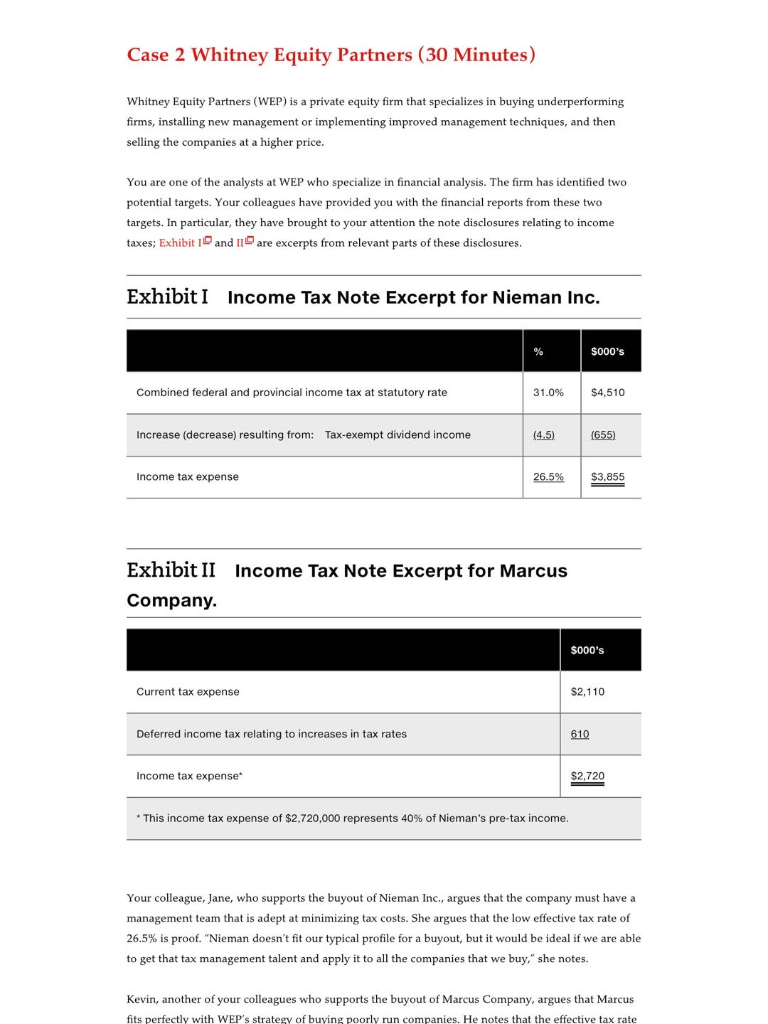

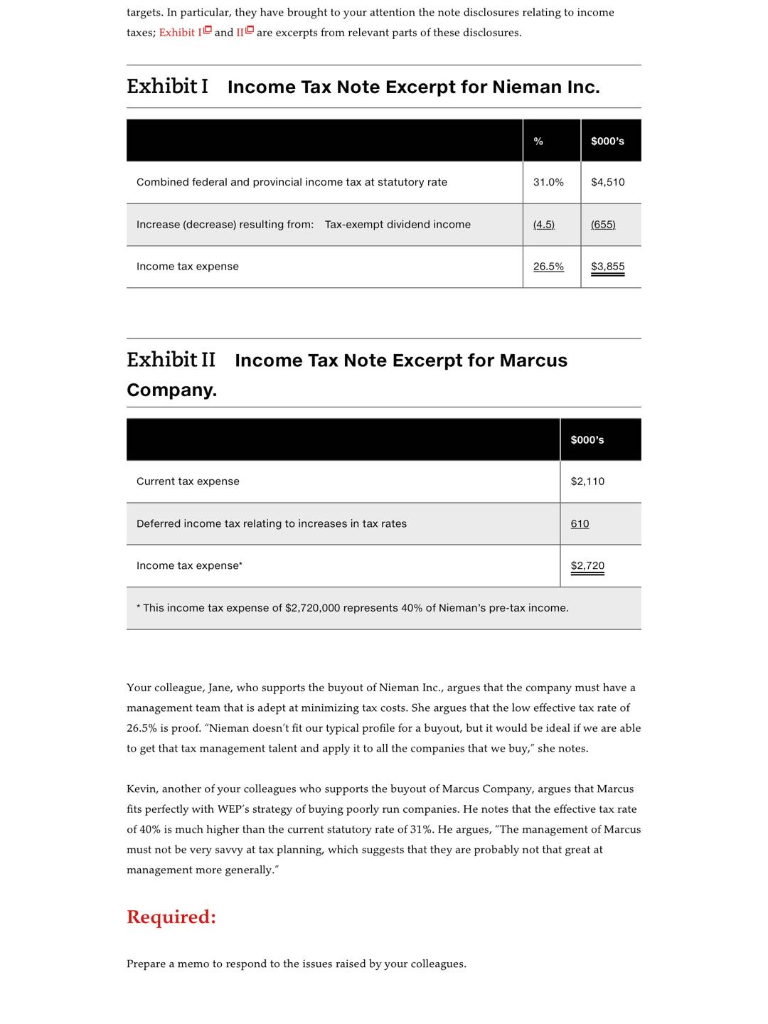

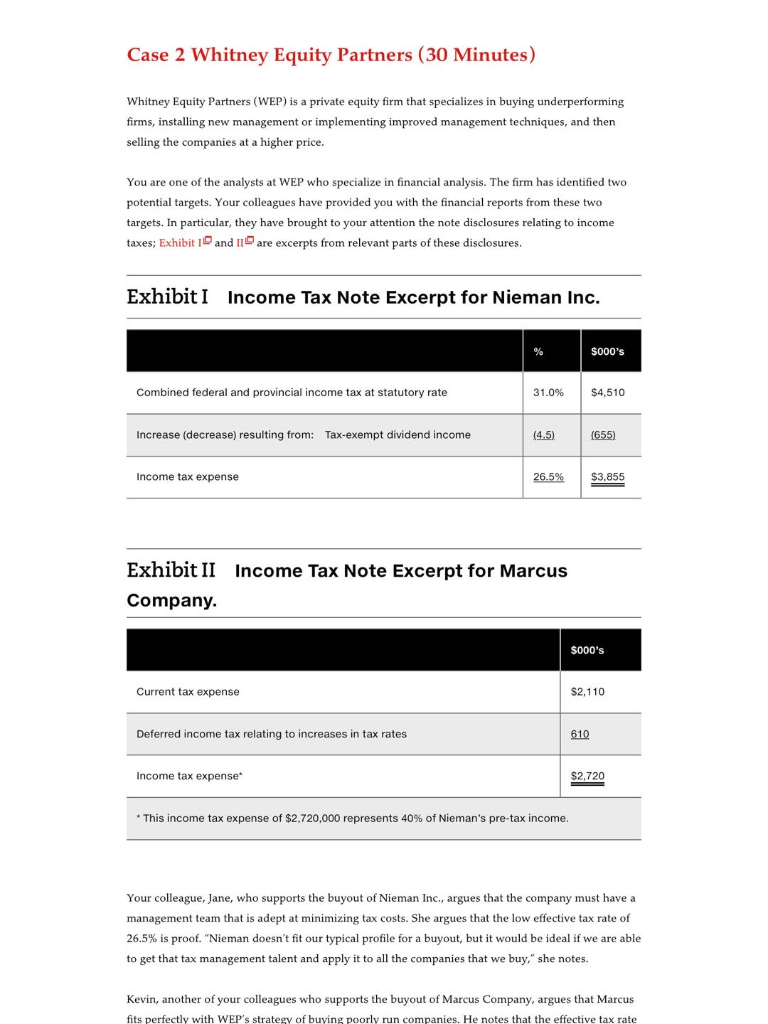

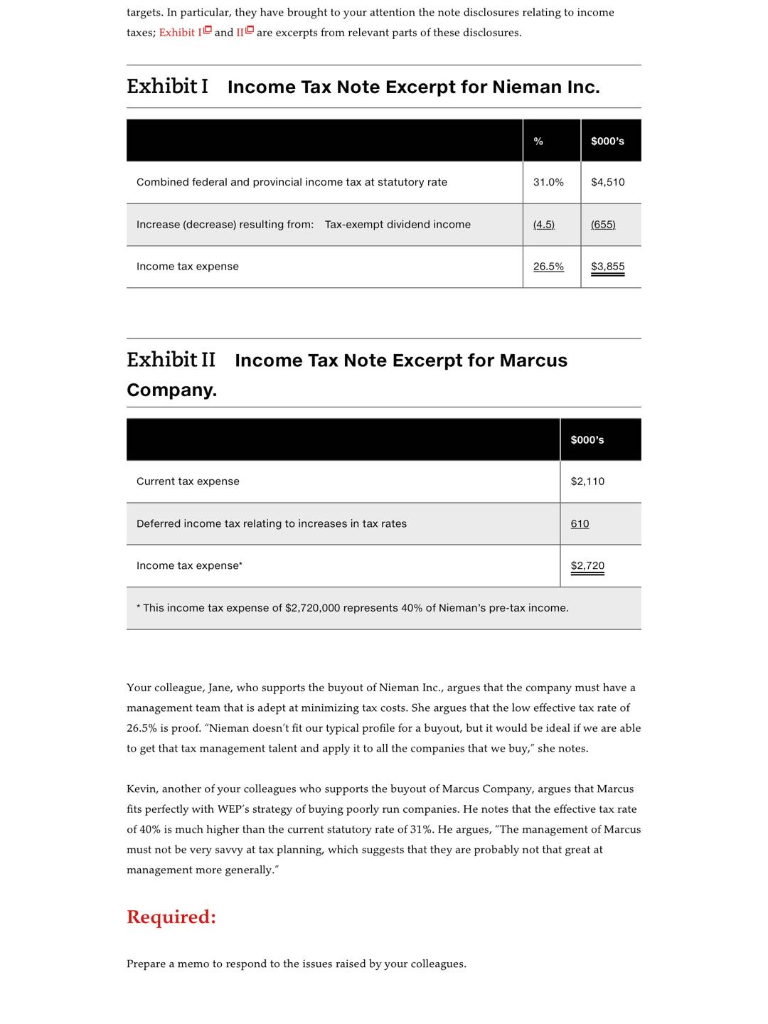

Case 2 Whitney Equity Partners (30 Minutes) Whitney Equity Partners (WEP) is a private equity firm that specializes in buying underperforming firms, installing new management or implementing improved management techniques, and then selling the companies at a higher price. You are one of the analysts at WEP who specialize in financial analysis. The firm has identified two potential targets. Your colleagues have provided you with the financial reports from these two targets. In particular, they have brought to your attention the note disclosures relating to income taxes; Exhibit 1 and 11 are excerpts from relevant parts of these disclosures. Exhibit I Income Tax Note Excerpt for Nieman Inc. % S000's Combined federal and provincial income tax at statutory rate 31.0% $4,510 Increase (decrease) resulting from: Tax-exempt dividend income (4.5) (655) Income tax expense 26.5% $3,855 Exhibit II Income Tax Note Excerpt for Marcus Company. $000's Current tax expense $2,110 Deferred income tax relating to increases in tax rates 610 Income tax expense* $2,720 * This income tax expense of $2,720,000 represents 40% of Nieman's pre-tax income. Your colleague, Jane, who supports the buyout of Nieman Inc., argues that the company must have a management team that is adept at minimizing tax costs. She argues that the low effective tax rate of 26.5% is proof. "Nieman doesn't fit our typical profile for a buyout, but it would be ideal if we are able to get that tax management talent and apply it to all the companies that we