Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 6 : IAS 3 6 - Impairment of Assets Scenario: FiberTech Ltd . owns a manufacturing plant located in City X . Due to

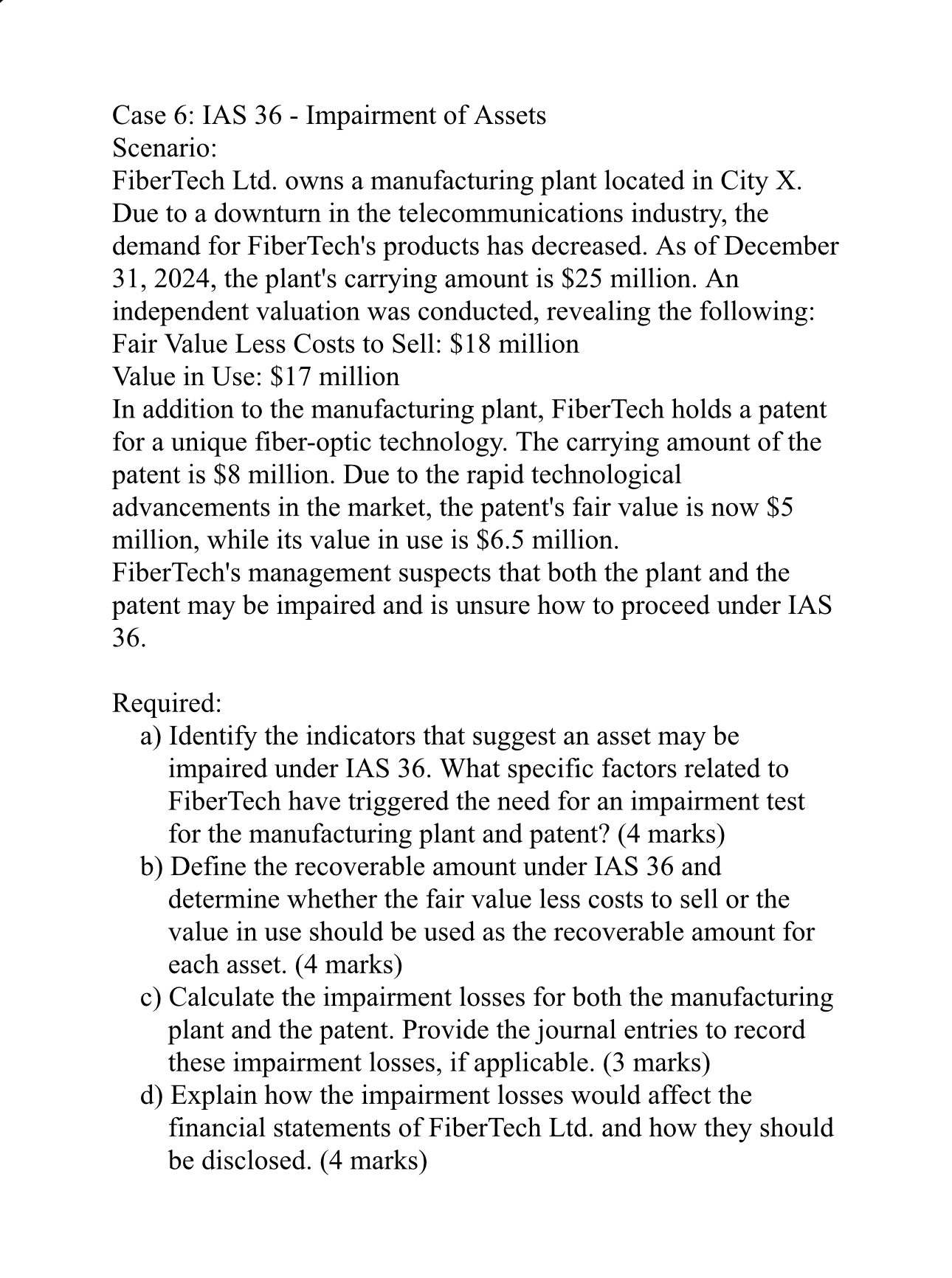

Case : IAS Impairment of Assets

Scenario:

FiberTech Ltd owns a manufacturing plant located in City X

Due to a downturn in the telecommunications industry, the

demand for FiberTech's products has decreased. As of December

the plant's carrying amount is $ million. An

independent valuation was conducted, revealing the following:

Fair Value Less Costs to Sell: $ million

Value in Use: $ million

In addition to the manufacturing plant, FiberTech holds a patent

for a unique fiberoptic technology. The carrying amount of the

patent is $ million. Due to the rapid technological

advancements in the market, the patent's fair value is now $

million, while its value in use is $ million.

FiberTech's management suspects that both the plant and the

patent may be impaired and is unsure how to proceed under IAS

Required:

a Identify the indicators that suggest an asset may be

impaired under IAS What specific factors related to

FiberTech have triggered the need for an impairment test

for the manufacturing plant and patent? marks

b Define the recoverable amount under IAS and

determine whether the fair value less costs to sell or the

value in use should be used as the recoverable amount for

each asset. marks

c Calculate the impairment losses for both the manufacturing

plant and the patent. Provide the journal entries to record

these impairment losses, if applicable. marks

d Explain how the impairment losses would affect the

financial statements of FiberTech Ltd and how they should

be disclosed. marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started