Case 7.3

Please answer Section (2): (a) as reported and (b) after capitalization of operating leases

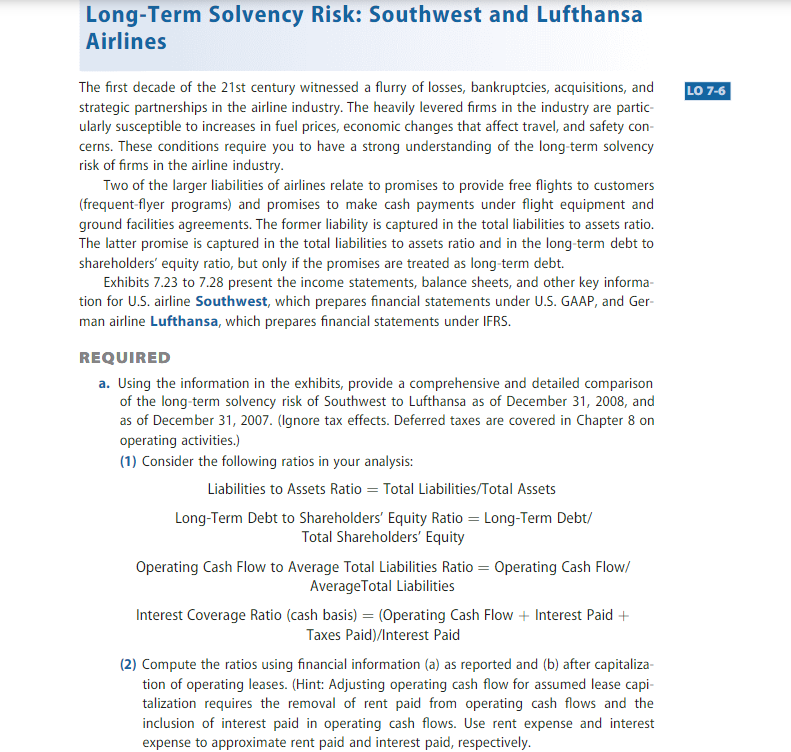

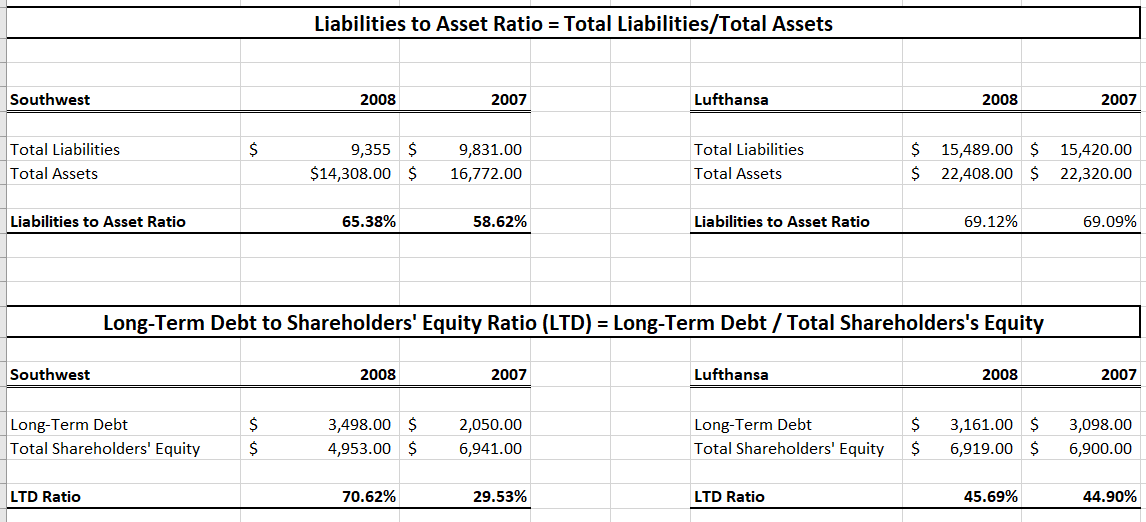

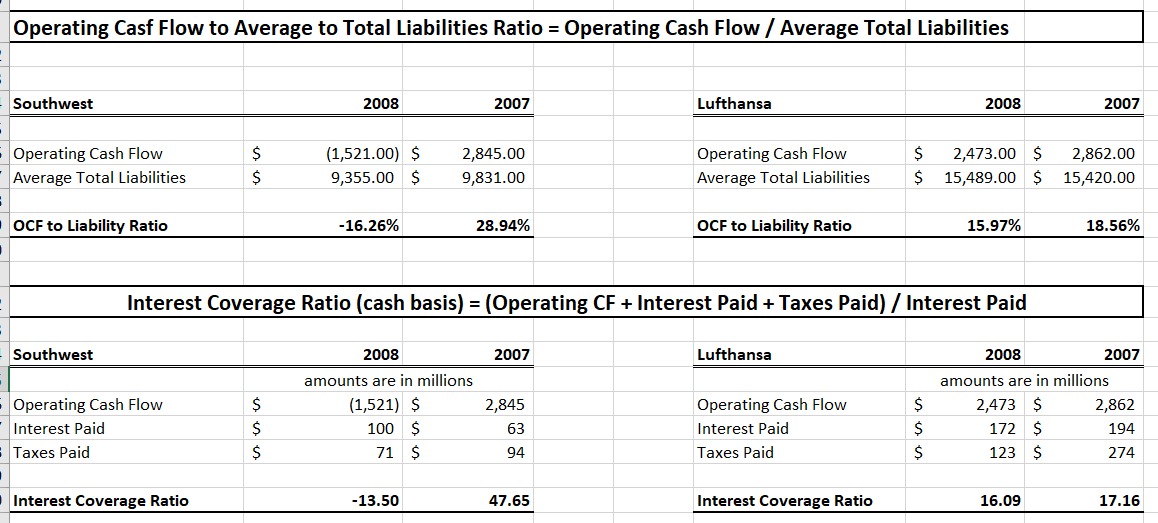

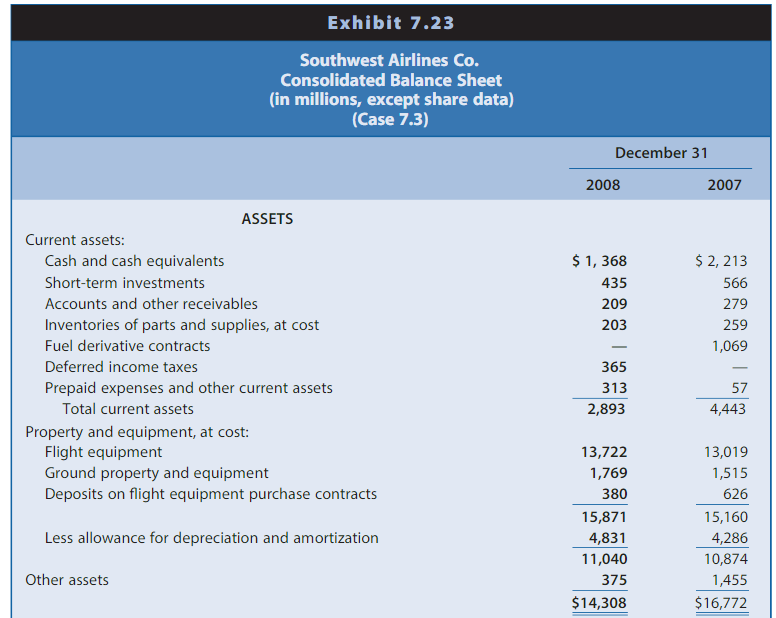

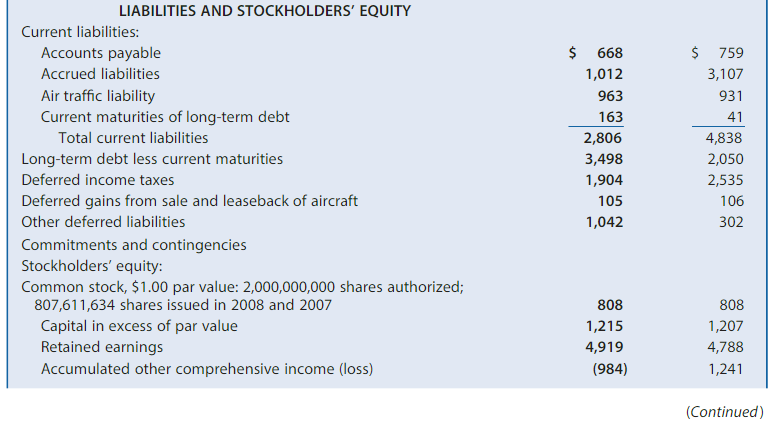

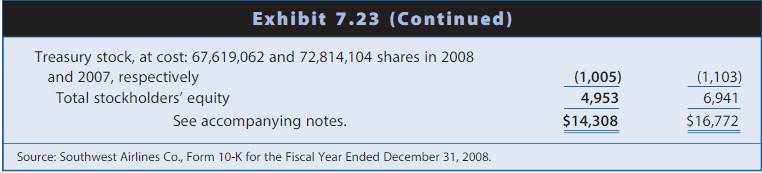

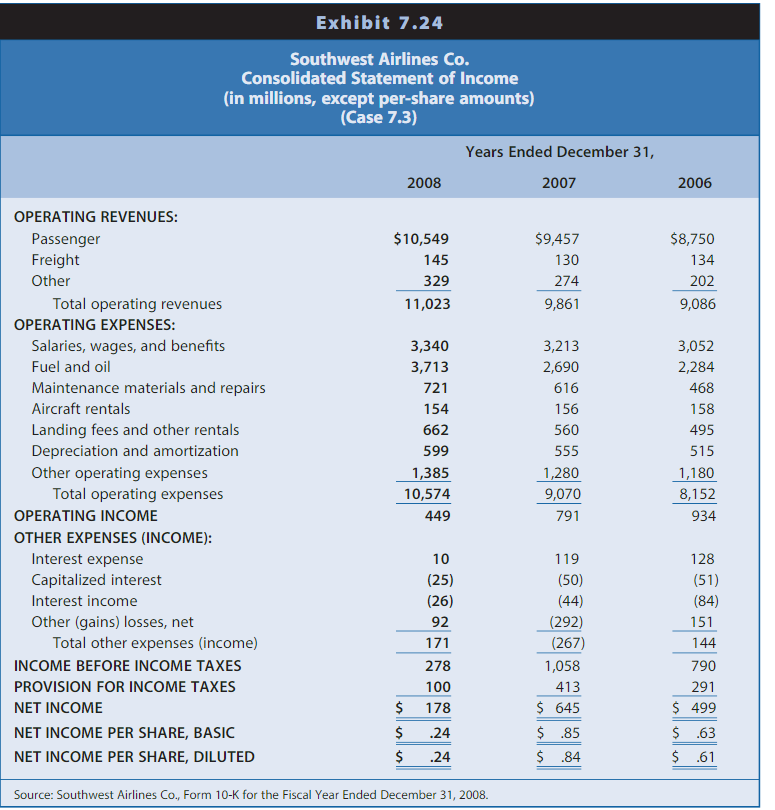

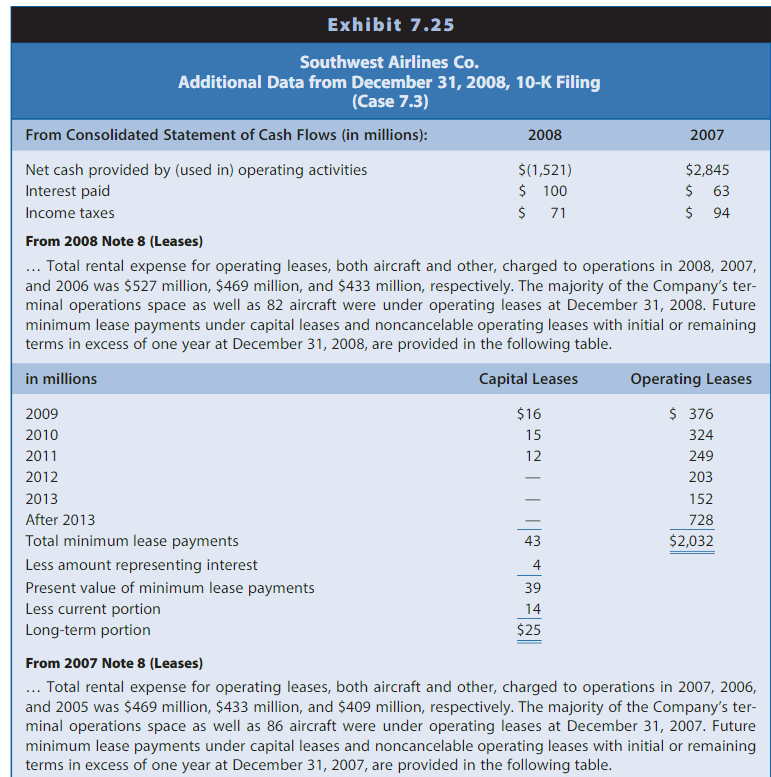

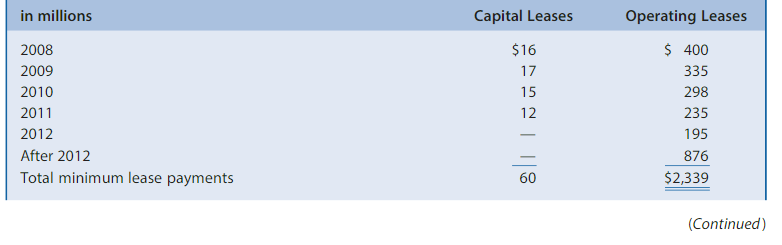

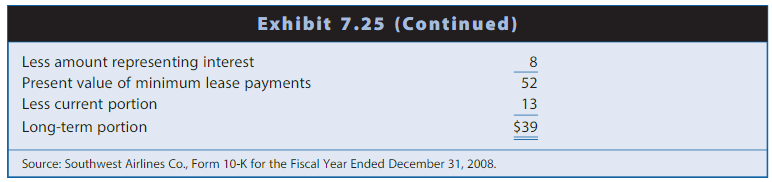

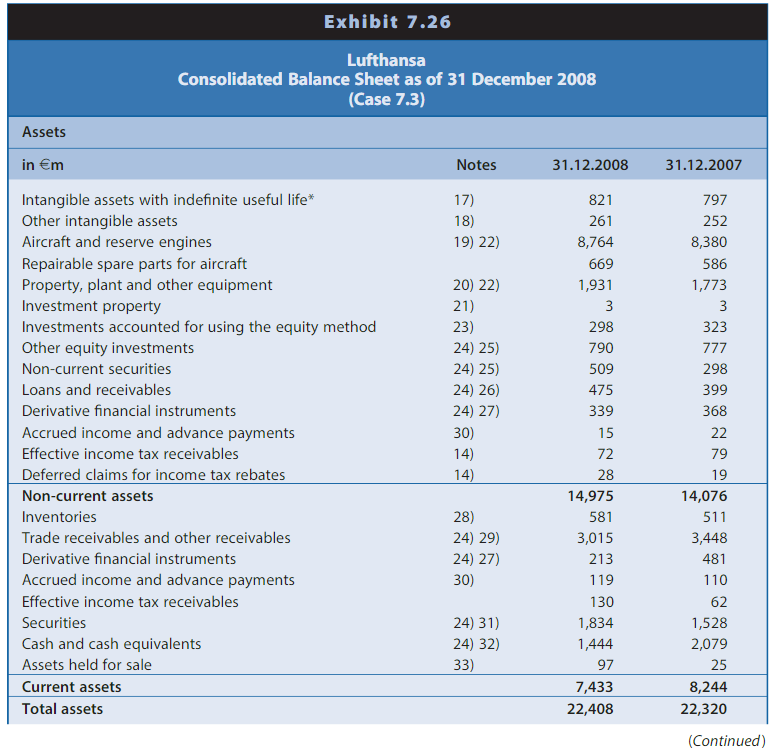

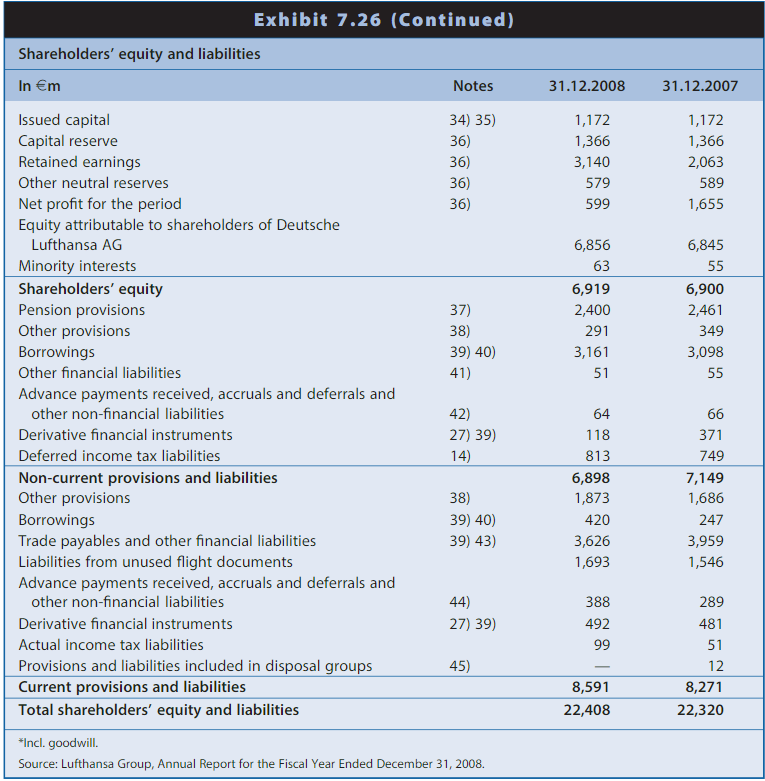

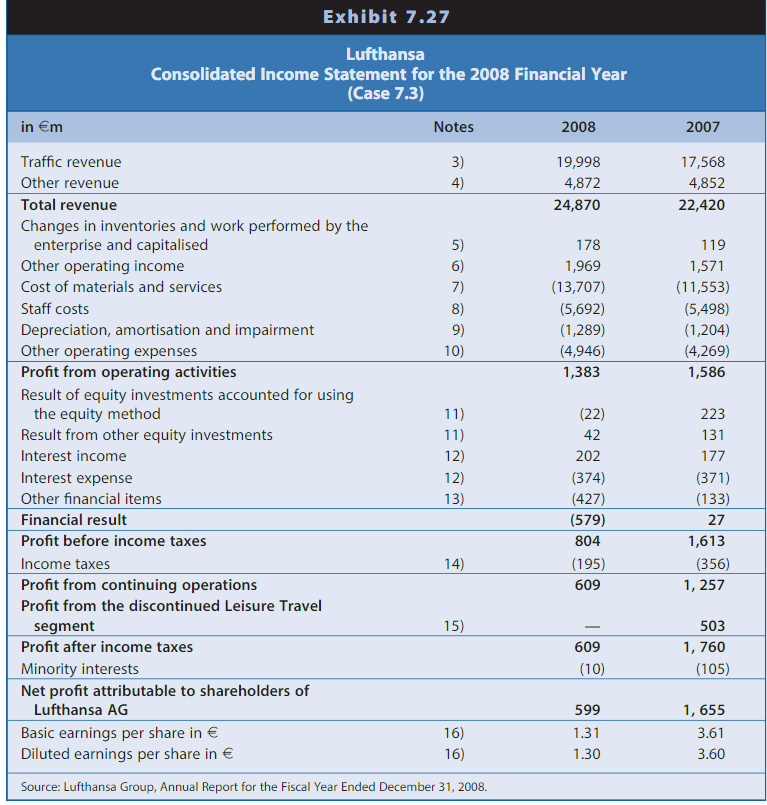

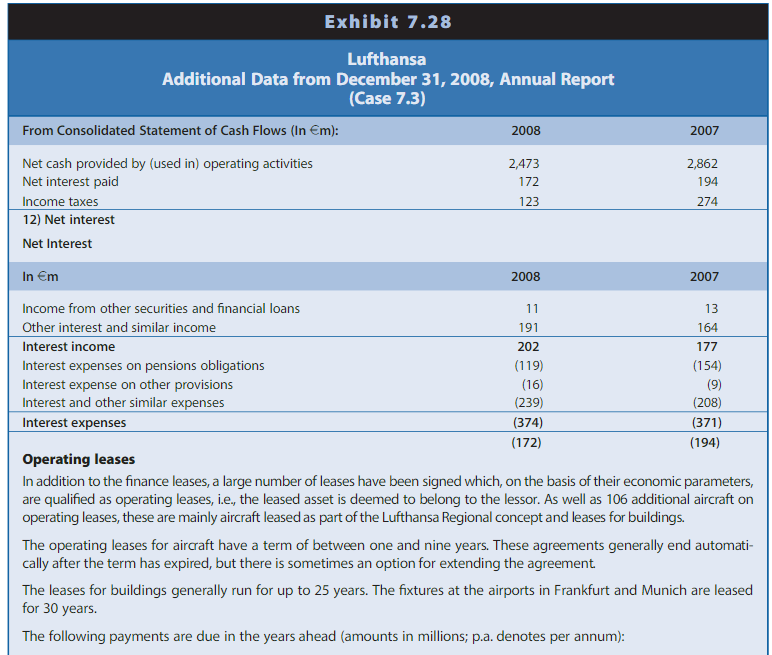

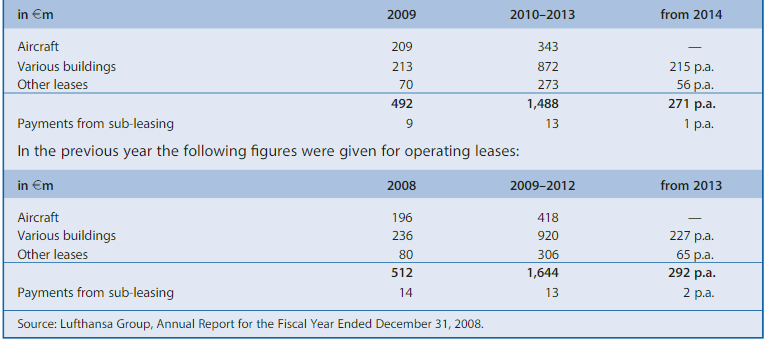

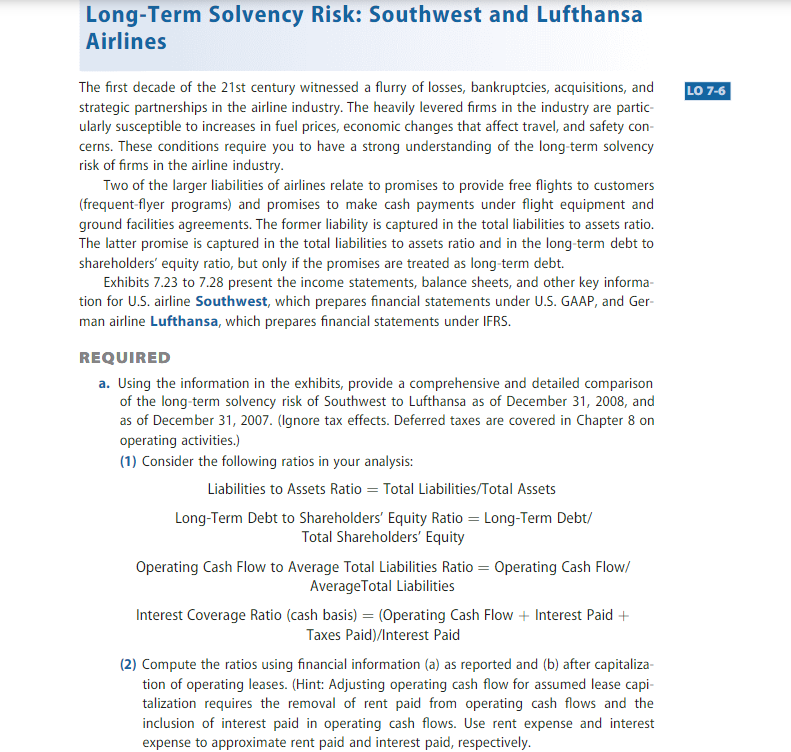

