Question

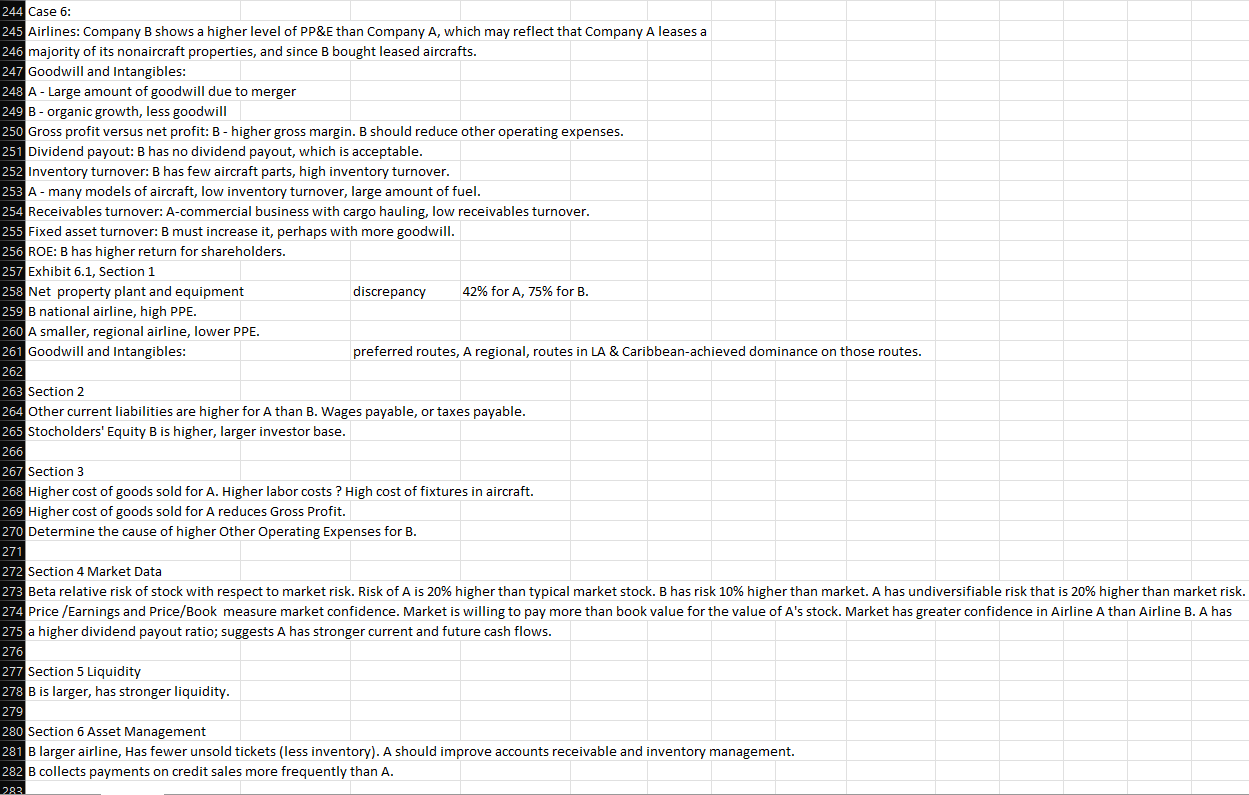

Case 6: See line 244. Write a paragraph for each comparison. Compare Company A and Company B's financial position. Compare Firm C and Firm D's

Case 6: See line 244. Write a paragraph for each comparison.

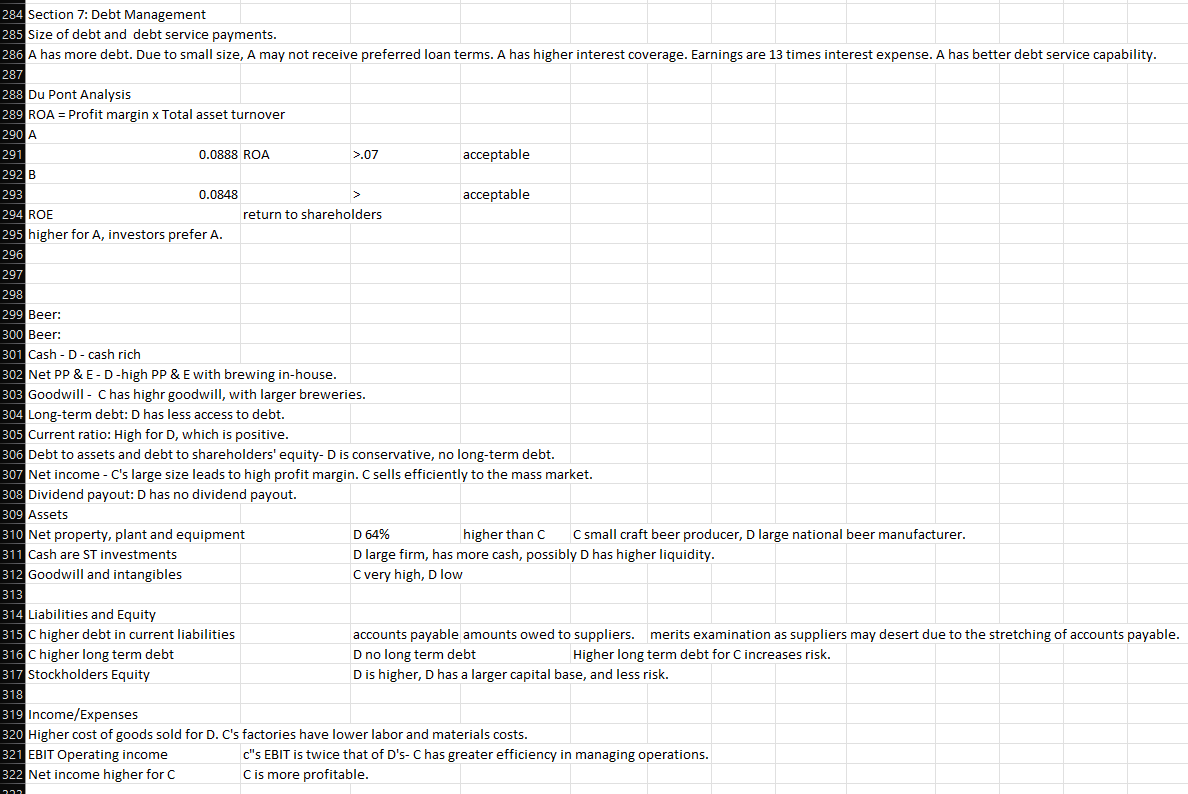

Compare Company A and Company B's financial position.

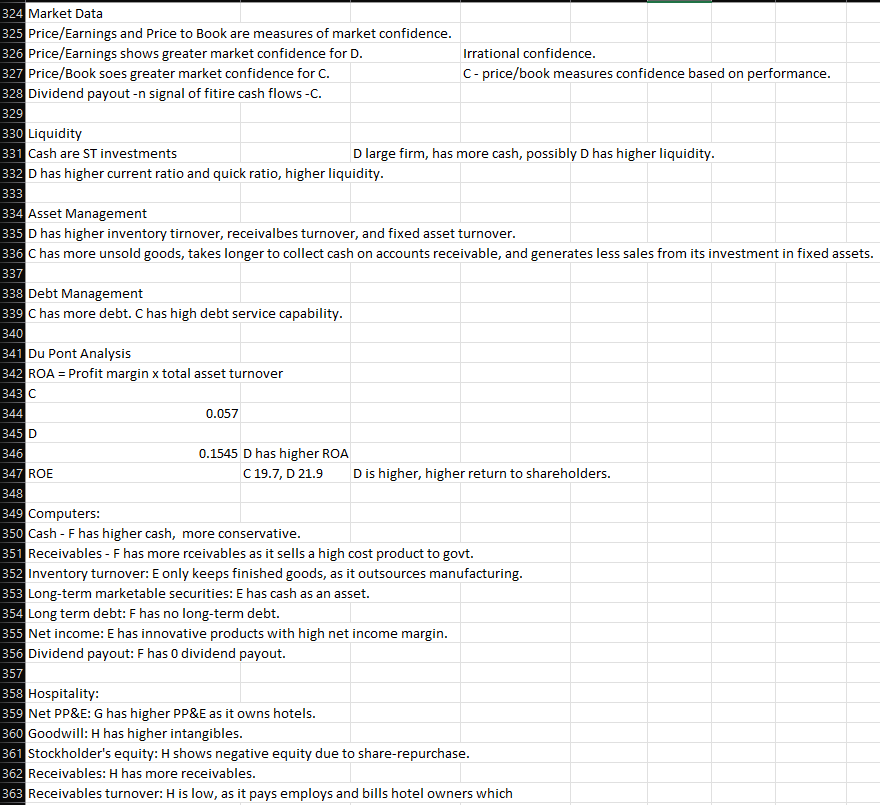

Compare Firm C and Firm D's financial position.

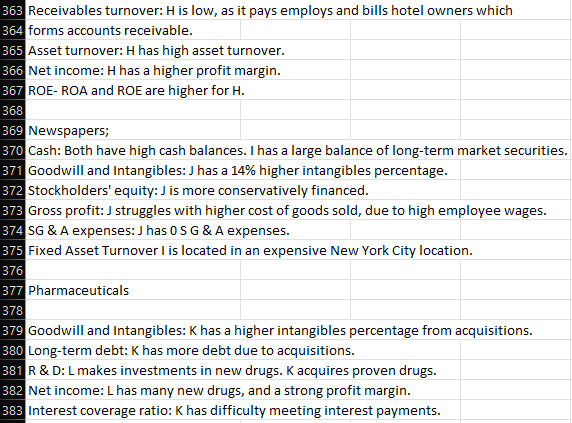

Compare Firm G and Firm H's financial position.

Compare Firm I and Firm J's financial position.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Please answer the instructions above based on the information below, thank you for your help.

(Answer will be scanned, including other Chegg answers, thumbs down for plagiarism)

____________________________________________________________________________________________________

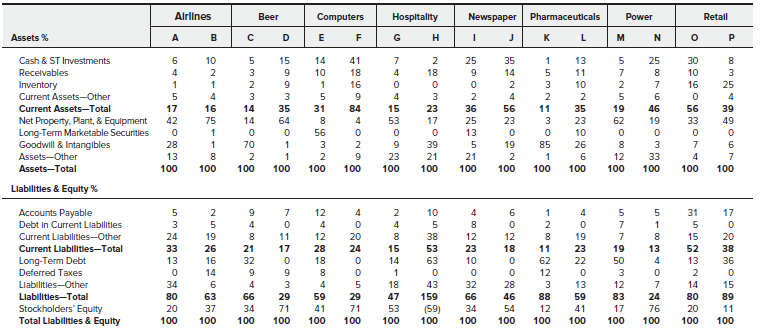

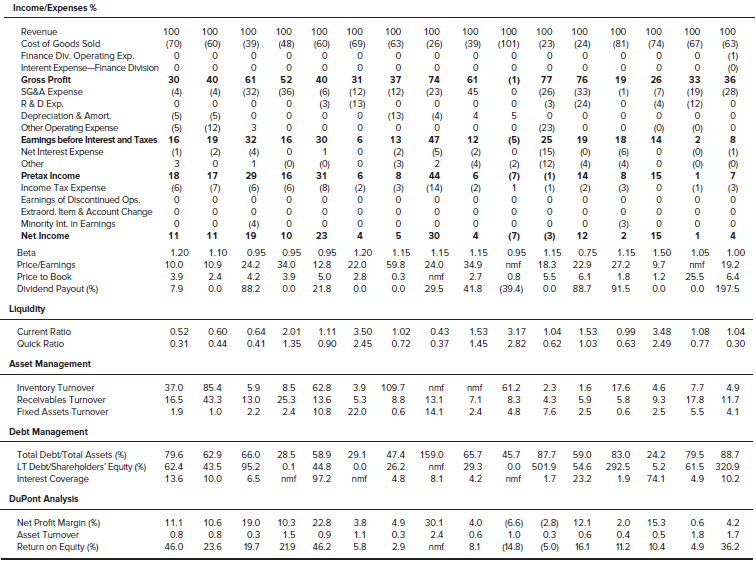

The financial characteristics of companies vary for many reasons. The two most prominent drivers are industry economics and firm strategy.

