Carter, Inc. uses a traditional volume-based costing system in which direct labor hours are the allocation base. Carter produces two different products: Product A,

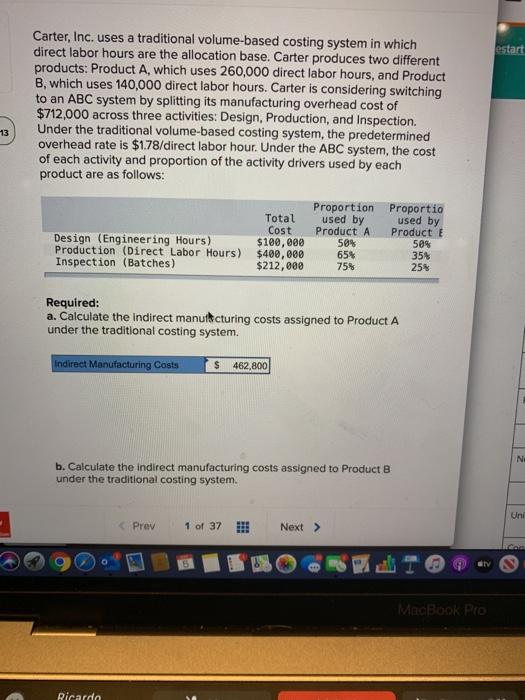

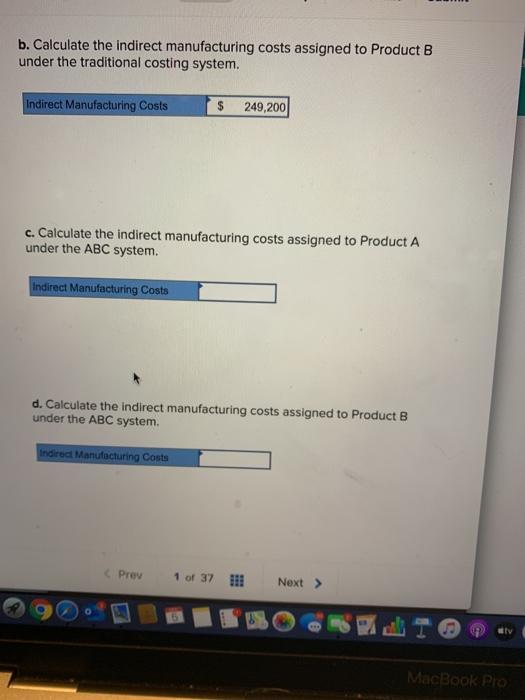

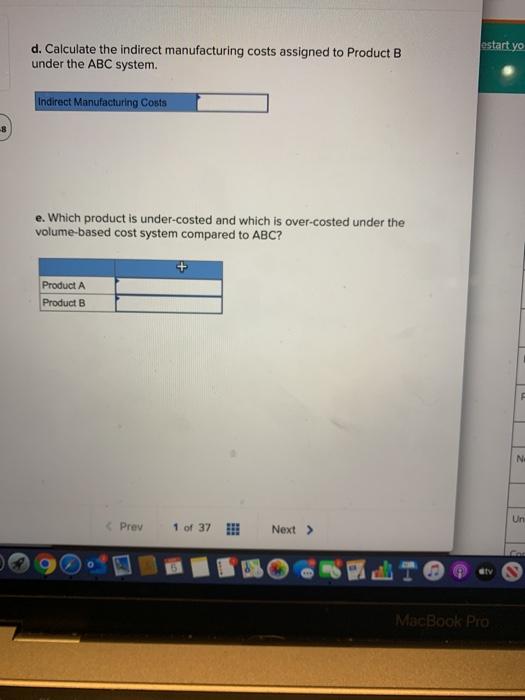

Carter, Inc. uses a traditional volume-based costing system in which direct labor hours are the allocation base. Carter produces two different products: Product A, which uses 260,000 direct labor hours, and Product B, which uses 140,000 direct labor hours. Carter is considering switching to an ABC system by splitting its manufacturing overhead cost of $712,000 across three activities: Design, Production, and Inspection. Under the traditional volume-based costing system, the predetermined estart 13 overhead rate is $1.78/direct labor hour. Under the ABC system, the cost of each activity and proportion of the activity drivers used by each product are as follows: Proportion Proportio used by Product E Total used by Cost Design (Engineering Hours) Production (Direct Labor Hours) Inspection (Batches) $100,000 $400, 000 $212, 000 Product A 50% 65% 75% 50% 35% 25% Required: a. Calculate the indirect manukcturing costs assigned to Product A under the traditional costing system. Indirect Manufacturing Costs 462,800 Ne b. Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system. Uni < Prev 1 of 37 Next > Con MacBook Pro Ricardo b. Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system. Indirect Manufacturing Costs 249,200 c. Calculate the indirect manufacturing costs assigned to Product A under the ABC system. Indirect Manufacturing Costs d. Calculate the indirect manufacturing costs assigned to Product B under the ABC system. Indirect Manufacturing Costs Prev 1 of 37 Next > A TO MacBook Pro estart yo d. Calculate the indirect manufacturing costs assigned to Product B under the ABC system. Indirect Manufacturing Costs e. Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC? Product A Product B Ne Un Cor S TO MacBook Pro

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Indirect manufacturing cost assigned to Product A under the traditional costing system ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started