Question

Case 15 provides a WACC calculation that contains errors based on conceptual mistakes in the analysis. Read the case carefully and present your answers to

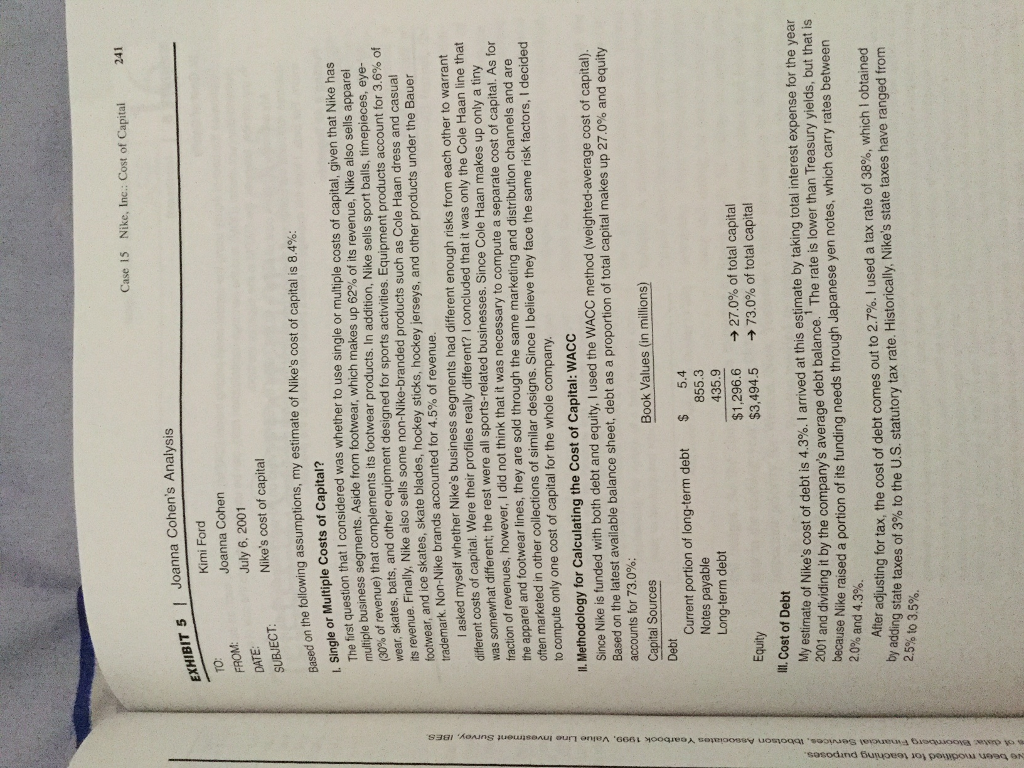

Case 15 provides a WACC calculation that contains errors based on conceptual mistakes in the analysis. Read the case carefully and present your answers to the following questions:

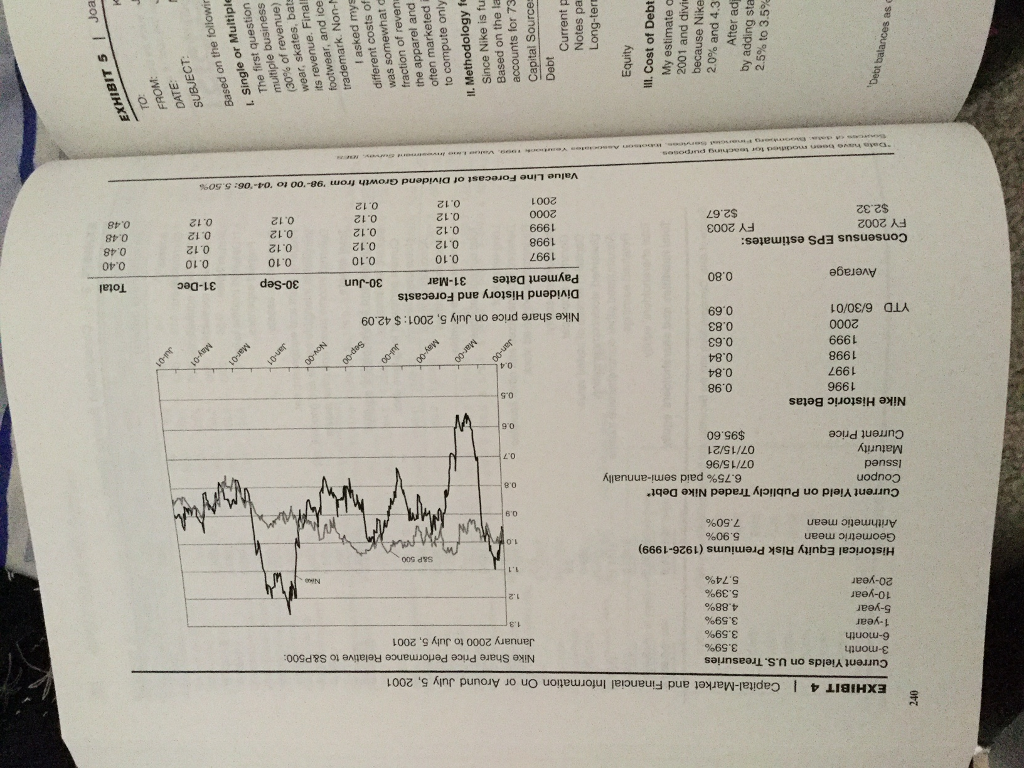

1. What is the WACC and why is it important to estimate a firm's cost of capital? Is the WACC set by investors or by managers?

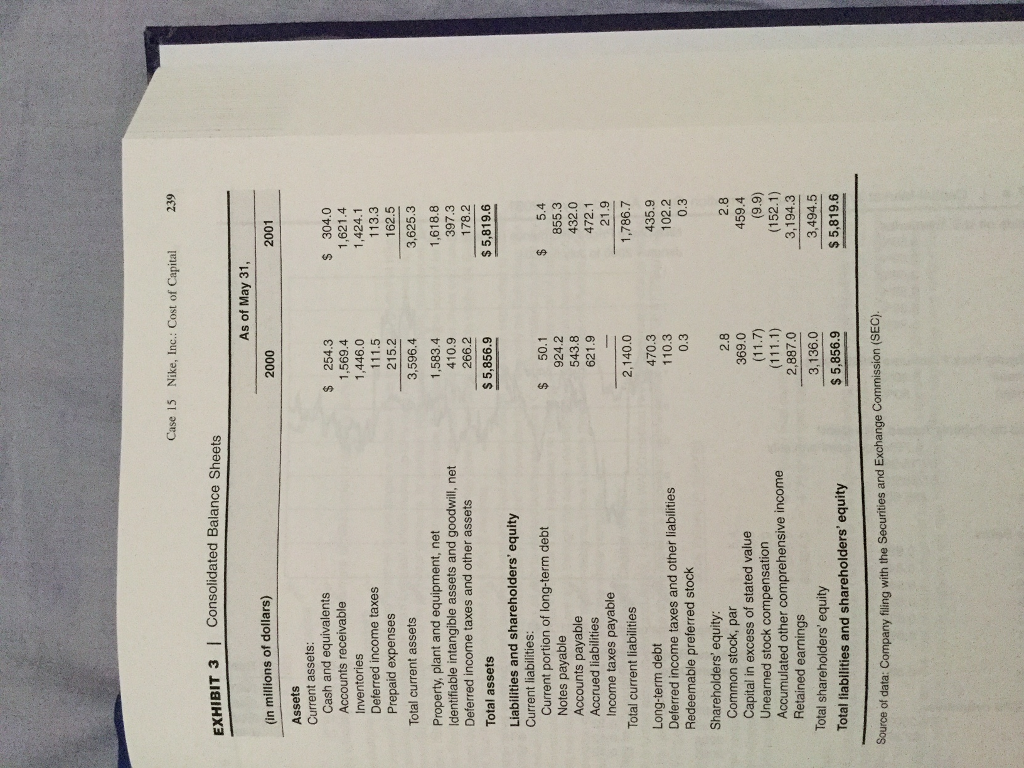

2. What was your estimate of cost of debt? What mistakes did Joanna Cohen make in her estimate? Provide justification for your estimate.

