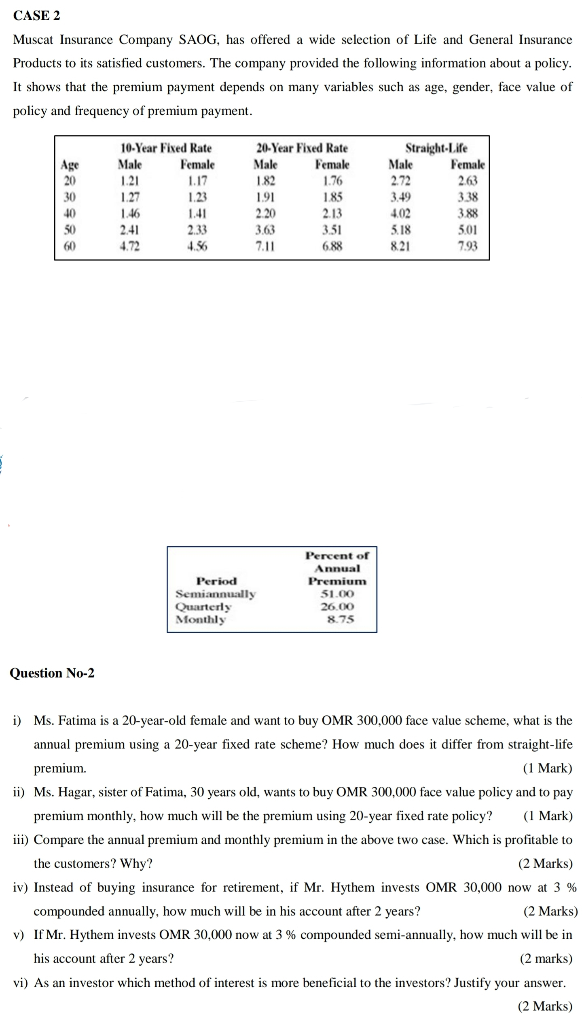

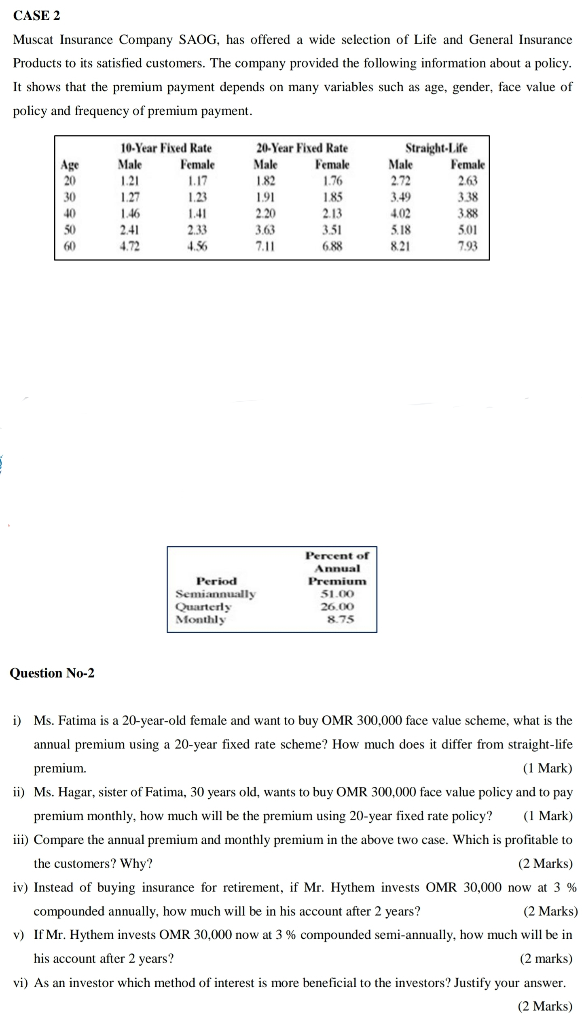

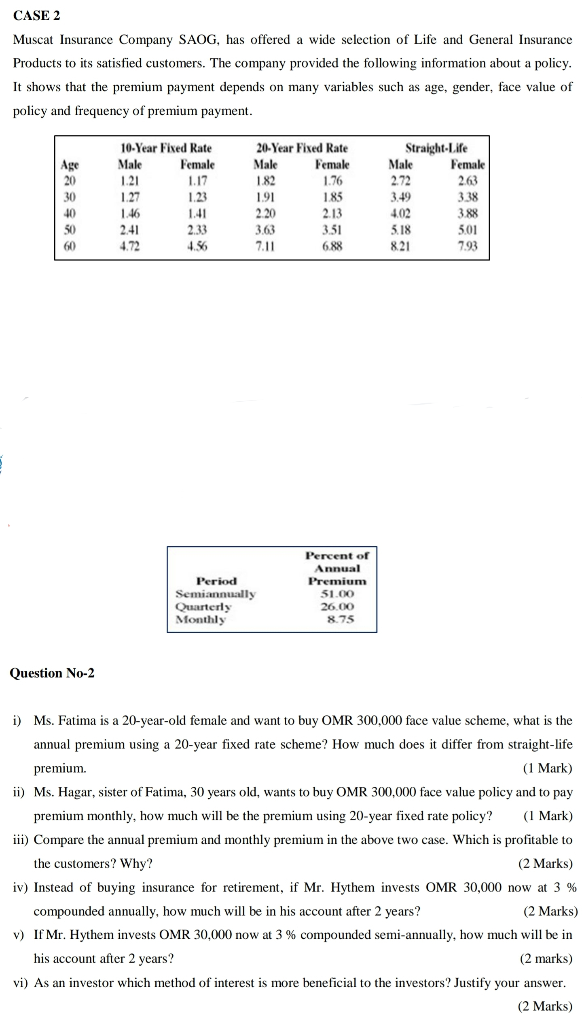

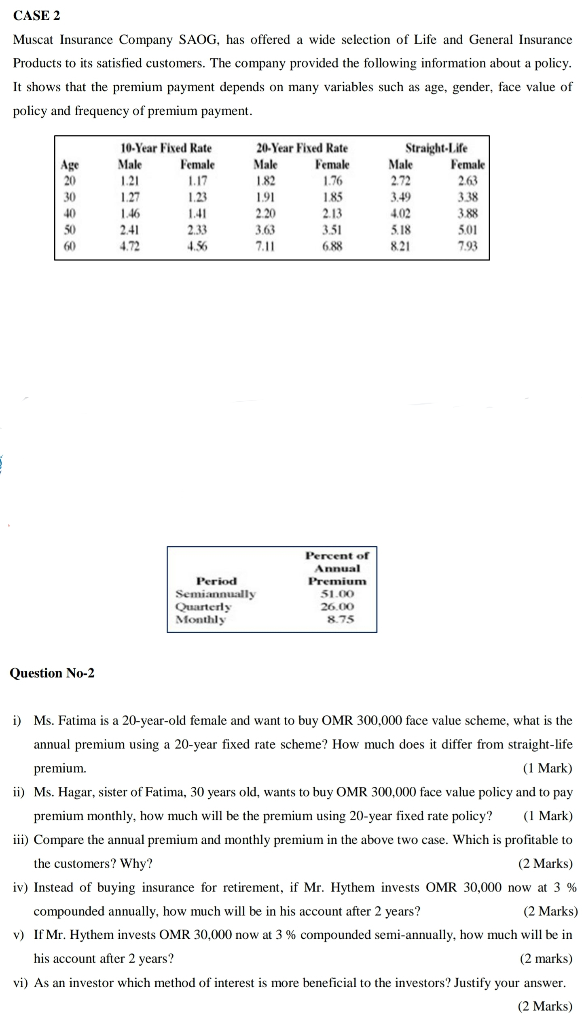

CASE 2 Muscat Insurance Company SAOG, has offered a wide selection of Life and General Insurance Products to its satisfied customers. The company provided the following information about a policy. It shows that the premium payment depends on many variables such as age, gender, face value of policy and frequency of premium payment. Age 20 30 10 50 60 10-Year Fixed Rate Male Female 1.21 1.17 1.27 1.23 1.46 1.41 2.41 233 4.72 4.56 20-Year Fixed Rate Male Female 1.82 1.76 191 185 2.20 2.13 3.63 351 7.11 6.88 Straight-Life Male Female 272 2.63 3.49 3.38 4.02 3.88 5.18 5.01 8.21 7.93 Period Semiannually Quarterly Monthly Percent of Annual Premium 51.00 26.00 8.75 Question No-2 i) Ms. Fatima is a 20-year-old female and want to buy OMR 300,000 face value scheme, what is the annual premium using a 20-year fixed rate scheme? How much does it differ from straight-life premium. (1 Mark) ii) Ms. Hagar, sister of Fatima, 30 years old, wants to buy OMR 300,000 face value policy and to pay premium monthly, how much will be the premium using 20-year fixed rate policy? (1 Mark) iii) Compare the annual premium and monthly premium in the above two case. Which is profitable to the customers? Why? (2 Marks) iv) Instead of buying insurance for retirement, if Mr. Hythem invests OMR 30,000 now at 3% compounded annually, how much will be in his account after 2 years? (2 Marks) v) If Mr. Hythem invests OMR 30,000 now at 3 % compounded semi-annually, how much will be in his account after 2 years? (2 marks) vi) As an investor which