Case 6.3 Amazon and Future Group

1. Did Amazon follow the right strategy to enter India? Did Amazon use the most appropriate mode of entry? 2. Partners in an alliance should be aware of the various risks involved. What probable risks were faced by Amazon and Future Group? What can they do to safeguard against those risks?

3. Comment on the structure and details of the alliance. What do you recommend should have been taken care of?

4. What action would you recommend for the AmazonFuture Group partnership? What are the implications for your recommendations?

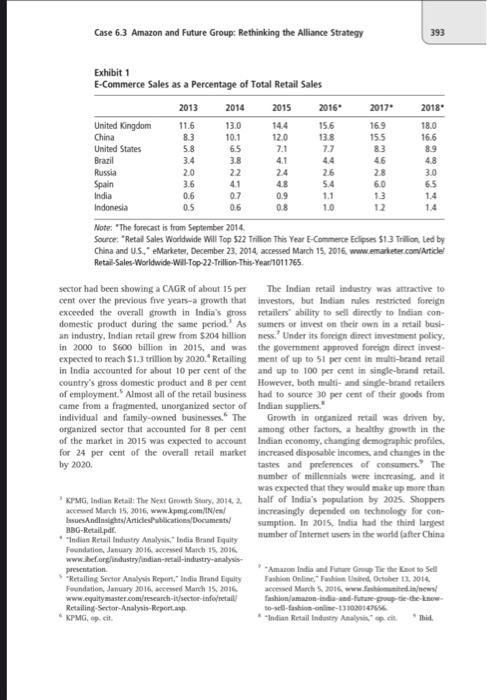

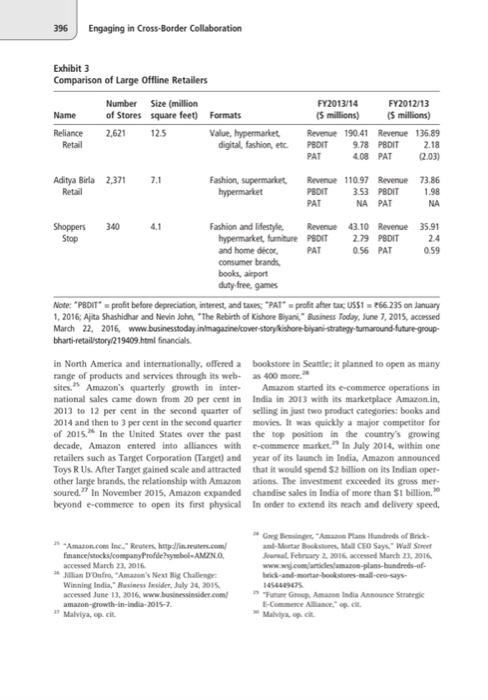

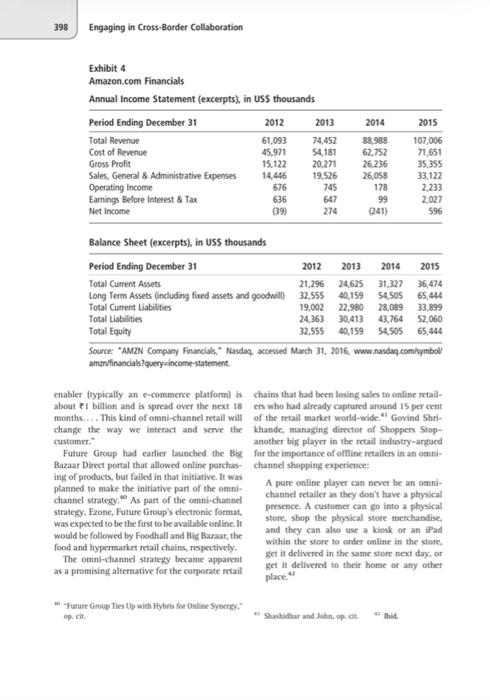

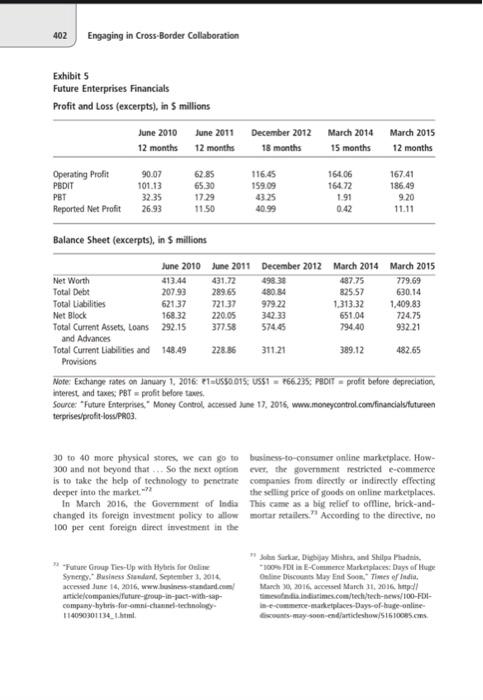

Slvey Publishing CASE 6.3 AMAZON AND FUTURE GROUP: RETHINKING THE ALLIANCE STRATEG Y1 Meeta Dasgupta wrote this caie solely to provide material for dass discssion. The author does not intend to illustate ether effective or ineffective handing of a managerial wituatisn. The author may have disgised certain names and other ideatiling infsematisn to protect confidentiality. This publication may not be transmitted, photocopied, digitited, of otherwice reproduced in any form or by any means without the permission of the copyright holder. Reprodaction of this material is not covered unter authoritation by any reproduction rights onganization. To order copies or request pemission to neproduce materiaks, coetact Ivey Publishing. Iwy Business Sthool, Western University, London, Ontario, Canada N6G ON1: (t) 519.661 3206: (e) caseselive as: www.weycases com. Copyright 0 2016, Management Development Inatitute Gurgaon and Richard hey School of fusiness Foundation Venion: 2016-10-25 In 2014, Kishore Biyani, founder and chief trillion in 2018. 2 Worldwide retail e-commerce executive officer (CEO) of Future Group, and Jeff sales had also grown. As a percentage of total Bezos, founder and CEO of Amazon, led their two retail sales, retail e-commerce sales grew from companies in a business alliance: Amizon would 5.1 per cent in 2013 (51.077 trillion) to 5.9 per sell Future Group's clothing brands and eventu= cent (\$1.316 trillion) in 2014,6.7 per cent ally retail other categories of goods for Future (S1.592 trillion) in 2015 and 7.4 per cent in Group. The alliance started on an optimistic note, 2016 (\$1.888 trilion). They were expected to but by early 2016, the alliance partners were in reach 8.8 per cent (\$2.489 trillion) in 2018. Inicrconflict over discounts and who would bear the estingly, although a majority of American conburden of those costs. Could the partners fund sumers vere purchasing online, more than 310 a way to resolve the conflict or was it time for out of every SII were still spent in stores: In the companies to be independent again? Was comparison, China and the United Kingdom, the the alliance continuing to deliver value for the other largest retail e-commerce markets, had companies? much higher proportions of online to fotal retail sales (see Exhibit 1). The Global Retail Industry The global retail industry had grown steadily The Indian Retail Industry from USS21.189 trillion in 2013 to $25.366 tril- By 2000 , the retail sector had emerged in India as lion in 2016, and was expected to reach $28.300 one of the largest sectors in the country's economy, registering a Compound Annual Growth Rate (CAGR) of 7.45 per cent. By 2014, the retall 1 This case bas been wrinen on the bases of published soarest Consequently, the interpectation and perspectives presented in this case are noe necessarily A All currency amounts are in WSD or INR unless otberwise those of Future Group or Amazan or any of their specified; - INR - lndian ruper; USS1 - 66 235 om. cimployers. January I, 2016. Case 6.3 Amazon and Future Group: Rethinking the Alliance Strategy 393 Exhibit 1 E-Commerce Sales as a Percentage of Total Retail Sales Note: "The farecant is from September 2014. Source: "Retal Sales Woridwide Wil Top 522 Trilion This Year E-Commeroe Eolipses 513 Trition. Led by China and US.," eMarketer, December 23, 2014, ascessed March 15, 2016, www emanker cominticlel Retail-Sales-Woeldwide-Wai-Top-22-Trillion-This-Yearh011765. sector had been showing a CAGR of about 15 per The Indian retall induatry was attractive to eent over the previous five years-a growth that investors, but