Answered step by step

Verified Expert Solution

Question

1 Approved Answer

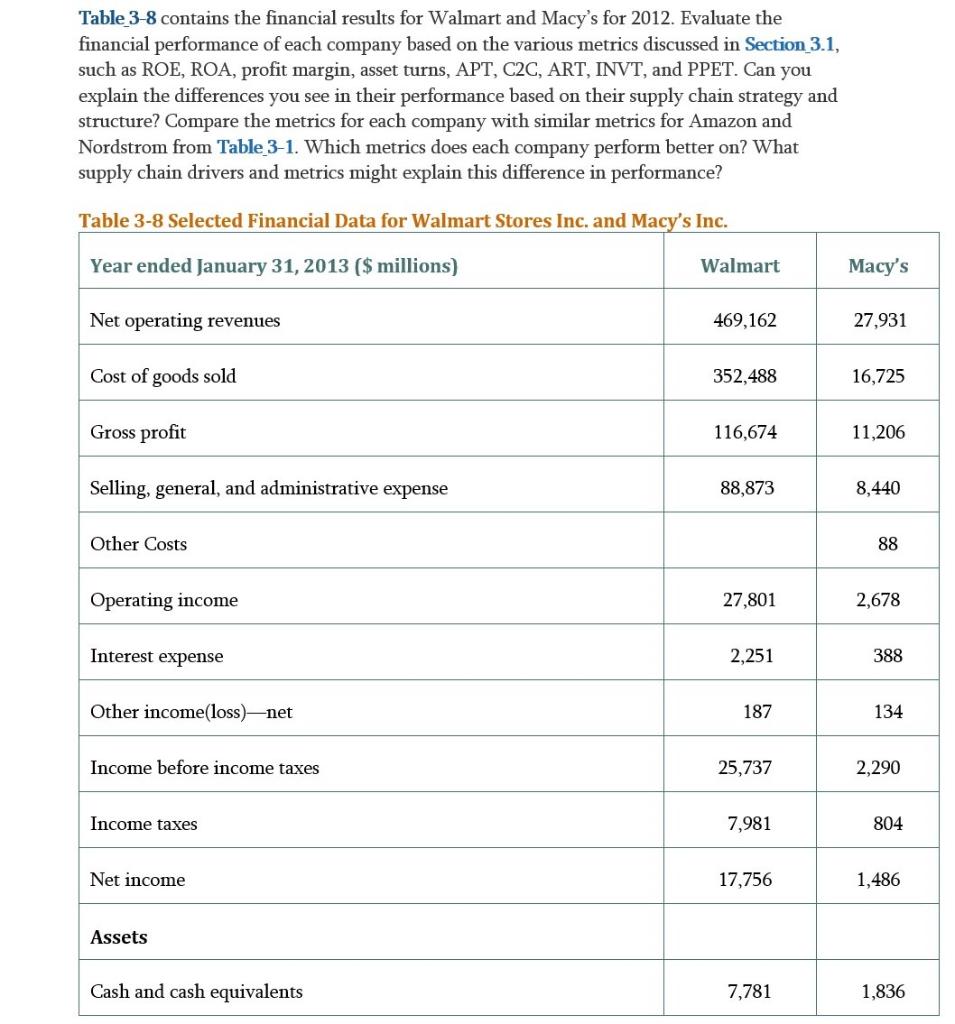

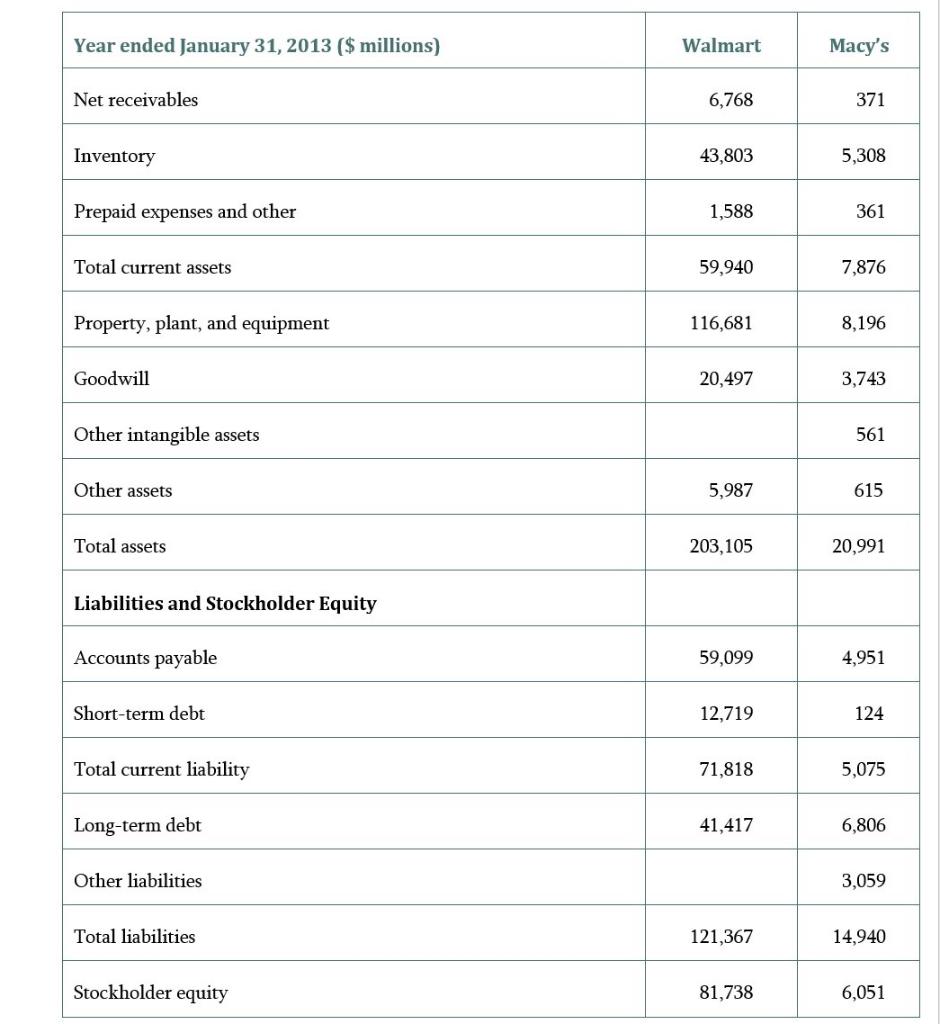

Table 3-8 contains the financial results for Walmart and Macy s for 2012. Evaluate the financial performance of each company based on the various

Table 3-8 contains the financial results for Walmart and Macy s for 2012. Evaluate the financial performance of each company based on the various metrics discussed in Section 3.1, such as ROE, ROA, profit margin, asset turns, APT, C2C, ART, INVT, and PPET. Can you explain the differences you see in their performance based on their supply chain strategy and structure? Compare the metrics for each company with similar metrics for Amazon and Nordstrom from Table 3-1. Which metrics does each company perform better on? What supply chain drivers and metrics might explain this difference in performance? Table 3-8 Selected Financial Data for Walmart Stores Inc. and Macy s Inc. Year ended January 31, 2013 ($ millions) Net operating revenues Cost of goods sold Gross profit Selling, general, and administrative expense Other Costs Operating income Interest expense Other income(loss)-net Income before income taxes Income taxes Net income Assets Cash and cash equivalents Walmart 469,162 352,488 116,674 88,873 27,801 2,251 187 25,737 7,981 17,756 7,781 Macy s 27,931 16,725 11,206 8,440 88 2,678 388 134 2,290 804 1,486 1,836 Year ended January 31, 2013 ($ millions) Net receivables Inventory Prepaid expenses and other Total current assets Property, plant, and equipment Goodwill Other intangible assets Other assets Total assets Liabilities and Stockholder Equity Accounts payable Short-term debt Total current liability Long-term debt Other liabilities Total liabilities Stockholder equity Walmart 6,768 43,803 1,588 59,940 116,681 20,497 5,987 203,105 59,099 12,719 71,818 41,417 121,367 81,738 Macy s 371 5,308 361 7,876 8,196 3,743 561 615 20,991 4,951 124 5,075 6,806 3,059 14,940 6,051

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 RETURN ON EQUITY WALMART MACY NET INCOME 17756 1198 SHARE HOLDERS EQUITY 76343 6051 RETURN ON EQUI...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started