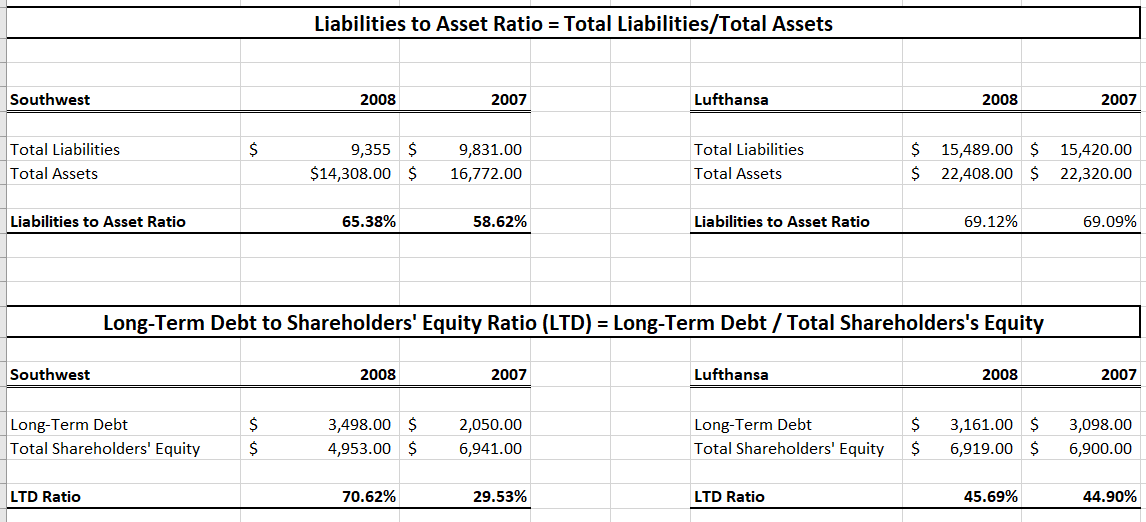

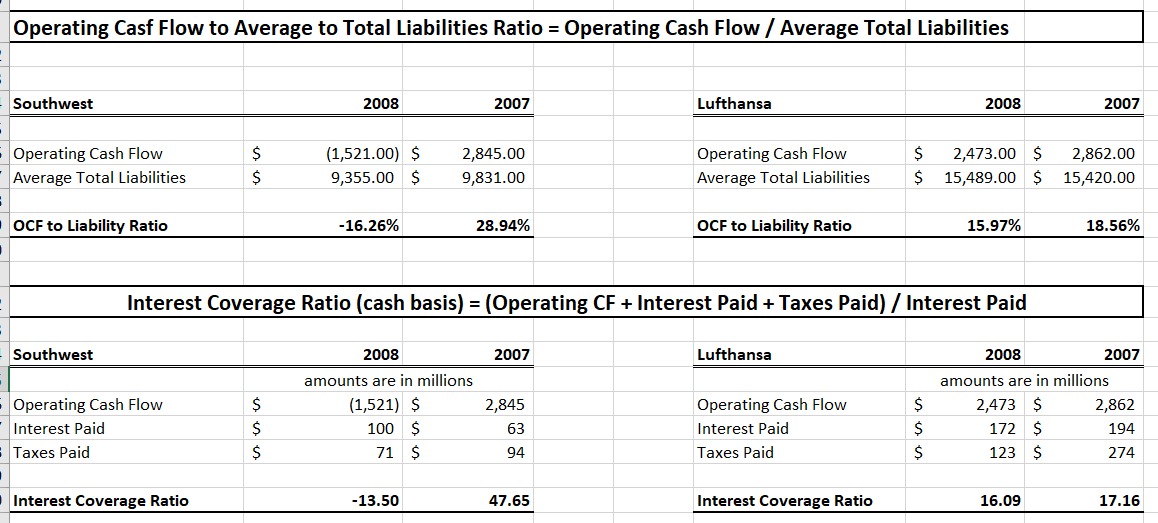

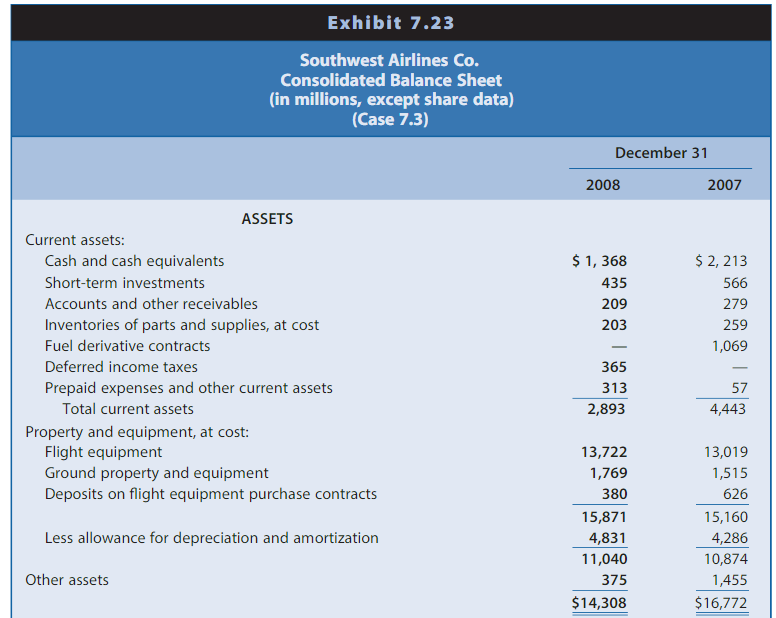

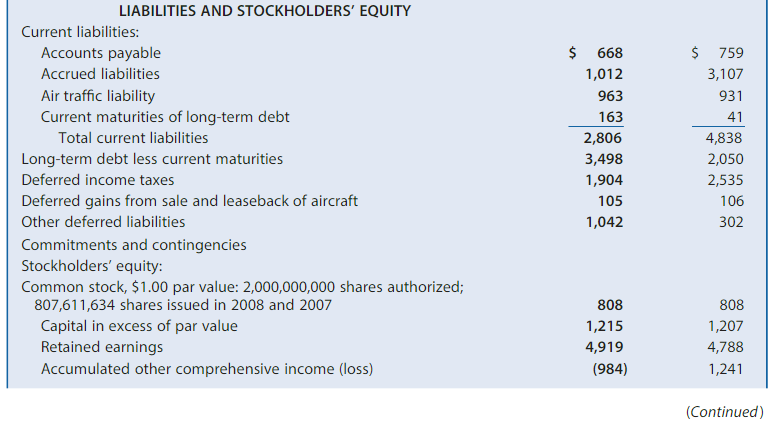

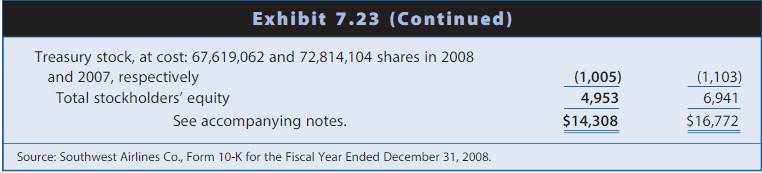

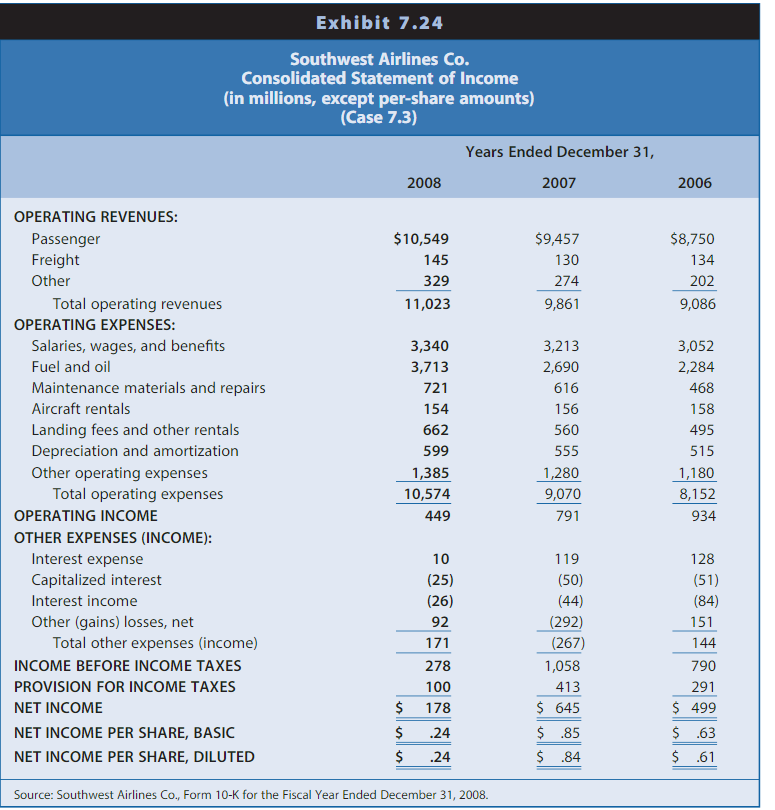

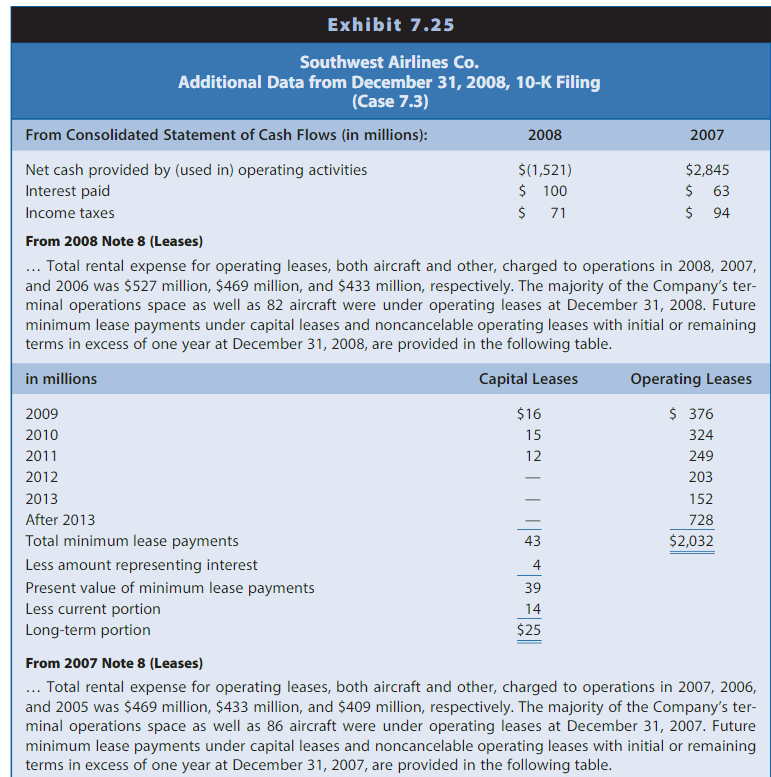

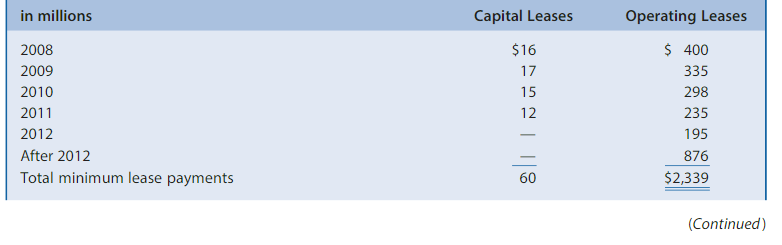

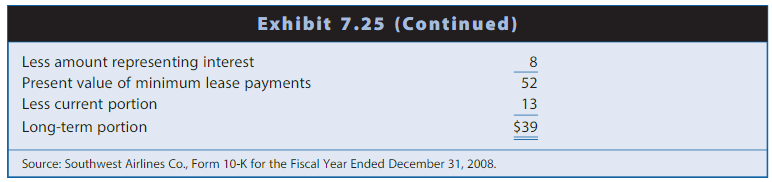

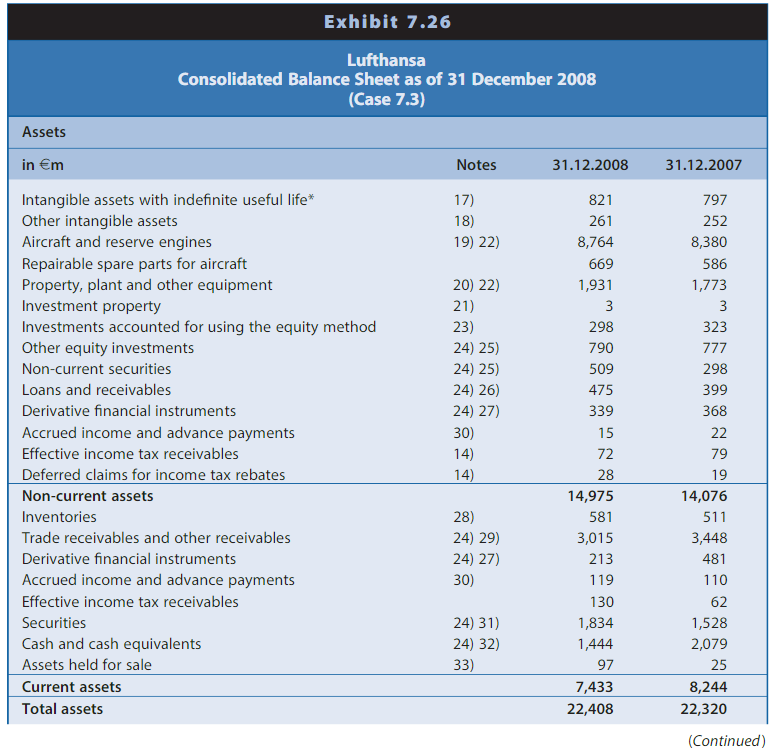

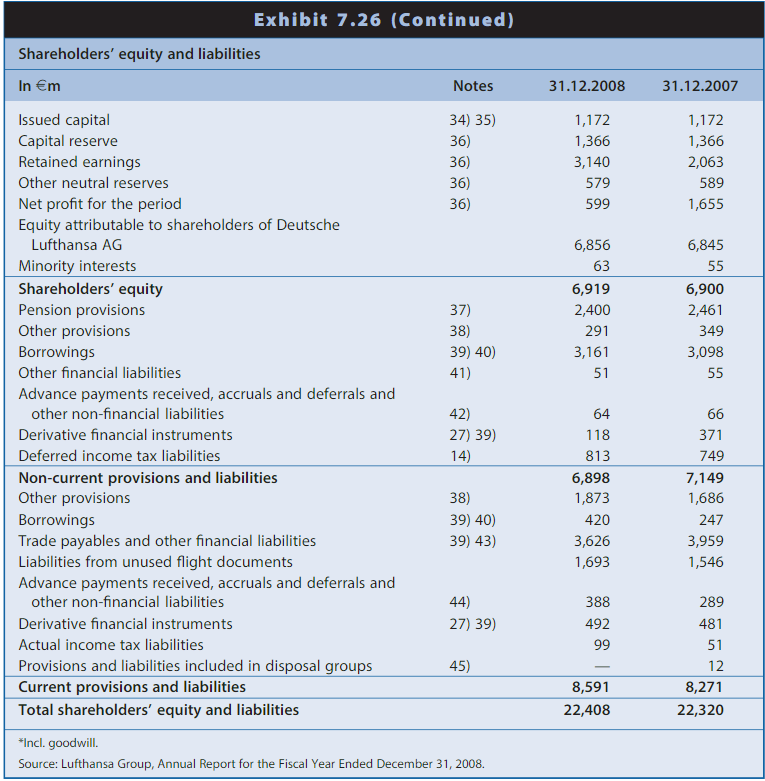

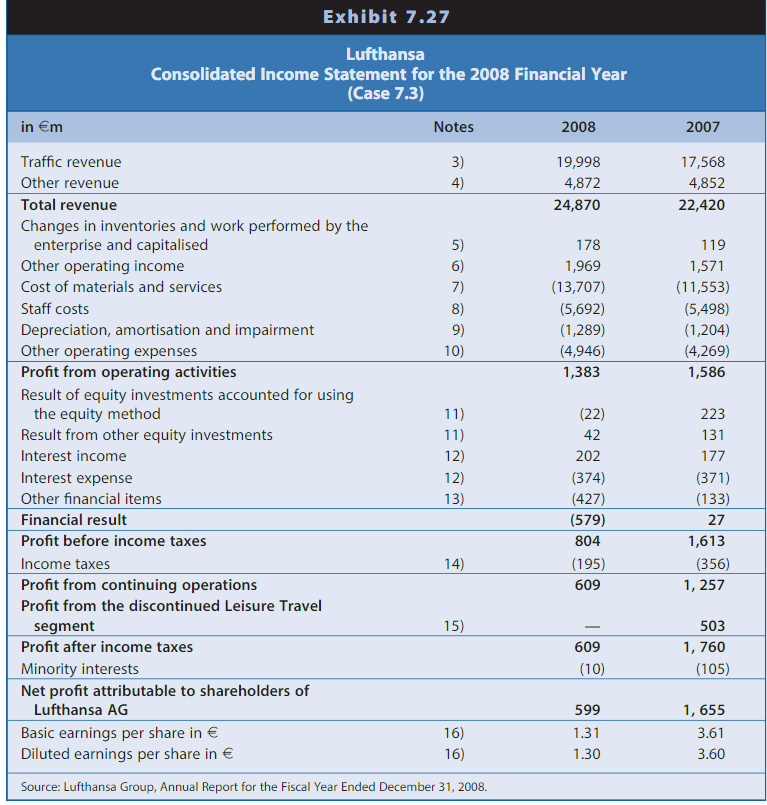

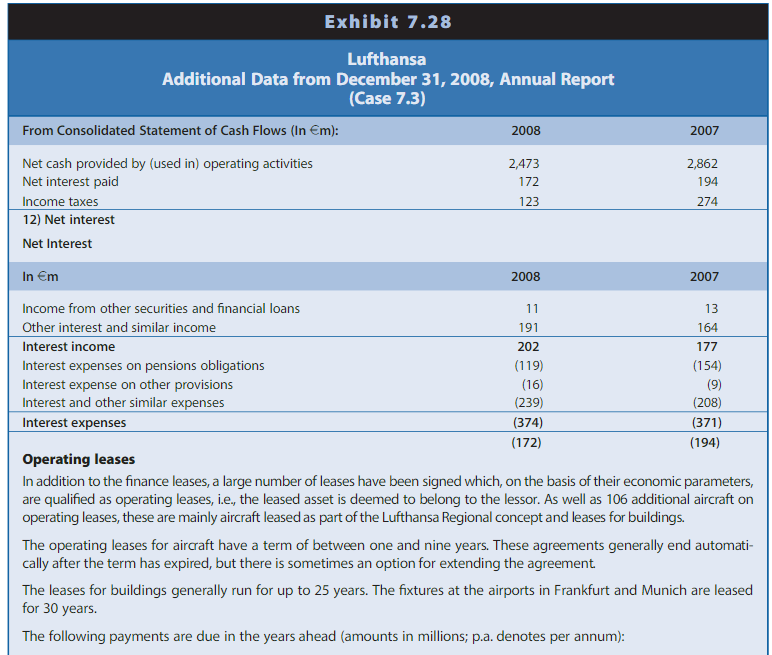

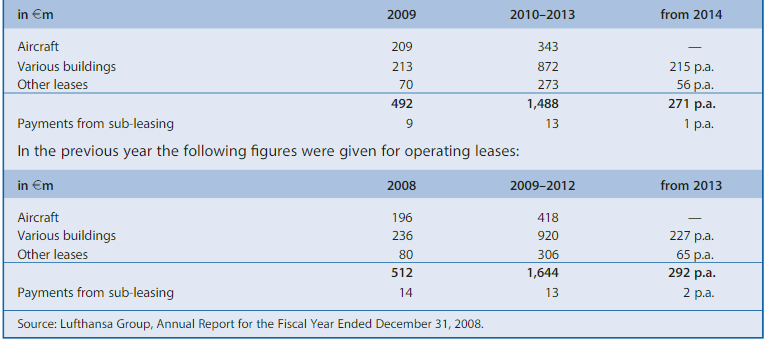

Long-Term Solvency Risk: Southwest and Lufthansa Airlines The first decade of the 21 st century witnessed a flurry of losses, bankruptcies, acquisitions, and