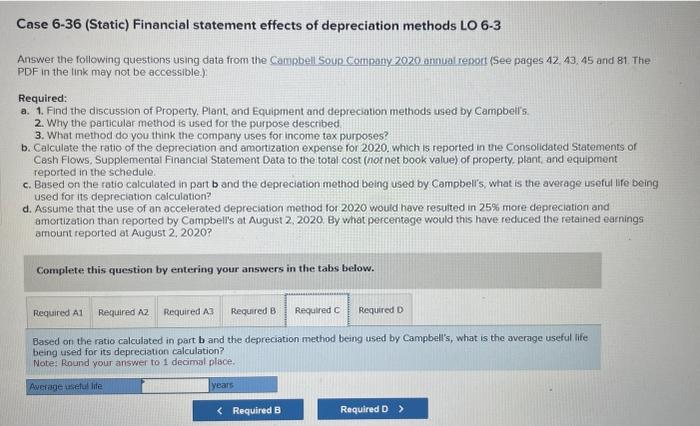

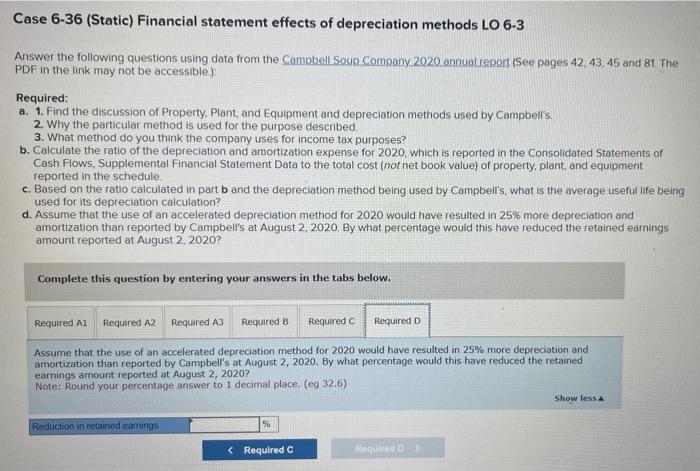

Case 6-36 (Static) Financial statement effects of depreciation methods LO 6-3 Answer the following questions using data from the Sampbell Soup Company 2020 annual report (See pages 42,43,45 and 81 . The PDF in the link may not be accessible.) Required: a. 1. Find the discussion of Property, Plant, and Equipment and depreciation methods used by Campbells. 2. Why the particular method is used for the purpose described. 3. What method do you think the company uses for income tax purposes? b. Calculate the ratio of the depreciation and amortization expense for 2020 , which is reported in the Consolidated Statements of Cash Flows. Supplemental Financial Statement Data to the total cast (not net book value) of property, plant, and equipment reported in the schedule. c. Based on the ratio calculated in part b and the depreciation method being used by Campbell's, what is the average useful life being used for its depreciation calculation? d. Assume that the use of an accelerated depreciation method for 2020 would have resulted in 25% more depreciation and amortization than reported by Campbell's at August 2,2020. By what percentage would this have reduced the retained earnings amount reported at August 2, 2020? Complete this question by entering your answers in the tabs below. What method do you think the company uses for income tax purposes? Case 6-36 (Static) Financial statement effects of depreciation methods LO 6-3 Answer the following questions using data from the Campbell Soup Company.2020 annual report (See pages 42, 43,45 and 81 The PDF in the link may not be accessible.). Required: a. 1. Find the discussion of Property. Plant, and Equipment and depreciation methods used by Campbell's. 2. Why the particular method is used for the purpose described. 3. What method do you think the company uses for income tax purposes? b. Calculate the ratio of the depreciation and amortization expense for 2020 , which is reported in the Consolidated Statements of Cash Flows, Supplementai Financial Statement Data to the total cost (not net book value) of property, plant, and equipment reported in the schedule. c. Based on the ratio calculated in part b and the depreciation method being used by Campbell's, what is the average useful life being used for its depreciation calculation? d. Assume that the use of an accelerated depreciation method for 2020 would have resulted in 25% more depreciation and amortization than reported by Campbell's at August 2,2020. By what percentage would this have reduced the retained earnings amount reported at August 2, 2020? Complete this question by entering your answers in the tabs below. Find the discussion of Property, Plant, and Equipment and depreciation methods used by Campbell's. Case 6-36 (Static) Financial statement effects of depreciation methods LO 6-3 POF in the link may not be accessible) Required: 2. Why the particular method is used for the puipose described 3. What method do you thenk the compary uses for inconse tax purposes? b. Caiculate the ratio of the depreclation and ampiticetion experse for 2020 , which is reported in the Consolidated staterrenas of reported in the schedule used for its depreciation calculation? amount reported at August 2.2020? Complete this question by entering your answers in the tabs below. Wiry the particutar anethod in und for the purpose described. Case 6-36 (Static) Financial statement effects of depreciation methods LO 6-3 Answer the following questions using data from the Compbell Soup Company 2020 annual report (See pages 42,43,45 and 81 . The PDF in the link may not be accessible.): Required: a. 1. Find the discussion of Property. Plant, and Equipment and depreciation methods used by Campbell's. 2. Why the particular method is used for the purpose described. 