Answered step by step

Verified Expert Solution

Question

1 Approved Answer

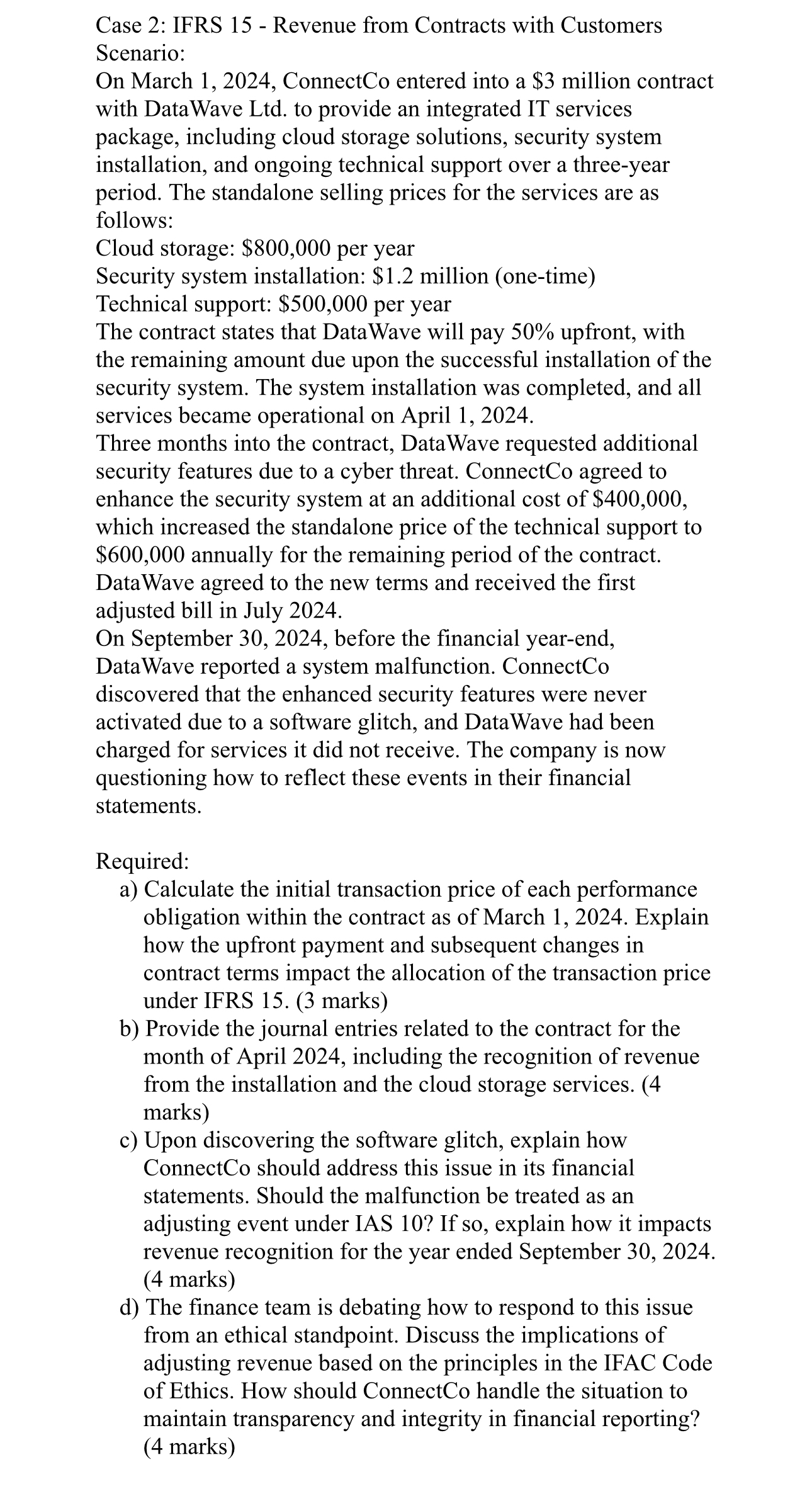

Case 2 : IFRS 1 5 - Revenue from Contracts with Customers Scenario: On March 1 , 2 0 2 4 , ConnectCo entered into

Case : IFRS Revenue from Contracts with Customers

Scenario:

On March ConnectCo entered into a $ million contract

with DataWave Ltd to provide an integrated IT services

package, including cloud storage solutions, security system

installation, and ongoing technical support over a threeyear

period. The standalone selling prices for the services are as

follows:

Cloud storage: $ per year

Security system installation: $ million onetime

Technical support: $ per year

The contract states that DataWave will pay upfront, with

the remaining amount due upon the successful installation of the

security system. The system installation was completed, and all

services became operational on April

Three months into the contract, DataWave requested additional

security features due to a cyber threat. ConnectCo agreed to

enhance the security system at an additional cost of $

which increased the standalone price of the technical support to

$ annually for the remaining period of the contract.

DataWave agreed to the new terms and received the first

adjusted bill in July

On September before the financial yearend,

DataWave reported a system malfunction. ConnectCo

discovered that the enhanced security features were never

activated due to a software glitch, and DataWave had been

charged for services it did not receive. The company is now

questioning how to reflect these events in their financial

statements.

Required:

a Calculate the initial transaction price of each performance

obligation within the contract as of March Explain

how the upfront payment and subsequent changes in

contract terms impact the allocation of the transaction price

under IFRS marks

b Provide the journal entries related to the contract for the

month of April including the recognition of revenue

from the installation and the cloud storage services.

marks

c Upon discovering the software glitch, explain how

ConnectCo should address this issue in its financial

statements. Should the malfunction be treated as an

adjusting event under IAS If so explain how it impacts

revenue recognition for the year ended September

marks

d The finance team is debating how to respond to this issue

from an ethical standpoint. Discuss the implications of

adjusting revenue based on the principles in the IFAC Code

of Ethics. How should ConnectCo handle the situation to

maintain transparency and integrity in financial reporting?

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started