buy," she notes. Kevin, another of your colleagues who supports the buyout of Marcus Company, argues that Marcus fits perfectly with WEP's strategy of buying poorly run companies. He notes that the effective tax rate targets. In particular, they have brought to your attention the note disclosures relating to income taxes; Exhibit and I are excerpts from relevant parts of these disclosures. Exhibit I Income Tax Note Excerpt for Nieman Inc. $000's Combined federal and provincial income tax at statutory rate 31.0% $4,510 Increase (decrease) resulting from: Tax-exempt dividend income (4.5) (655) Income tax expense 26.5% $3,855 Exhibit II Income Tax Note Excerpt for Marcus Company. $000's Current tax expense $2,110 Deferred income tax relating to increases in tax rates 610 Income tax expense $2,720 * This income tax expense of $2,720,000 represents 40% of Nieman's pre-tax income. Your colleague, Jane, who supports the buyout of Nieman Inc., argues that the company must have a management team that is adept at minimizing tax costs. She argues that the low effective tax rate of 26.5% is proof. "Nieman doesn't fit our typical profile for a buyout, but it would be ideal if we are able to get that tax management talent and apply it to all the companies that we buy," she notes. Kevin, another of your colleagues who supports the buyout of Marcus Company, argues that Marcus fits perfectly with WEP's strategy of buying poorly run companies. He notes that the effective tax rate of 40% is much higher than the current statutory rate of 31%. He argues, "The management of Marcus must not be very savvy at tax planning, which suggests that they are probably not that great at management more