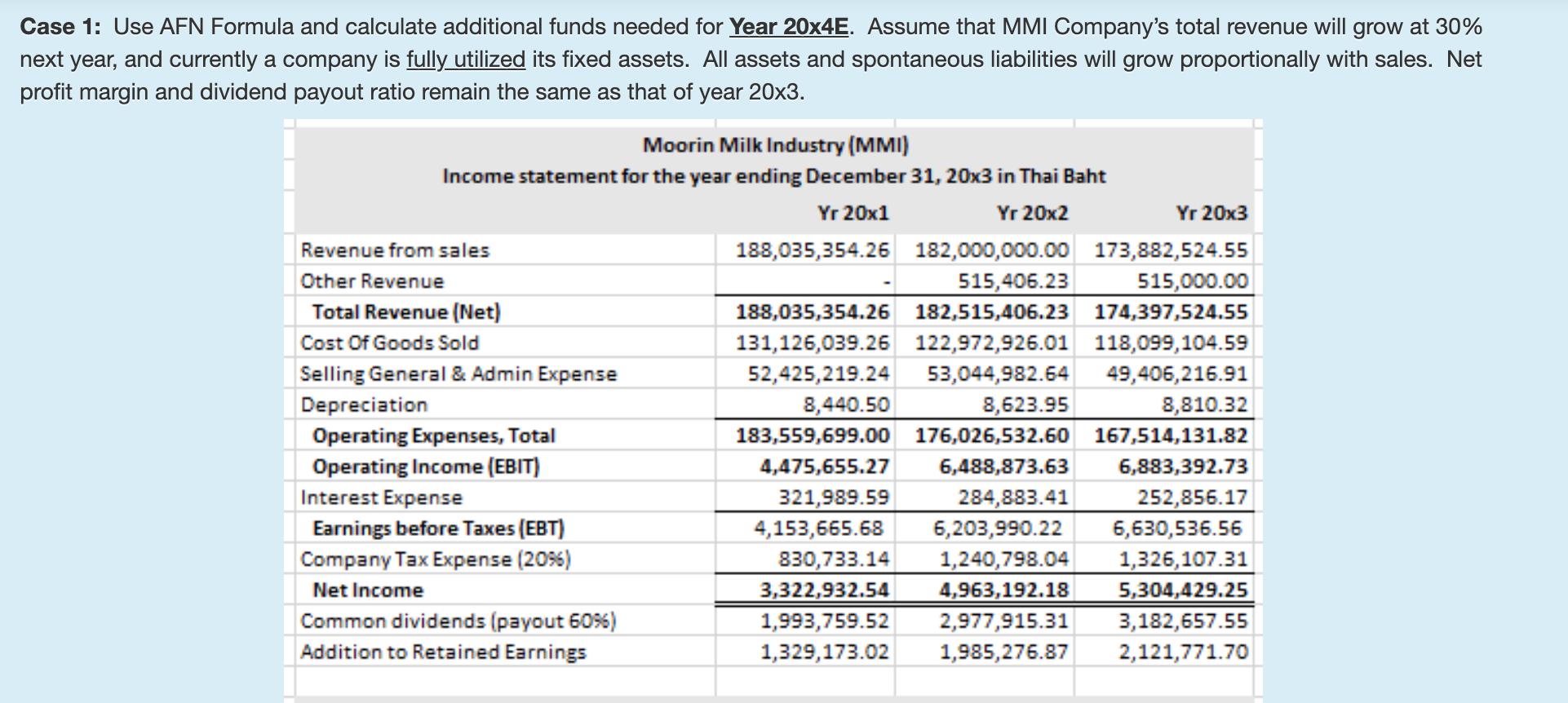

Case 1: Use AFN Formula and calculate additional funds needed for Year 20x4E. Assume that MMI Company's total revenue will grow at 30% next

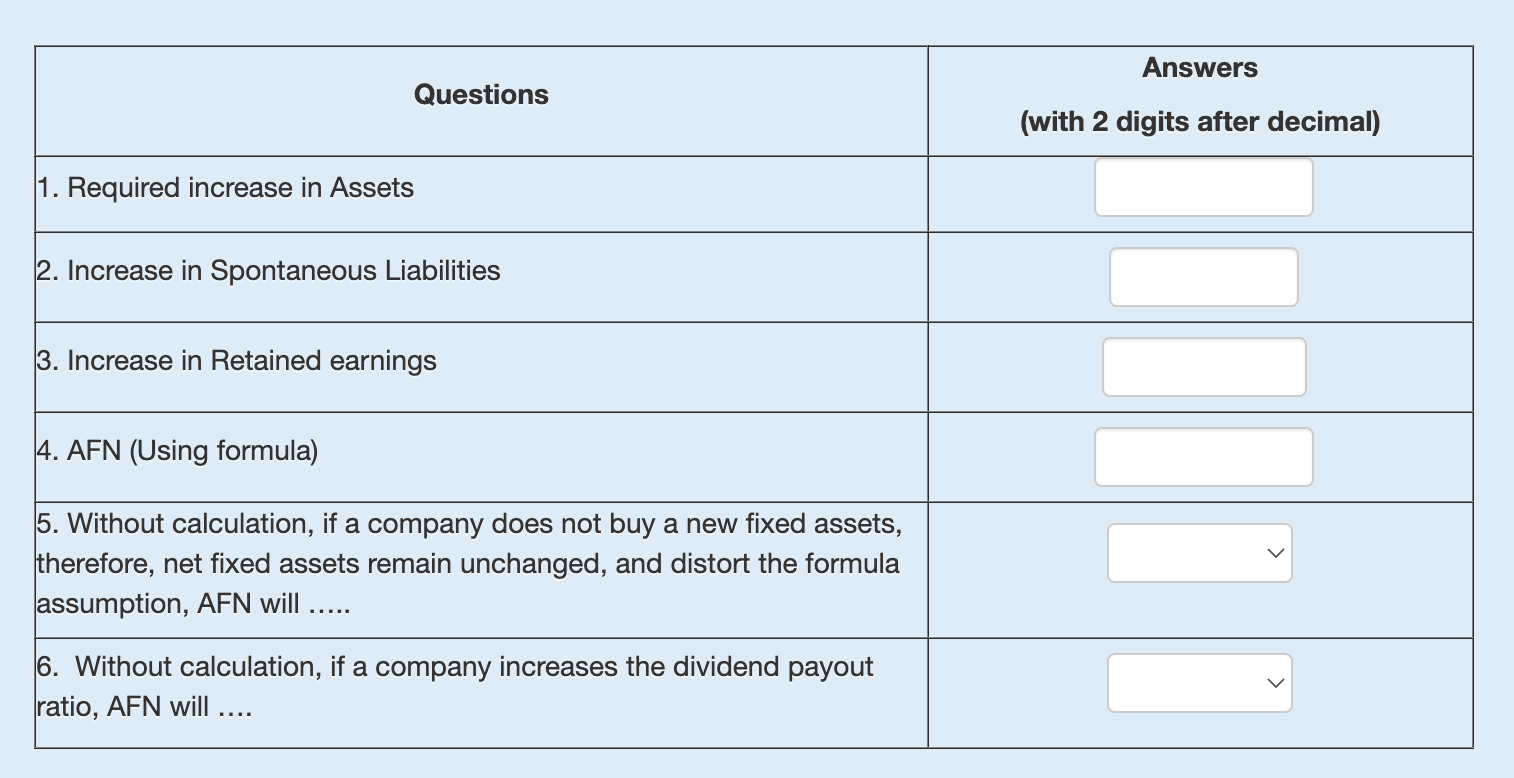

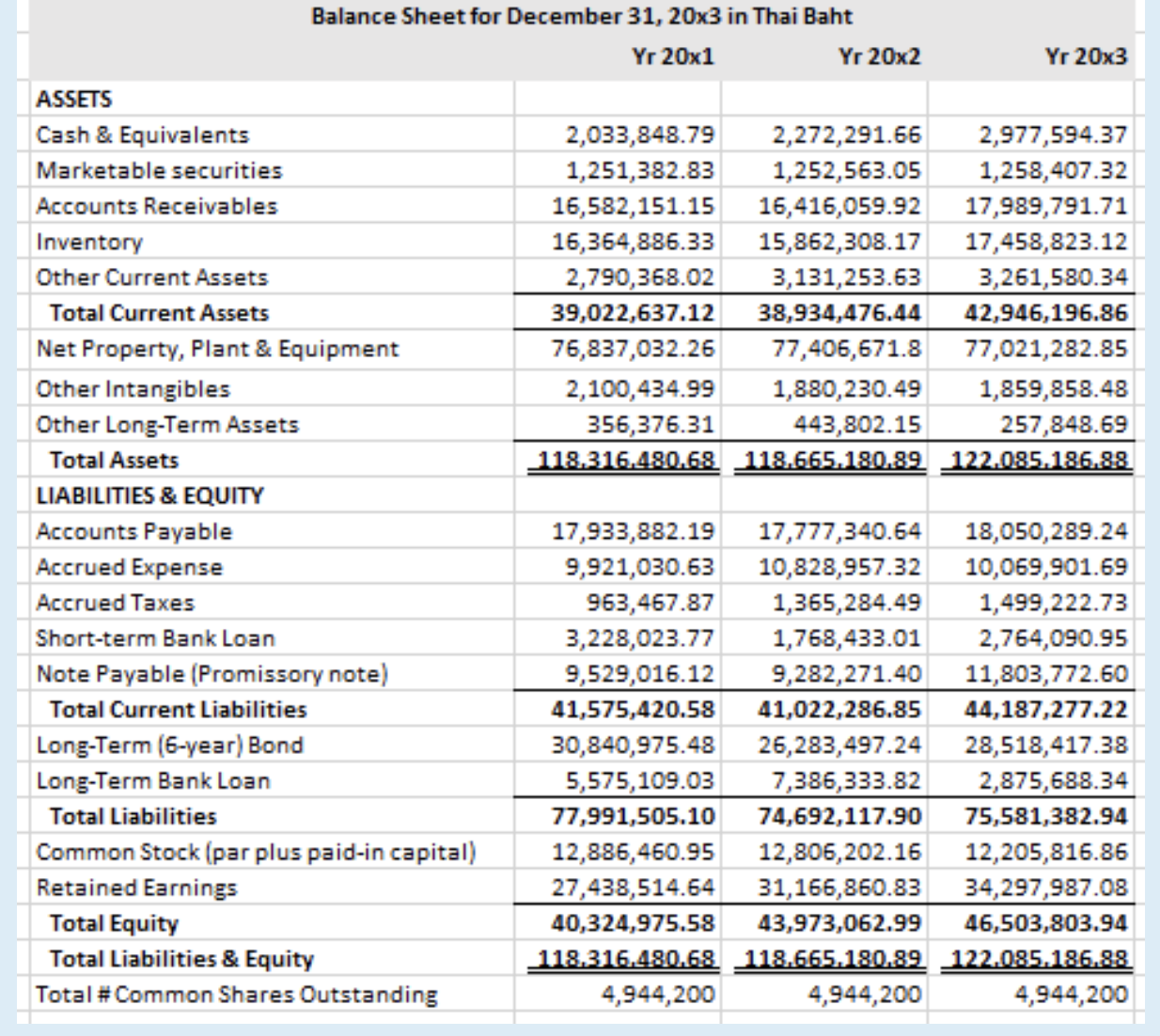

Case 1: Use AFN Formula and calculate additional funds needed for Year 20x4E. Assume that MMI Company's total revenue will grow at 30% next year, and currently a company is fully utilized its fixed assets. All assets and spontaneous liabilities will grow proportionally with sales. Net profit margin and dividend payout ratio remain the same as that of year 20x3. Moorin Milk Industry (MMI) Income statement for the year ending December 31, 20x3 in Thai Baht Yr 20x1 Revenue from sales Other Revenue Total Revenue (Net) Cost Of Goods Sold Selling General & Admin Expense Depreciation Operating Expenses, Total Operating Income (EBIT) Interest Expense