Question

Case 5 Twin Falls Community Hospital (Capital Investment Analysis) #1 Twin Falls Community Hospital is a 250-bed, not-for-profit hospital located in the city of Twin

Case 5 Twin Falls Community Hospital (Capital Investment Analysis) #1 Twin Falls Community Hospital is a 250-bed, not-for-profit hospital located in the city of Twin Falls, the largest city in Idahos Magic Valley region and the seventh largest in the state. The hospital was founded in 1972 and today is acknowledged to be one of the leading healthcare providers in the area. Twin Falls management is currently evaluating a proposed ambulatory (outpatient) surgery center. Over 80 percent of all outpatient surgery is performed by specialists in gastroenterology, gynecology, ophthalmology, otolaryngology, orthopedics, plastic surgery, and urology. Ambulatory surgery requires an average of about one and one-half hours; minor procedures take about one hour or less, and major procedures take about two or more hours. About 60 percent of the procedures are performed under general anesthesia, 30 percent under local anesthesia, and 10 percent under regional or spinal anesthesia. In general, operating rooms are built in pairs so that a patient can be prepped in one room while the surgeon is completing a procedure in the other room. The outpatient surgery market has experienced significant growth since the first ambulatory surgery center opened in 1970. This growth has been fueled by three factors. First, rapid advancements in technology have enabled many procedures that were historically performed in inpatient surgical suites to be switched to outpatient settings. This shift was caused mainly by advances in laser, laparoscopic, endoscopic, and arthroscopic technologies. Second, Medicare has been aggressive in approving new minimally invasive surgery techniques, so the number of Medicare patients utilizing outpatient surgery services has grown substantially. Finally, patients prefer outpatient surgeries because they are more convenient, and third-party payers prefer them because they are less costly. These factors have led to a situation in which the number of inpatient surgeries has grown little (if at all) in recent years while the number of outpatient procedures has been growing at over 10 percent annually and now totals about 22 million a year. Rapid growth in the number of outpatient surgeries has been accompanied by a corresponding growth in the number of outpatient surgical facilities. The number currently stands at about 5,000 nationwide, so competition in many areas has become intense. Somewhat surprisingly, there is no outpatient surgery center in the Twin Falls area, although there have been rumors that local physicians are exploring the feasibility of a physician-owned facility. The hospital currently owns a parcel of land that is a perfect location for the surgery center. The land was purchased five years ago for $350,000, and last year the hospital spent (and expensed for tax purposes) $25,000 to clear the land and put in sewer and utility lines. If sold in todays market, the land would bring in $500,000, net of realtor commissions and fees. Land prices have been extremely volatile, so the hospitals standard procedure is to assume a salvage value equal to the current value of the land. The surgery center building, which will house four operating suites, would cost $5 million and the equipment would cost an additional $5 million, for a total of $10 million. The project will probably have a long life, but the hospital typically assumes a five-year life in its capital budgeting analyses and then approximates the value of the cash flows beyond Year 5 by including a terminal, or salvage, value in the analysis. To estimate the terminal value, the hospital typically uses the market value of the building and equipment after five years, which for this project is estimated to be $5 million, excluding the land value. The expected volume at the surgery center is 20 procedures a day. The average charge per procedure is expected to be $1,500, but charity care, bad debts, insurer discounts (including Medicare and Medicaid), and other allowances lower the net revenue amount to $1,000. The center would be open five days a week, 50 weeks a year, for a total of 250 days a year. Labor costs to run the surgery center are estimated at $800,000 per year, including fringe benefits. Supplies costs, on average, would run $400 per procedure, including anesthetics. Utilities, including hazardous waste disposal, would add another $50,000 in annual costs. If the surgery center were built, the hospitals cash overhead costs would increase by $36,000 annually, primarily for housekeeping and buildings and grounds maintenance. One of the most difficult factors to deal with in project analysis is inflation. Both input costs and charges in the healthcare industry have been rising at about twice the rate of overall inflation. Furthermore, inflationary pressures have been highly variable. Because of the difficulties involved in forecasting inflation rates, the hospital begins each analysis by assuming that both revenues and costs, except for depreciation, will increase at a constant rate. Under current conditions, this rate is assumed to be 3 percent. The hospitals corporate cost of capital is 10 percent. When the project was mentioned briefly at the last meeting of the hospitals board of directors, several questions were raised. In particular, one director wanted to make sure that a risk analysis was performed prior to presenting the proposal to the board. Recently, the board was forced to close a day care center that appeared to be profitable when analyzed but turned out to be a big money loser. They do not want a repeat of that occurrence. Another director stated that she thought the hospital was putting too much faith in the numbers: After all, she pointed out, that is what got us into trouble on the day care center. We need to start worrying more about how projects fit into our strategic vision and how they impact the services that we currently offer. Another director, who also is the hospitals chief of medicine, expressed concern over the impact of the ambulatory surgery center on the current volume of inpatient surgeries. To develop the data needed for the risk (scenario) analysis, Jules Bergman, the hospitals director of capital budgeting, met with department heads of surgery, marketing, and facilities. After several sessions, they concluded that only two input variables are highly uncertain: number of procedures per day and building/equipment salvage value. If another entity entered the local ambulatory surgery market, the number of procedures could be as low as 15 per day. Conversely, if acceptance is strong and no competing centers are built, the number of procedures could be as high as 25 per day, compared to the most likely value of 20 per day. If real estate and medical equipment values stay strong, the building/equipment salvage value could be as high as $7 million, but if the market weakens, the salvage value could be as low as $3 million, compared to an expected value of $5 million. Jules also discussed the probabilities of the various scenarios with the medical and marketing staffs, and after a great deal of discussion reached a consensus of 70 percent for the most likely case and 15 percent each for the best and worst cases. Assume that the hospital has hired you as a financial consultant. Your task is to conduct a complete project analysis on the ambulatory surgery center and to present your findings and recommendations to the hospitals board of directors. To get you started, Table 1 contains the cash flow analysis for the first three years.

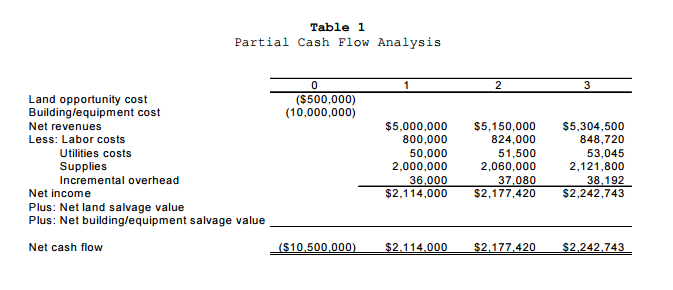

#1 Complete Table 1 by adding the cash flows for Years 4 and 5.

Table 1 Partial Cash Flow Analysis Land opportunity cost ($500,000) Building/equipment cost (10,000,000) Net revenues $5,000,000 $5,150,000 $5,304,500 800,000 848,720 Less: Labor costs 824,000 50,000 51,500 53,045 Utilities costs 2,000,000 2,060,000 2,121,800 Supplies 36,000 37.080 Incremental overhead 38,192 Net income $2,114,000 $2,177,420 $2,242,743 Plus: Net land salvage value Plus: Net building/equipment salvage value $2.177.420 Net cash flow 10,500 2.11 4.000 2,242,743 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started