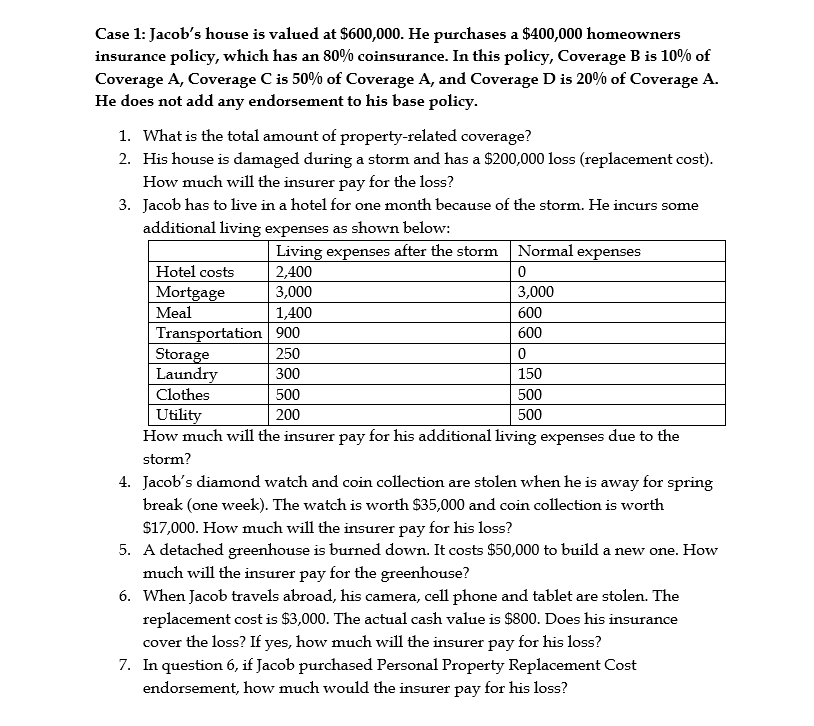

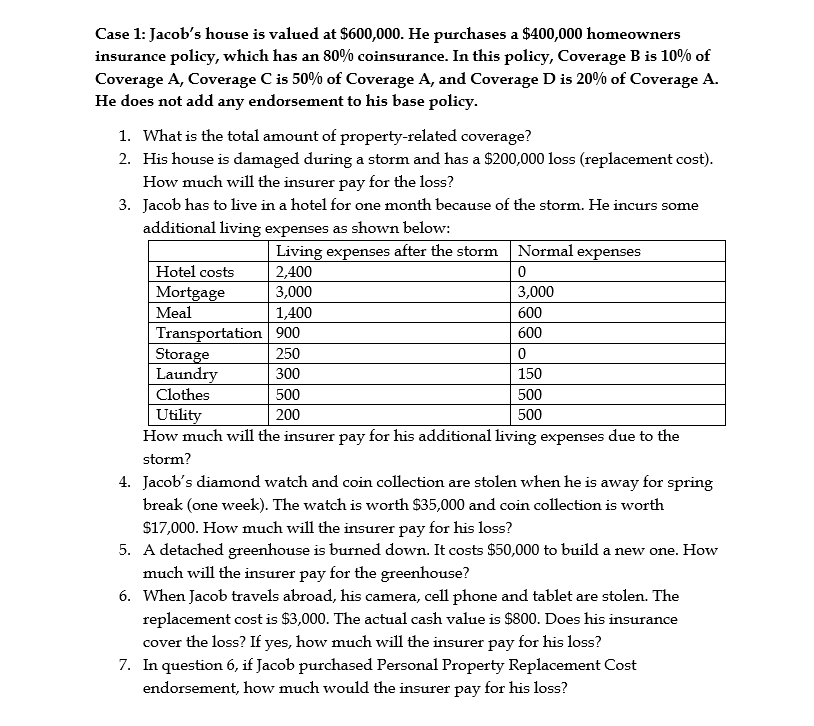

Case 1: Jacob's house is valued at $600,000. He purchases a $400,000 homeowners insurance policy, which has an 80% coinsurance. In this policy, Coverage B is 10% of Coverage A. Coverage C is 50% of Coverage A, and Coverage D is 20% of Coverage A. He does not add any endorsement to his base policy. 1. 2. What is the total amount of property-related coverage? His house is damaged during a storm and has a $200,000 loss (replacement cost) How much will the insurer pay for the loss? 3. Jacob has to live in a hotel for one month because of the storm. He incurs some additional living expenses as shown below: Livin 2,400 3,000 1,400 es after the storm Normal expenses Hotel costs Mortgage Meal 3,000 600 600 Stora Laun Clothes Utili ortation 900 250 300 500 200 150 500 500 living expenses due to the How much will the insurer pay for his additional storm 4. Jacob's diamond watch and coin collection are stolen when he is away for spring break (one week). The watch is worth S35,000 and coin collection is worth $17,000. How much will the insurer pay for his loss? A detached greenhouse is burned down. It costs $50,000 to build a new one. How much will the insurer pay for the greenhouse? When Jacob travels abroad, his camera, cell phone and tablet are stolen. The replacement cost is $3,000. The actual cash value is $800. Does his insurance cover the loss? If yes, how much will the insurer pay for his loss? In question 6, if Jacob purchased Personal Property Replacement Cost endorsement, how much would the insurer pay for his loss? 5. 6. 7. Case 1: Jacob's house is valued at $600,000. He purchases a $400,000 homeowners insurance policy, which has an 80% coinsurance. In this policy, Coverage B is 10% of Coverage A. Coverage C is 50% of Coverage A, and Coverage D is 20% of Coverage A. He does not add any endorsement to his base policy. 1. 2. What is the total amount of property-related coverage? His house is damaged during a storm and has a $200,000 loss (replacement cost) How much will the insurer pay for the loss? 3. Jacob has to live in a hotel for one month because of the storm. He incurs some additional living expenses as shown below: Livin 2,400 3,000 1,400 es after the storm Normal expenses Hotel costs Mortgage Meal 3,000 600 600 Stora Laun Clothes Utili ortation 900 250 300 500 200 150 500 500 living expenses due to the How much will the insurer pay for his additional storm 4. Jacob's diamond watch and coin collection are stolen when he is away for spring break (one week). The watch is worth S35,000 and coin collection is worth $17,000. How much will the insurer pay for his loss? A detached greenhouse is burned down. It costs $50,000 to build a new one. How much will the insurer pay for the greenhouse? When Jacob travels abroad, his camera, cell phone and tablet are stolen. The replacement cost is $3,000. The actual cash value is $800. Does his insurance cover the loss? If yes, how much will the insurer pay for his loss? In question 6, if Jacob purchased Personal Property Replacement Cost endorsement, how much would the insurer pay for his loss? 5. 6. 7