Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(1) Employment termination payment Barbra Purcell began her employment with the Republic Bank of Australia (RBA) in January 2005 and was made redundant on

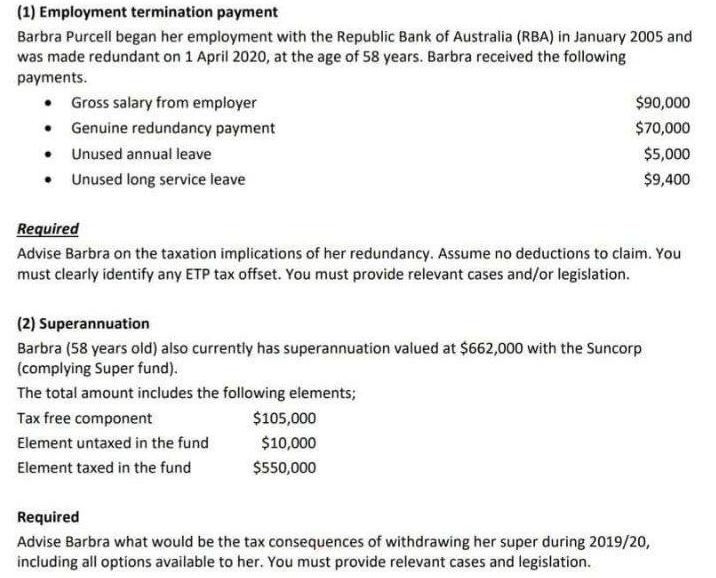

(1) Employment termination payment Barbra Purcell began her employment with the Republic Bank of Australia (RBA) in January 2005 and was made redundant on 1 April 2020, at the age of 58 years. Barbra received the following payments. Gross salary from employer Genuine redundancy payment Unused annual leave $90,000 $70,000 $5,000 Unused long service leave $9,400 Required Advise Barbra on the taxation implications of her redundancy. Assume no deductions to claim. You must clearly identify any ETP tax offset. You must provide relevant cases and/or legislation. (2) Superannuation Barbra (58 years old) aiso currently has superannuation valued at $662,000 with the Suncorp (complying Super fund). The total amount includes the following elements; Tax free component $105,000 Element untaxed in the fund $10,000 Element taxed in the fund $550,000 Required Advise Barbra what would be the tax consequences of withdrawing her super during 2019/20, including all options available to her. You must provide relevant cases and legislation.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Redundancy in Employment There are two types of Redundancy in the employment which ar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started