Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Background Live Nation Entertainment (Live Nation) is a publicly traded company headquartered in Beverly Hills, California. Live Nation has retained alliantgroup to identify

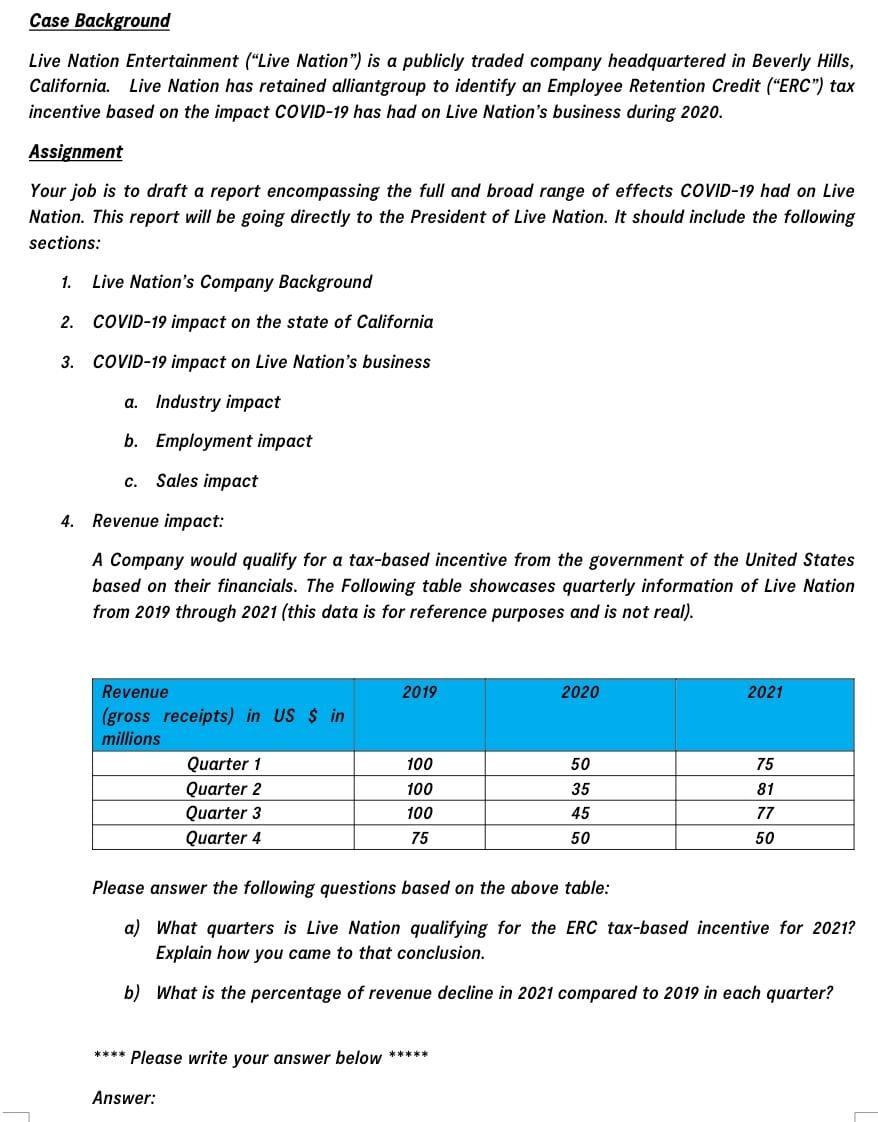

Case Background Live Nation Entertainment ("Live Nation") is a publicly traded company headquartered in Beverly Hills, California. Live Nation has retained alliantgroup to identify an Employee Retention Credit ("ERC") tax incentive based on the impact COVID-19 has had on Live Nation's business during 2020. Assignment Your job is to draft a report encompassing the full and broad range of effects COVID-19 had on Live Nation. This report will be going directly to the President of Live Nation. It should include the following sections: 1. Live Nation's Company Background 2. COVID-19 impact on the state of California 3. COVID-19 impact on Live Nation's business a. Industry impact b. Employment impact . Sales impact 4. Revenue impact: A Company would qualify for a tax-based incentive from the government of the United States based on their financials. The Following table showcases quarterly information of Live Nation from 2019 through 2021 (this data is for reference purposes and is not real). Revenue 2019 2020 2021 (gross receipts) in US $ in millions Quarter 1 100 50 75 Quarter 2 100 35 81 Quarter 3 Quarter 4 100 45 77 75 50 50 Please answer the following questions based on the above table: a) What quarters is Live Nation qualifying for the ERC tax-based incentive for 2021? Explain how you came to that conclusion. b) What is the percentage of revenue decline in 2021 compared to 2019 in each quarter? **** Please write your answer below ***** Answer:

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Live Nation is qualifying for the ERC taxbased incentive for 2021 in Quarter 1 and Quarter 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started