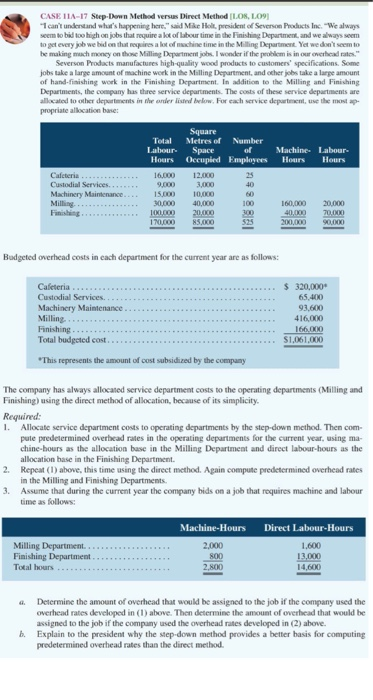

CASE 11A-17 Step-Down Method versus Direct Method [LOS, L09) I can't understand what's happening here." said Mike Holt president of Severson Products Inc. "We always seem to bid too high on jobs that require a lot of labour time in the Finishing Department, and we always seem to get every job we bid on that requires a lot of machine time in the Milling Department. Yet we don't seem to he making much money on those Milling Department jobs. I wonder if the problem is in our overhead rates." Severson Products manufactures high-quality wood products to customers' specifications. Some jobs take a large amount of machine work in the Milling Department, and other jobs take a large amount of hand-finishing work in the Finishing Department. In addition to the Milling and Finishing Departments, the company has three service departments. The costs of these service departments are allocated to other departments in the ander listed below. For each service department, use the most ap propriate allocation base Cafeteria Custodial Services Machinery Maintenance Milling Square Total Metres of Number Labour Space of Machine. Labour Hours Occupied Employees Hours Hours 16.000 12.000 9.000 3,000 40 15.000 10,000 30.000 40,000 100 160,000 20.000 100.000 20.00 40,000 70.000 170000 85,000 525 200,000 SOLO Budgeted overhead costs in each department for the current year are as follows: Cafeteria Custodial Services Machinery Maintenance Milling Finishing Total budgeted cost $ 320,000 65.400 93.600 416,000 166.000 $1.061.000 "This represents the amount of cost subsidized by the company The company has always allocated service department costs to the operating departments (Milling and Finishing) using the direct method of allocation, because of its simplicity Required: 1. Allocate service department costs to operating departments by the step-down method. Then com- pule predetermined overhead rates in the operating departments for the current year, using ma- chine-hours as the allocation base in the Milling Department and direct labour-hours as the allocation base in the Finishing Department 2. Repeat (1) above, this time using the direct method. Again compute predetermined overhead rates in the Milling and Finishing Departments. 3. Assume that during the current year the company bids on a job that requires machine and labour time as follows: Milling Department Finishing Department Total hours Machine-Hours Direct Labour-Hours 2,000 1,600 800 13,000 2,800 14,600 a. Determine the amount of overhead that would be assigned to the job if the company used the overhead rates developed in (1) above. Then determine the amount of overhead that would be assigned to the job if the company used the overhead rates developed in (2) above. b. Explain to the president why the step-down method provides a better basis for computing predetermined overhead rates than the direct method