Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 8 - 1 LO 3 On December 3 1 , Year 7 , Pepper Company, a public company, agreed to a business combination with

Case

LO

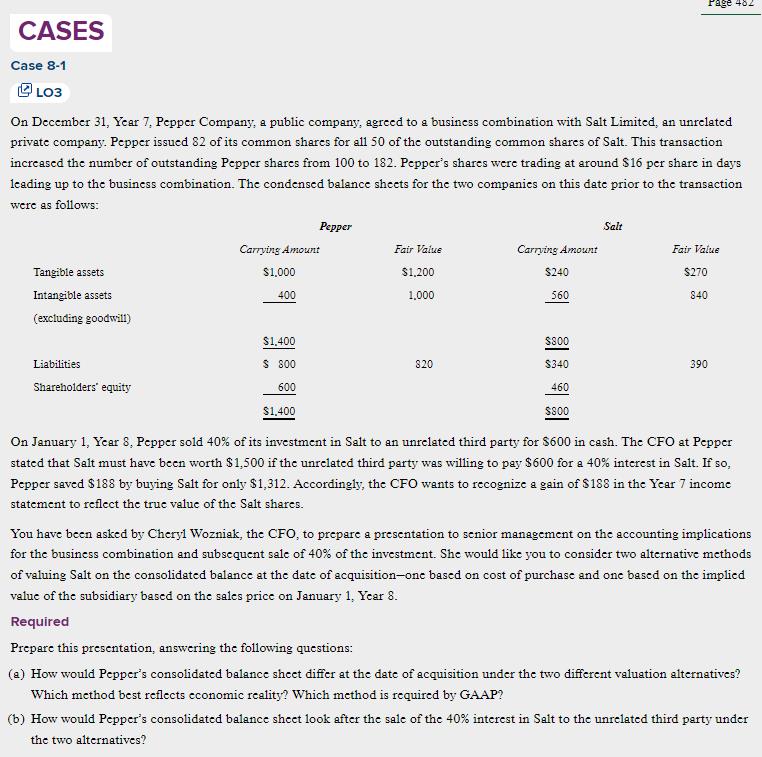

On December Year Pepper Company, a public company, agreed to a business combination with Salt Limited, an unrelated

private company. Pepper issued of its common shares for all of the outstanding common shares of Salt. This transaction

increased the number of outstanding Pepper shares from to Pepper's shares were trading at around $ per share in days

leading up to the business combination. The condensed balance sheets for the two companies on this date prior to the transaction

were as follows:

On January Year Pepper sold of its investment in Salt to an unrelated third party for $ in cash. The CFO at Pepper

stated that Salt must have been worth $ if the unrelated third party was willing to pay $ for a interest in Salt. If so

Pepper saved $ by buying Salt for only $ Accordingly, the CFO wants to recognize a gain of $ in the Year income

statement to reflect the true value of the Salt shares.

You have been asked by Cheryl Wozniak, the CFO, to prepare a presentation to senior management on the accounting implications

for the business combination and subsequent sale of of the investment. She would like you to consider two alternative methods

of valuing Salt on the consolidated balance at the date of acquisitionone based on cost purchase and one based on the implied

value of the subsidiary based on the sales price on January Year

Required

Prepare this presentation, answering the following questions:

a How would Pepper's consolidated balance sheet differ at the date of acquisition under the two different valuation alternatives?

Which method best reflects economic reality? Which method is required by GAAP?

b How would Pepper's consolidated balance sheet look after the sale of the interest in Salt to the unrelated third party under

the two alternatives?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started