Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 2 Jenkins Inc has $500,000 in credit sales for the month of June. Per the Trial Balance, the account Allowance for expected Credit

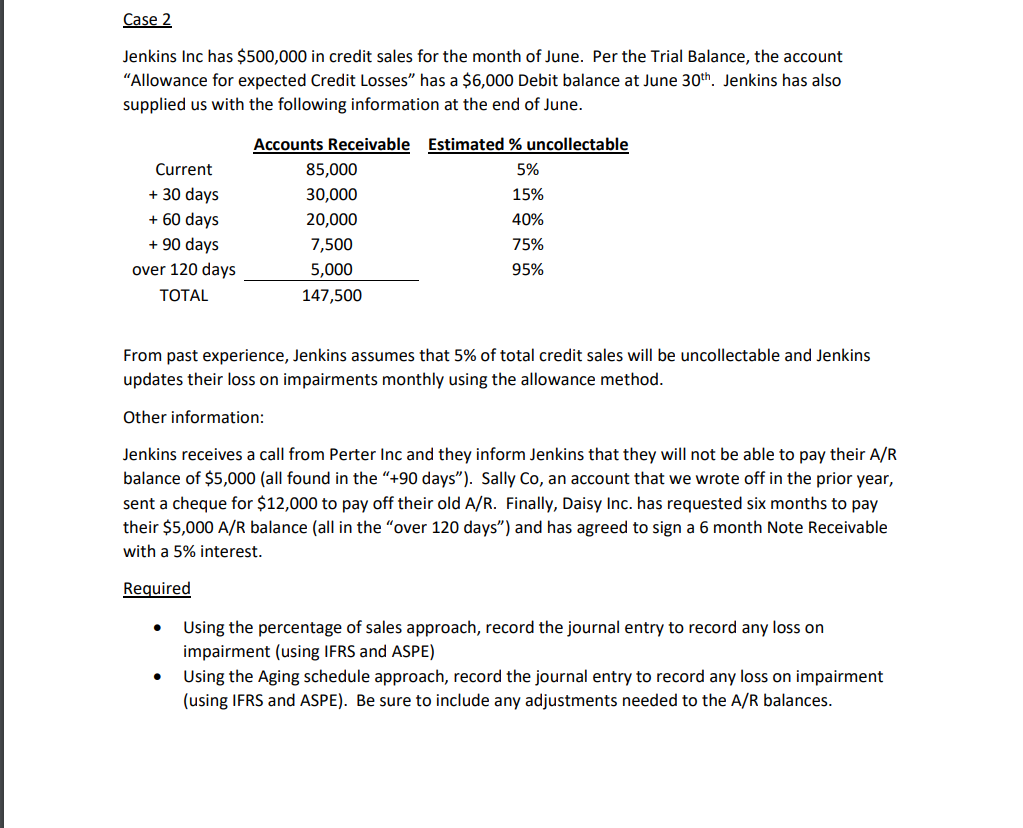

Case 2 Jenkins Inc has $500,000 in credit sales for the month of June. Per the Trial Balance, the account "Allowance for expected Credit Losses" has a $6,000 Debit balance at June 30th. Jenkins has also supplied us with the following information at the end of June. Accounts Receivable Estimated % uncollectable Current 85,000 5% + 30 days 30,000 15% + 60 days 20,000 40% +90 days 7,500 75% over 120 days TOTAL 5,000 147,500 95% From past experience, Jenkins assumes that 5% of total credit sales will be uncollectable and Jenkins updates their loss on impairments monthly using the allowance method. Other information: Jenkins receives a call from Perter Inc and they inform Jenkins that they will not be able to pay their A/R balance of $5,000 (all found in the "+90 days"). Sally Co, an account that we wrote off in the prior year, sent a cheque for $12,000 to pay off their old A/R. Finally, Daisy Inc. has requested six months to pay their $5,000 A/R balance (all in the "over 120 days") and has agreed to sign a 6 month Note Receivable with a 5% interest. Required Using the percentage of sales approach, record the journal entry to record any loss on impairment (using IFRS and ASPE) Using the Aging schedule approach, record the journal entry to record any loss on impairment (using IFRS and ASPE). Be sure to include any adjustments needed to the A/R balances.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started