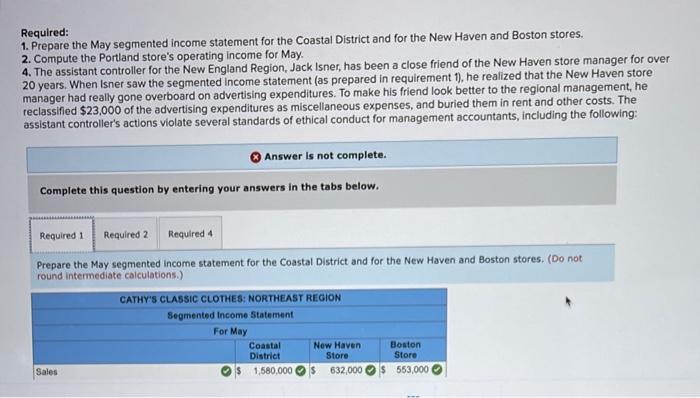

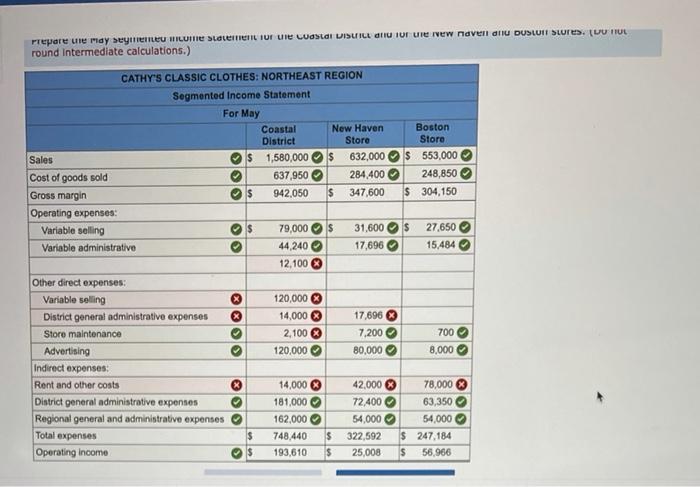

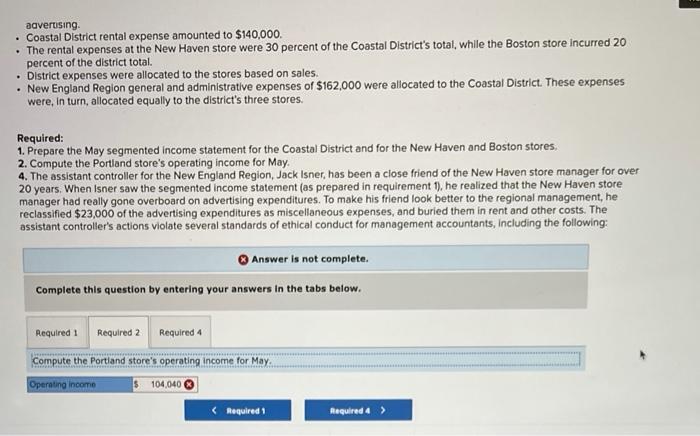

Case 12-52 Segmented Income Statement; Responsibility Accounting; Bonuses; Motivation; Ethics (LO 12-1, 12-2, 12-5) Cathy's Classic Clothes is a retailer that sells to professional women in the northeast. The firm leases space for stores in upscale shopping centers, and the organizational structure consists of regions, districts, and stores. Each region consists of two or more districts, each district consists of three or more stores. Each store, district, and region has been established as a profit center. At all levels, the company uses a responsibility-accounting system focusing on information and knowledge rather than blame and control. Each year, managers, in consultation with their supervisors, establish financial and nonfinancial goals, and these goals are integrated Into the budget. Actual performance is measured each month The New England Region consists of the Coastal District and the Inland District. The Coastal District includes the New Haven, Boston, and Portland stores. The Coastal District's performance has not been up to expectations in the past. For the month of May, the district manager has set performance goals with the managers of the New Haven and Boston stores, who will receive bonuses if certain performance measures are exceeded. The manager in Portland decided not to participate in the bonus scheme. Since the district manager is unsure what type of bonus will encourage better performance, the New Haven manager will receive a bonus based on sales in excess of budgeted sales of $560,000, while the Boston manager will receive a bonus based on operating income in excess of budget. The company's operating income goal for each store is 11 percent of sales. The budgeted sales revenue for the Boston store is $520,000 Other pertinent data for May are as follows: Coastal District sales revenue was $1,580,000, and its cost of goods sold amounted to $637,950, The Coastal District spent $120,000 on advertising . General and administrative expenses for the Coastal District amounted to $181,000, . At the New Haven store, sales were 40 percent of Coastal District sales, while sales at the Boston store were 35 percent of district sales. The cost of goods sold in both New Haven and Boston was 45 percent of sales. Variable selling expenses (sales commissions) were 5 percent of sales for all stores, districts, and regions. Variable administrative expenses were 2.8 percent of sales for all stores, districts, and regions. Maintenance cost includes janitorial and repair services and is a direct cost for each store. The store manager has complete control Prey 1 of 2 !!! Next > Other pertinent data for May are as follows: Coastal District sales revenue was $1,580,000, and its cost of goods sold amounted to $637,950. The Coastal District spent $120,000 on advertising. General and administrative expenses for the Coastal District amounted to $181,000. At the New Haven store, sales were 40 percent of Coastal District sales, while sales at the Boston store were 35 percent of district sales. The cost of goods sold in both New Haven and Boston was 45 percent of sales. Variable selling expenses (sales commissions) were 5 percent of sales for all stores, districts, and regions. Variable administrative expenses were 2.8 percent of sales for all stores, districts, and regions. Maintenance cost includes janitorial and repair services and is a direct cost for each store. The store manager has complete control over this outlay. Maintenance costs were incurred as follows: New Haven, $7.200; Boston, $700, and Portland, 54,200. Advertising is considered a direct cost for each store and is completely under the control of the store manager. The New Haven store spent two-thirds of the Coastal District total outlay for advertising, which was 10 times the amount spent in Boston on advertising Coastal District rental expense amounted to $140,000 The rental expenses at the New Haven store were 30 percent of the Coastal District's total, while the Boston store incurred 20 percent of the district total. District expenses were allocated to the stores based on sales. New England Region general and administrative expenses of $162,000 were allocated to the Coastal District. These expenses were, in turn, allocated equally to the district's three stores. Required: 1. Prepare the May segmented income statement for the Coastal District and for the New Haven and Boston stores. 