Indian nules restricted foreign exceeded the overall growth in India's gross retaliers' ability to sell directly to Indian condomestic product daring the same period.. As sumes of invest on their own in a retail besian industry, Indiae retail grew from \$204 hillion ness." Under its forcign diset ievestment policy. in 2000 to $600 billion in 2015 , and was the government approved forcign dirnet investexpected to reach $1.3 triliton by 2020 . "Retailing ment of up to 51 per eent in mulri-beand retail in India accounted for about 10 per cent of the and up to 100 per cent in single-brand retail. country's gross domestic product and 8 per cent However, both multi- and single-brand retailers of employment. Almost all of the retail business had to source 30 per cent of their goods from came from a fragmented, unorganized sector of Indian supplies." individual and family-owned businesses." The Growth in otganized retail was driven by. organized sector that accounted for 8 per cent among other facton, a beallhy growth in the of the market in 2015 was expected to account. Indian cconomy, changing demographic proftlor, for 24 per cent of the overall retail market increased disposable incomes and chances in the by 2020 . tastes and preferences of consumers? The number of milleanials were incrasing, and if was expected that they would muke up more than ' Krast, Indian ketail: Thr Next Gruwth Stary, 2014,2. half of India's population by 2025. Shoppers accosed Marti 15, 2016, mww kpmpeom,iNiteal incrcasingly depended on technology for conIsuestalnaights/Articicshulkatioesbocamests/ samption. In 2015, India had the thind largest BBG-Eetailpde. " "Tndian Retail Industry Analyois," Intia Brand Bquity number of Internet uses in the world (after China Feondation, January 2016 accessed Math 15,2016. www beforg/industry findian-serall-industry-abalysispreicntation. Retailing-Sectar-Analynis-Reportasp. bo-sd-fashion-anlise-13103014rss * KPMGi, ap, cit. " "Indian Rrail lndewery Amalysits" op at "Mit. Engaging in Cross-Border Collaboration and the Lnited Statesl, and wars similarly ranked Growing laternet penefration, aggressive in penetration of smartphones. Economic fore- pricing strategies, and e-commerce companies casters predicted that by 2020 , India would be a with resoures of investor cash spurred the growth. $3 trillion economy with 5.8 per cent of global. Young companies like Flipkart and Snapdeal domspending happening in the country-a significant inated sencral e-coenmerce and Myntra and increase from 2.6 per cent in 2015." Anil Agat- Jabong dominated in apparels. 13 In FY2014/15, wal, then managing director of Amazon India, online rctailers collectively captured \$6 billion of observed. "Everything is nascent in India-the the 500 bitlion onganized retall market fexcluding seller ecosystem, the logistics; the payments.... Kiruma of small neighbourhood stores] Regular We have to connect the dots on a massive scale retail stores wene on the decline as evidenced by that involves hundreds of cities, thocsands of sales fugures during the festival season in October seliers, and millioess of products," -t2 to Nevember 2014; visits at most of the beicks and Even though the online retall industry in fadia mortar stores fell by 12 per cent. 36 occupied only about 2 per cent of the country's The prowing enerny aratund online retail was overall retail industry, online retailing was grow- also reflected in the valuations of online retail ing quickly, from less than $500 million in cotmpanies (see Exhibit 2). At the end of 2014, 2009 to aboat $5 billion in 2014.13 Acconding India's biggest online retailer, Flipkart, was to a report by the consulting firm Technepalk valued at 511 billion ( 700 bidion) while Future the overall retail industry was expected to double Group's three listed companies were collectively by 2020. The online retailing market represented valued at $1.2 ballion (80 billion). The online an increasing portion of that growth; the 52.3 netaller, 5 napoleal, then just five years old, was billion online retail market in 2014 was expected already valued at $1.85 biltion tabout 117 bilto be $32 billion by 2020, an increase from 2 per Fionl, and after a round of fundraising in 2015 , cent to 3 per cent of the Indian retail sector., was valued at $4.9 billion (about 330 billion). 