generally." Required: Prepare a memo to respond to the issues raised by your colleagues. Case 2 Whitney Equity Partners (30 Minutes) Whitney Equity Partners (WEP) is a private equity firm that specializes in buying underperforming firms, installing new management or implementing improved management techniques, and then selling the companies at a higher price. You are one of the analysts at WEP who specialize in financial analysis. The firm has identified two potential targets. Your colleagues have provided you with the financial reports from these two targets. In particular, they have brought to your attention the note disclosures relating to income taxes; Exhibit 1 and 11 are excerpts from relevant parts of these disclosures. Exhibit I Income Tax Note Excerpt for Nieman Inc. % S000's Combined federal and provincial income tax at statutory rate 31.0% $4,510 Increase (decrease) resulting from: Tax-exempt dividend income (4.5) (655) Income tax expense 26.5% $3,855 Exhibit II Income Tax Note Excerpt for Marcus Company. $000's Current tax expense $2,110 Deferred income tax relating to increases in tax rates 610 Income tax expense* $2,720 * This income tax expense of $2,720,000 represents 40% of Nieman's pre-tax income. Your colleague, Jane, who supports the buyout of Nieman Inc., argues that the company must have a management team that is adept at minimizing tax costs. She argues that the low effective tax rate of 26.5% is proof. "Nieman doesn't fit our typical profile for a buyout, but it would be ideal if we are able to get that tax management talent and apply it to all the companies that we buy," she notes. Kevin, another of your colleagues who supports the buyout of Marcus