2. Compute the Portland store's operating income for May. 4. The assistant controller for the New England Region, Jack Isner, has been a close friend of the New Haven store manager for over 20 years. When Isner saw the segmented income statement (as prepared in requirement 1). he realized that the New Haven store manager had really gone overboard on advertising expenditures. To make his friend look better to the regional management, he reclassified $23,000 of the advertising expenditures as miscellaneous expenses, and buried them in rent and other costs. The assistant controller's actions violate several standards of ethical conduct for management accountants, including the following: Required: 1. Prepare the May segmented income statement for the Coastal District and for the New Haven and Boston stores. 2. Compute the Portland store's operating income for May. 4. The assistant controller for the New England Region, Jack Isner, has been a close friend of the New Haven store manager for over 20 years. When Isner saw the segmented income statement (as prepared in requirement 1), he realized that the New Haven store manager had really gone overboard on advertising expenditures. To make his friend look better to the regional management, he reclassified $23,000 of the advertising expenditures as miscellaneous expenses, and buried them in rent and other costs. The assistant controller's actions violate several standards of ethical conduct for management accountants, including the following: Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 4 Prepare the May segmented Income statement for the coastal District and for the New Haven and Boston stores. (Do not round intermediate calculations.) CATHY'S CLASSIC CLOTHES: NORTHEAST REGION Segmented Income Statement For May Coastal New Haven Boston District Store Store Sales $ 1,580,000 632,000 $ 553,000 Prepare ure may beytime HLUTIE Salement sur le Luostai UISLILL FUTUR UTE New naven anu DUSLUIT SLUTES. DUTUL round Intermediate calculations.) > CATHY'S CLASSIC CLOTHES: NORTHEAST REGION Segmented Income Statement For May Coastal New Haven Boston District Store Store Sales $ 1,580,000 $ 632,000 $ 553,000 Cost of goods sold 637,950 284,400 248,850 Gross margin $ 942,050 s 347,600 $ 304,150 Operating expenses: Variable selling $ 79,000 $ 31,600 $ 27,650 Variable administrative 44,240 17,696 15,484 12.100 Other direct expenses: Variable selling 120,000 District general administrative expenses 14,000 17,696 Store maintenance 2,100 7,200 700 Advertising 120,000 80,000 8,000 Indirect expenses: Rent and other costs 14,000 42,000 78,000 District general administrative expenses 181,000 72,400 63,350 Regional general and administrative expenses 162,000 54,000 54,000 Total expenses $ 748,440 $ 322,592 $ 247.184 Operating income 193,610 $ 25,008 $ 56,966 O 3 ells > aavertising Coastal District rental expense amounted to $140,000 The rental expenses at the New Haven store were 30 percent of the Coastal District's total, while the Boston store incurred 20 percent of the district total. District expenses were allocated to the stores based on sales. New England Region general and administrative expenses of S162,000 were allocated to the Coastal District. These expenses were, in turn, allocated equally to the district's three stores. Required: 1. Prepare the May segmented income statement for the Coastal District and for the New Haven and Boston stores, 2. Compute the Portland store's operating income for May. 4. The assistant controller for the New England Region, Jack Isner, has been a close friend of the New Haven store manager for over 20 years. When Isner saw the segmented income statement (as prepared in requirement 1), he realized that the New Haven store manager had really gone overboard on advertising expenditures. To make his friend look better to the regional management, he reclassified $23,000 of the advertising expenditures as miscellaneous expenses, and buried them in rent and other costs. The assistant controller's actions violate several standards of ethical conduct for management accountants, including the following: Answer is not complete Complete this question by entering your answers in the tabs below. Required Required 2 Required 4 Compute the Portland store's operating income for May Operating Income 104,040