17 Heavy discounting was leading to increased level of conflict between the online and offine retallen. Iraditional retailess that were being hit w zAfonsumes Werldwide no Get Smamphenes ay _by aggrasive pricing or undercutting protested 2016." eMarketer, Decmber 11. 2014, accosed Masch Fliplart's Bigg Billion Day Sale held on October 6, 21. 2016. wwu.rmarketectompintide/2-talien- 2014. Flpkart promised to hold the greatest sale 1011694. Khatere Blyani," Rusincss Tidry, Jube ?, 2015, arwosond Marth 22, 2016. www.businessiodiydin/magayiter! cvve-storylkichare-biyani-strateig-turharoundfuture-gted-tharti-trtal/vory/21960 ham nemsise9roes4_t_bangalore-based-Diplart-andfinanctak. Th -Why the Futare Groep-Anaane the-tip is a Win-Win as Saritha Rai, "Amit Agerwal Leads Amanon tndia a the Bech" Muecy Centrot, October 14, 20t4, aceeseel Or.line Retail is Taking Or., Furbes, Jene 4, 2015. Muth 5. 2016. wwi matcycoetrol comewv/ acreved June 13. 2016 ene firtes.cum/klew? Beninnalwhyfiture-group-amazod-tie-ep-toain-einaritharai/20ts/o6/o4/primed-foe-bartlel for-both_1 17ezs hohem. 6351392f9icoe A Staitilhar and Johis, op cit. Manch 5, 2016, www.moneycontmolcotninews" in 2015, "Hasiness Stendunt, January 7, 2016, accessed busines/wlyyfuture-group-amason-tie-up-iswin-win-_hme 11, 2016, wiww-busines-standard com/articio/ foe-both_ 1202070,html. esepuakieveapedeal-fliplart-bep-valuation- fporinthtimes, Detober 13, 2014, accensed Jene 13, 2016, lerpedl Seag, Octrber 6, 2014, acmsed Juat 13, 20t6, hrtpolf afticies reunomiktime indiatimen.eum/2014-10-13/ yeuntery com/20s/tha/tiphearf-big-billiea-duy. Case 6.3 Amazon and Future Group: Rethinking the Alliance Strategy 395 Exhibit 2 Comparison of Large E-Commerce Retaillers Source Ajita Shashidhar and Nevin John. "The Rebith of Kishore Biyan," Ausiness Fodiy, kne 7, 2015, accessed March 22, 2016, www businesstoday in/magasineicoved-stogyishore-bijaci-itrategy aumaroundfutue-group-bharti-tetail/story/219409/tml financiak. complaints by saying that the e-commeroe policy and Amazon had delivery networks: ekart Logiswould be reviewed." Amazon, in response, ties and Amazon Inansportation Solutions. Snapoffered Diwali sales but did not offer the kind of deal acquired a stake in Golavas; acquired an hesvy discounts that Flipkart and Snapdeal online onder marugement stam-up. Unicomoffered. 20 merse; and made an imverment of $377 million With the popularity of e-commerce, trad- (2250 million) in its own mbolly-owned bogistics Itional, brick-and-mortar retallers had to change unit, Vulcan Fxpross. 23 their approsch to business by partnering with The battie in the lndian c-commence industry e-commerce eatities in order to grow and survive. was expected to intensify. Asmazon's main tivals One of the major retailers, Croms, owned by the in India-Bangalore-based Fliphart and DelhiTata group, catered into an alliance with Snap- based-Snagdeal-sold goods worth mote than $4 deal. 21 Just three companies in the offine retail billion in 2014, with Flipkart alone estimated to market-Aditya Birla's Madura Fashion and Life- harve grossed $2 billion. lndestry expens believed style, Arvind Lifestyle Brands, and Future Group- that the lndian c-commerce sector nould owned or sold more than two dozen brands eacth, undergo a spate of consolidation with smalier thus qualifying to be a preferred partner for an .companies lacking the abdity to sustain competionline retailer (see Exhibit 3). 23 tion against a company like Anuzon. Flipkart's Successful and faster delivery of ptodacts was acquisition of online fashion retailer Myntra in the key to success for most of the e-commerce May 2014 set the trend. p sector. Companies were trying to make their delivery networks increasingly efficient. Flipkart. Amazon Amazoncem. an e-commecroe company, was. 34 Maliya, ep cit. incomporated in 1996. The company. operating is Nivedita Bhattachagjer, "Blyanl's Future Group Tes Up with Amaans Inatla," at. Stephen Ceases, Reaters, October 13, 2014, actesved March 5, 2016, httpll in meuterseomvarticlegfuture-netail-amsonitinKCCNot206E20t410t3. itilsk CSot 206220 td 1013. Future Supply Chais Solations," hncti, April 3, 2015, 11 "Furur Group Amazse indas Anmeanse Stratrigic acciked March 22, 2014, Intpilitinc2zcom/truaf E-Commerce Allience, "lusinos Stindard, October 14. future-swpply-dhain-solitions. enterinto-stritefic-partuentlp-114101300145_I. Hitml. M Malviya, op, cit. spun-e-commere-mmpetinien 396 Engaging in Cross-Border Collaboration Exhibit 3 Comparison of Large Offline Retallers 1. 2016; A/ta Shashichar and Nevin dohn. "The Rebirth of Richore Elyani," Eusiness fodiyy, June 7, 2015, actessed March 22, 2016, www businesstodyy inimagagineloovestory kishore biyani-statigy-tumarcund-future-groupbharti-fetail/storyp19409.html financials. in North America and internationally, offered a bookstote in Scanle; it planned to open as many range of products and services through its web- 2s.400 moee. 2 sites. 'S Amazon's quarterly growth in inter- Amaron garted its e-commerce operatiens in national sales came down from 20 per cent in India in 2013 with its marketplace Amazon.in, 2013 to 12 per cent in the second quarter of selling in jast two product categgories: books and 2014 and then to 3 per cent in the secosd quarter movien. It was cuickly a major competitor for of 2015. 2 In the United States over the past the nop ponition in the country's growing decade, Amazon entered inte alliances with e-commerce market. 2 ln July 2014, within one retailers such as Tanget Corporation (fatget) and year of its launch in fndia, Amazon annodnced Toys R. Us. After Target gained scale and attracted that it would spend 52 billion on its Indian operother lange brands, the relationship with Amxon ations. The invelment exceeded its gross mersoared. D In November 2015, Amazon expanded chandise sales in lndia of more than SI bellion. 10 beyond e-commeroe to open its first phasical In onder to ectend its reach and delivery speed, 3 Oore Areinere, "Anube Fhans Hundreds of Arickand-Mhertar Aoskines, Mull Cre Says" Waal Siner accensed March 23, 2016. wwin my coenlaricleslanase-plans-bundreds-at- at Jillan DDnfre. 'Amatun's Nex1 Milg Challengr brisk-and-mortar-boik stinc-teall-seo-saysWinning India," Basiers fxelder, Jaly 24, 2515 . I4544647. amazon-growth-in-india-2015-7. L-Ciemere Alliner, ofe. dit, 37 Malviya, ep rit. = Malviju up cit. Case 6.3 Amazon and Future Group: Rethinking the Alliance Strategy 397 Amazon built two centres, one in Bangalore and cZone were some of India's most favourite retail the other in Bhiwadi on the catskirts of chains opcrated by Future Group. The company Mumbal. 31 had more than 75 of its awn brands that earned Sellers joined Amazon from all over India. ln the Group at least is per cent higher margins on 2015, the number of sellers joining Amazon was average compared to ether national brands. "The two times more than those that joined in 2014. Group eperated approximately 480,000 square But the number of otders received by sellens in metres (17 miltion square feet) of retail space in 2015 was three times the namber of onders 98 urtan, and 40 raral locations. Approximately reccived in 2014. with scilen" total business 30.000 small medium, and large enterprises were increasing in the same period by $150.000 ( t10 conoctied to its retail formats and about 300 milmillion). The number of seliers using fulfillment lion customers yearly visited them., The comcentres-inventory storage space-increased by pany hud 140,000 stock units across India. 30 See three times, with 86 per cent of those using the Exhibit. 5 for Future enterprises financials. fulfillment centres increasing their sales volume. The core value of the Group was "Indlianness." The storage space provided to sellers increased Future Group believed in building a strong underfrom 28,000 square metres in 2014 to 765,000 standing of Indian consumers, and built its busisquare metres in 2015.12 ness based on Indian ideas. The Group's corporate Amazon's logistics innovation for the Indian principle was "Rewrite rules, retain values. 