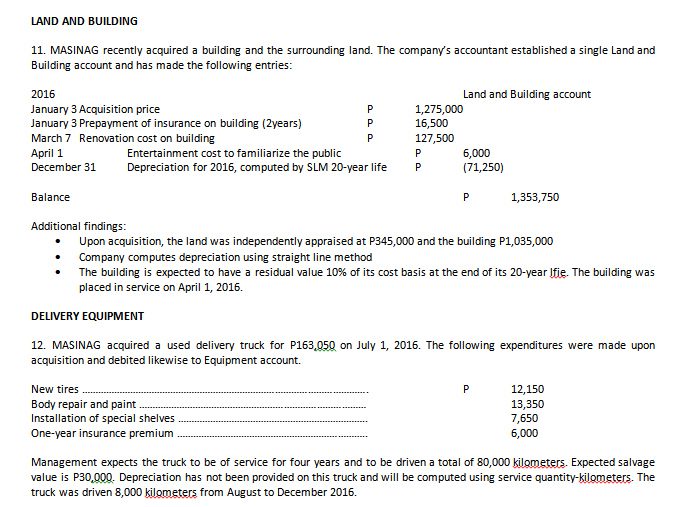

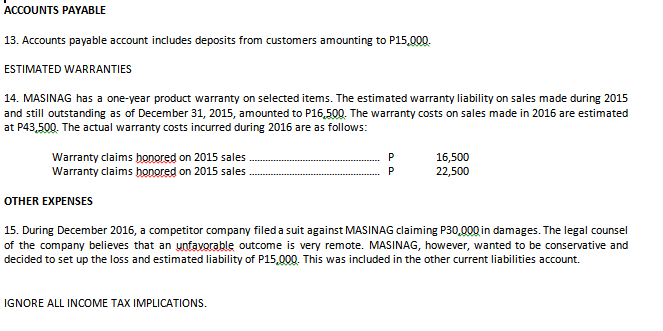

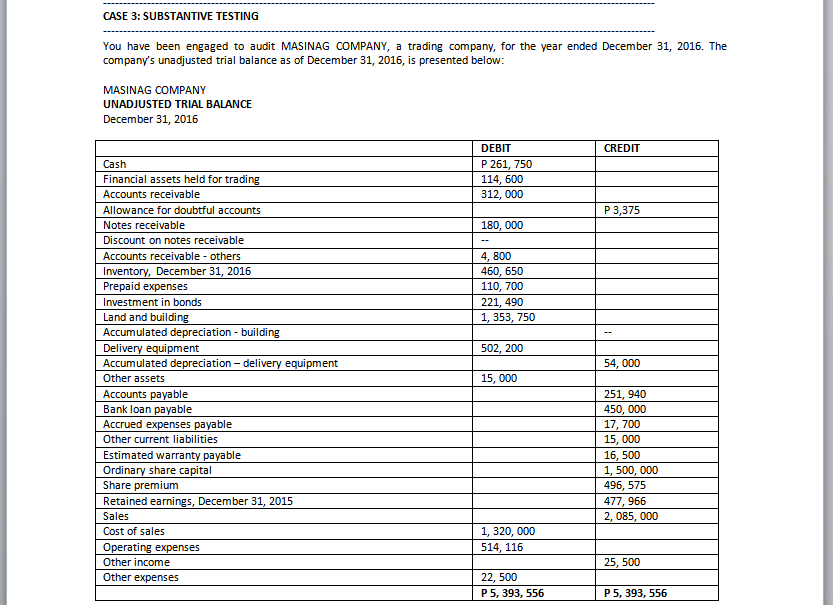

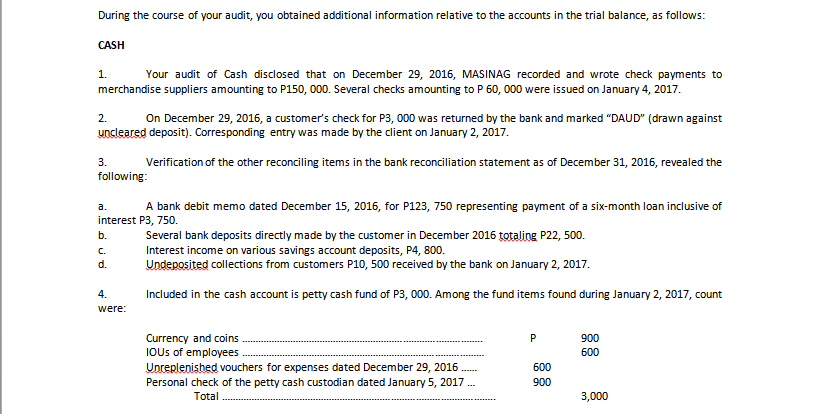

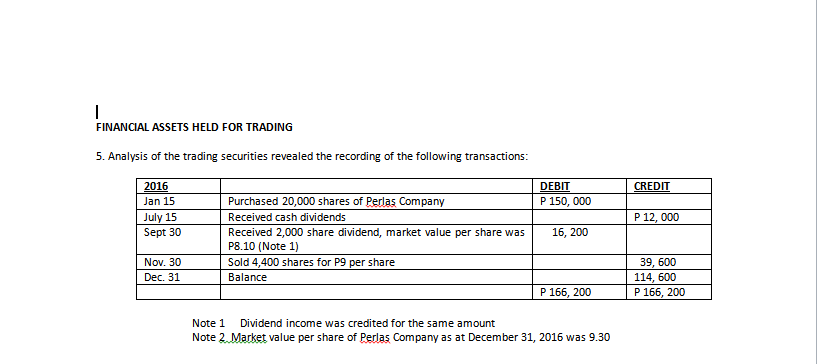

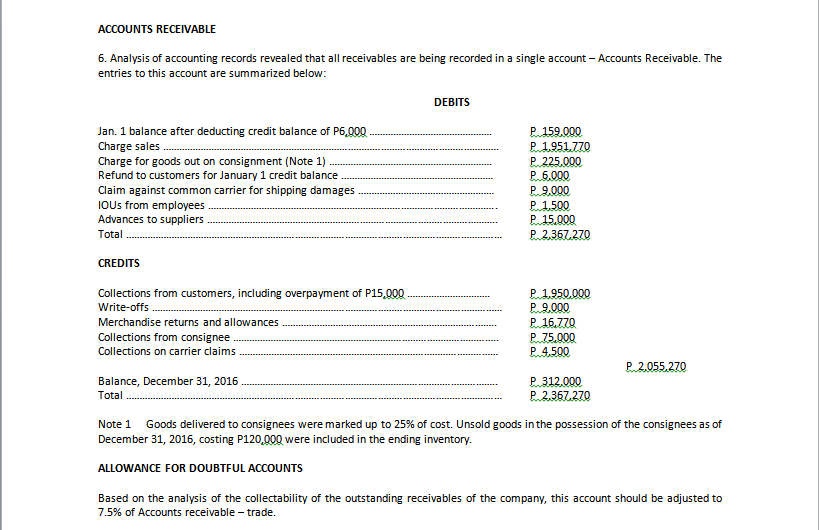

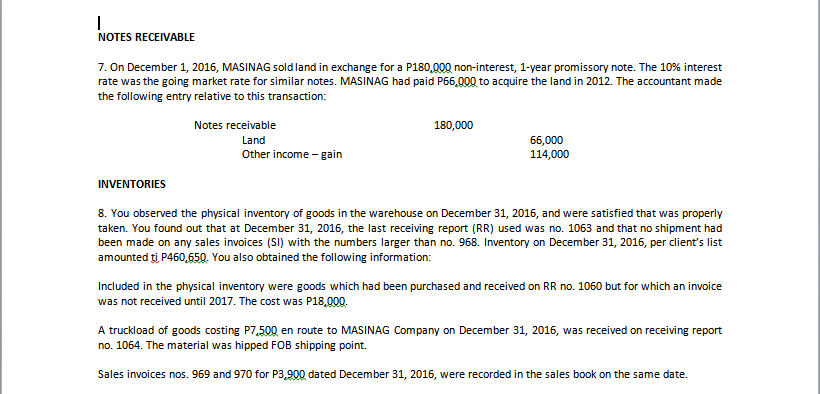

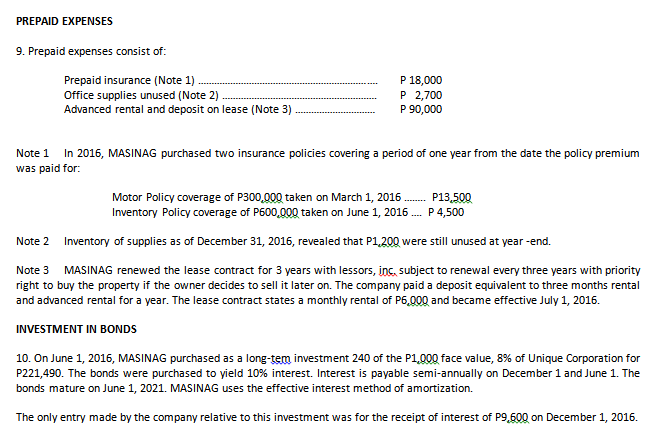

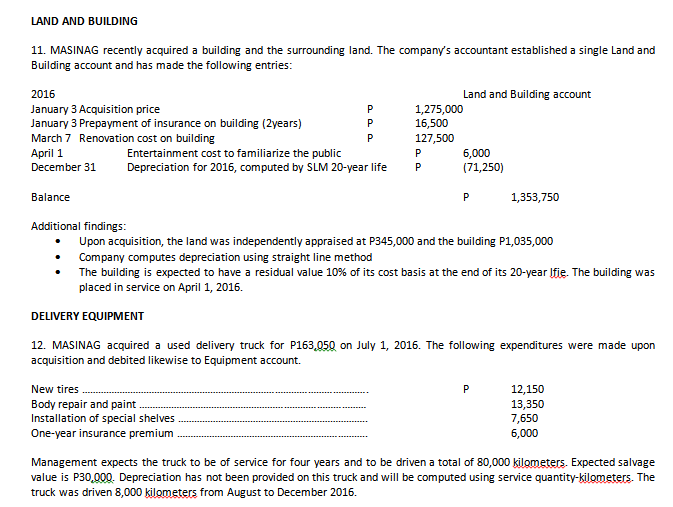

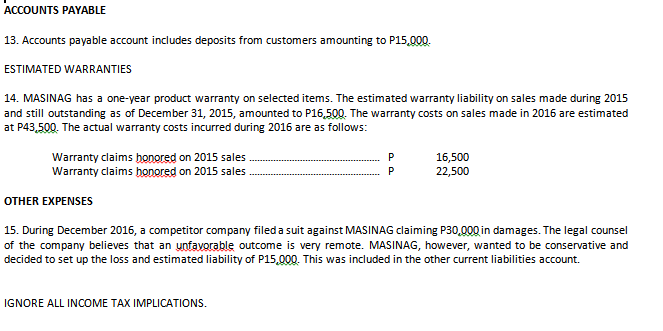

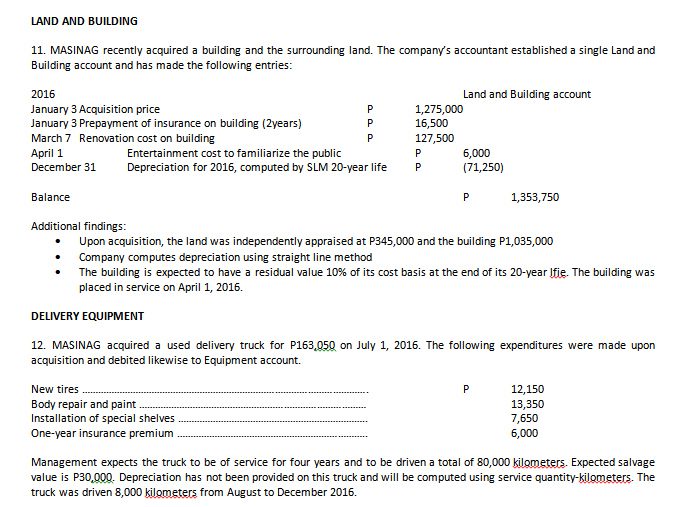

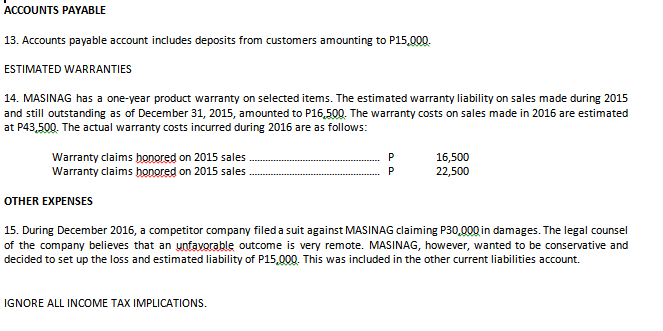

CASE 3: SUBSTANTIVE TESTING You have been engaged to audit MASINAG COMPANY, a trading company, for the year ended December 31, 2016. The company's unadjusted trial balance as of December 31, 2016, is presented below: MASINAG COMPANY UNADJUSTED TRIAL BALANCE December 31, 2016 DEBIT CREDIT Cash P 261, 750 Financial assets held for trading 114, 600 Accounts receivable 312, 000 Allowance for doubtful accounts P 3,375 Notes receivable 180, 000 Discount on notes receivable Accounts receivable - others 4, 800 Inventory, December 31, 2016 460, 650 Prepaid expenses 110, 700 Investment in bonds 221, 490 Land and building 1, 353, 750 Accumulated depreciation - building Delivery equipment 502, 200 Accumulated depreciation - delivery equipment 54, 000 Other assets 15, 000 Accounts payable 251, 940 Bank loan payable 450, 000 Accrued expenses payable 17, 700 Other current liabilities 15, 000 Estimated warranty payable 16, 500 Ordinary share capital 1, 500, 000 Share premium 496, 575 Retained earnings, December 31, 2015 477, 966 Sales 2, 085, 000 Cost of sales 1, 320, 000 Operating expenses 514, 116 Other income 25, 500 Other expenses 22, 500 P 5, 393, 556 P 5, 393, 556During the course of your audit, you obtained additional information relative to the accounts in the trial balance, as follows: CASH 1. Your audit of Cash disclosed that on December 29, 2016, MASINAG recorded and wrote check payments to merchandise suppliers amounting to P150, 000. Several checks amounting to P 60, 000 were issued on January 4, 2017. 