Case 4.2 Applied Material Comprehensive Analysis Case Using the Financial Statement Analysis Template

You will be using the Financial Statement Analysis Template that you started on in Case 1.2 so you need to locate that on your computer. You will also be using the 2013 Form 10-K for Applied Materials which you can locate at this link: Applied Materials 2013 10-K

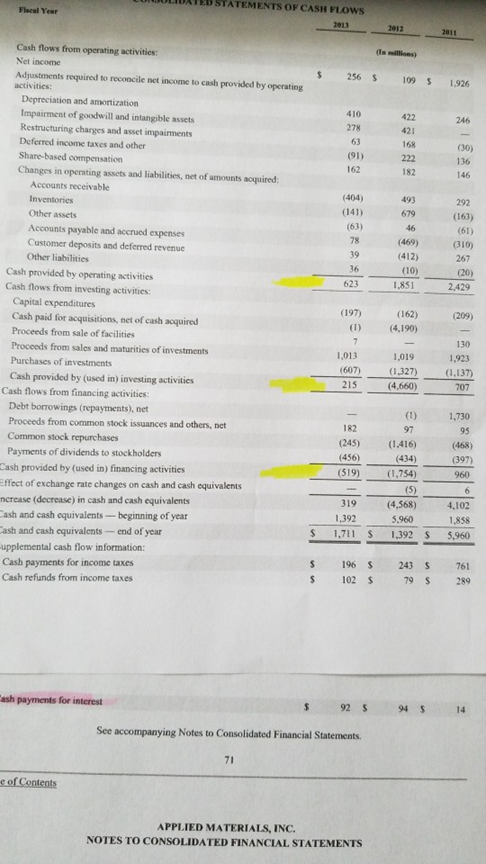

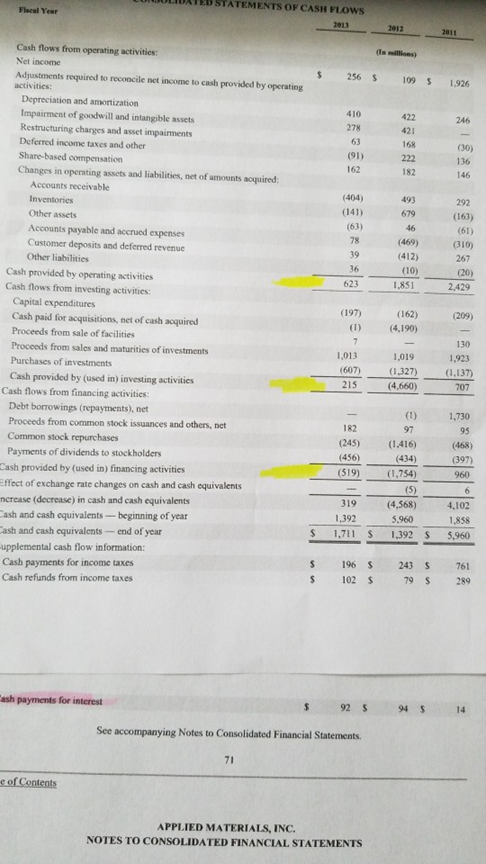

(a) Input the data from the Applied Materials cash flow statement. When you have finished inputting the data, review the cash flow statement to make sure there are no red blocks indicating that your numbers do not match the cover sheet information you input from the Chapter 1 problem. There will be blanks on the cash flow statement and some lines will require you to add two lines together. At the bottom, you must finish the whole statement including the beginning cash balances. The summary analysis of the cash flow statements will automatically be created for you and you can find it by clicking on the tab at the bottom called the summary of cash flows. You will be answering fill-in-the-blank questions using the cash flow statement and the summary.

(b) Using the cash flow statements, summary analysis, and the Management Discussion & Analysis section of the Form 10-K, you will answer questions regarding the ability of Applied Materials to generate cash flows and the appropriateness of the use of cash flows.

