Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Mateo and Santo Divisions are two divisions of Mario Ltd. Mateo manufactures digital consoles while Santo Division manufactures handsets. There were no

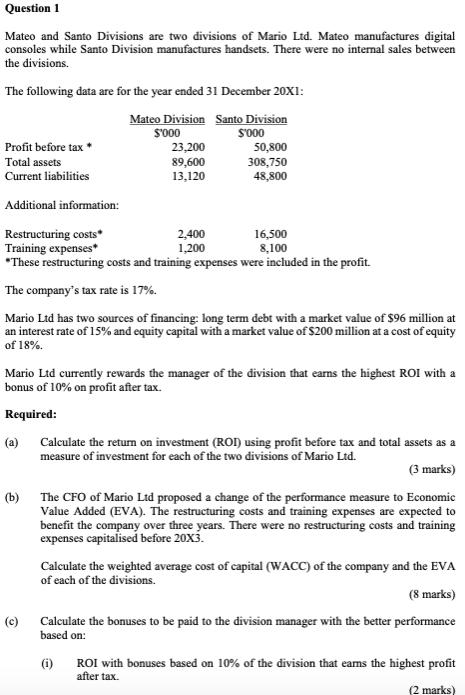

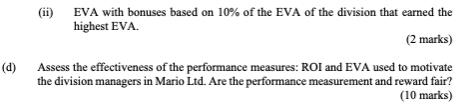

Question 1 Mateo and Santo Divisions are two divisions of Mario Ltd. Mateo manufactures digital consoles while Santo Division manufactures handsets. There were no internal sales between the divisions. The following data are for the year ended 31 December 20X1: Mateo Division Santo Division $'000 $'000 Profit before tax * Total assets Current liabilities Additional information: Restructuring costs* Training expenses* *These restructuring costs and training expenses were included in the profit. The company's tax rate is 17%. Mario Ltd has two sources of financing: long term debt with a market value of $96 million at an interest rate of 15% and equity capital with a market value of $200 million at a cost of equity of 18%. 23,200 89,600 13,120 50,800 308,750 48,800 2,400 1,200 (c) 16,500 8,100 Mario Ltd currently rewards the manager of the division that earns the highest ROI with a bonus of 10% on profit after tax. Required: (a) Calculate the return on investment (ROI) using profit before tax and total assets as a measure of investment for each of the two divisions of Mario Ltd. (3 marks) (b) The CFO of Mario Ltd proposed a change of the performance measure to Economic Value Added (EVA). The restructuring costs and training expenses are expected to benefit the company over three years. There were no restructuring costs and training expenses capitalised before 20X3. Calculate the weighted average cost of capital (WACC) of the company and the EVA of each of the divisions. (8 marks) Calculate the bonuses to be paid to the division manager with the better performance based on: (i) ROI with bonuses based on 10% of the division that earns the highest profit after tax. (2 marks) (d) (ii) EVA with bonuses based on 10% of the EVA of the division that earned the highest EVA. (2 marks) Assess the effectiveness of the performance measures: ROI and EVA used to motivate the division managers in Mario Ltd. Are the performance measurement and reward fair? (10 marks)

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

d EVA and ROi both ae effective ways of measuring performance with their ow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started