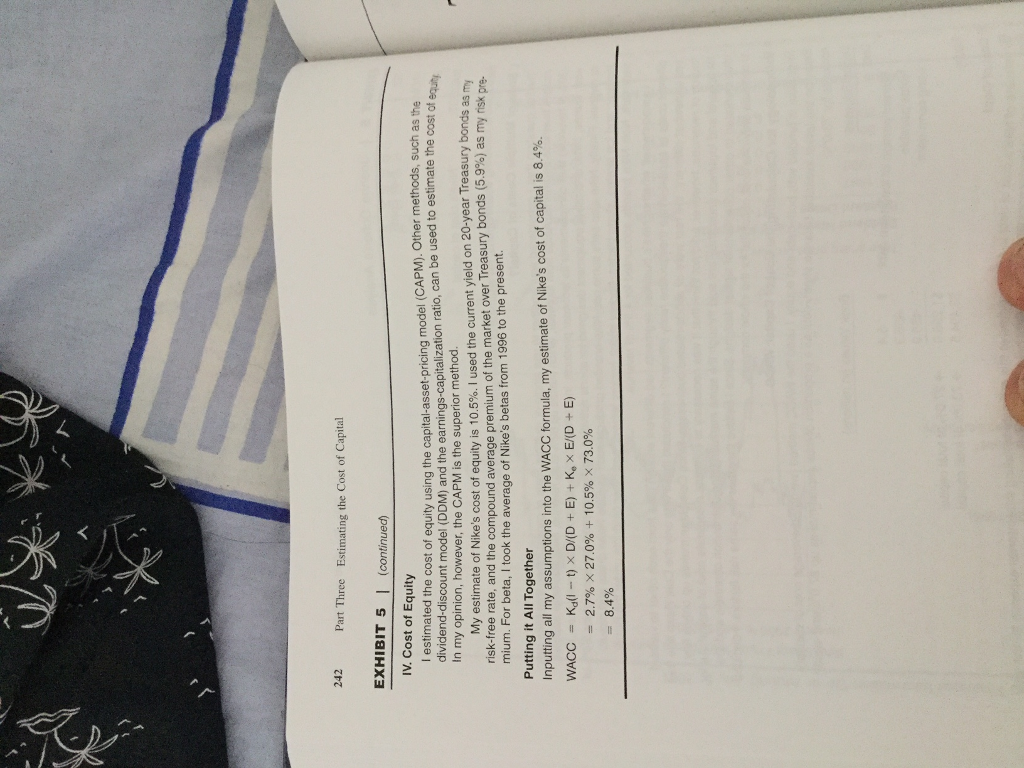

3. Do you agree with Cohen's assumption of risk free rate and beta in her estimate of the cost of equity ? Calculate the cost of equity using CAPM and the dividend growth model. What are the advantages and disadvantages of each method?

4. Cohen was using book values as the basis for debt and equity weights. Calculate the weight of debt and equity using market value basis. What basis should be used in your opinion? and Why?

5. What was your estimate of WACC? What should Kimi Ford recommend regarding an investment in Nike?

PLEASE USE A LAPTOP .. THE PICTURES MIGHT BE DISTORTED ON THE PHONE BECAUSE OF THE SIZE CONSTRAINTS ON CHEGG.