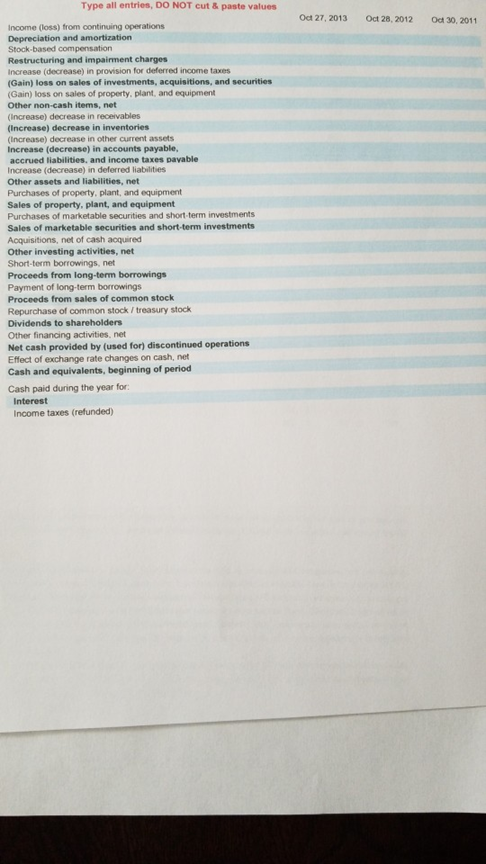

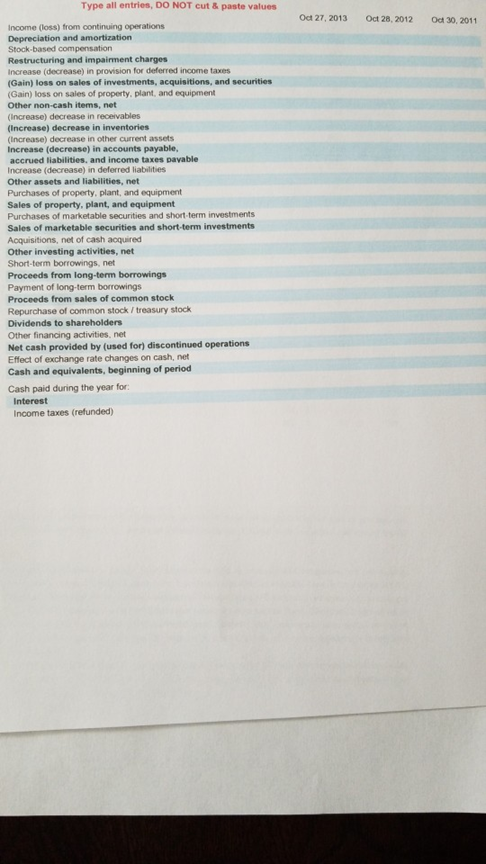

What I need to be filled out and the numbers.

