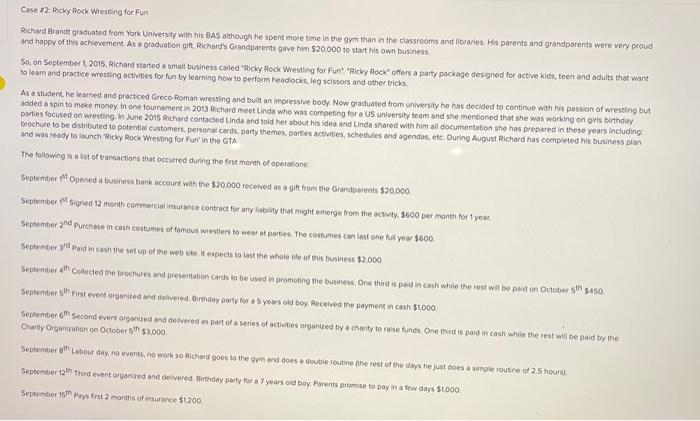

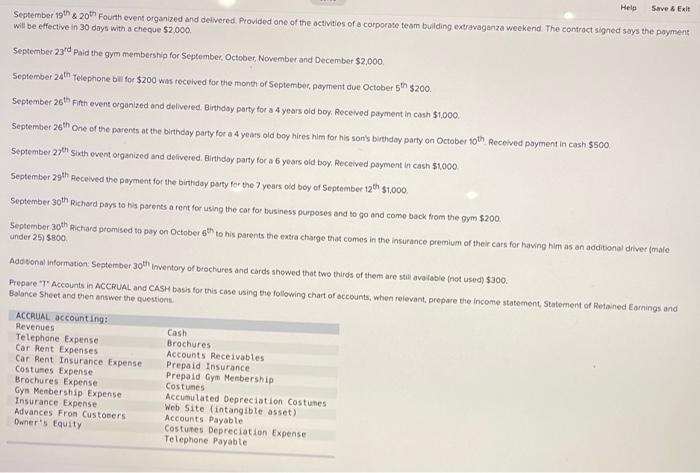

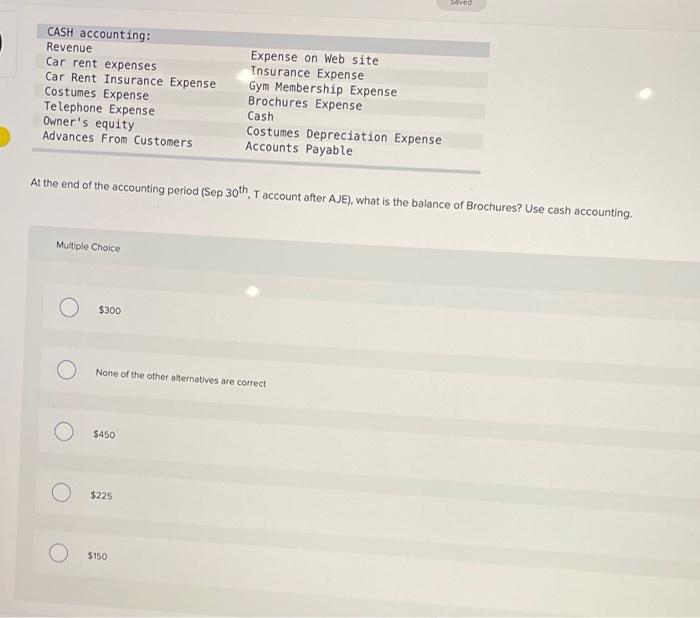

Case 12. Ricky Rock Wresting for Fun Richard Brandt graduated from York University with his BAS although he spent more time in the gym than in the classrooms and libraries. His parents and grandparents were very proud and happy of this achievement As a graduation gift Richard's Grandparents gave him $20,000 to start his own business So, on September 1, 2015, Richard started a small business called "Ricky Rock Wresting for Fun "Ricky Rock offers a party package designed for active kids, teen and adults that want to learn and practice wresting activities for fun by learning how to perform beadlocks, leg scissors and other tricks As a student heamed and practiced Greco Roman wresting and built an impressive body Now graduated from university he has decided to continue with his passion of wresting but added a spin to make money in one tournament in 2013 Richard meet Linda who was competing for a US university team and she mentioned that she was working on girls birthday parties focused on wresting in June 2015 Richard contacted Linda and told her about his idea and Linda shared with him all documentation she has prepared in these years including: brochure to be distributed to potential customers, personal cards, party themes partes activities, schedules and agendas, etc. During August Richard has completed his business plan and was ready to launch Ricky Rock Wresting for Fur' in the GTA The following is a stof transactions that occurred during the first month of operations September of opened a business bank account with the $20.000 received as a gift from the Grandparents $20,000 September tit signed 12 month commercial insurance contract for any liability that might emerge from the activity, 5600 per month for you September and purchase in cash costumes of tomous westers to wear at porties. The comunes con last one year 5600 September yd Paid in can the top of the website espects to last the whole of this business $2.000 September oth Conected e brochures and presentation cards to be ed in promoting the business. One thing is paid in cash while the rest will be pued on October 5450. September shpest event organized and covered. Orday party for a 5 years old boy received the payment in cash $1,000 September eth second evert organized and delivered as part of a series of activities organised by a certy to raise funds. One third is paid in cash while the rest will be paid by the Charity Organisation on October 5th $3.000 Septembergh Labour day. no events, no worso Richard goes to them and does a double routine the rest of the days he just does a simple routine