Earnings before Taxes (EBT) Company Tax Expense (20%) Net Income Common dividends (payout 60%) Addition to Retained Earnings Yr 20x2 Yr 20x3 188,035,354.26 182,000,000.00 173,882,524.55 515,406.23 515,000.00 188,035,354.26 182,515,406.23 174,397,524.55 131,126,039.26 122,972,926.01 118,099,104.59 52,425,219.24 53,044,982.64 49,406,216.91 8,440.50 8,623.95 8,810.32 183,559,699.00 176,026,532.60 167,514,131.82 4,475,655.27 6,488,873.63 6,883,392.73 321,989.59 284,883.41 252,856.17 4,153,665.68 6,203,990.22 6,630,536.56 830,733.14 1,240,798.04 1,326,107.31 3,322,932.54 4,963,192.18 5,304,429.25 1,993,759.52 2,977,915.31 3,182,657.55 1,329,173.02 1,985,276.87 2,121,771.70 Questions 1. Required increase in Assets 2. Increase in Spontaneous Liabilities 3. Increase in Retained earnings 4. AFN (Using formula) 5. Without calculation, if a company does not buy a new fixed assets, therefore, net fixed assets remain unchanged, and distort the formula assumption, AFN will ..... 6. Without calculation, if a company increases the dividend payout ratio, AFN will .... Answers (with 2 digits after decimal) ASSETS Cash & Equivalents Marketable securities Accounts Receivables Inventory Other Current Assets Total Current Assets Net Property, Plant & Equipment Other Intangibles Other Long-Term Assets Total Assets LIABILITIES & EQUITY Accounts Payable Accrued Expense Accrued Taxes Balance Sheet for December 31, 20x3 in Thai Baht Yr 20x1 Short-term Bank Loan Note Payable (Promissory note) Total Current Liabilities Long-Term (6-year) Bond Long-Term Bank Loan Total Liabilities Common Stock (par plus paid-in capital) Retained Earnings Total Equity Total Liabilities & Equity Total # Common Shares Outstanding Yr 20x2 Yr 20x3 2,033,848.79 2,272,291.66 2,977,594.37 1,251,382.83 1,252,563.05 1,258,407.32 16,582,151.15 16,416,059.92 17,989,791.71 16,364,886.33 15,862,308.17 17,458,823.12 2,790,368.02 3,131,253.63 3,261,580.34 39,022,637.12 38,934,476.44 42,946,196.86 76,837,032.26 77,406,671.8 77,021,282.85 2,100,434.99 1,880,230.49 1,859,858.48 356,376.31 443,802.15 257,848.69 118.316.480.68 118.665.180.89 122.085.186.88 17,933,882.19 17,777,340.64 18,050,289.24 9,921,030.63 10,828,957.32 10,069,901.69 963,467.87 1,365,284.49 1,499,222.73 3,228,023.77 1,768,433.01 2,764,090.95 9,529,016.12 9,282,271.40 11,803,772.60 41,575,420.58 41,022,286.85 44,187,277.22 30,840,975.48 26,283,497.24 28,518,417.38 5,575,109.03 7,386,333.82 2,875,688.34 77,991,505.10 74,692,117.90 75,581,382.94 12,886,460.95 12,806,202.16 12,205,816.86 27,438,514.64 31,166,860.83 34,297,987.08 40,324,975.58 43,973,062.99 46,503,803.94 118.316.480.68 118.665.180.89 122.085.186.88 4,944,200 4,944,200 4,944,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started