Oct 27, 2013 Oct 28, 2012 Oct 30, 2011 Type all entries, DO NOT cut & paste values Income (loss) from continuing operations Depreciation and amortization Stock-based compensation Restructuring and impairment charges Increase (decrease) in provision for deferred income taxes (Gain) loss on sales of investments, acquisitions, and securities (Gain) loss on sales of property, plant, and equipment Other non-cash items, net (Increase) decrease in receivables (Increase) decrease in inventories (Increase) decrease in other current assets Increase (decrease) in accounts payable, accrued liabilities, and income taxes payable Increase (decrease) in deferred liabilities Other assets and liabilities, net Purchases of property, plant, and equipment Sales of property, plant, and equipment Purchases of marketable securities and short-term investments Sales of marketable securities and short-term investments Acquisitions, net of cash acquired Other investing activities, net Short-term borrowings, net Proceeds from long-term borrowings Payment of long-term borrowings Proceeds from sales of common stock Repurchase of common stock/treasury stock Dividends to shareholders Other financing activities, net Net cash provided by (used for) discontinued operations Effect of exchange rate changes on cash, net Cash and equivalents, beginning of period Cash paid during the year for: Interest Income taxes (refunded) local Year TATEMENTS OF CASH FLOWS 2012 2011 tamil $ 2.56 $ 1095 1.926 246 410 278 63 (91) 162 422 421 168 222 (30) 136 146 182 (404) (141) (63) 78 39 36 493 679 46 (469) (412) (10) 1.851 292 (163) (61) (310) 267 (20) 2.429 623 Cash flows from operating activities: Net income Adjustments required to reconcile net income to cash provided by operating activities: Depreciation and amortization Impairment of goodwill and intangible assets Restructuring charges and asset impairments Deferred income taxes and other Share-based compensation Changes in operating assets and liabilities, net of amounts acquired: Accounts receivable Inventories Other assets Accounts payable and accrued expenses Customer deposits and deferred revenue Other liabilities Cash provided by operating activities Cash flows from investing activities Capital expenditures Cash paid for acquisitions, net of cash acquired Proceeds from sale of facilities Proceeds from sales and maturities of investments Purchases of investments Cash provided by (used in) investing activities Cash flows from financing activities: Debt borrowings (repayments), net Proceeds from common stock issuances and others, net Common stock repurchases Payments of dividends to stockholders Cash provided by (used in) financing activities Effect of exchange rate changes on cash and cash equivalents increase (decrease) in cash and cash equivalents Cash and cash equivalents - beginning of year Cash and cash equivalents -- end of year upplemental cash flow information: Cash payments for income taxes Cash refunds from income taxes (197) (209) (162) (4.190) 7 1,013 130 1,923 (1.137) 707 1,019 (1,327) (4,660) (607) 215 182 (245) (456) (519) 1,730 95 (468) (397) 960 97 (1.416) (434) (1,754) (5) (4,568) 5.960 1.392 $ 6 319 1,392 1,711 $ 4.102 1.858 5.960 $ $ $ 196 $ 102S 243 S 79 $ 761 289 ash payments for interest $ 925 94 5 14 See accompanying Notes to Consolidated Financial Statements. 71 e of Contents APPLIED MATERIALS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Oct 27, 2013 Oct 28, 2012 Oct 30, 2011 Type all entries, DO NOT cut & paste values Income (loss) from continuing operations Depreciation and amortization Stock-based compensation Restructuring and impairment charges Increase (decrease) in provision for deferred income taxes (Gain) loss on sales of investments, acquisitions, and securities (Gain) loss on sales of property, plant, and equipment Other non-cash items, net (Increase) decrease in receivables (Increase) decrease in inventories (Increase) decrease in other current assets Increase (decrease) in accounts payable, accrued liabilities, and income taxes payable Increase (decrease) in deferred liabilities Other assets and liabilities, net Purchases of property, plant, and equipment Sales of property, plant, and equipment Purchases of marketable securities and short-term investments Sales of marketable securities and short-term investments Acquisitions, net of cash acquired Other investing activities, net Short-term borrowings, net Proceeds from long-term borrowings Payment of long-term borrowings Proceeds from sales of common stock Repurchase of common stock/treasury stock Dividends to shareholders Other financing activities, net Net cash provided by (used for) discontinued operations Effect of exchange rate changes on cash, net Cash and equivalents, beginning of period Cash paid during the year for: Interest Income taxes (refunded) local Year TATEMENTS OF CASH FLOWS 2012 2011 tamil $ 2.56 $ 1095 1.926 246 410 278 63 (91) 162 422 421 168 222 (30) 136 146 182 (404) (141) (63) 78 39 36 493 679 46 (469) (412) (10) 1.851 292 (163) (61) (310) 267 (20) 2.429 623 Cash flows from operating activities: Net income Adjustments required to reconcile net income to cash provided by operating activities: Depreciation and amortization Impairment of goodwill and intangible assets Restructuring charges and asset impairments Deferred income taxes and other Share-based compensation Changes in operating assets and liabilities, net of amounts acquired: Accounts receivable Inventories Other assets Accounts payable and accrued expenses Customer deposits and deferred revenue Other liabilities Cash provided by operating activities Cash flows from investing activities Capital expenditures Cash paid for acquisitions, net of cash acquired Proceeds from sale of facilities Proceeds from sales and maturities of investments Purchases of investments Cash provided by (used in) investing activities Cash flows from financing activities: Debt borrowings (repayments), net Proceeds from common stock issuances and others, net Common stock repurchases Payments of dividends to stockholders Cash provided by (used in) financing activities Effect of exchange rate changes on cash and cash equivalents increase (decrease) in cash and cash equivalents Cash and cash equivalents - beginning of year Cash and cash equivalents -- end of year upplemental cash flow information: Cash payments for income taxes Cash refunds from income taxes (197) (209) (162) (4.190) 7 1,013 130 1,923 (1.137) 707 1,019 (1,327) (4,660) (607) 215 182 (245) (456) (519) 1,730 95 (468) (397) 960 97 (1.416) (434) (1,754) (5) (4,568) 5.960 1.392 $ 6 319 1,392 1,711 $ 4.102 1.858 5.960 $ $ $ 196 $ 102S 243 S 79 $ 761 289 ash payments for interest $ 925 94 5 14 See accompanying Notes to Consolidated Financial Statements. 71 e of Contents APPLIED MATERIALS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS