Answered step by step

Verified Expert Solution

Question

1 Approved Answer

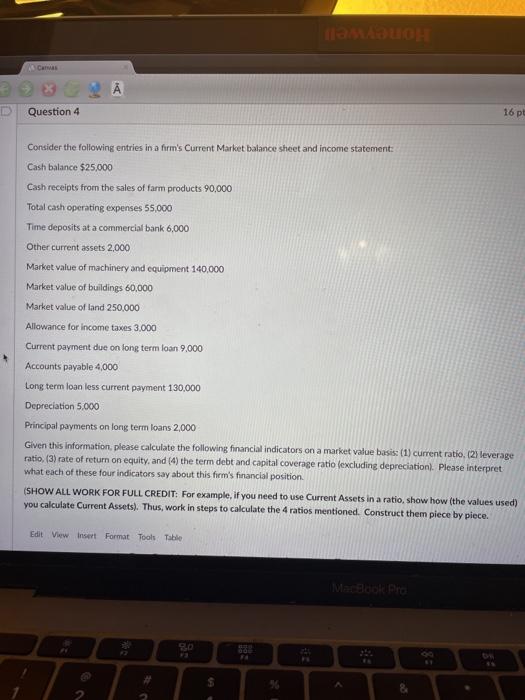

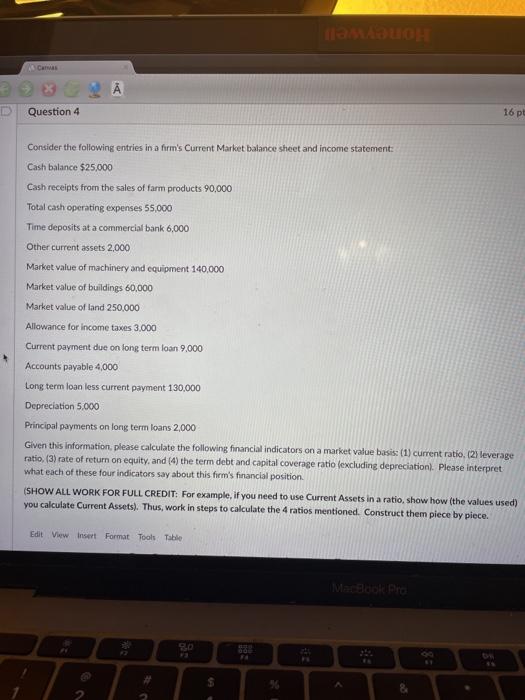

Carwas Question 4 16 pe Consider the following entries in a firm's Current Market balance sheet and income statement: Cash balance $25,000 Cash receipts from

Carwas Question 4 16 pe Consider the following entries in a firm's Current Market balance sheet and income statement: Cash balance $25,000 Cash receipts from the sales of farm products 90,000 Total cash operating expenses 55,000 Time deposits at a commercial bank 6,000 Other current assets 2,000 Market value of machinery and equipment 140.000 Market value of buildings 60,000 Market value of land 250,000 Allowance for income taxes 3.000 Current payment due on long term loan 9.000 Accounts payable 4,000 Long term loan less current payment 130,000 Depreciation 5,000 Principal payments on long term loans 2,000 Given this information, please calculate the following financial indicators on a market value basis: (1) current ratio, (2) leverage ratio, (3) rate of return on equity, and (4) the term debt and capital coverage ratio (excluding depreciation. Please interpret what each of these four indicators say about this firm's financial position (SHOW ALL WORK FOR FULL CREDIT: For example, if you need to use Current Assets in a ratio, show how (the values used) you calculate Current Assets). Thus, work in steps to calculate the 4 ratios mentioned. Construct them piece by piece. Edit View insert Format Tools Table MERINO S Carwas Question 4 16 pe Consider the following entries in a firm's Current Market balance sheet and income statement: Cash balance $25,000 Cash receipts from the sales of farm products 90,000 Total cash operating expenses 55,000 Time deposits at a commercial bank 6,000 Other current assets 2,000 Market value of machinery and equipment 140.000 Market value of buildings 60,000 Market value of land 250,000 Allowance for income taxes 3.000 Current payment due on long term loan 9.000 Accounts payable 4,000 Long term loan less current payment 130,000 Depreciation 5,000 Principal payments on long term loans 2,000 Given this information, please calculate the following financial indicators on a market value basis: (1) current ratio, (2) leverage ratio, (3) rate of return on equity, and (4) the term debt and capital coverage ratio (excluding depreciation. Please interpret what each of these four indicators say about this firm's financial position (SHOW ALL WORK FOR FULL CREDIT: For example, if you need to use Current Assets in a ratio, show how (the values used) you calculate Current Assets). Thus, work in steps to calculate the 4 ratios mentioned. Construct them piece by piece. Edit View insert Format Tools Table MERINO S

Carwas Question 4 16 pe Consider the following entries in a firm's Current Market balance sheet and income statement: Cash balance $25,000 Cash receipts from the sales of farm products 90,000 Total cash operating expenses 55,000 Time deposits at a commercial bank 6,000 Other current assets 2,000 Market value of machinery and equipment 140.000 Market value of buildings 60,000 Market value of land 250,000 Allowance for income taxes 3.000 Current payment due on long term loan 9.000 Accounts payable 4,000 Long term loan less current payment 130,000 Depreciation 5,000 Principal payments on long term loans 2,000 Given this information, please calculate the following financial indicators on a market value basis: (1) current ratio, (2) leverage ratio, (3) rate of return on equity, and (4) the term debt and capital coverage ratio (excluding depreciation. Please interpret what each of these four indicators say about this firm's financial position (SHOW ALL WORK FOR FULL CREDIT: For example, if you need to use Current Assets in a ratio, show how (the values used) you calculate Current Assets). Thus, work in steps to calculate the 4 ratios mentioned. Construct them piece by piece. Edit View insert Format Tools Table MERINO S Carwas Question 4 16 pe Consider the following entries in a firm's Current Market balance sheet and income statement: Cash balance $25,000 Cash receipts from the sales of farm products 90,000 Total cash operating expenses 55,000 Time deposits at a commercial bank 6,000 Other current assets 2,000 Market value of machinery and equipment 140.000 Market value of buildings 60,000 Market value of land 250,000 Allowance for income taxes 3.000 Current payment due on long term loan 9.000 Accounts payable 4,000 Long term loan less current payment 130,000 Depreciation 5,000 Principal payments on long term loans 2,000 Given this information, please calculate the following financial indicators on a market value basis: (1) current ratio, (2) leverage ratio, (3) rate of return on equity, and (4) the term debt and capital coverage ratio (excluding depreciation. Please interpret what each of these four indicators say about this firm's financial position (SHOW ALL WORK FOR FULL CREDIT: For example, if you need to use Current Assets in a ratio, show how (the values used) you calculate Current Assets). Thus, work in steps to calculate the 4 ratios mentioned. Construct them piece by piece. Edit View insert Format Tools Table MERINO S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started