strategic partnerships in the airline industry. The heavily levered firms in the industry are particularly susceptible to increases in fuel prices, economic changes that affect travel, and safety concerns. These conditions require you to have a strong understanding of the long-term solvency risk of firms in the airline industry. Two of the larger liabilities of airlines relate to promises to provide free flights to customers (frequent-flyer programs) and promises to make cash payments under flight equipment and ground facilities agreements. The former liability is captured in the total liabilities to assets ratio. The latter promise is captured in the total liabilities to assets ratio and in the long-term debt to shareholders' equity ratio, but only if the promises are treated as long-term debt. Exhibits 7.23 to 7.28 present the income statements, balance sheets, and other key information for U.S. airline Southwest, which prepares financial statements under U.S. GAAP, and German airline Lufthansa, which prepares financial statements under IFRS. REQUIRED a. Using the information in the exhibits, provide a comprehensive and detailed comparison of the long-term solvency risk of Southwest to Lufthansa as of December 31, 2008, and as of December 31,2007 . (Ignore tax effects. Deferred taxes are covered in Chapter 8 on operating activities.) (1) Consider the following ratios in your analysis: Liabilities to Assets Ratio = Total Liabilities/Total Assets Long-Term Debt to Shareholders' Equity Ratio = Long-Term Debt/ Total Shareholders' Equity Operating Cash Flow to Average Total Liabilities Ratio = Operating Cash Flow/ AverageTotal Liabilities Interest Coverage Ratio (cash basis) = (Operating Cash Flow + Interest Paid + Taxes Paid)/Interest Paid (2) Compute the ratios using financial information (a) as reported and (b) after capitalization of operating leases. (Hint: Adjusting operating cash flow for assumed lease capitalization requires the removal of rent paid from operating cash flows and the inclusion of interest paid in operating cash flows. Use rent expense and interest expense to approximate rent paid and interest paid, respectively. Operating Casf Flow to Average to Total Liabilities Ratio = Operating Cash Flow / Average Total Liabilities Exhibit 