Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 61 Nicholas and Whitney Clement 6. If Nicholas and Whitney sell the K&B stock on January 1, 2022, for the fair market value

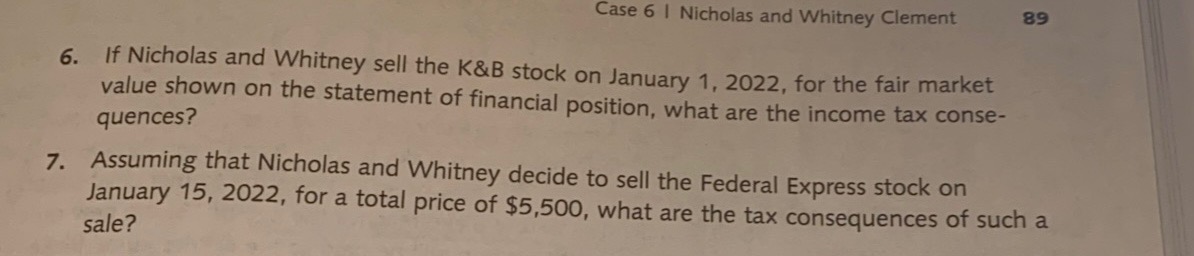

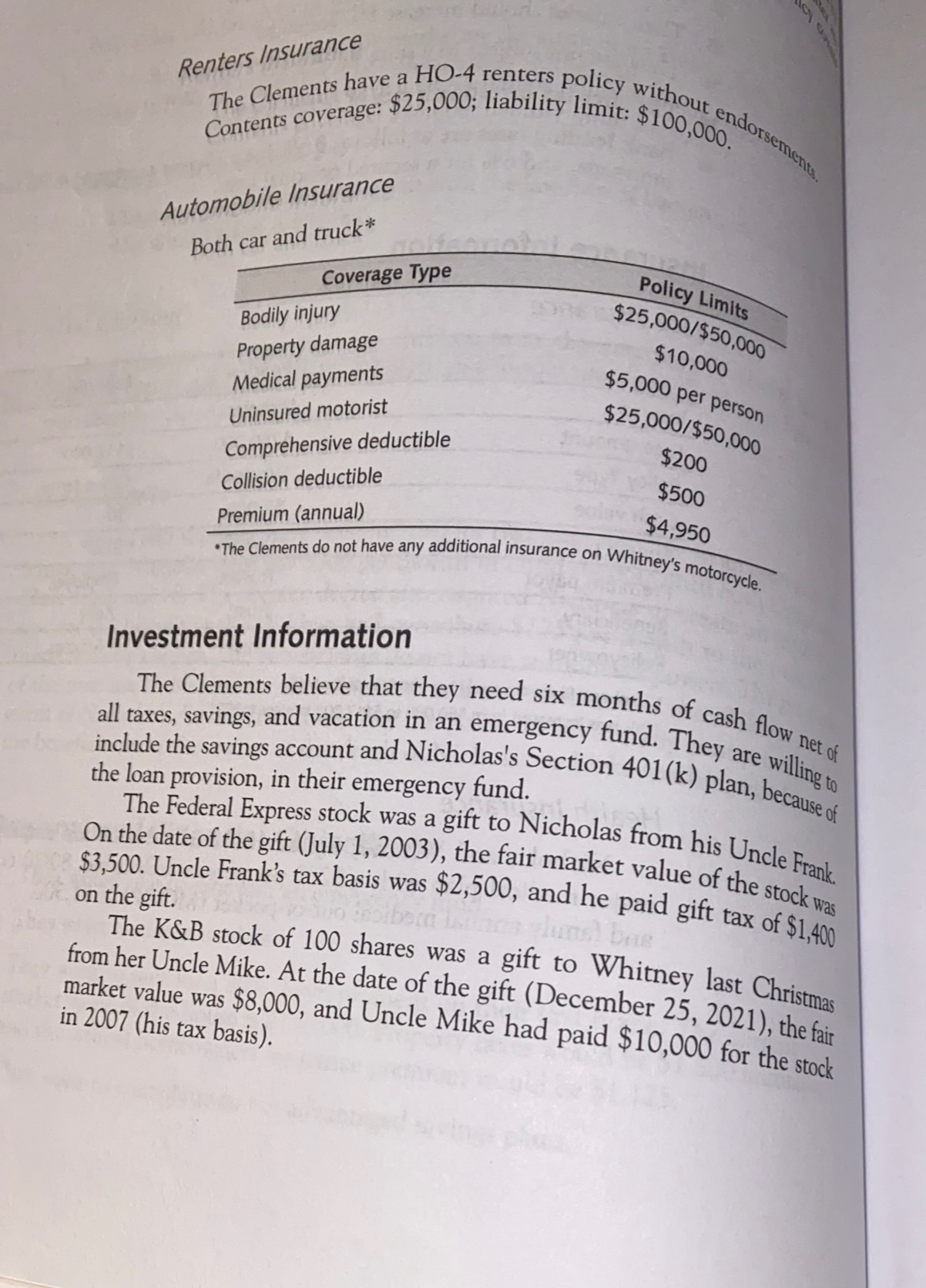

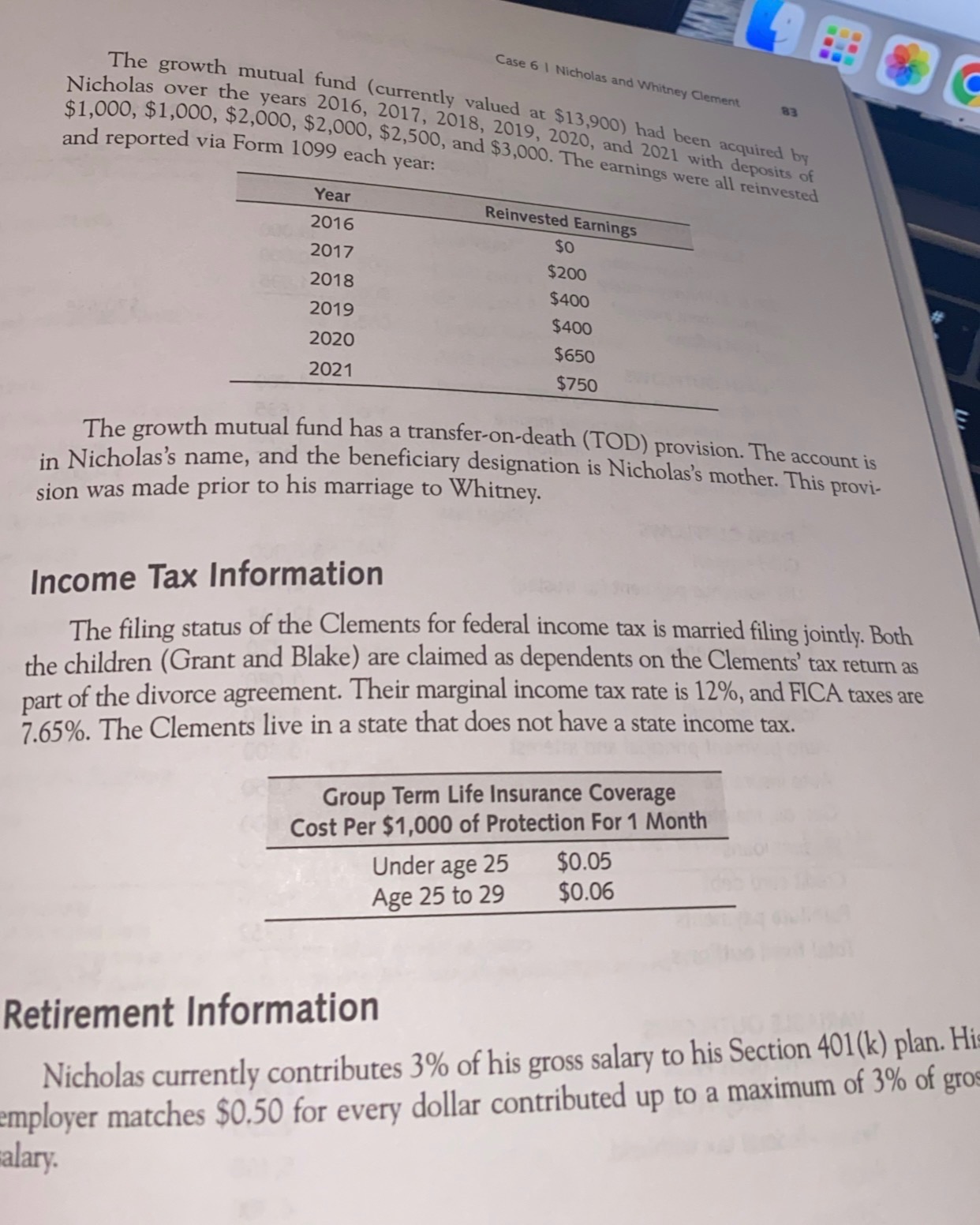

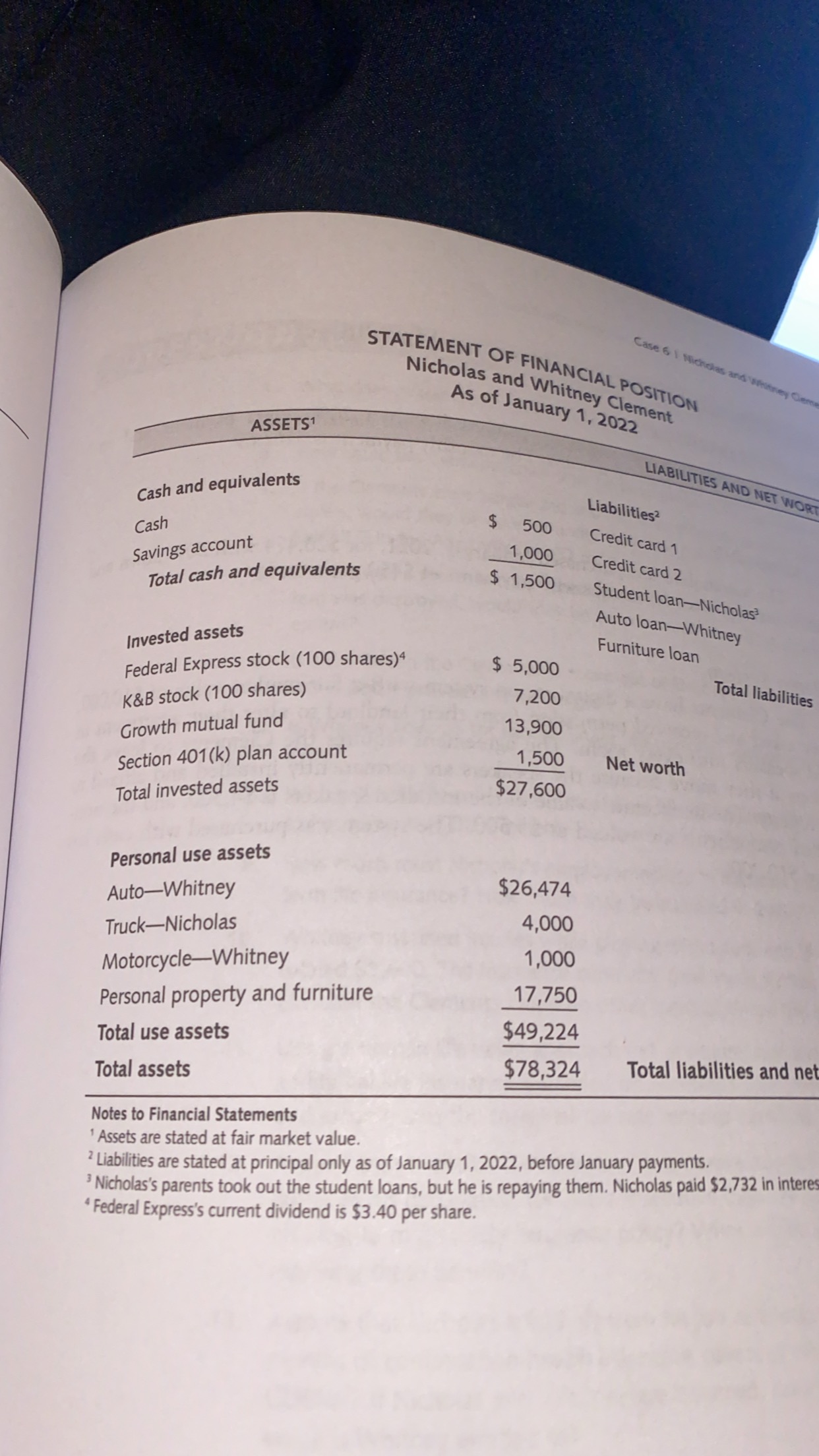

Case 61 Nicholas and Whitney Clement 6. If Nicholas and Whitney sell the K&B stock on January 1, 2022, for the fair market value shown on the statement of financial position, what are the income tax conse- quences? 89 7. Assuming that Nicholas and Whitney decide to sell the Federal Express stock on January 15, 2022, for a total price of $5,500, what are the tax consequences of such a sale? Renters Insurance Contents coverage: $25,000; liability limit: $100,000. The Clements have a HO-4 renters policy without Automobile Insurance Both car and truck* Coverage Type Bodily injury Property damage Medical payments Uninsured motorist Comprehensive deductible Collision deductible Premium (annual) endorsements. Policy Limits $25,000/$50,000 $10,000 $5,000 per person $25,000/$50,000 $200 $500 $4,950 *The Clements do not have any additional insurance on Whitney's motorcycle. Investment Information The Clements believe that they need six months of cash flow net of willing to all taxes, savings, and vacation in an emergency fund. They are include the savings account and Nicholas's Section 401(k) plan, because of the loan provision, in their emergency fund. The Federal Express stock was a gift to Nicholas from his Uncle Frank. On the date of the gift (July 1, 2003), the fair market value of the stock was $3,500. Uncle Frank's tax basis was $2,500, and he paid gift on the gift. lunal bus tax of $1,400 The K&B stock of 100 shares was a gift to Whitney last Christmas from her Uncle Mike. At the date of the gift (December 25, 2021), the fair market value was $8,000, and Uncle Mike had paid $10,000 for the stock in 2007 (his tax basis). Case 61 Nicholas and Whitney Clement 83 The growth mutual fund (currently valued at $13,900) had been acquired by Nicholas over the years 2016, 2017, 2018, 2019, 2020, and 2021 with deposits of $1,000, $1,000, $2,000, $2,000, $2,500, and $3,000. The earnings were all reinvested and reported via Form 1099 each year: Reinvested Earnings Year 2016 2017 2018 2019 2020 2021 $0 $200 $400 $400 $650 $750 The growth mutual fund has a transfer-on-death (TOD) provision. The account is in Nicholas's name, and the beneficiary designation is Nicholas's mother. This provi- sion was made prior to his marriage to Whitney. Income Tax Information The filing status of the Clements for federal income tax is married filing jointly. Both the children (Grant and Blake) are claimed as dependents on the Clements' tax return as part of the divorce agreement. Their marginal income tax rate is 12%, and FICA taxes are 7.65%. The Clements live in a state that does not have a state income tax. Group Term Life Insurance Coverage Cost Per $1,000 of Protection For 1 Month Under age 25 $0.05 Age 25 to 29 $0.06 Retirement Information Nicholas currently contributes 3% of his gross salary to his Section 401(k) plan. Hi employer matches $0.50 for every dollar contributed up to a maximum of 3% of gros salary. ASSETS Cash and equivalents Cash Savings account Case 61 Nicholas and Whitney Ceme STATEMENT OF FINANCIAL POSITION Nicholas and Whitney Clement As of January 1, 2022 LIABILITIES AND NET WORT Liabilities? Total cash and equivalents Invested assets Federal Express stock (100 shares)4 K&B stock (100 shares) $ 500 Credit card 1 1,000 Credit card 2 $ 1,500 Student loan-Nicholas Auto loan-Whitney Furniture loan $ 5,000 7,200 Total liabilities Growth mutual fund 13,900 Section 401(k) plan account 1,500 Net worth Total invested assets $27,600 Personal use assets Auto-Whitney $26,474 Truck-Nicholas 4,000 Motorcycle-Whitney 1,000 Personal property and furniture 17,750 Total use assets $49,224 Total assets $78,324 Total liabilities and net Notes to Financial Statements 1 Assets are stated at fair market value. 2 Liabilities are stated at principal only as of January 1, 2022, before January payments. 3 Nicholas's parents took out the student loans, but he is repaying them. Nicholas paid $2,732 in interes 4Federal Express's current dividend is $3.40 per share.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started