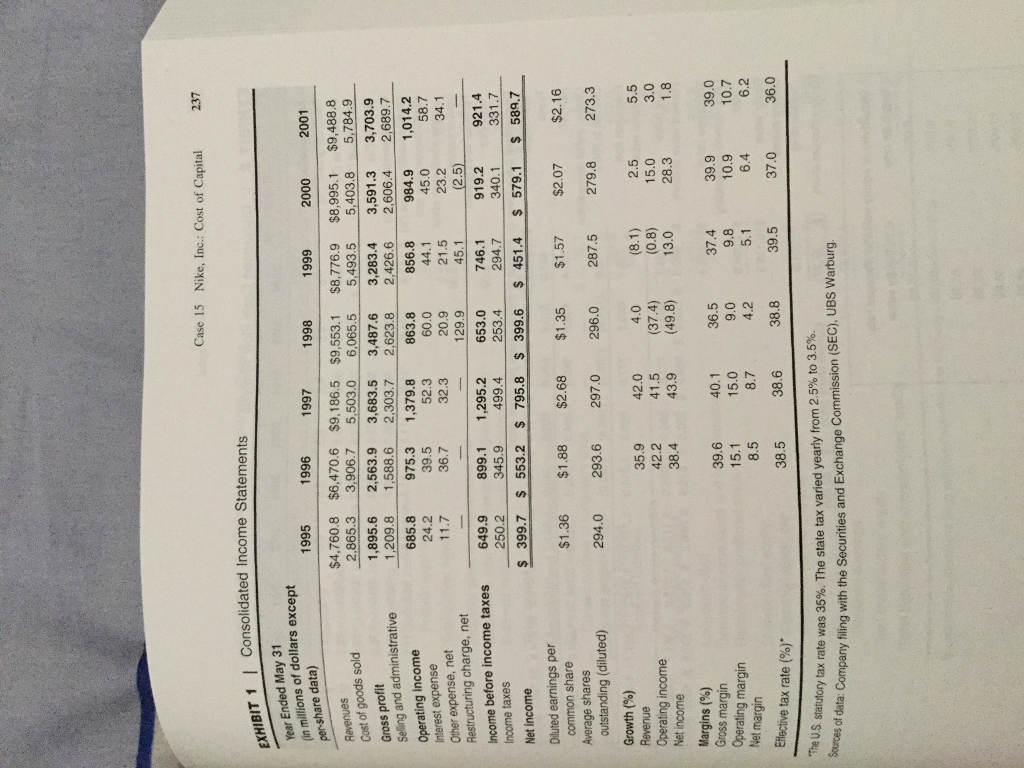

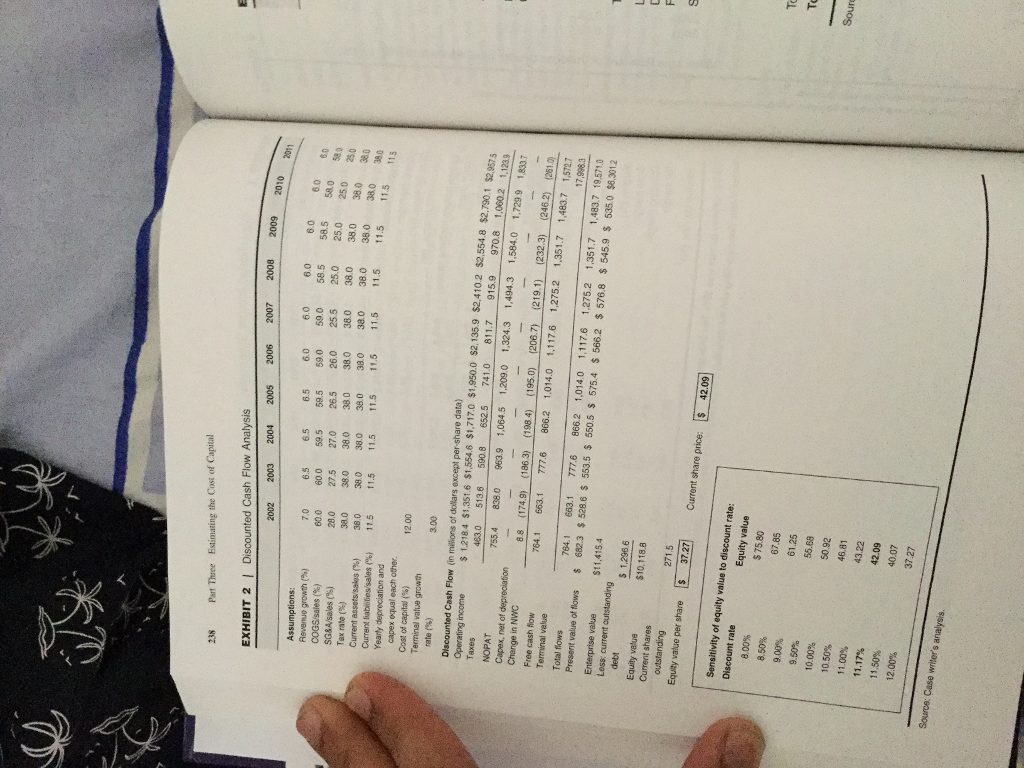

Nike, Inc Cost of Capital July 5, 2001, Kimi Ford, a manager at NorthPoint Group, a mutu fund man management firm, pored over analysts' of Nike, Inc the the year. Nike's share price had declined significantly from the beginning of ed, NorthPoint Ford was considering buying some shares for companies, with an emphasis Fund, which invested mostly in 500 Motors, McDonald's on value investing. Its top holdings included ExxonMobil, General market had 3M, and other large-cap, generally old-economy stocks. While the stock performed declined over the last 18 months, the Large-Cap Fund had 500 fell extremely well. In 2000, the fund earned a return of 20.7%, even as the S&P versus 10.1%. At the end of June 2001, the fund's year-to-date returns stood at 6.4% -7.3% for the S&P 500 held an analysts' meeting to dis only a week earlier, on June 28, 2001, Nike had purpose: Nike close its fiscal-year 2001 results. The meeting, however, had another Since management wanted to communicate a strategy for revitalizing the company. fallen 1997, its revenues had plateaued at around $9 billion, while net income had in from almost $800 million to $580 million (see Exhibit 1). Nike's market share Us. athletic shoes had fallen from 48%, in 1997, to 42% in 2000.2 In addition, recent supply-chain issues and the adverse effect of a strong dollar had negatively affected revenue At the meeting, management revealed plans to address both top-line growth and operating performance. To boost revenue, the company would develop more athletic shoe products in the midpriced segment a segment that Nike had overlooked in recent years. Nike also planned to push its apparel line, which, under the recent leadership of Nike's fiscal year ended in May. something: Nike's insularity and Foot Dragging Have It Running in Place Douglas Robson, "Just Do BusinessWeek, (2 July 2001) 'sneakers in this segment sold for STo s90 a pair. This case was prepared from publicly available information by Jessica Chan, under the supervision of Robert F. Bruner and with the assistance Sean Carr. The financial support of the Batten Institute is gratefully acknowledged. It was written as a basis for class discussion rather than to illustrate effective or ineffective handlin of an administrative situation. Copyright o 2001 by the University of Virginia Darden School ardenbusi No To order copies, send an e-mail to sales@ used in a part of this may be reproduced, stored in a retrieval system, spreadsheet, or transmitted in any form or by any ectronic, mechani recording, or otherwise- without the permission of the cal, photocopying, Darden School Founda on. Rev. 10/05 235Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started