2. On December 29, 2016, a customer's check for P3, 000 was returned by the bank and marked "DAUD" (drawn against uncleared deposit). Corresponding entry was made by the client on January 2, 2017. 3. Verification of the other reconciling items in the bank reconciliation statement as of December 31, 2016, revealed the following: a. A bank debit memo dated December 15, 2016, for P123, 750 representing payment of a six-month loan inclusive of interest P3, 750. b. Several bank deposits directly made by the customer in December 2016 totaling P22, 500. C. Interest income on various savings account deposits, P4, 800. d. Undeposited collections from customers P10, 500 received by the bank on January 2, 2017. 4. Included in the cash account is petty cash fund of P3, 000. Among the fund items found during January 2, 2017, count were: Currency and coins P 900 IOUs of employees 600 Unreplenished vouchers for expenses dated December 29, 2016 600 Personal check of the petty cash custodian dated January 5, 2017 ... 900 Total . 3,000FINANCIAL ASSETS HELD FOR TRADING 5. Analysis of the trading securities revealed the recording of the following transactions: 2016 DEBIT CREDIT Jan 15 Purchased 20,000 shares of Perlas Company P 150, 000 July 15 Received cash dividends P 12, 000 Sept 30 Received 2,000 share dividend, market value per share was 16, 200 P8.10 ( Note 1) Nov. 30 Sold 4,400 shares for P9 per share 39, 600 Dec. 31 Balance 114, 600 P 166, 200 P 166, 200 Note 1 Dividend income was credited for the same amount Note 2. Market value per share of Perlas Company as at December 31, 2016 was 9.30ACCOUNTS RECEIVABLE 6. Analysis of accounting records revealed that all receivables are being recorded in a single account - Accounts Receivable. The entries to this account are summarized below: DEBITS Jan. 1 balance after deducting credit balance of P6,000 P. 159,000 Charge sales P. 1.951 770 Charge for goods out on consignment (Note 1) P 225,000 Refund to customers