17 market, EasyShip, was paying efr. Amaton Future Group claimed to have a well-developed picked up products from supplicn outlets and and well-equipped logistios system. an in addition distributed them to customers using its logistiss to its own loghties chain, the Group also had a services. The number of sellets using Easyship third-party logistios arrangement that it planned increased three times, and the sellers wing to leverage for its omni-channel strategy. Amazon's Easy Ship increased their sales by In September 2014. Future Group entered into 40 per cent. In response. Amazon increased the a cellaboration with SAP Hybris, an e-commerce shipping service from covering 2,000 postal service, for an omni-channel retail strategy that codes in 2014 to covering 20,000 postal codes woeld allow the Group to convenge its digital and in 2015 (sec Exhibit 4). physical channels. According to Rakesh Biyani, the joint managing director at Future Retail, "The Future Group overall investment in this fousiness to consumer] Future Group was controlled by Biyani, knows in India as the man whe introduced larse seale retail we Maktya ep ci., Planet Sports, Brand Factory, Home Town, and E-Coemme Alince, op cit, " "Tusace Girpep Tia Up with lhtiris for Online 5ynengy." Bndecss Shadank, September 13 , 2014. actesset Murch 16. 2016, www.buainess-standart comatatielef Marh 23, 2016, wwi bratinewa-itandant ceentarticlef IHel. 11+04030008 __1.hami. March 5, 2016. hitpelitimesofindia indiatinacoml Bocatios, ender the product to be delivered, of reserve tech/tech-news/Amanon-and-Fulure-Groep- the pesdact for pickap at the nearest sfore. The stratngy partnenhip-en-rocks-ovet-funding-ef-devenuest mqueded 1/gnificant iater-departerntal cooperation articleshow/505s736t.m. from soply divin management, supplien, stores. in Nivedita Mhattartatikc, op tit. menchandeing, logthtios, and ticthology. 398 Engaging in Cross-Border Collaboration Exhibit 4 Amazon.com Financials Annual Income Statement (excerpts), in USS thousands Balance Sheet (excerpts), in USS thousands Source: "AM2N Company Finunciak," Navdaq, accessed March 31, 2016, www nasdaqcom/symboll amzvfinanciak?query income-statement. enabler ftypically an e-commeree platform) is chains that had been losing sale to online retailabout FI billion and is spread over the next 18 es who had already captured around 15 per eent months... . This kind of omni-channel reail will of the retall market world-wide." Govind Shrchange the way we interact and serve the khande, managing director of Shoppen Stopcustomer." another big player in the retail industry-argeed Future Group had eatlier launched the Big for the importance of offline retailes in an oannBazaar Direct portal that allowed online parchas- channel shopping experience: ing of products, but failed in that initiative. It was planned to make the initiative part of the omni- A pure online player can never be an oaniwas expected to be the first to be available online. It store, shop the physical store merchandise. would be followed by Foodhall and Hig Baraar, the and they can also we a kiosk or an IPad food and hypernarket retail chains, rejectively. Within the store to order online in the store. The omni-channel stratezy became apparent get it delivered in the same store next day, or as a promising alternative for the componte retail Eet it delivered to their home of any other place. 3 Case 6.3 Amazon and Future Group: Rethinking the Alliance Strategy 399 Over the next 18 months, Future Group aimed portfolio on Amazon's marketplace in India. to eam approximately 20 per cent of revenue Amapon would be the exclusive online platform from online sales and around 40 per cent by for the brands." Fulfillment of orders and cus2020.43 tomer service of the products on its portal wisuld Biyani's negotiations with Flipkart to jointly be handied by Amazon. sell goods stretehed over 20 days, then collapset. To provide vibibitity of its brants on Amaton. in October 2014. According to media sources. in. Future Group entered into an exclusive Future Group wanted a fee of 510 million for marketing arrangement with Arnazon. Cloudtail, giving sole, online retail rights-a price that Flip- a 49:51 joint venture between Amazon and the kart found excessive. Flipkart maintained that it Indian investment firm Catamaran Venturs, did not pay for exclusive rights to retail peoducts. would sill brands owned by or licensed to Future Instead, Flipkart wanted Future Group to pay a Group, inclading Lee Coopers, Converse, Indigo commission on every sale on its platform. Future Nation. Scullers, Jealous 21, and 40 other private Group would have preferred a lower commission label brands owned by Future Group. The prodfee. A person involved in the talks said, "There ucts would be offered to customers at a discount was no warmth between the two partics." of 30 per cent to 40 per cent. is Following the Another source said, "The Flipkart team felt the deal, mote than 40 brands owned by Future terms were onerous." Group were to be removed from other online Biyani was not in favour of marketplace marketplaces where thry were prevently being models used by companies such as Amaxon. Flip- sold. 90 While the deal involved fashion and food Kart, and Sapdeal. He strongly believed theit labels fers. Amazon was expected to pick up models were "front-end retalling with smant other categories from Future Grotep's portfolio accounting to dodge Indian lavs that bar ovet- in the future." seas investment in these venturs. 