Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To recover the energy lost in the primary cooling stage of a food processing system, a engineering design requires building a insulating chamber with

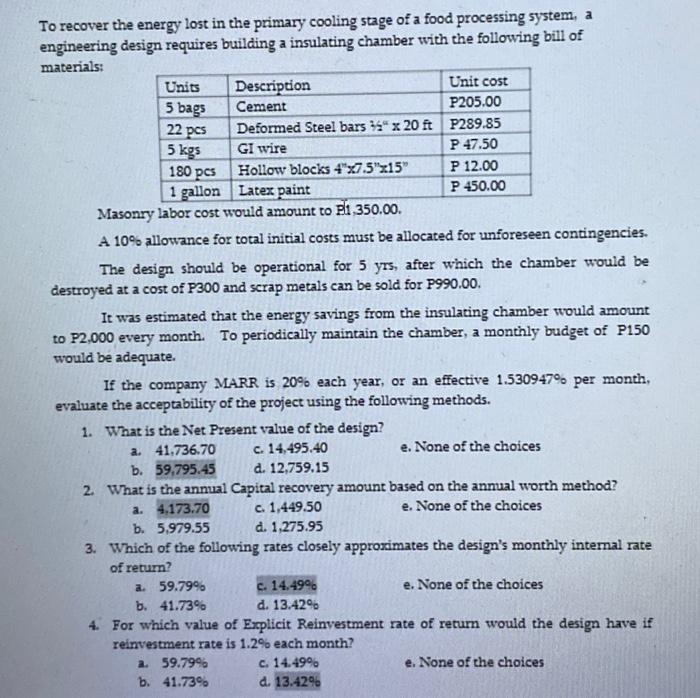

To recover the energy lost in the primary cooling stage of a food processing system, a engineering design requires building a insulating chamber with the following bill of materials: Units 5 bags 22 pcs 5 kgs 180 pcs Hollow blocks 4"x7.5"x15" 1 gallon Latex paint Masonry labor cost would amount to P1,350.00. Description Unit cost Cement P205.00 Deformed Steel bars 4" x 20 ft P289.85 GI wire P 47.50 A 10% allowance for total initial costs must be allocated for unforeseen contingencies. The design should be operational for 5 yrs, after which the chamber would be destroyed at a cost of P300 and scrap metals can be sold for P990.00. It was estimated that the energy savings from the insulating chamber would amount to P2,000 every month. To periodically maintain the chamber, a monthly budget of P150 would be adequate. If the company MARR is 20% each year, or an effective 1.530947% per month, evaluate the acceptability of the project using the following methods. 1. What is the Net Present value of the design? c. 14,495.40 d. 12,759.15 a. 41.736.70 b. 59,795.45 P 12.00 P 450.00 a. 59.79% b. 41.73% 2. What is the annual Capital recovery amount based on the annual worth method? e. None of the choices a. 4.173.70 c. 1,449.50 b. 5,979.55 d. 1,275.95 3. Which of the following rates closely approximates the design's monthly internal rate of return? a. 59.79% b. 41.73% e. None of the choices c. 14.49% d. 13.42% 4. For which value of Explicit Reinvestment rate of return would the design have if reinvestment rate is 1.2% each month? e. None of the choices c. 14.49% d. 13.42% e. None of the choices

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate the acceptability of the project we need to calculate the Net Present Value NPV the Annual Capital Recovery amount the Monthly Internal Rate of Return MIRR and the Explicit Reinvestment Ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started