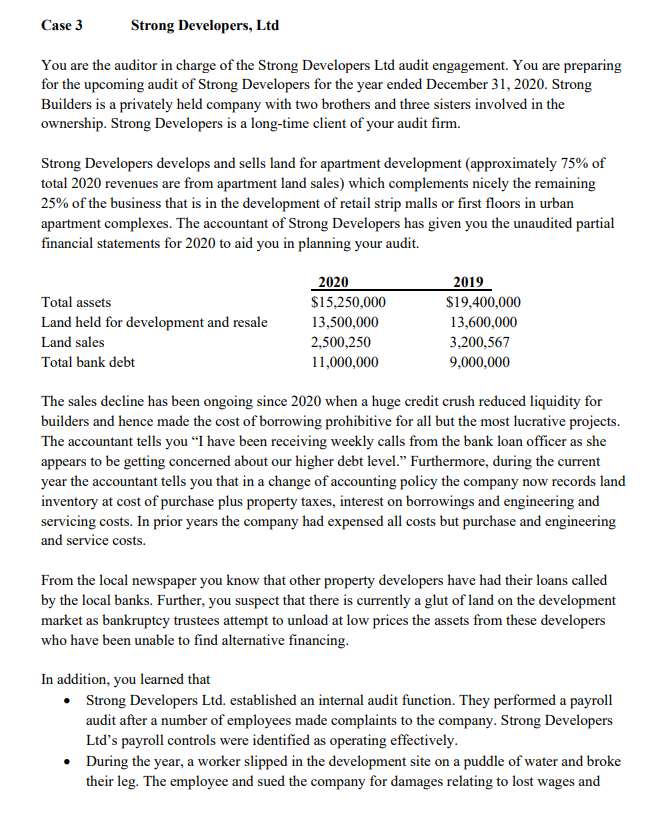

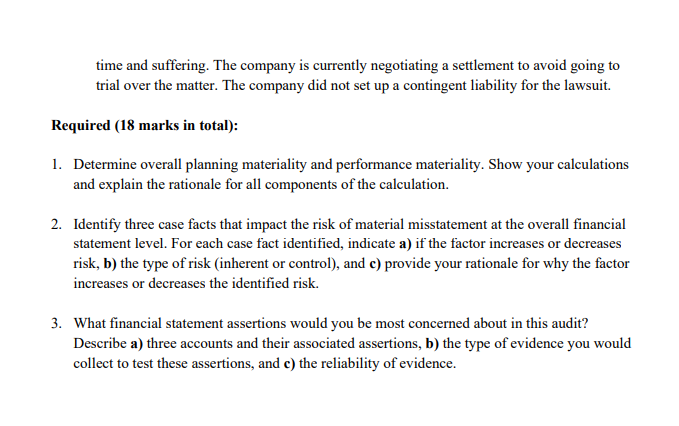

Case 3 Strong Developers, Ltd You are the auditor in charge of the Strong Developers Ltd audit engagement. You are preparing for the upcoming audit of Strong Developers for the year ended December 31, 2020. Strong Builders is a privately held company with two brothers and three sisters involved in the ownership. Strong Developers is a long-time client of your audit firm. Strong Developers develops and sells land for apartment development (approximately 75% of total 2020 revenues are from apartment land sales) which complements nicely the remaining 25% of the business that is in the development of retail strip malls or first floors in urban apartment complexes. The accountant of Strong Developers has given you the unaudited partial financial statements for 2020 to aid you in planning your audit. Total assets Land held for development and resale Land sales Total bank debt 2020 $15,250,000 13,500,000 2,500,250 11,000,000 2019 $19,400,000 13,600,000 3,200,567 9,000,000 The sales decline has been ongoing since 2020 when a huge credit crush reduced liquidity for builders and hence made the cost of borrowing prohibitive for all but the most lucrative projects. The accountant tells you I have been receiving weekly calls from the bank loan officer as she appears to be getting concerned about our higher debt level. Furthermore, during the current year the accountant tells you that in a change of accounting policy the company now records land inventory at cost of purchase plus property taxes, interest on borrowings and engineering and servicing costs. In prior years the company had expensed all costs but purchase and engineering and service costs. From the local newspaper you know that other property developers have had their loans called by the local banks. Further, you suspect that there is currently a glut of land on the development market as bankruptcy trustees attempt to unload at low prices the assets from these developers who have been unable to find alternative financing. In addition, you learned that Strong Developers Ltd. established an internal audit function. They performed a payroll audit after a number of employees made complaints to the company. Strong Developers Ltd's payroll controls were identified as operating effectively. During the year, a worker slipped in the development site on a puddle of water and broke their leg. The employee and sued the company for damages relating to lost wages and . time and suffering. The company is currently negotiating a settlement to avoid going to trial over the matter. The company did not set up a contingent liability for the lawsuit. Required (18 marks in total): 1. Determine overall planning materiality and performance materiality. Show your calculations and explain the rationale for all components of the calculation. 2. Identify three case facts that impact the risk of material misstatement at the overall financial statement level. For each case fact identified, indicate a) if the factor increases or decreases risk, b) the type of risk (inherent or control), and c) provide your rationale for why the factor increases or decreases the identified risk. 3. What financial statement assertions would you be most concerned about in this audit? Describe a) three accounts and their associated assertions, b) the type of evidence you would collect to test these assertions, and c) the reliability of evidence