41. Biyani . The deal was theant to be an arrangement built accused online marketplaces of trying to destroy on customer service. Biyani's strategy for Future competition by selling products below manufac- Group retall was to know and cater to lndian turing costs. He pointed out that online retailers consumers. The bottom line in each of our retail were spending buge sums on advertising and success stories is 'know your customer." Insights customer acquisition. Biyani maintained, "Just into the soul of Indian consumer-how they because [online retailers] have foreign funding operate, think, dream, and live-helps us innovate they can't kill local tmde like that. 46 and create functionally differentiating products and experiences. 1/ The Amazon-Future Group Deal Blyani saw Amazon as an epportunity to exiend that stratefy to custoeners in about In 0ctober 2014. Biyani and Bezos met to finalize 19,000 postal codes in India served by Amanon., a deal to sell brands from Future Group's -Partnerskip with Amazon, which obsenses to be Earth's most customet-centric company. will enable as to leverage their strengths, a3 Malviya, op, cit. 44 Radhika P. Nair, "Hon Fiplar's Cold kroponve Sealed Futur Grocp and Amaten' Deat, EIRitaleam, October 14, 2014, accessed Mardb 5, 2016, hitpalf " Halay and Chakrwarty, op, cit. Ae Malviym, og, cit. fliplan-039-2-cold -reqonie-saled-fuhusegroup- ie Makdya of eit. 45 - Plailay and Chakravarty, op cit. E.Commerioe Alliance, op, tit. 45 Vikas 5N, "Ooe Wock Afer Dissing E-Tailers, Funure At Amacon in, "Amutonin and Future Groep Enter Into a 20:4/ tol22]-future-groep-amaton. nodc-9320679001. Engaging in Cross-Blorder Collaboration invotments, and innovations in lechnology to The Amuzon-future Giroup partnership was evireach out to a wider set of consumers across dence of the importance of combining product India. "s) with technology in aenni-channel retailing. Biyani's goals for the deal were considerable: Amanon lndia noted that the partnership would "We are targeting gross merhandise sales of bencfit customers" in making a purchase decision $60 billion in the next three years through the through rich prodact content, secure payments, alliance.-54 fast delivery, and easy returs on the For Amazon, the partnership was an import- wwwamamonin platform. ant growth opportunity in the Indian setail The media reported: industry. Future Group helped to provide Amazon with the lndian soures ir needed under The partnenhip ,... is not one between two lndia's foreign direct-investment policy. The retailess but of vendor and technology platpartnenhip was also expected to be a crucial forms offering technology and logistics serstep for Amazon's growth in the much sought vice. This will help in the growth of new after fashion category. Hecause of high margins brands and private labels... . It etablishes and growing demand, fashion was the focus that leading brick and mortar retailers cannot category for most of the e-contmerec netailers. be dismissive about e-commerve players. Fipkart and Snapdeal were leading in terms of . which have become a brand in the online product assortment and number of sellers and brands, and Flipkart. Myntra, and Jabong had News of the partnership trigsered an intra-day their own private labels in India, which Amanon jump in the shares of rwo of Future Group's listed did not have." companics: Future Retail Ltd. and Future LifeAmazon acknowledged the strategic partnes- style Fashion Ltd. " Howrver, industry experts ship with Future Group. Am Agrawal, vice- folt there were alvo possible pitfalls in the deal. president and coantry manager for Amazon lndia Devangike Dutta, chief executive afficer at the reported: retail consultancy firm Third Eyesight, said, "if We are exeifed