Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 2: Short Put Ananth also thinks that the price of BITO is likely to go up, but he finds the call premiums too expensive.

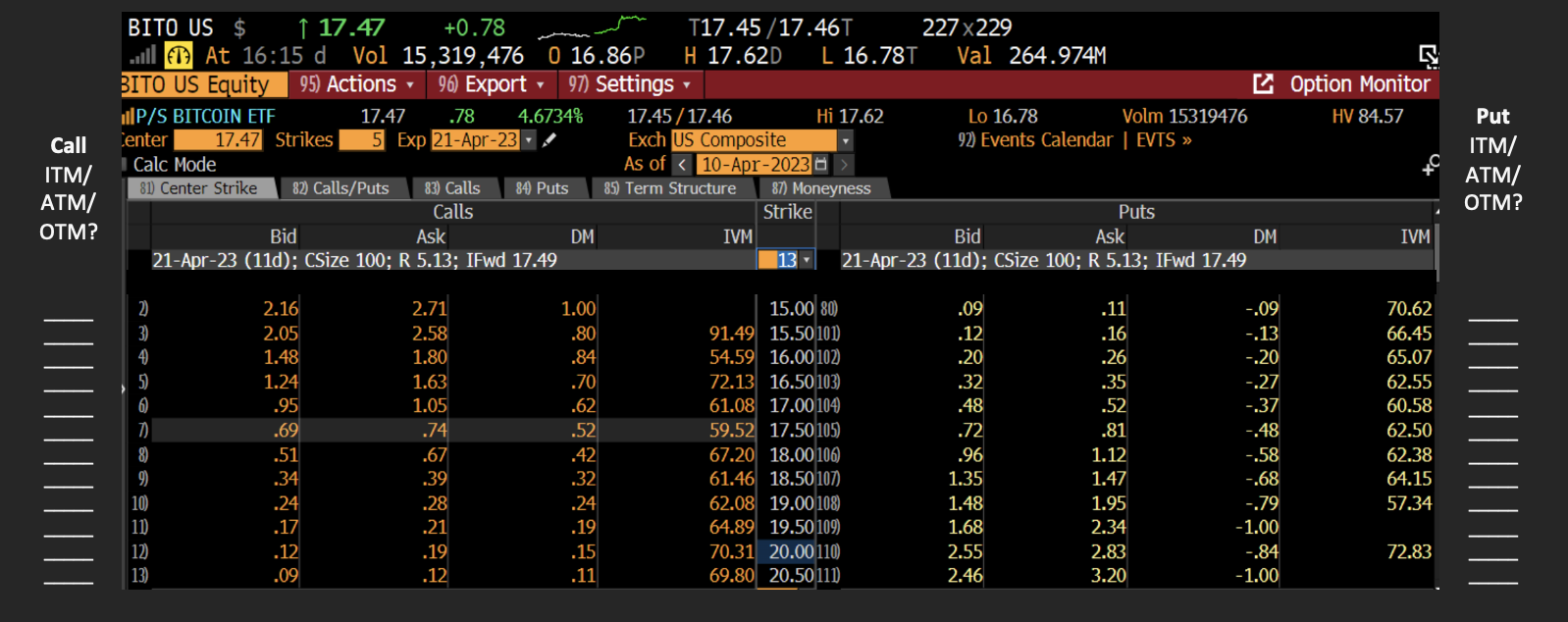

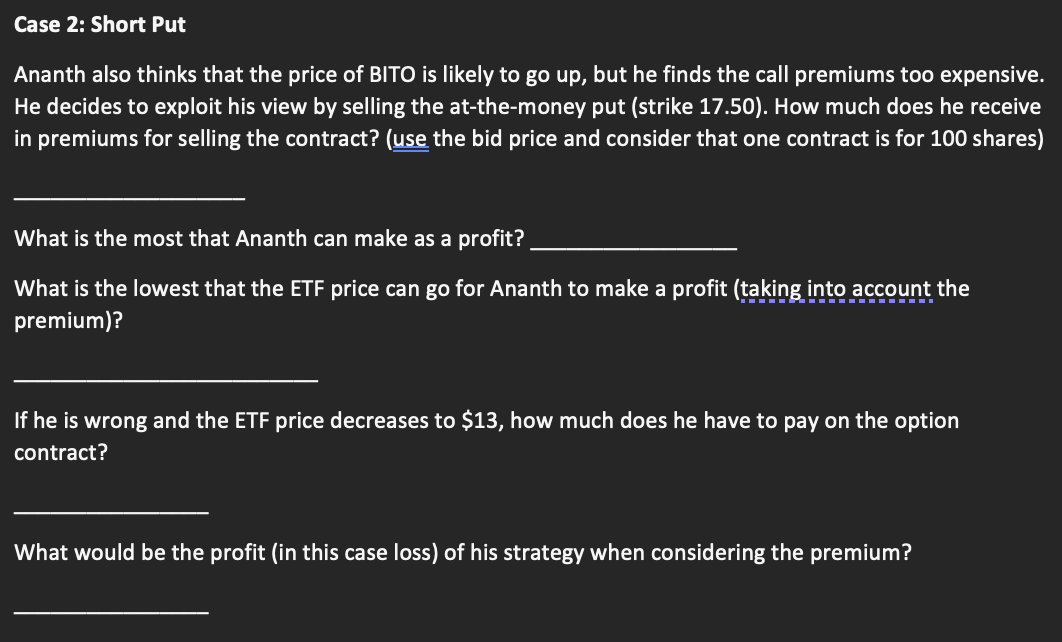

Case 2: Short Put Ananth also thinks that the price of BITO is likely to go up, but he finds the call premiums too expensive. He decides to exploit his view by selling the at-the-money put (strike 17.50). How much does he receive in premiums for selling the contract? (use the bid price and consider that one contract is for 100 shares) What is the most that Ananth can make as a profit? What is the lowest that the ETF price can go for Ananth to make a profit (taking into account the premium)? If he is wrong and the ETF price decreases to $13, how much does he have to pay on the option contract? What would be the profit (in this case loss) of his strategy when considering the premium

Case 2: Short Put Ananth also thinks that the price of BITO is likely to go up, but he finds the call premiums too expensive. He decides to exploit his view by selling the at-the-money put (strike 17.50). How much does he receive in premiums for selling the contract? (use the bid price and consider that one contract is for 100 shares) What is the most that Ananth can make as a profit? What is the lowest that the ETF price can go for Ananth to make a profit (taking into account the premium)? If he is wrong and the ETF price decreases to $13, how much does he have to pay on the option contract? What would be the profit (in this case loss) of his strategy when considering the premium Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started