for January 1 credit balance P. 6.000 Claim against common carrier for shipping damages P. 9.000 IOUs from employees P 1.500 Advances to suppliers P. 15,000 Total P. 2.367.270 CREDITS Collections from customers, including overpayment of P15,000 P. 1,950.000 Write-offs .. P. 9.000 Merchandise returns and allowances P 16.770 Collections from consignee P. 75,000 Collections on carrier claims P. 4.500 P. 2.055.270 Balance, December 31, 2016. P. 312,000 Total P. 2.367.270 Note 1 Goods delivered to consignees were marked up to 25% of cost. Unsold goods in the possession of the consignees as of December 31, 2016, costing P120,000 were included in the ending inventory. ALLOWANCE FOR DOUBTFUL ACCOUNTS Based on the analysis of the collectability of the outstanding receivables of the company, this account should be adjusted to 7.5% of Accounts receivable - trade.- NOTES RECEIVABLE 7. On December 1, 2016, MASINAG sold land in exchange for a P180,000 non-interest, 1-year promissory note. The 10% interest rate was the going market rate for similar notes. MASINAG had paid P66,000 to acquire the land in 2012. The accountant made the following entry relative to this transaction: Notes receivable 180,000 Land 66,000 Other income - gain 114,000 INVENTORIES 8. You observed the physical inventory of goods in the warehouse on December 31, 2016, and were satisfied that was properly taken. You found out that at December 31, 2016, the last receiving report (RR) used was no. 1063 and that no shipment had been made on any sales invoices (SI) with the numbers larger than no. 968. Inventory on December 31, 2016, per client's list amounted ti P460,650. You also obtained the following information: Included in the physical inventory were goods which had been purchased and received on RR no. 1060 but for which an invoice was not received until 2017. The cost was P18,000. A truckload of goods costing P7,500 en route to MASINAG Company on December 31, 2016, was received on receiving report no. 