Each industry has a financial norm around which companies within the industry tend to operate. An airline, for example, would naturally be expected to have a high proportion of fixed assets (airplanes), while a consulting firm would not. A steel manufacturer would be expected to have a lower gross margin than a pharmaceutical manufacturer because commodities such as steel are subject to strong price competition, while highly differentiated products like patented drugs enjoy much more pricing freedom. Because of each industrys unique economic features, average financial statements will vary from one industry to the next.

Similarly, companies within industries have different financial characteristics, in part because of the diverse strategies that can be employed. Executives choose strategies that will position their company favorably in the competitive jockeying within an industry. Strategies typically entail making important choices in how a product is made (e.g., capital intensive versus labor intensive), how it is marketed (e.g., direct sales versus the use of distributors), and how the company is financed (e.g., the use of debt or equity). Strategies among companies in the same industry can differ dramatically. Different strategies can produce striking differences in financial results for firms in the same industry.

The following paragraphs describe pairs of participants in several different industries. Their strategies and market niches provide clues as to the financial condition and performance that one would expect of them. The companies common-sized financial statements and operating data, as of early 2016, are presented in a standardized format in the figure. It is up to you to match the financial data with the company descriptions. Also, try to explain the differences in financial results across industries.

Companies A and B are airline companies. One firm is a major airline that flies both domestically and internationally and offers additional services including travel packages and airplane repair. The company owns a refinery to supply its jet fuel as a hedge to fuel-price volatility. In 2008, this company merged with one of the largest airline carriers in the United States.

The other company operates primarily in the United States, with some routes to the Caribbean and Latin America. It is the leading low-cost carrier in the United States. One source of operating efficiency is the fact that the company carries only three different aircraft in its fleet, making maintenance much simpler than for legacy airlines that might need to service 20 or 30 different aircraft models. This companys growth has been mostly organicit expands its routes by purchasing new aircraft and the rights to fly into new airports.

Of the beer companies, C and D, one is a national brewer of mass-market consumer beers sold under a variety of brand names. This company operates an extensive network of breweries and distribution systems. The firm also owns several beer-related businessessuch as snack food and aluminum-container manufacturing companiesand several major theme parks. Over the past 12 years, it has acquired several large brewers from around the globe.

The other company is the largest craft brewer in the United States. Like most craft brewers, this company produces higher-quality beers than the mass-market brands, but production is at a lower volume and the beers carry premium prices. The firm is financially conservative.

Companies E and F sell computers and related equipment. One company sells high-performance computing systems (supercomputers) to government agencies, universities, and commercial businesses. It has experienced considerable growth due to an increasing customer base. The company is financially conservative.

The other company sells personal computers as well as handheld devices and software. The firm has been able to differentiate itself by using its operating system for its computers and by creating new and innovative designs for all its products. These products carry premium prices domestically and globally. The company follows a vertical integration strategy starting with owning chip manufacturers and ending with owning its retail stores.

Companies G and H are both in the hospitality business. One company operates hotels and residential complexes. Rather than owning the hotels, this firm chooses to manage or franchise its hotels. The company receives its revenues each month based on long-term Page 109 contracts with the hotel owners, who pay a percentage of the hotel revenues as a management fee or franchise fee. Much of this companys growth is inorganicthe company buys the rights to manage existing hotel chains and also the rights to use the hotels brand name. This company has also pursued a strategy of repurchasing a significant percentage of the shares of its common stock.

The other company owns and operates several chains of upscale, full-service hotels and resorts. The firms strategy is to maintain market presence by owning all of its properties, which contributes to the high recognition of its industry-leading brands.

Companies I and J are newspaper companies. One company owns and operates two newspapers in the southwestern United States. Due to the transition of customer preference from print to digital, the company has begun offering marketing and digital-advertising services and acquiring firms in more profitable industries. The company has introduced cost controls to address cost-structure issues such as personnel expenses.

Founded in 1851, the other company is renowned for its highly circulated newspaper offered both in print and online formats. This paper is sold and distributed domestically as well as around the world. Because the company is focused largely on one product, it has strong central controls that have allowed it to remain profitable despite the fierce competition for subscribers and advertising revenues.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started