to collaborate, leverage cach the busines is bot aligned in terms of orientation other's unique strengths, and serve custom- and customer service, then it could create lssues ers across India. The product portolio of foing foewasd, especially when ane of the bigget Future Group, their innate undentanding of barrien for oaline sale is inconsistency of the Indian consumer mindset, and our ability prodocts - Under the deat, Amazon and Furure Group to serve and deliver a comvenient, easy, would woek together to navigate the discounting. trusted, and reliable delivery experience to conflict between enline and ofline retailen. The , a nationwide set of customers is a win-win two businesses would jointly develop the pricing for all." and discounting stratogy. To avoid a conflict between the online and offline channels that could, in the end, andermine the business efforts of both, Amwon and Future Group agreed that Hellay and Chakavarty, op, rit, Malavila Veayanikal, the online price ef peodacts under Future Group's "Amaton Now Has a Fowerful Brikk-and Mortar Ally in tnda. Fiplart and Seupdeal, Your More." Teck in Asia, Ocsober 13. 2014. acensed June 14. \$016. www,techinasiacon/amanon- partinen-future-retall. of hed. Case 6.3 Amazon and Future Groupt Rethinking the Alliance Strategy 401 brands would not be very different from the Biyani feared deep discounting would hurt the prices at the stores. 6 . other retail channels 05 The partnership was also expected to extend to exploring synergies in distribution, customer The Downturn acquisition, and cross-promotions. 62 Amazon announced that Amazon. in woald also partner In January 2016, the media reported that differwith Fature Group brands in promoting existing ences had emerged between Future Group and and new brands in the markec, exploting co- Amazon over the funding structure for discounts branding opportunities, and accelerating devel Amazon offered on products sold from Future opment of new products in eategories that were Group's fashion brands. Discoanting wres a not presently served by retailers. .3 common practice with online retailers in Food was expected to be the next category of India, but it affected the profitahility of most products for the partnership. Amazon was e-commerce companies. Amazon asked Future already offerins ready-to-eat foods and similar Group to bear a portion of offered discounts by products online, and Future Group had plans to taking a reduced margin on sales. begin retailing food brands as well, 54 Biyani Given Biyani's public criticisan of deep online had a bigg vision for retailing fast-moving con- discounting and his reluctance to share the cost stamer goods: he wanted to move beyond the of rebates, the media didn't expect Blyani to 25 per cent to. 30 per cent margin of Future accept Amazon's proposal. If Future Groap did Group's immediate competitors and, instead, agree to Amazon's request, the result would be earn a margin of 40 per cent on premium prod- different prices for the products sold in Future ucts. This would have put Future Group in a Group's physical stores and soid online. The category with Hindustan Unilever. Nestle, and rumour was that Amazon, in tum, told Future Britannia. is Biyani admitted that he lacked the Group to end the exclusive deal with Amazon product developenent experience of consamer and instead, tike any other vendor, list its private foods companies, bat he hoped to bridge the labels online and pay Amazon a commission on glap by entering into collaborations with experts sales. 70 in varioas fields. . Industry experts criticized the Amazon-Future Interestingly, even after partnering with Group deal, alleging that it was a media strategy Amazon, Biyani continued his previously estab- for attention. According to Harminder Sahni, lished criticism of foreign-funded e-commerce founder of retail consultancy furm Wazir companies. 67 Biyani boldly declared in an inter- Advisors, "Discounts should be the first thing to view with Business Standard that "the mindspace be discussed fin an e-commerce arrangement]. [c-commerce stakeholders] have occupied bs far What priority pricing Future [Group] will give to larger than their share of the market. tat Biyani Amazon, what price differentiation wall work: was particularly critical of decp-disceunting between offline and online, should be the first. schemes, criticizing Flipkart and other things to be discussed. 