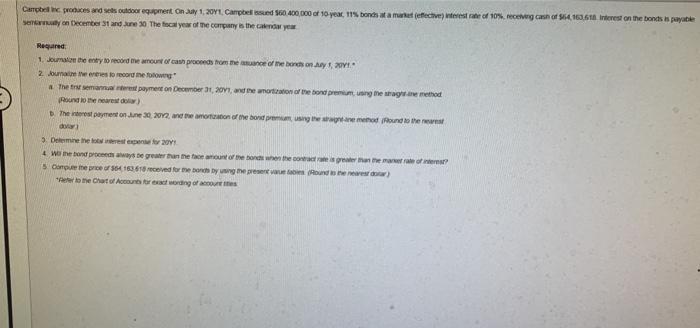

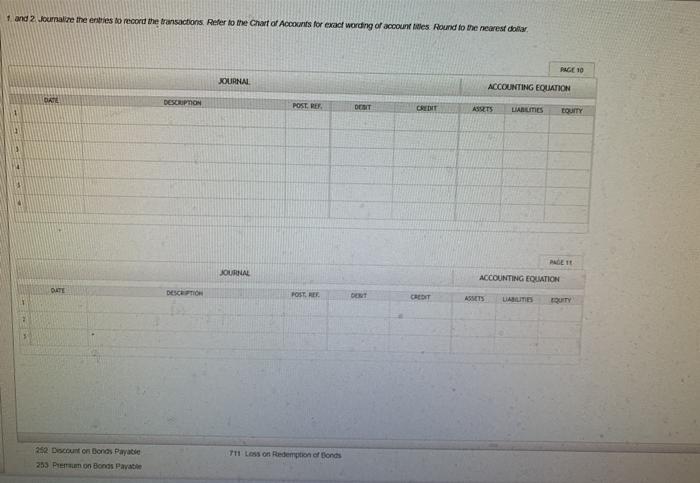

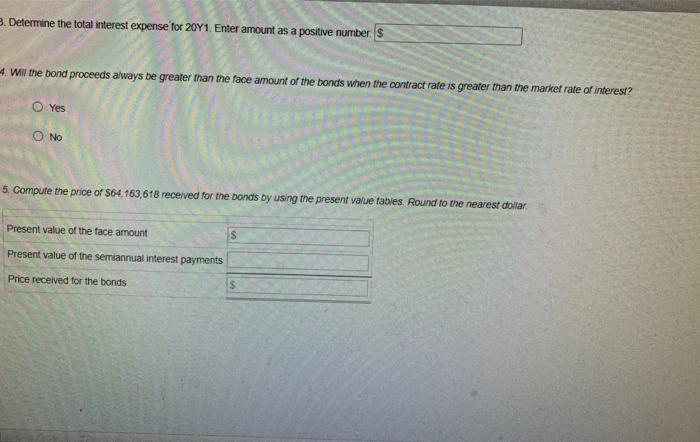

Carti proces and sets outdoor equipment on any 1, 2011. Campbeld 560 400 000 of 10 year11 bonds wat effective resa of 10%,receng case of $154.160.616 Interest on the bonds is payable Se on December 31 anne 30 The focal year of the company is the candy Recured 1. Journal the entry to record he noun or can proces from the cance of me bons on a XIV. 2. Je res to record the flow The term payment on December 31, 2011, and the moon of the bod remmang memas. method Rondo e rest) The worst payment on June 30, 2002, and the motion of the son premum ung hewan mend Round to the Deleminen on 2011 4 wone bond powerede han the one of the bonds with the worst? One the price of 163618 received for me bange present and the to the Chart of Accounts for wording of the 1 and 2 journalize the entries to record the transactions. Refer to the Chart of Accounts for exact wording of account des Round to the nearest dollar PAGE 10 OURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DEAT CREDIT ASSETS LARLITIES LOUITY JOURNAL ACCOUNTING EQUATION DATE DESCEPTION POSTER DET LATIE QUITY 252 Discount on Bonds Payable 253 Premium on Bons Payable 711 Loss on Redemption of bonds 3. Determine the total interest expense for 20Y1. Enter amount as a positive number. 4. Will the bond proceeds always be greater than the face amount of the bonds when the contract rate is greater than the market rate of interest? Yes O NO 5 Compute the price of $64, 163,618 received for the bonds by using the present value tables Round to the nearest dollar Present value of the face amount S Present value of the semiannual interest payments Price received for the bonds S Instructions Campbelline produces and test equipment on 1 2011, Campbelse 60 400.000 of toy. Tohammed effective interest rate of 10% Recering cash of 64.163618 mesest on the bonds is payable sem on December June 30 The fiscal year of the company is the you Required: 1 Jounate the enby to record the amount of con proceeds from eance of the Bonich only 1, 2011 2. mere enses to record the following # The first searest payment on December 31, 2011, and memoration of the bond premium rationem Found the web The Interest payment on June 30, 2012, and the motion of me bond premium using the method to the nearest do 3 Define the rest expense for 2011 4 the band proceeds aways be greater than the face amount of the one when the contact rate your taste ofert 5. Come price of $64161618 received for the bonds by using the presentatie Round to the nearest *Refer to me Chart of Accounts for wording of account 252 count ons TH1 Lesson of Bones Carti proces and sets outdoor equipment on any 1, 2011. Campbeld 560 400 000 of 10 year11 bonds wat effective resa of 10%,receng case of $154.160.616 Interest on the bonds is payable Se on December 31 anne 30 The focal year of the company is the candy Recured 1. Journal the entry to record he noun or can proces from the cance of me bons on a XIV. 2. Je res to record the flow The term payment on December 31, 2011, and the moon of the bod remmang memas. method Rondo e rest) The worst payment on June 30, 2002, and the motion of the son premum ung hewan mend Round to the Deleminen on 2011 4 wone bond powerede han the one of the bonds with the worst? One the price of 163618 received for me bange present and the to the Chart of Accounts for wording of the 1 and 2 journalize the entries to record the transactions. Refer to the Chart of Accounts for exact wording of account des Round to the nearest dollar PAGE 10 OURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DEAT CREDIT ASSETS LARLITIES LOUITY JOURNAL ACCOUNTING EQUATION DATE DESCEPTION POSTER DET LATIE QUITY 252 Discount on Bonds Payable 253 Premium on Bons Payable 711 Loss on Redemption of bonds 3. Determine the total interest expense for 20Y1. Enter amount as a positive number. 4. Will the bond proceeds always be greater than the face amount of the bonds when the contract rate is greater than the market rate of interest? Yes O NO 5 Compute the price of $64, 163,618 received for the bonds by using the present value tables Round to the nearest dollar Present value of the face amount S Present value of the semiannual interest payments Price received for the bonds S Instructions Campbelline produces and test equipment on 1 2011, Campbelse 60 400.000 of toy. Tohammed effective interest rate of 10% Recering cash of 64.163618 mesest on the bonds is payable sem on December June 30 The fiscal year of the company is the you Required: 1 Jounate the enby to record the amount of con proceeds from eance of the Bonich only 1, 2011 2. mere enses to record the following # The first searest payment on December 31, 2011, and memoration of the bond premium rationem Found the web The Interest payment on June 30, 2012, and the motion of me bond premium using the method to the nearest do 3 Define the rest expense for 2011 4 the band proceeds aways be greater than the face amount of the one when the contact rate your taste ofert 5. Come price of $64161618 received for the bonds by using the presentatie Round to the nearest *Refer to me Chart of Accounts for wording of account 252 count ons TH1 Lesson of Bones