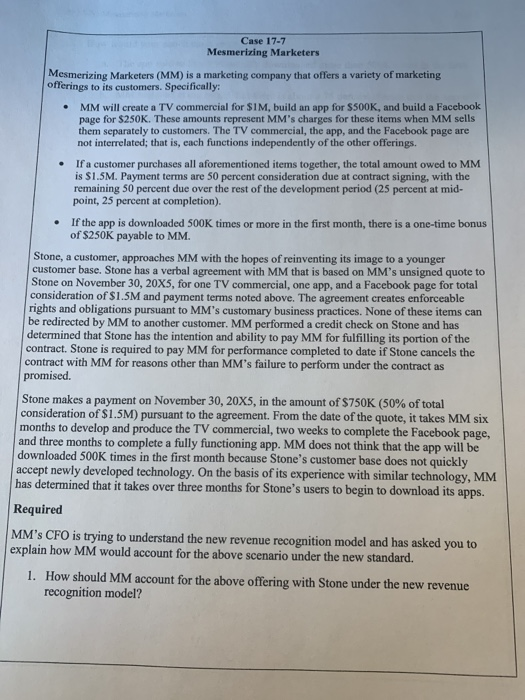

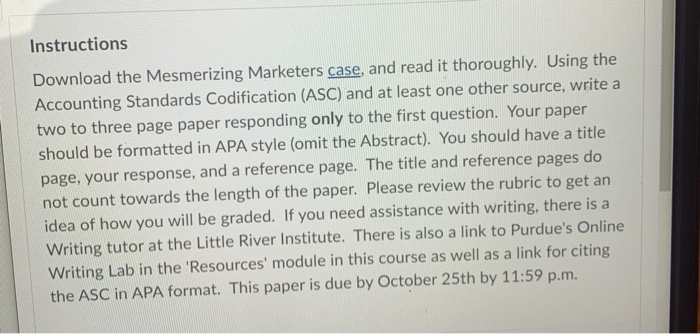

Case 17-7 Mesmerizing Marketers Mesmerizing Marketers (MM) is a marketing company that offers a variety of marketing offerings to its customers. Specifically: MM will create a TV commercial for SIM, build an app for SSOOK, and build a Facebook page for $250K. These amounts represent MM's charges for these items when MM sells them separately to customers. The TV commercial, the app, and the Facebook page are not interrelated; that is, each functions independently of the other offerings. If a customer purchases all aforementioned items together, the total amount owed to MM is $1.5M. Payment terms are 50 percent consideration due at contract signing, with the remaining 50 percent due over the rest of the development period (25 percent at mid- point, 25 percent at completion). If the app is downloaded SOOK times or more in the first month, there is a one-time bonus of $250K payable to MM. Stone, a customer, approaches MM with the hopes of reinventing its image to a younger customer base. Stone has a verbal agreement with MM that is based on MM's unsigned quote to Stone on November 30, 20X5, for one TV commercial, one app, and a Facebook page for total consideration of $1.5M and payment terms noted above. The agreement creates enforceable rights and obligations pursuant to MM's customary business practices. None of these items can be redirected by MM to another customer. MM performed a credit check on Stone and has determined that Stone has the intention and ability to pay MM for fulfilling its portion of the contract. Stone is required to pay MM for performance completed to date if Stone cancels the contract with MM for reasons other than MM's failure to perform under the contract as promised. Stone makes a payment on November 30, 20X5, in the amount of $750K (50% of total consideration of $1.5M) pursuant to the agreement. From the date of the quote, it takes MM six months to develop and produce the TV commercial, two weeks to complete the Facebook page, and three months to complete a fully functioning app. MM does not think that the app will be downloaded 500K times in the first month because Stone's customer base does not quickly accept newly developed technology. On the basis of its experience with similar technology, MM has determined that it takes over three months for Stone's users to begin to download its apps. Required MM's CFO is trying to understand the new revenue recognition model and has asked you to explain how MM would account for the above scenario under the new standard. 1. How should MM account for the above offering with Stone under the new revenue recognition model? Instructions Download the Mesmerizing Marketers case, and read it thoroughly. Using the Accounting Standards Codification (ASC) and at least one other source, write a two to three page paper responding only to the first question. Your paper should be formatted in APA style (omit the Abstract). You should have a title page, your response, and a reference page. The title and reference pages do not count towards the length of the paper. Please review the rubric to get an idea of how you will be graded. If you need assistance with writing, there is a Writing tutor at the Little River Institute. There is also a link to Purdue's Online Writing Lab in the 'Resources' module in this course as well as a link for citing the ASC in APA format. This paper is due by October 25th by 11:59 p.m