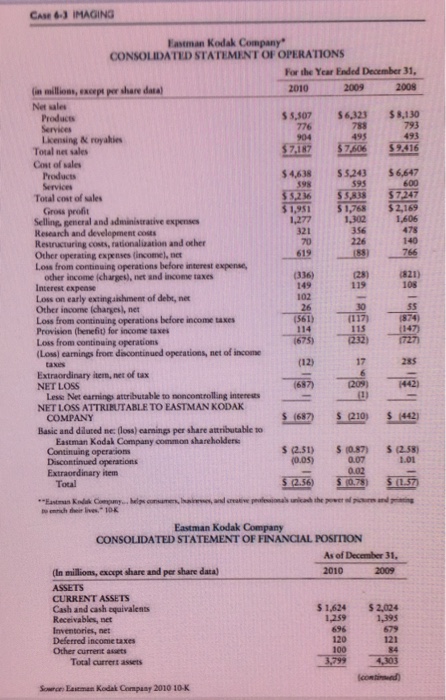

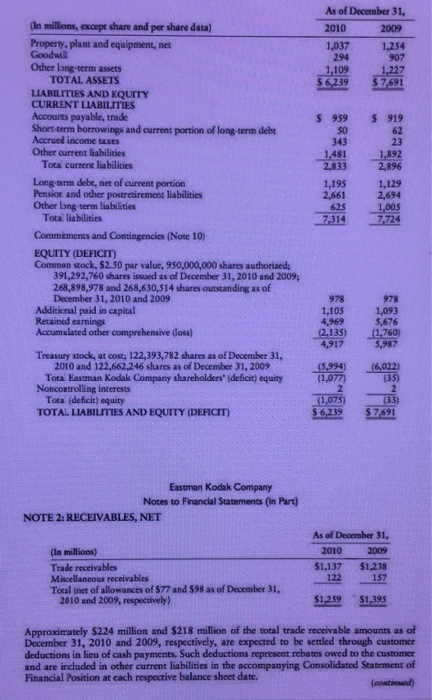

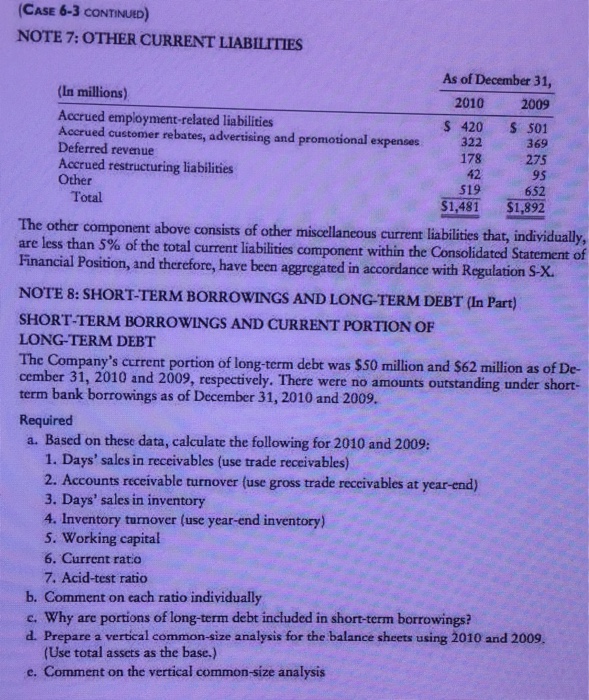

CAse 63 IMAGING Eastman Kodak Company CONSOLIDATED STATEMENT OF OPERATIONS For the Year Ended December 31, 20102009 2008 share datal Net sales 5,307 $6,323 $8,130 Lkensing & royakies Total nes sales Cost of sales 493 57,--A06-9,416 4638 S5243 $6,647 595 3,236$3,838$7247 $1.951 $1,768 ,169 1,2771,3021,606 Total cost of sales Gross profit Selling, general and aduninistrative expenses Reeanch and development coas Resiracturing costs, rationalization and other 226 Other operating expenses (inconel, net (336) 149 other income icharges), net and income taxes Interest expense Loss on early exzingaishment of debt, net Other income (charges), net Loss from continuing operations before income taxes Provision (henefit) for income taxes Loss from continuing operations Loss) earnings froe diacontinued operations, net of income Extraordinary item, net of tax NET LOSs Les& Net earning, attributable to noncontrolling interests NET LOSS ATTRIBUTABLE TO EASTMAN KODAK (687) 210 $442 COMPANY Basic and diuted ne: (loss) earnings per share attributable so Eastman Kadak Company common shareholders 5 (2.51) $ (0.87) $ (2.58) (0.05) Discontinued operations Extraordinary item Eastman Kodak Company CONSOLIDATED STATEMENT OF FINANCIAL POsITION As of December 31 2010 (In millions, except share and per share data) CURRENT ASSETS Cash and cash cquivalents Receivables, net Inventories, net Deferred income taxes Other current asaets 1,624 $ 2,024 1,259 1,395 Total currers assets Scwror Easeman Kodak Compaay 2010 10-K CAse 63 IMAGING Eastman Kodak Company CONSOLIDATED STATEMENT OF OPERATIONS For the Year Ended December 31, 20102009 2008 share datal Net sales 5,307 $6,323 $8,130 Lkensing & royakies Total nes sales Cost of sales 493 57,--A06-9,416 4638 S5243 $6,647 595 3,236$3,838$7247 $1.951 $1,768 ,169 1,2771,3021,606 Total cost of sales Gross profit Selling, general and aduninistrative expenses Reeanch and development coas Resiracturing costs, rationalization and other 226 Other operating expenses (inconel, net (336) 149 other income icharges), net and income taxes Interest expense Loss on early exzingaishment of debt, net Other income (charges), net Loss from continuing operations before income taxes Provision (henefit) for income taxes Loss from continuing operations Loss) earnings froe diacontinued operations, net of income Extraordinary item, net of tax NET LOSs Les& Net earning, attributable to noncontrolling interests NET LOSS ATTRIBUTABLE TO EASTMAN KODAK (687) 210 $442 COMPANY Basic and diuted ne: (loss) earnings per share attributable so Eastman Kadak Company common shareholders 5 (2.51) $ (0.87) $ (2.58) (0.05) Discontinued operations Extraordinary item Eastman Kodak Company CONSOLIDATED STATEMENT OF FINANCIAL POsITION As of December 31 2010 (In millions, except share and per share data) CURRENT ASSETS Cash and cash cquivalents Receivables, net Inventories, net Deferred income taxes Other current asaets 1,624 $ 2,024 1,259 1,395 Total currers assets Scwror Easeman Kodak Compaay 2010 10-K