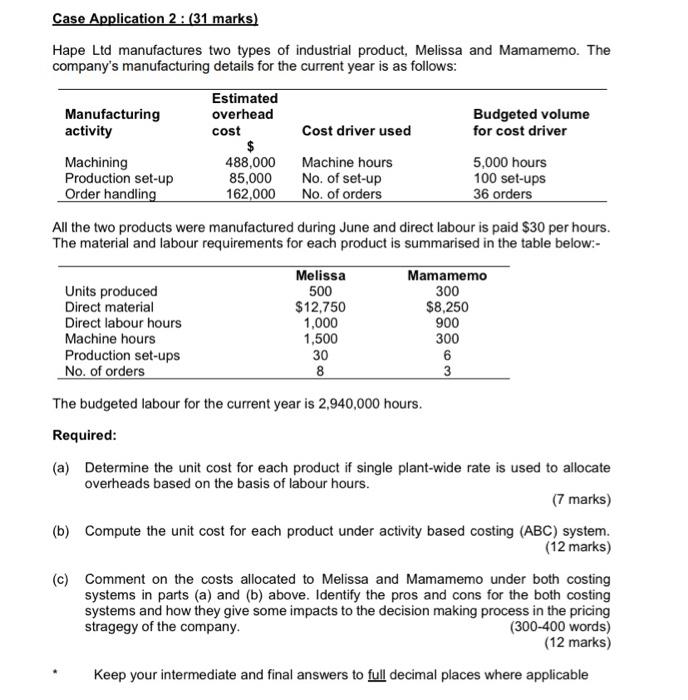

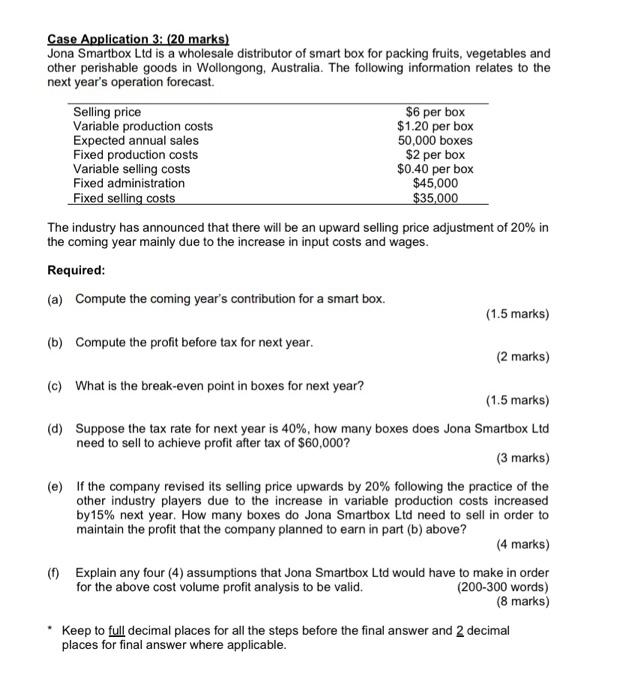

Case Application 2: (31 marks) Hape Ltd manufactures two types of industrial product, Melissa and Mamamemo. The company's manufacturing details for the current year is as follows: Estimated Manufacturing overhead Budgeted volume activity cost Cost driver used for cost driver $ Machining 488,000 Machine hours 5,000 hours Production set-up 85,000 No. of set-up 100 set-ups Order handling 162,000 No. of orders 36 orders All the two products were manufactured during June and direct labour is paid $30 per hours. The material and labour requirements for each product is summarised in the table below:- Mamamemo 300 Units produced Direct material Direct labour hours Machine hours Production set-ups No. of orders Melissa 500 $12,750 1,000 1,500 30 8 $8,250 900 300 6 3 The budgeted labour for the current year is 2,940,000 hours. Required: (a) Determine the unit cost for each product if single plant-wide rate is used to allocate overheads based on the basis of labour hours. (7 marks) (b) Compute the unit cost for each product under activity based costing (ABC) system. (12 marks) (c) Comment on the costs allocated to Melissa and Mamamemo under both costing systems in parts (a) and (b) above. Identify the pros and cons for the both costing systems and how they give some impacts to the decision making process in the pricing stragegy of the company. (300-400 words) (12 marks) Keep your intermediate and final answers to full decimal places where applicable Case Application 3: (20 marks) Jona Smartbox Ltd is a wholesale distributor of smart box for packing fruits, vegetables and other perishable goods in Wollongong, Australia. The following information relates to the next year's operation forecast. Selling price $6 per box Variable production costs $1.20 per box Expected annual sales 50,000 boxes Fixed production costs $2 per box Variable selling costs $0.40 per box Fixed administration $45,000 Fixed selling costs $35,000 The industry has announced that there will be an upward selling price adjustment of 20% in the coming year mainly due to the increase in input costs and wages. Required: (a) Compute the coming year's contribution for a smart box. (1.5 marks) (b) Compute the profit before tax for next year. (2 marks) (c) What is the break-even point in boxes for next year? (1.5 marks) (d) Suppose the tax rate for next year is 40%, how many boxes does Jona Smartbox Ltd need to sell to achieve profit after tax of $60,000? (3 marks) (e) If the company revised its selling price upwards by 20% following the practice of the other industry players due to the increase in variable production costs increased by15% next year. How many boxes do Jona Smartbox Ltd need to sell in order to maintain the profit that the company planned to earn in part (b) above? (4 marks) (0) Explain any four (4) assumptions that Jona Smartbox Ltd would have to make in order for the above cost volume profit analysis to be valid. (200-300 words) (8 marks) Keep to full decimal places for all the steps before the final answer and 2 decimal places for final answer where applicable