method of interest is more beneficial to the investors? Justify your answer. (2 Marks) CASE 2 Muscat Insurance Company SAOG, has offered a wide selection of Life and General Insurance Products to its satisfied customers. The company provided the following information about a policy. It shows that the premium payment depends on many variables such as age, gender, face value of policy and frequency of premium payment. Age 20 30 10 50 60 10-Year Fixed Rate Male Female 1.21 1.17 1.27 1.23 1.46 1.41 2.41 233 4.72 4.56 20-Year Fixed Rate Male Female 1.82 1.76 191 185 2.20 2.13 3.63 351 7.11 6.88 Straight-Life Male Female 272 2.63 3.49 3.38 4.02 3.88 5.18 5.01 8.21 7.93 Period Semiannually Quarterly Monthly Percent of Annual Premium 51.00 26.00 8.75 Question No-2 i) Ms. Fatima is a 20-year-old female and want to buy OMR 300,000 face value scheme, what is the annual premium using a 20-year fixed rate scheme? How much does it differ from straight-life premium. (1 Mark) ii) Ms. Hagar, sister of Fatima, 30 years old, wants to buy OMR 300,000 face value policy and to pay premium monthly, how much will be the premium using 20-year fixed rate policy? (1 Mark) iii) Compare the annual premium and monthly premium in the above two case. Which is profitable to the customers? Why? (2 Marks) iv) Instead of buying insurance for retirement, if Mr. Hythem invests OMR 30,000 now at 3% compounded annually, how much will be in his account after 2 years? (2 Marks) v) If Mr. Hythem invests OMR 30,000 now at 3 % compounded semi-annually, how much will be in his account after 2 years? (2 marks) vi) As an investor which method of interest is more beneficial to the investors? Justify your answer. (2 Marks)