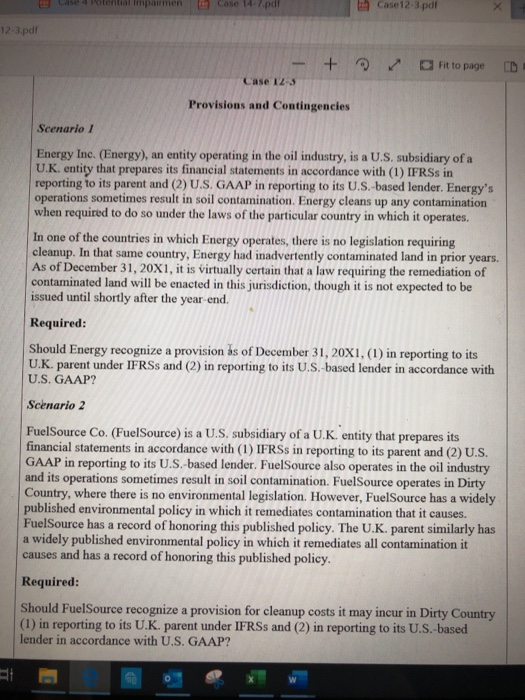

Case 14-7.pdf Case 12-3.pdf X 12-3.pdf Fit to page Case 12-3 Provisions and Contingencies Scenario / Energy Inc. (Energy), an entity operating in the oil industry, is a U.S. subsidiary of a U.K. entity that prepares its financial statements in accordance with (1) IFRSs in reporting to its parent and (2) U.S. GAAP in reporting to its U.S.-based lender. Energy's operations sometimes result in soil contamination. Energy cleans up any contamination when required to do so under the laws of the particular country in which it operates. In one of the countries in which Energy operates, there is no legislation requiring cleanup. In that same country, Energy had inadvertently contaminated land in prior years. As of December 31, 20X1, it is virtually certain that a law requiring the remediation of contaminated land will be enacted in this jurisdiction, though it is not expected to be issued until shortly after the year-end. Required: Should Energy recognize a provision ds of December 31, 20X1, (1) in reporting to its U.K. parent under IFRSs and (2) in reporting to its U.S. -based lender in accordance with U.S. GAAP? Scenario 2 FuelSource Co. (FuelSource) is a U.S. subsidiary of a U.K. entity that prepares its financial statements in accordance with (1) IFRSs in reporting to its parent and (2) U.S. GAAP in reporting to its U.S.-based lender. FuelSource also operates in the oil industry and its operations sometimes result in soil contamination. FuelSource operates in Dirty Country, where there is no environmental legislation. However, FuelSource has a widely published environmental policy in which it remediates contamination that it causes. FuelSource has a record of honoring this published policy. The U.K. parent similarly has a widely published environmental policy in which it remediates all contamination it causes and has a record of honoring this published policy. Required: Should FuelSource recognize a provision for cleanup costs it may incur in Dirty Country (1) in reporting to its U.K. parent under IFRSs and (2) in reporting to its U.S.-based lender in accordance with U.S. GAAP? Paragraph Required: What FASB Code Sections would be relevant to this topic? I" ORI