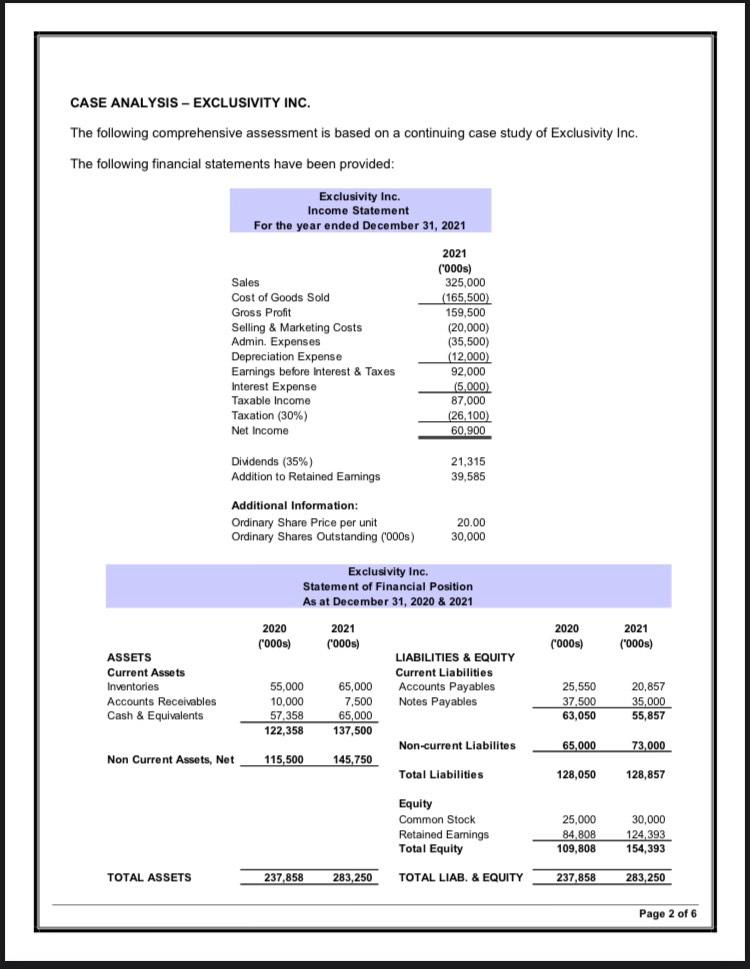

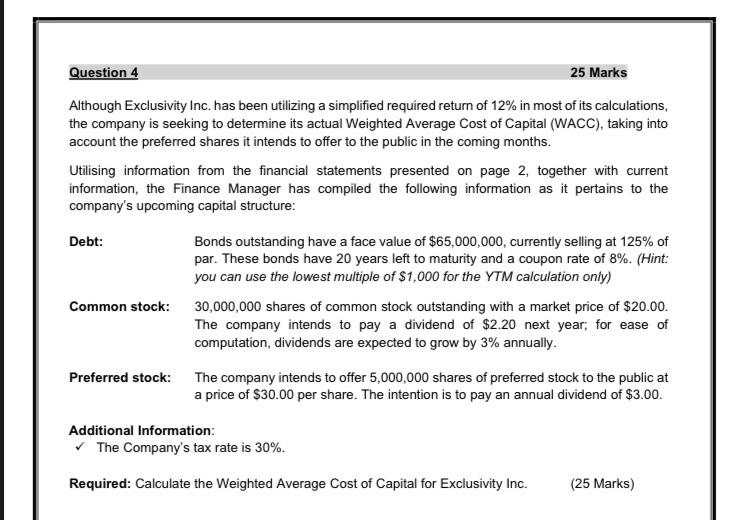

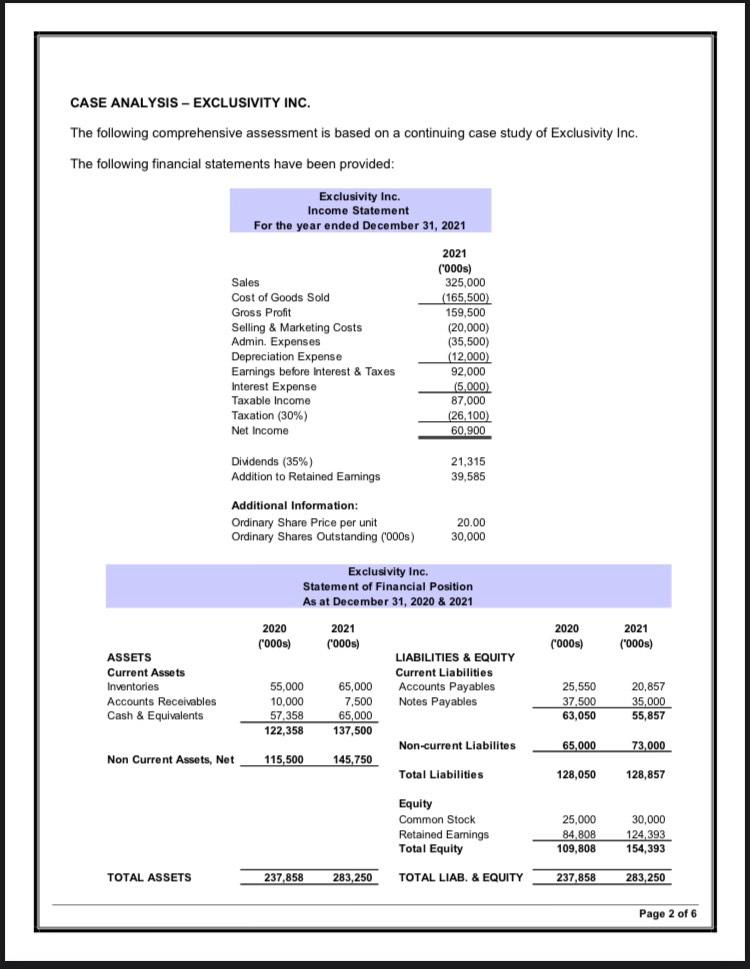

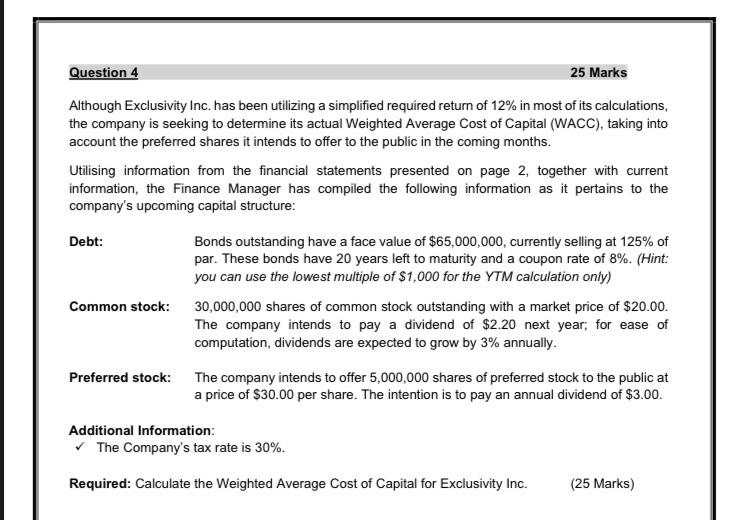

CASE ANALYSIS - EXCLUSIVITY INC. The following comprehensive assessment is based on a continuing case study of Exclusivity Inc. The following financial statements have been provided: Although Exclusivity Inc. has been utilizing a simplified required return of 12% in most of its calculations, the company is seeking to determine its actual Weighted Average Cost of Capital (WACC), taking into account the preferred shares it intends to offer to the public in the coming months. Utilising information from the financial statements presented on page 2, together with current information, the Finance Manager has compiled the following information as it pertains to the company's upcoming capital structure: Debt: Bonds outstanding have a face value of $65,000,000, currently selling at 125% of par. These bonds have 20 years left to maturity and a coupon rate of 8%. (Hint: you can use the lowest multiple of $1,000 for the YTM calculation only) Common stock: 30,000,000 shares of common stock outstanding with a market price of $20.00. The company intends to pay a dividend of $2.20 next year; for ease of computation, dividends are expected to grow by 3% annually. Preferred stock: The company intends to offer 5,000,000 shares of preferred stock to the public at a price of $30.00 per share. The intention is to pay an annual dividend of $3.00. Additional Information: The Company's tax rate is 30%. Required: Calculate the Weighted Average Cost of Capital for Exclusivity Inc. (25 Marks) CASE ANALYSIS - EXCLUSIVITY INC. The following comprehensive assessment is based on a continuing case study of Exclusivity Inc. The following financial statements have been provided: Although Exclusivity Inc. has been utilizing a simplified required return of 12% in most of its calculations, the company is seeking to determine its actual Weighted Average Cost of Capital (WACC), taking into account the preferred shares it intends to offer to the public in the coming months. Utilising information from the financial statements presented on page 2, together with current information, the Finance Manager has compiled the following information as it pertains to the company's upcoming capital structure: Debt: Bonds outstanding have a face value of $65,000,000, currently selling at 125% of par. These bonds have 20 years left to maturity and a coupon rate of 8%. (Hint: you can use the lowest multiple of $1,000 for the YTM calculation only) Common stock: 30,000,000 shares of common stock outstanding with a market price of $20.00. The company intends to pay a dividend of $2.20 next year; for ease of computation, dividends are expected to grow by 3% annually. Preferred stock: The company intends to offer 5,000,000 shares of preferred stock to the public at a price of $30.00 per share. The intention is to pay an annual dividend of $3.00. Additional Information: The Company's tax rate is 30%. Required: Calculate the Weighted Average Cost of Capital for Exclusivity Inc. (25 Marks)