71 e-commerce retallers for the deep discounts they offered during a Diwali promotional sale event. The Way Forward Biyani felt that there was a limit to the number of physical stores. Future Group could bave. He (t) Ibil. 4 Hhattiahariec, op cit. planned to increase the number of stores to 4. Amatan in, of, cit. 44 Future Group Amakon lndia Annance Serategic 260 by 2018, but added, "Even if we add another E.Commerse Alitince," op. ci.. th Shawhithar and John, op, eit. Ibat. "t Bailay and Chakravarty, op, cit, 4. Future Groce Amatron lndia Announce Scrategic "B Bhattacharjee, op cit. E-Commerce Alliance," op, cit. "Bailay and Chakraverty, op, at. "It. Ibid. 402 Engaging in Cross-Border Collaboration Exhibit 5 Future Enterprises Financials Profit and Loss (excerpts), in 5 millions Balance Sheet (excerpts), in 5 millions Note: Exchange rates on danuary 1, 2016: e1=US\$0015; WSSt = r66.235; Fgoit = prolit betore depreciation, interest and taxes; PBT = profit belore tames. Source: "Future Enterprises," Money Control, actenied lune 17, 20:5, www.moneycontrol.comfirancialututureen terprises/profit-losspena. 30 to 40 more physical stores, we can go to besiness-to-consumer online marketplace. How300 and not beyond that ... So the next option ever. the govermment restricted e-commeree is to take the help of technology to penctrate companies from directly or indirectly effecting decper into the market m ? the selling price of goods an online markeiplaces. In March 2016, the Govemment of lndis This came as a big relief to oftline, larick-andchanged its foreign investment policy to allow mortar sctailen.r Accotding to the directive, no 100 per cent foreign direct investment in the Chapter 6 Recommended Practitioner Readings 403 single vendor or their group of companies could billionl. best was expected to turn profitable in account for more than 25 per cent of the overall 2016 sales on a platform. 24 Amaron and Future Group necded to sort out The policy change was a major blow to their differtnces in the context of the changing Amaton, which had been lobbying for fotcign market and evolving policy. Should the cumpanies direct investment on an inveatory-based nurture the partnenhip on the existing tentis and model 75 of e-commerce. In 2015, Amazon's conditions, look for altemate options for growing Cloadtail posted a loss of 54,7 mallion (2317 together, and adjust the tents of the partnenhip. million) on revenues of 5170 millian (e11.5 or exir from the partoensip altogether? Ihid. the phosical invendary of productu therity enabling a 2016, accoued Marth 11, 2016, hirpelf in the persesion of the seller. Decrmber 31. 204\$, acesot Mand 31, 2016. Chapter 6 Recommended Practitioner Readings - Paul W. Beamish, A Note on the Design and Management of laternational Joint Ventures (lvey Publishing, 2017). "A Note on the Design and Management of Intemational Joint Ventures" examines the alliance form that typically requires the greatest level of interaction, cooperation, and investment: the equity joint venture. The reading focuses on two primary issues. The first of these considers the reasons why companies create international joint ventures. These include strengthening the existing business, taking existing products to forcign markets, bringing foteign products to local markets, and diversifying into a new business. The second of these considers the requirements for international joint venture success. These include testing the strategic logic, partnership and fit, shape. and design, doing the deal, and making the venture work. - Ulrich Wassmer, Pierre Dussauge, and Marcel Planellas, 'How to manage alliances better than one at a time, - MII Sloan Management Revieu, 51:3 (2010), 77-94. In "How to manage alliances better than one at a time," Wassmer, Dussauge, and Planellas focus on how companies can employ a more strategic approach to configuring effective alliance portfolios. The authors advocate a two-stage alliance assessment process (which includes both individual alliance analysis and alliance portfolio analysis) that can be used when considering any new alliance opportunity. They contend that when a company adds a new alliance to its portfolio, the firm tends to focus on how much value the alliance will