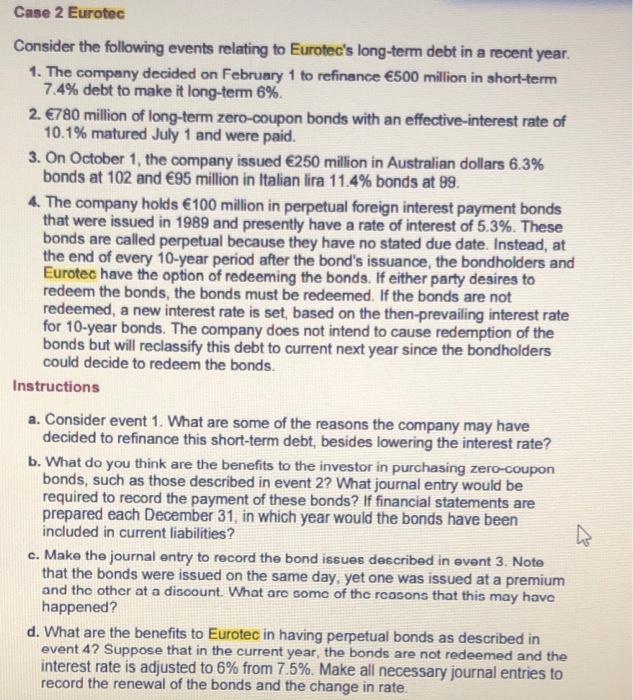

Case 2 Eurotec Consider the following events relating to Eurotec's long-term debt in a recent year. 1. The company decided on February 1 to refinance 500 million in short-term 7.4% debt to make it long-term 6%. 2. 780 million of long-term zero-coupon bonds with an effective-interest rate of 10.1% matured July 1 and were paid. 3. On October 1, the company issued 250 million in Australian dollars 6.3% bonds at 102 and 95 million in Italian lira 11.4% bonds at 99. 4. The company holds 100 million in perpetual foreign interest payment bonds that were issued in 1989 and presently have a rate of interest of 5.3%. These bonds are called perpetual because they have no stated due date. Instead, at the end of every 10-year period after the bond's issuance, the bondholders and Eurotec have the option of redeeming the bonds. If either party desires to redeem the bonds, the bonds must be redeemed. If the bonds are not redeemed a new interest rate is set, based on the then-prevailing interest rate for 10-year bonds. The company does not intend to cause redemption of the bonds but will reclassify this debt to current next year since the bondholders could decide to redeem the bonds. Instructions a. Consider event 1. What are some of the reasons the company may have decided to refinance this short-term debt, besides lowering the interest rate? b. What do you think are the benefits to the investor in purchasing zero-coupon bonds, such as those described in event 2? What journal entry would be required to record the payment of these bonds? If financial statements are prepared each December 31, in which year would the bonds have been included in current liabilities? c. Make the journal entry to record the bond issues described in event 3. Note that the bonds were issued on the same day, yet one was issued at a premium and the other at a discount. What are some of the reasons that this may have happened? d. What are the benefits to Eurotec in having perpetual bonds as described in event 42 Suppose that in the current year, the bonds are not redeemed and the interest rate is adjusted to 6% from 7.5%. Make all necessary journal entries to record the renewal of the bonds and the change in rate. Case 2 Eurotec Consider the following events relating to Eurotec's long-term debt in a recent year. 1. The company decided on February 1 to refinance 500 million in short-term 7.4% debt to make it long-term 6%. 2. 780 million of long-term zero-coupon bonds with an effective-interest rate of 10.1% matured July 1 and were paid. 3. On October 1, the company issued 250 million in Australian dollars 6.3% bonds at 102 and 95 million in Italian lira 11.4% bonds at 99. 4. The company holds 100 million in perpetual foreign interest payment bonds that were issued in 1989 and presently have a rate of interest of 5.3%. These bonds are called perpetual because they have no stated due date. Instead, at the end of every 10-year period after the bond's issuance, the bondholders and Eurotec have the option of redeeming the bonds. If either party desires to redeem the bonds, the bonds must be redeemed. If the bonds are not redeemed a new interest rate is set, based on the then-prevailing interest rate for 10-year bonds. The company does not intend to cause redemption of the bonds but will reclassify this debt to current next year since the bondholders could decide to redeem the bonds. Instructions a. Consider event 1. What are some of the reasons the company may have decided to refinance this short-term debt, besides lowering the interest rate? b. What do you think are the benefits to the investor in purchasing zero-coupon bonds, such as those described in event 2? What journal entry would be required to record the payment of these bonds? If financial statements are prepared each December 31, in which year would the bonds have been included in current liabilities? c. Make the journal entry to record the bond issues described in event 3. Note that the bonds were issued on the same day, yet one was issued at a premium and the other at a discount. What are some of the reasons that this may have happened? d. What are the benefits to Eurotec in having perpetual bonds as described in event 42 Suppose that in the current year, the bonds are not redeemed and the interest rate is adjusted to 6% from 7.5%. Make all necessary journal entries to record the renewal of the bonds and the change in rate