1064. The material was hipped FOB shipping point. Sales invoices nos. 969 and 970 for P3,900 dated December 31, 2016, were recorded in the sales book on the same date.PREPAID EXPENSES 9. Prepaid expenses consist of: Prepaid insurance (Note 1) P 18,000 Office supplies unused (Note 2) . P 2,700 Advanced rental and deposit on lease (Note 3) P 90,000 Note 1 In 2016, MASINAG purchased two insurance policies covering a period of one year from the date the policy premium was paid for: Motor Policy coverage of P300,000 taken on March 1, 2016 ... P13,500 Inventory Policy coverage of P600,000 taken on June 1, 2016 ... P 4,500 Note 2 Inventory of supplies as of December 31, 2016, revealed that P1,200 were still unused at year -end. Note 3 MASINAG renewed the lease contract for 3 years with lessors, inc. subject to renewal every three years with priority right to buy the property if the owner decides to sell it later on. The company paid a deposit equivalent to three months rental and advanced rental for a year. The lease contract states a monthly rental of P6,000 and became effective July 1, 2016. INVESTMENT IN BONDS 10. On June 1, 2016, MASINAG purchased as a long-ten investment 240 of the P1,000 face value, 8%% of Unique Corporation for P221,490. The bonds were purchased to yield 10%% interest. Interest is payable semi-annually on December 1 and June 1. The bonds mature on June 1, 2021. MASINAG uses the effective interest method of amortization. The only entry made by the company relative to this investment was for the receipt of interest of P9,600 on December 1, 2016.LAND AND BUILDING 11. MASINAG recently acquired a building and the surrounding land. The company's accountant established a single Land and Building account and has made the following entries: 2016 Land and Building account January 3 Acquisition price 1,275,000 January 3 Prepayment of insurance on building (2years) 16,500 March 7 Renovation cost on building 127,500 April 1 Entertainment cost to familiarize the public 