7.23 (Continued) Exhibit 7.23 (Continued) Treasury stock, at cost: 67,619,062 and 72,814,104 shares in 2008 and 2007, respectively Total stockholders' equity \begin{tabular}{ll} 4,953(1,005) & \( \frac{(1,103)}{\hline 6,941} \) \\ & $16,772 \\ \hline \end{tabular} See accompanying notes. Source: Southwest Airlines Co., Form 10-K for the Fiscal Year Ended December 31, 2008. Exhibit 7.24 ... Total rental expense for operating leases, both aircraft and other, charged to operations in 2008, 2007, and 2006 was $527 million, $469 million, and $433 million, respectively. The majority of the Company's terminal operations space as well as 82 aircraft were under operating leases at December 31, 2008. Future minimum lease payments under capital leases and noncancelable operating leases with initial or remaining terms in excess of one year at December 31, 2008, are provided in the following table. From 2007 Note 8 (Leases) ... Total rental expense for operating leases, both aircraft and other, charged to operations in 2007, 2006, and 2005 was $469 million, $433 million, and $409 million, respectively. The majority of the Company's terminal operations space as well as 86 aircraft were under operating leases at December 31,2007 . Future minimum lease payments under capital leases and noncancelable operating leases with initial or remaining terms in excess of one year at December 31,2007 , are provided in the following table. (Continued) Exhibit 7.25 (Continued) Less amount representing interest 528 Present value of minimum lease payments $3913 Less current portion Long-term portion Source: Southwest Airlines Co., Form 10-K for the Fiscal Year Ended December 31, 2008. Exhibit 7.26 (Continued) Shareholders' equity and liabilities *Incl. goodwill. Source: Lufthansa Group, Annual Report for the Fiscal Year Ended December 31, 2008. Source: Lufthansa Group, Annual Report for the Fiscal Year Ended December 31, 2008. Exhibit 7.28 \begin{tabular}{|lrrr|} \hline in m & 2009 & 20102013 & from 2014 \\ \hline Aircraft & 209 & 343 & \\ Various buildings & 213 & 872 & 215 p.a. \\ Other leases & 70 & 273 & 56 p.a. \\ \hline Payments from sub-leasing & 492 & 1,488 & 271 p.a. \\ \hline \end{tabular} In the previous year the following figures were given for operating leases