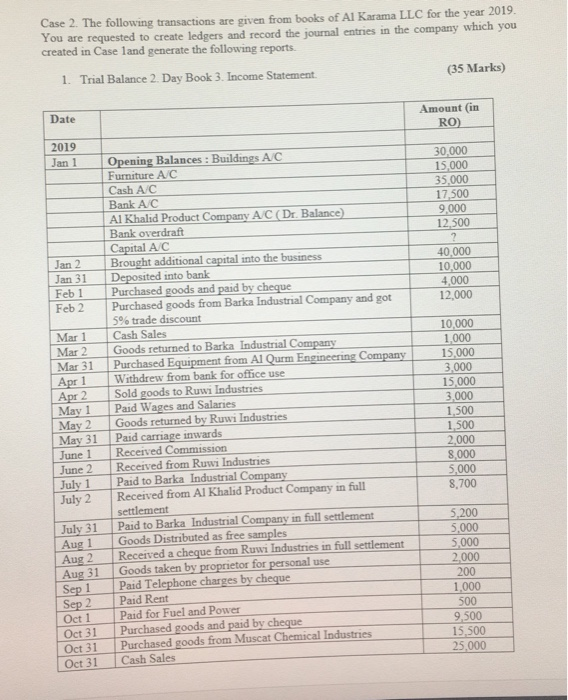

Case 2. The following transactions are given from books of Al Karama LLC for the year 2019. You are requested to create ledgers and record the journal entries in the company which you created in Case land generate the following reports. 1. Trial Balance 2. Day Book 3. Income Statement. (35 Marks) Date Amount in RO) 2019 Jan 1 30,000 15,000 35,000 17,500 9,000 12 500 2 40,000 10,000 4,000 12,000 Jan 2 Jan 31 Feb 1 Feb 2 Mar 1 Mar 2 Mar 31 Apr 1 Apr 2 May 1 May 2 May 31 June 1 June 2 July 1 July 2 Opening Balances : Buildings A/C Furniture A/C Cash AC Bank A/C Al Khalid Product Company A/C (Dr. Balance) Bank overdraft Capital AC Brought additional capital into the business Deposited into bank Purchased goods and paid by cheque Purchased goods from Barka Industrial Company and got 5% trade discount Cash Sales Goods returned to Barka Industrial Company Purchased Equipment from Al Qurm Engineering Company Withdrew from bank for office use Sold goods to Ruwi Industries Paid Wages and Salaries Goods returned by Ruwi Industries Paid carriage inwards Received Commission Received from Ruwi Industries Paid to Barka Industrial Company Received from Al Khalid Product Company in full settlement Paid to Barka Industrial Company in full settlement Goods Distributed as free samples Received a cheque from Ruwi Industries in full settlement Goods taken by proprietor for personal use Paid Telephone charges by cheque Paid Rent Paid for Fuel and Power Purchased goods and paid by cheque Purchased goods from Muscat Chemical Industries Cash Sales 10,000 1,000 15,000 3,000 15,000 3,000 1,500 1,500 2,000 8.000 5.000 8,700 July 31 Aug 1 Aug 2 Aug 31 Sep 1 Sep 2 Oct 1 Oct 31 Oct 31 Oct 31 5,200 5,000 5,000 2.000 200 1.000 500 9.500 15,500 25,000 25.000 8,000 1,500 Oct 31 Oct 31 Norl Norl Nora Nov1 Nov 2 Nor2 Nor 2 Nor 2 Nor2 Nor 2 Nov 30 Nov 30 Nov 30 Dec 1 Dec 1 Dec 31 Dec 31 Sold goods to Al Naba Services Purchased goods from Raya Industries Company Cash withdrawn from bank by proprietor for personal use Sold Machinery worth RO. 3250 for RO. 3000 Goods returned to Muscat Chemical Industries Goods returned by Al Naba Services Paid carriage on purchases Withdrew from bank for office use Brought additional capital into business Received cash from Oman Packaging Factory for cash sale Purchased Equipment worth Paid Insurance on Office Building Paid for fuel and Power Goods taken by proprietor for personal use Sold goods to L&T Industries Advertisement expenses Deposited into Bank Recenved interest Paid Electricity charges Paid Salaries and Wages through bank transfer 1,500 1.000 150 2,500 50.000 6.000 11.500 1.350 950 1.000 14.800 2.500 15.000 150 1.100 2.500 For Recording transaction (30 Marks), Ledger Creations (2 Marks) Report generation (3 Marks). Note: Create only one company to record stock items and the transaction. All the reports from case land 2 is to be pasted in one word file and submit through e-learning portal