of 25 hours) September This event organized and delivered Bay party for a 7 years old boy. Parents promise to pay in a few days $1,000 September 15th Pays Best 2 months of urance $1200 Help Save & Exit September 19th & 20th Fourth event organized and delivered. Provided one of the activities of a corporate team building extravaganza weekend. The contract signed says the payment will be effective in 30 days with a cheque $2,000 September 23rd Paid the gym membership for September October November and December $2,000 September 24th Telephone bill for $200 was received for the month of September, payment due October 5th $200 September 26th Fith event organized and delivered. Bithday party for a 4 years old boy. Received payment in cash $1,000. September 26th one of the parents at the birthday party for a 4 years old boy hires him for his son's birthday party on October 10th Received payment in cash $500 September 27th sixth event organized and delivered. Birthday party for a 6 years old boy, Received payment in cash $1000 September 29th Received the payment for the birthday party for the 7 years old boy of September 12th $1,000 September 30th Richard Days to his parents a rent for using the car for business purposes and to go and come back from the gym $200 September 30th Richard promised to pay on October 6th to his parents the extra charge that comes in the insurance premium of their cars for having him as an additional driver male under 25) 5800 Additional information September 30th Inventory of brochures and cards showed that two thirds of them are still avalable not used $300 Prepare "T" Accounts in ACCRUAL and CASH basis for this case using the following chart of accounts, when relevant, prepare the income statement, Statement of Retained Earnings and Balance Sheet and then answer the questions ACCRUAL accounting: Revenues Telephone Expense Car Rent Expenses Car Rent Insurance Expense Costumes Expense Brochures Expense Gys Membership Expense Insurance Expense Advances Fron Customers Owner's Equity Cash Brochures Accounts Receivables Prepaid Insurance Prepaid Gyn Membership Costumes Accumulated Depreciation Costumes Web Site intangible asset) Accounts Payable Costutes Depreciation Expense Telephone Payable ved CASH accounting: Revenue Car rent expenses Car Rent Insurance Expense Costumes Expense Telephone Expense Owner's equity Advances From Customers Expense on Web site Insurance Expense Gym Membership Expense Brochures Expense Cash Costumes Depreciation Expense Accounts Payable At the end of the accounting period (Sep 30th, T account after AJE), what is the balance of Brochures? Use cash accounting. Multiple Choice $300 None of the other alternatives are correct $450 $225 $150