3. What method do you think the company uses for income tax purposes? b. Calculate the ratio of the depreciation and amortization expense for 2020 . which is reported in the Consolidated Statements of Cash Flows, Supplementai Financial Statement Data to the total cost (not net book value) of property, plant, and equipment reported in the schedule. c. Based on the ratio calculated in part b and the depreciation method being used by Campbell's, what is the average useful life being used for its depreciation calculation? d. Assume that the use of an accelerated depreciation method for 2020 would have resuited in 25% more depreciation and amortization than reported by Campbell's at August 2,2020. By what percentage would this have reduced the retained earnings amount reported at August 2, 2020? Complete this question by entering your answers in the tabs below. Based on the ratio calculated in part b and the depreciation method being used by Campbell's, what is the average useful life being used for its depreciation calculation? Notes Round your answer to 1 decimal place. Case 6-36 (Static) Financial statement effects of depreciation methods LO 6-3 Answer the following questions using data from the Campbell Soup Company 2020 annual report (See pages 42,43, 45 and 81 The PDF in the link may not be accessible). Required: a. 1. Find the discussion of Property, Plant, and Equipment and depreciation methods used by Campbeli's 2. Why the particular method is used for the purpose described. 3. What method do you think the company uses for income tax purposes? b. Calculate the ratio of the depreciation and amortization expense for 2020 , which is reported in the Consolidated Statements of Cash Flows, Supplemental Financial Statement Data to the total cost (not net book value) of property. plant, and equipment reported in the schedule. c. Based on the ratio calculated in part b and the depreciation method being used by Campbell's, what is the average useful life being used for its depreciation calculation? d. Assume that the use of an accelerated depreciation method for 2020 would have resulted in 25% more depreclation and amortization than reported by Campbell's at August 2, 2020. By what percentage would this have reduced the retained earnings amount reported at August 2, 2020? Complete this question by entering your answers in the tabs below. Calculate the ratio of the depreciation and amortization expense for 2020 , which is reported in the Consolidated Statements of Cash Flows, Supplemental Financial Statement Data to the total cost (not net book value) of property, plant, and equipment reported in the schedule. Note: Round your percentage answer to 1 decimal place. (eg 32.6) Case 6-36 (Static) Financial statement effects of depreciation methods LO 6-3 Answer the following questions using data from the Campbell Soup Company 2020 annual report (See pages 42,43,45 and 81 . The PDF in the link may not be accessible.) Required: a. 1. Find the discussion of Property, Plant, and Equipment and depreciation methods used by Campbell's. 2. Why the particular method is used for the purpose described. 3. What method do you think the company uses for income tax purposes? b. Calculate the ratio of the depreciation and amortization expense for 2020 , which is reported in the Consolidated Statements of Cash Flows, Supplemental Financial Statement Data to the total cost (not net book value) of property, plant, and equipment reported in the schedule. c. Based on the ratio calculated in part b and the depreciation method being used by Campbell's, what is the average useful life being used for its depreciation calculation? d. Assume that the use of an accelerated depreciation method for 2020 would have resulted in 25% more depreciation and amortization than reported by Campbell's at August 2,2020. By what percentage would this have reduced the retained eamings amount reported at August 2, 2020? Complete this question by entering your answers in the tabs below. Assume that the use of an accelerated depreciation method for 2020 would have resulted in 25% more depreciation and amortization than reported by Campbell's at August 2, 2020. By what percentage would this have reduced the retained earnings amount reported at August 2, 2020? Note: Round your percentage answer to 1 decimal place. (eg 32.6)