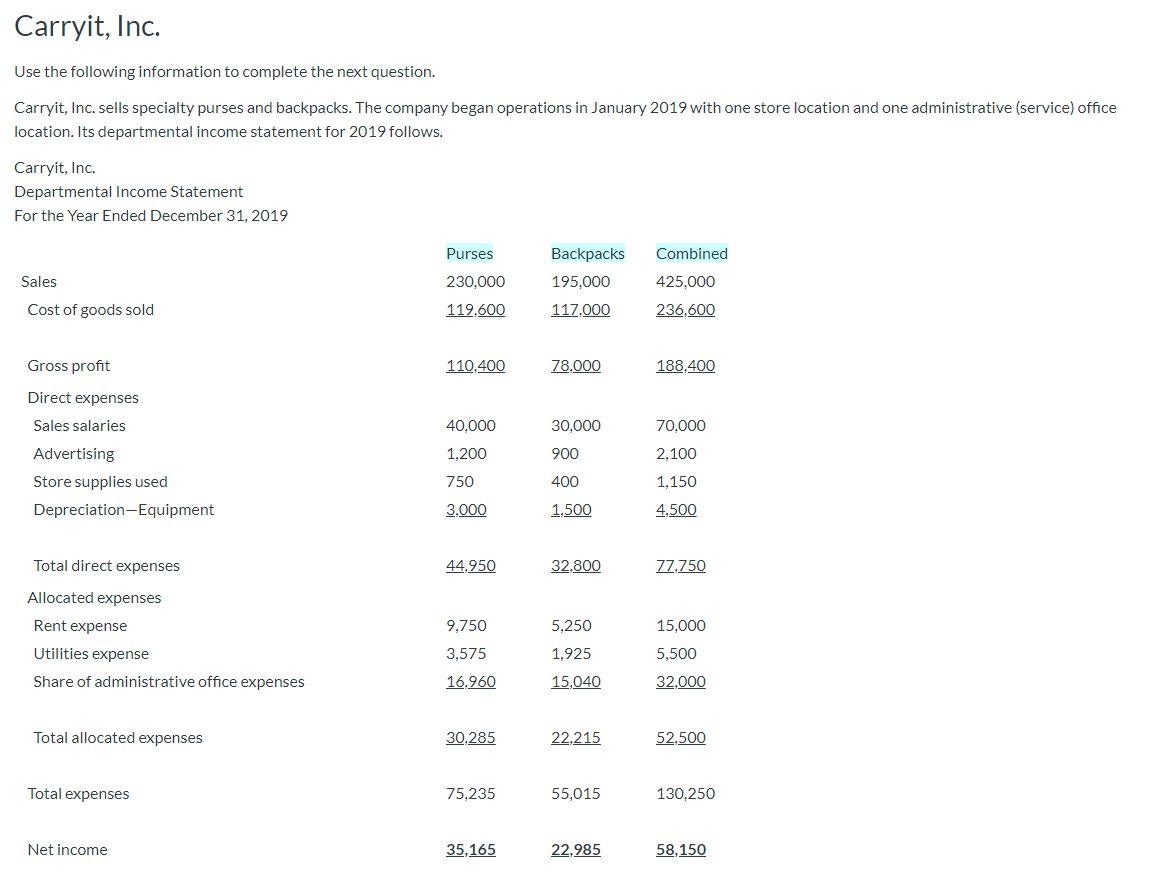

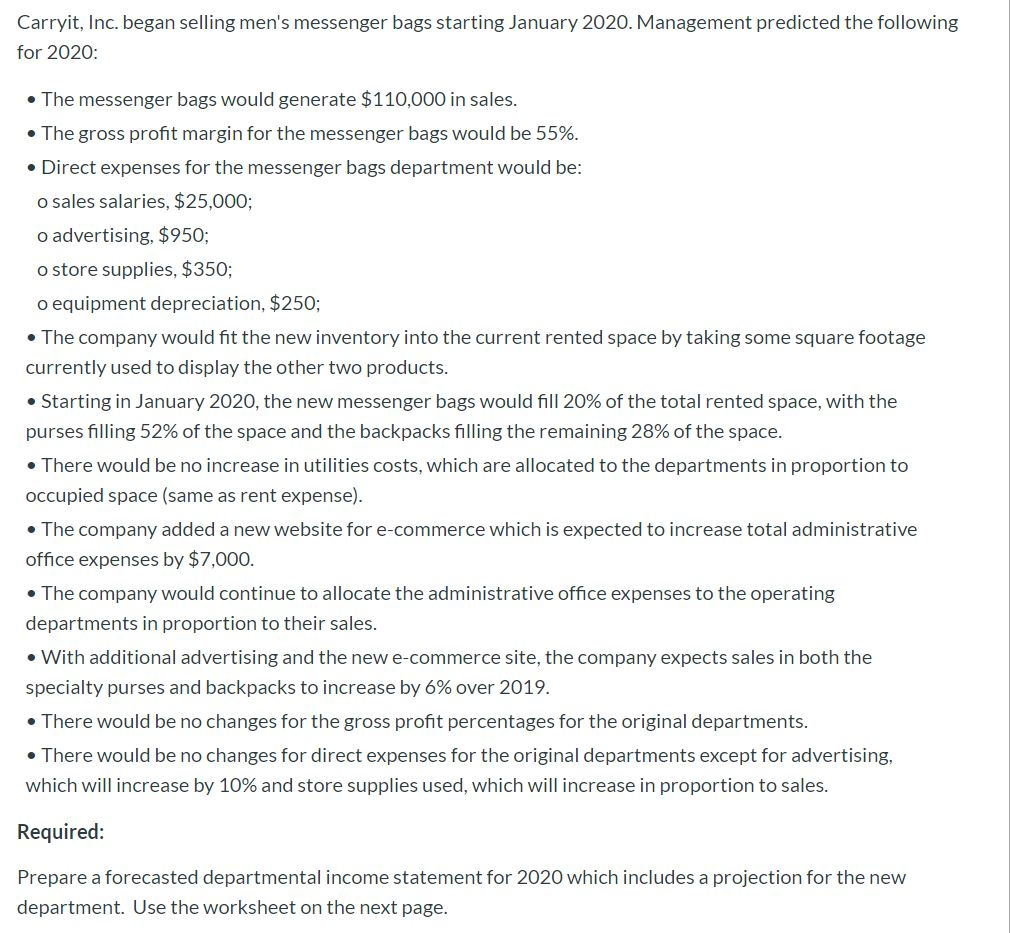

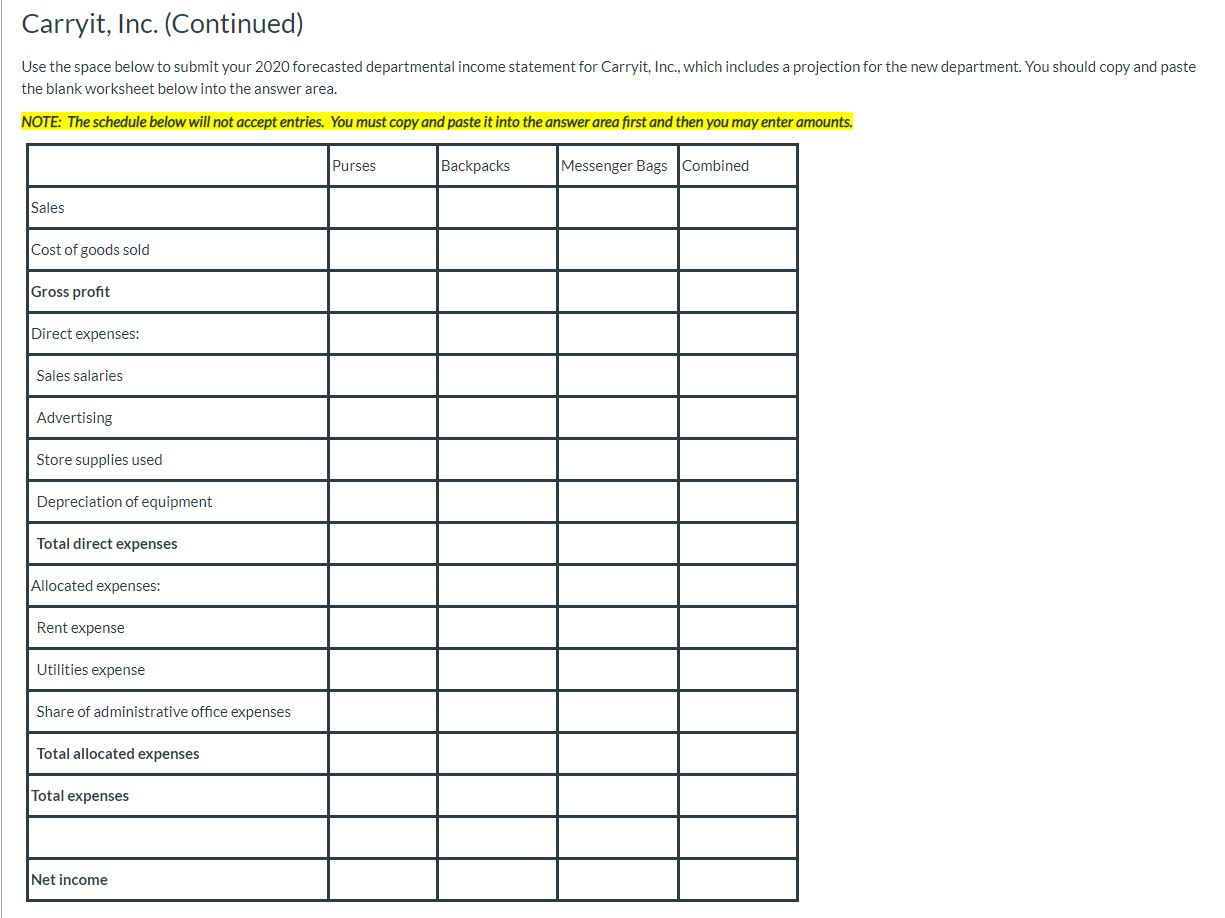

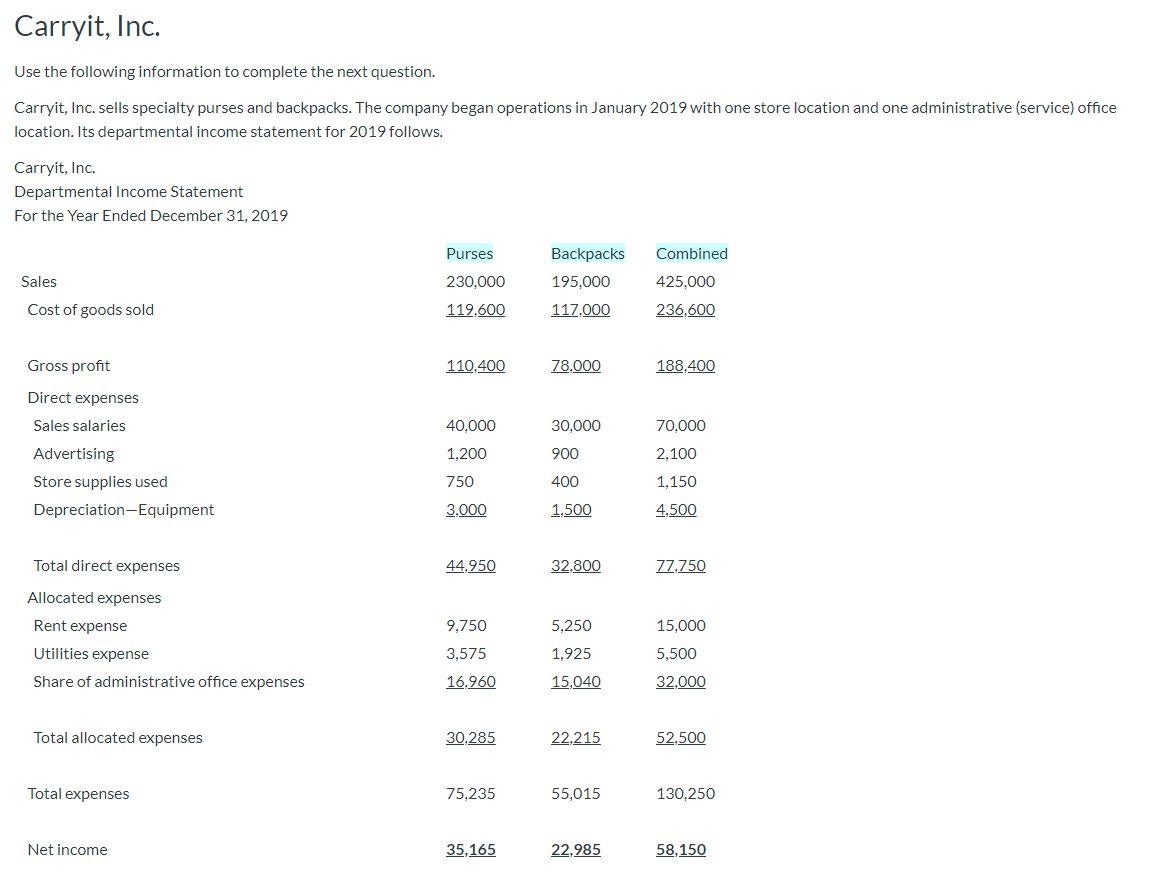

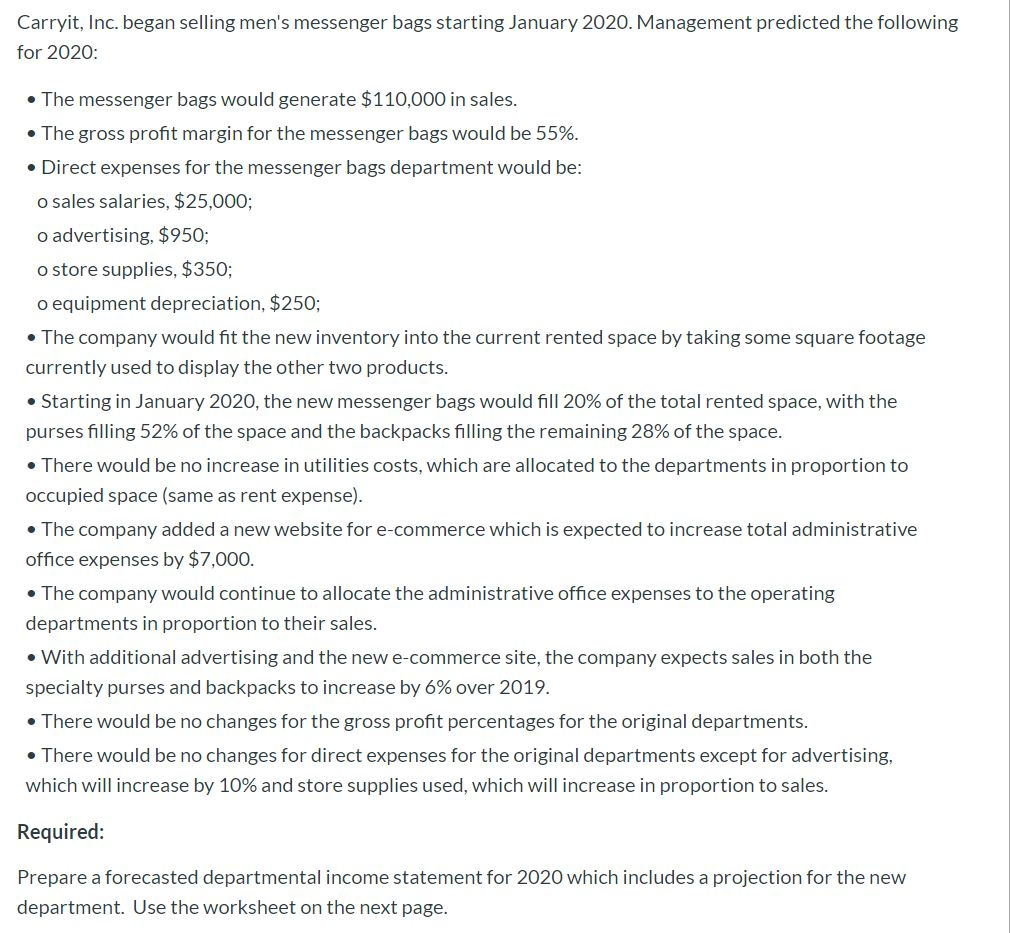

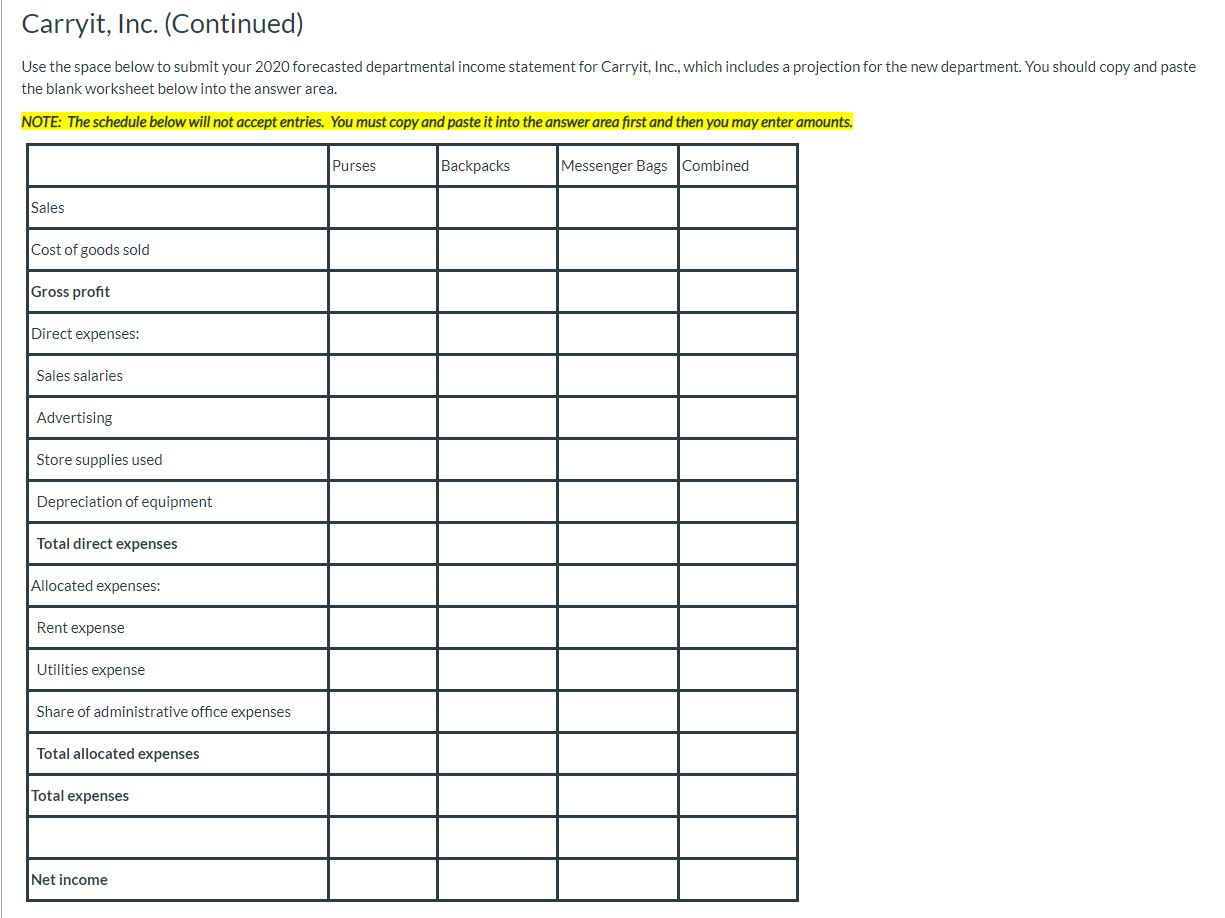

Carryit, Inc. Use the following information to complete the next question. Carryit, Inc. sells specialty purses and backpacks. The company began operations in January 2019 with one store location and one administrative (service) office location. Its departmental income statement for 2019 follows. Carryit, Inc. Departmental Income Statement For the Year Ended