Company, argues that Marcus fits perfectly with WEP's strategy of buying poorly run companies. He notes that the effective tax rate targets. In particular, they have brought to your attention the note disclosures relating to income taxes; Exhibit and I are excerpts from relevant parts of these disclosures. Exhibit I Income Tax Note Excerpt for Nieman Inc. $000's Combined federal and provincial income tax at statutory rate 31.0% $4,510 Increase (decrease) resulting from: Tax-exempt dividend income (4.5) (655) Income tax expense 26.5% $3,855 Exhibit II Income Tax Note Excerpt for Marcus Company. $000's Current tax expense $2,110 Deferred income tax relating to increases in tax rates 610 Income tax expense $2,720 * This income tax expense of $2,720,000 represents 40% of Nieman's pre-tax income. Your colleague, Jane, who supports the buyout of Nieman Inc., argues that the company must have a management team that is adept at minimizing tax costs. She argues that the low effective tax rate of 26.5% is proof. "Nieman doesn't fit our typical profile for a buyout, but it would be ideal if we are able to get that tax management talent and apply it to all the companies that we buy," she notes. Kevin, another of your colleagues who supports the buyout of Marcus Company, argues that Marcus fits perfectly with WEP's strategy of buying poorly run companies. He notes that the effective tax rate of 40% is much higher than the current statutory rate of 31%. He argues, "The management of Marcus must not be very savvy at tax planning, which suggests that they are probably not that great at management more generally." Required: Prepare a memo to respond to the issues raised by your colleagues