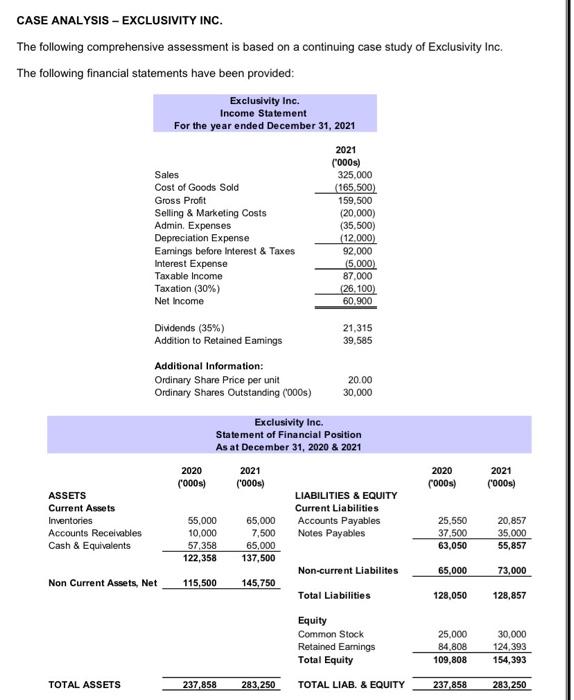

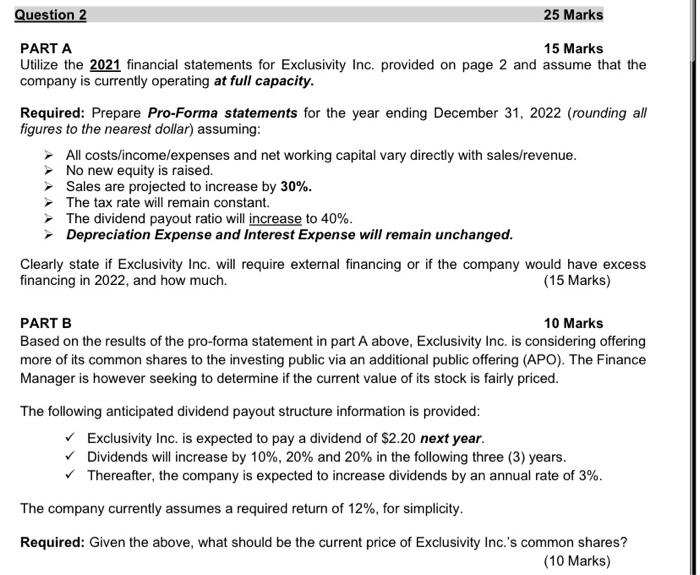

CASE ANALYSIS - EXCLUSIVITY INC. The following comprehensive assessment is based on a continuing case study of Exclusivity Inc. The following financial statements have been provided: PART A 15 Marks Utilize the 2021 financial statements for Exclusivity Inc. provided on page 2 and assume that the company is currently operating at full capacity. Required: Prepare Pro-Forma statements for the year ending December 31, 2022 (rounding all figures to the nearest dollar) assuming: - All costs/income/expenses and net working capital vary directly with sales/revenue. > No new equity is raised. - Sales are projected to increase by 30%. - The tax rate will remain constant. The dividend payout ratio will increase to 40%. - Depreciation Expense and Interest Expense will remain unchanged. Clearly state if Exclusivity Inc. will require external financing or if the company would have excess financing in 2022, and how much. (15 Marks) PART B 10 Marks Based on the results of the pro-forma statement in part A above, Exclusivity Inc. is considering offering more of its common shares to the investing public via an additional public offering (APO). The Finance Manager is however seeking to determine if the current value of its stock is fairly priced. The following anticipated dividend payout structure information is provided: Exclusivity Inc. is expected to pay a dividend of $2.20 next year. Dividends will increase by 10%,20% and 20% in the following three (3) years. Thereafter, the company is expected to increase dividends by an annual rate of 3%. The company currently assumes a required return of 12%, for simplicity. Required: Given the above, what should be the current price of Exclusivity Inc.'s common shares? CASE ANALYSIS - EXCLUSIVITY INC. The following comprehensive assessment is based on a continuing case study of Exclusivity Inc. The following financial statements have been provided: PART A 15 Marks Utilize the 2021 financial statements for Exclusivity Inc. provided on page 2 and assume that the company is currently operating at full capacity. Required: Prepare Pro-Forma statements for the year ending December 31, 2022 (rounding all figures to the nearest dollar) assuming: - All costs/income/expenses and net working capital vary directly with sales/revenue. > No new equity is raised. - Sales are projected to increase by 30%. - The tax rate will remain constant. The dividend payout ratio will increase to 40%. - Depreciation Expense and Interest Expense will remain unchanged. Clearly state if Exclusivity Inc. will require external financing or if the company would have excess financing in 2022, and how much. (15 Marks) PART B 10 Marks Based on the results of the pro-forma statement in part A above, Exclusivity Inc. is considering offering more of its common shares to the investing public via an additional public offering (APO). The Finance Manager is however seeking to determine if the current value of its stock is fairly priced. The following anticipated dividend payout structure information is provided: Exclusivity Inc. is expected to pay a dividend of $2.20 next year. Dividends will increase by 10%,20% and 20% in the following three (3) years. Thereafter, the company is expected to increase dividends by an annual rate of 3%. The company currently assumes a required return of 12%, for simplicity. Required: Given the above, what should be the current price of Exclusivity Inc.'s common shares