December 31, 2019 Purses Combined Backpacks 195,000 Sales 230,000 425,000 236,600 Cost of goods sold 119.600 117.000 Gross profit 110,400 78,000 188.400 Direct expenses Sales salaries 40,000 30,000 70,000 1,200 900 2,100 Advertising Store supplies used Depreciation-Equipment 750 400 1,150 3,000 1,500 4,500 Total direct expenses 44,950 32.800 77,750 5,250 15,000 Allocated expenses Rent expense Utilities expense Share of administrative office expenses 9,750 3,575 1,925 5,500 16.960 15,040 32.000 Total allocated expenses 30,285 22.215 52,500 Total expenses 75,235 55,015 130,250 Net income 35,165 22,985 58,150 Carryit, Inc. began selling men's messenger bags starting January 2020. Management predicted the following for 2020: The messenger bags would generate $110,000 in sales. The gross profit margin for the messenger bags would be 55%. Direct expenses for the messenger bags department would be: o sales salaries, $25,000; o advertising, $950; o store supplies, $350; o equipment depreciation, $250; The company would fit the new inventory into the current rented space by taking some square footage currently used to display the other two products. Starting in January 2020, the new messenger bags would fill 20% of the total rented space, with the purses filling 52% of the space and the backpacks filling the remaining 28% of the space. There would be no increase in utilities costs, which are allocated to the departments in proportion to occupied space (same as rent expense). The company added a new website for e-commerce which is expected to increase total administrative office expenses by $7,000. The company would continue to allocate the administrative office expenses to the operating departments in proportion to their sales. With additional advertising and the new e-commerce site, the company expects sales in both the specialty purses and backpacks to increase by 6% over 2019. There would be no changes for the gross profit percentages for the original departments. There would be no changes for direct expenses for the original departments except for advertising, which will increase by 10% and store supplies used, which will increase in proportion to sales. Required: Prepare a forecasted departmental income statement for 2020 which includes a projection for the new department. Use the worksheet on the next page. Carryit, Inc. (Continued) Use the space below to submit your 2020 forecasted departmental income statement for Carryit, Inc., which includes a projection for the new department. You should copy and paste the blank worksheet below into the answer area. NOTE: The schedule below will not accept entries. You must copy and paste it into the answer area first and then you may enter amounts. Purses Backpacks Messenger Bags Combined Sales Cost of goods sold Gross profit Direct expenses: Sales salaries Advertising Store supplies used Depreciation of equipment Total direct expenses Allocated expenses: Rent expense Utilities expense Share of administrative office expenses Total allocated expenses Total expenses Net income