6,000 December 31 Depreciation for 2016, computed by SLM 20-year life (71,250) Balance P 1,353,750 Additional findings: Upon acquisition, the land was independently appraised at P345,000 and the building P1,035,000 Company computes depreciation using straight line method The building is expected to have a residual value 10%% of its cost basis at the end of its 20-year Ifie. The building was placed in service on April 1, 2016. DELIVERY EQUIPMENT 12. MASINAG acquired a used delivery truck for P163,050 on July 1, 2016. The following expenditures were made upon acquisition and debited likewise to Equipment account. New tires P 12,150 Body repair and paint 13,350 Installation of special shelves 7,650 One-year insurance premium 6,000 Management expects the truck to be of service for four years and to be driven a total of 80,000 kilometers. Expected salvage value is P30,000. Depreciation has not been provided on this truck and will be computed using service quantity-kilometers. The truck was driven 8,000 kilometers from August to December 2016.ACCOUNTS PAYABLE 13. Accounts payable account includes deposits from customers amounting to P15,000. ESTIMATED WARRANTIES 14. MASINAG has a one-year product warranty on selected items. The estimated warranty liability on sales made during 2015 and still outstanding as of December 31, 2015, amounted to P16,500. The warranty costs on sales made in 2016 are estimated at P43,500. The actual warranty costs incurred during 2016 are as follows: Warranty claims honored on 2015 sales P 16,500 Warranty claims honored on 2015 sales P 22,500 OTHER EXPENSES 15. During December 2016, a competitor company filed a suit against MASINAG claiming P30,000 in damages. The legal counsel of the company believes that an unfavorable outcome is very remote. MASINAG, however, wanted to be conservative and decided to set up the loss and estimated liability of P15,000. This was included in the other current liabilities account. IGNORE ALL INCOME TAX IMPLICATIONS